As filed with the Securities and Exchange Commission on July 1, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Top Ships Inc.

(Exact name of Registrant as specified in its charter)

| Republic of the Marshall Islands |

|

4412 |

|

N.A. |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer Identification No.) |

TOP Ships Inc.

1 Vas. Sofias and Meg. Alexandrou Str,

15124 Maroussi, Greece

Tel: +30 210 812 8180

(Address, including zip code, and telephone number, including area code,

of Registrant’s principal executive offices)

With copy to:

Will Vogel

Watson Farley & Williams LLP

250 West 55th Street

New York, New York 10019

(212) 922-2200 (telephone number)

(212) 922-1512 (facsimile number)

(Name, address, including zip code, and telephone number, including area

code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after

this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in

accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this Registration Statement on such date

or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended,

or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to

said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The

selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any

state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY

1, 2022

PROSPECTUS

14,303,000 Common Shares

Issuable upon Exercise of Warrants

Offered by the Selling Shareholders

TOP Ships Inc.

This prospectus relates to the resale, from time to

time, by the selling shareholders identified in this prospectus under the caption “Selling Shareholders,” or the Selling Shareholders,

of up to 14,303,000 of our common shares, par value $0.01 per share, issuable upon exercise of certain outstanding warrants to purchase

common shares at an exercise price of $0.50 per share, or the Warrants. The Warrants were issued by us in a private placement pursuant

to the Securities Purchase Agreement dated June 3, 2022.

We are not selling any common shares under this prospectus

and will not receive any proceeds from the sale of common shares by the Selling Shareholders. We may receive proceeds from the cash exercise

of the Warrants which, if exercised in cash with respect to all of the 14,303,000 common shares, would result in gross proceeds of approximately

$7,151,500 to us. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the common shares.

The Selling Shareholders may sell the common shares

offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or

through any other means described in this prospectus under the caption “Plan of Distribution.” The common shares may be sold

at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices.

Our common shares are listed on the Nasdaq Capital Market

under the symbol “TOPS”.

Investing in our securities involves a high degree of risk. See “Risk

Factors” below, beginning on page 6, and in our Annual Report on Form 20-F for the year ended December 31, 2021, which is

incorporated by reference herein, to read about the risks you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

As permitted under the rules

of the U.S. Securities and Exchange Commission, or the Commission, this prospectus incorporates important information about us that is

contained in documents that we have previously filed with the Commission but that are not included in or delivered with this prospectus.

You may obtain copies of these documents, without charge, from the website maintained by the Commission at www.sec.gov, as well as other

sources. You may also obtain copies of the incorporated documents, without charge, upon written or oral request to TOP Ships Inc., 1 Vas.

Sofias and Meg. Alexandrou Str, 15124 Maroussi, Greece. The telephone number of our registered office is 011-30-210-812-8000. See

“Where You Can Find Additional Information.”

You should rely only on information

contained in and incorporated by reference into this prospectus. We have not, and the Selling Shareholders have not, authorized anyone

to give any information or to make any representations other than those contained in this prospectus. We take no responsibility for, and

can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is not an offer to

sell, and it is not soliciting an offer to buy, (1) any securities other than our common shares or (2) our common shares in any circumstances

in which such an offer or solicitation is unlawful. The information contained in this prospectus may change after the date of this prospectus.

Do not assume after the date of this prospectus that the information contained in this prospectus is still correct. Information

contained on our website, www.topships.org, does not constitute part of this prospectus.

We obtained certain statistical

data, market data and other industry data and forecasts used or incorporated by reference into this prospectus from publicly available

information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently

verified the data, and we do not make any representation as to the accuracy of that information.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Matters discussed in this prospectus may constitute

forward-looking statements. The Private Securities Litigation Reform Act of 1995, or the PSLRA, provides safe harbor protections for forward-looking

statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include

statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements,

which are statements other than statements of historical facts.

TOP Ships Inc. desires to take advantage of the safe

harbor provisions of the PSLRA and is including this cautionary statement in connection with this safe harbor legislation. This prospectus

and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current

views with respect to future events and financial performance. When used in this prospectus, statements that are predictive in nature,

that depend upon or refer to future events or conditions, or that include words such as “anticipate,” “believe,”

“expect,” “intend,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “continue,” “possible,” “likely,” “may,” “should,”

and similar expressions identify forward-looking statements.

The forward-looking statements in this prospectus are

based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s

examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe

that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies

that are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these

expectations, beliefs or projections.

In addition to these assumptions and matters discussed

elsewhere herein and in the documents incorporated by reference herein, important factors that, in our view, could cause actual results

to differ materially from those discussed in the forward-looking statements include the following:

| |

• |

our ability to maintain or develop new and existing customer relationships with refined product importers and exporters, major crude oil companies and major commodity traders, including our ability to enter into long-term charters for our vessels; |

| |

• |

our future operating and financial results; |

| |

• |

our future vessel acquisitions, our business strategy and expected and unexpected capital spending or operating expenses, including any dry-docking, crewing, bunker costs and insurance costs; |

| |

• |

our financial condition and liquidity, including our ability to pay amounts that we owe and to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities; |

| |

• |

oil and chemical tanker industry trends, including fluctuations in charter rates and vessel values and factors affecting vessel supply and demand; |

| |

• |

our ability to take delivery of, integrate into our fleet, and employ any newbuildings we have ordered or may acquire or order in the future and the ability of shipyards to deliver vessels on a timely basis; |

| |

• |

the aging of our vessels and resultant increases in operation and dry-docking costs; |

| |

• |

the ability of our vessels to pass classification inspections and vetting inspections by oil majors and big chemical corporations; |

| |

• |

significant changes in vessel performance, including increased vessel breakdowns; |

| |

• |

the creditworthiness of our charterers and the ability of our contract counterparties to fulfill their obligations to us; |

| |

• |

our ability to repay outstanding indebtedness, to obtain additional financing and to obtain replacement charters for our vessels, in each case, at commercially acceptable rates or at all; |

| |

• |

changes to governmental rules and regulations or actions taken by regulatory authorities and the expected costs thereof; |

| |

• |

our ability to maintain the listing of our common shares on Nasdaq or another trading market; |

| |

• |

our ability to comply with additional costs and risks related to our environmental, social and governance policies; |

| |

• |

potential liability from litigation, including purported class-action litigation; |

| |

• |

changes in general economic and business conditions; |

| |

• |

general domestic and international political conditions, international conflict or war (or threatened war), including between Russia and Ukraine, potential disruption of shipping routes due to accidents, political events, including “trade wars”, piracy, acts by terrorists or major disease outbreaks such as the recent worldwide coronavirus outbreak; |

| |

• |

changes in production of or demand for oil and petroleum products and chemicals, either globally or in particular regions; |

| |

• |

the strength of world economies and currencies, including fluctuations in charterhire rates and vessel values; |

| |

• |

potential liability from future litigation and potential costs due to our vessel operations, including due to any environmental damage and vessel collisions; |

| |

• |

the length and severity of epidemics and pandemics, including the ongoing global outbreak of the novel coronavirus (“COVID-19”) and its impact on the demand for commercial seaborne transportation and the condition of the financial markets; and |

| |

• |

other important factors described from time to time in the reports filed by us with the U.S. Securities and Exchange Commission, or the SEC. |

You should not place undue reliance on forward-looking

statements contained in this prospectus because they are statements about events that are not certain to occur as described or at all.

All forward-looking statements in this prospectus are qualified in their entirety by the cautionary statements contained in this prospectus.

Any forward-looking statements contained herein are

made only as of the date of this prospectus, and except to the extent required by applicable law or regulation we undertake no obligation

to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made

or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict

all or any of these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which any factor,

or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a Marshall Islands

company, and our principal executive office is located outside of the United States in Greece. Most of our directors, officers and the

experts named in this registration statement reside outside the United States. In addition, a substantial portion of our assets and the

assets of certain of our directors, officers and experts are located outside of the United States. As a result, it may be difficult or

impossible for U.S. purchasers to serve process within the United States upon us or any of these persons. You may also have difficulty

enforcing, both in and outside the United States, judgments you may obtain in United States courts against us or these persons in any

action, including actions based upon the civil liability provisions of United States federal or state securities laws.

Furthermore, there is substantial

doubt that courts in the countries in which we or our subsidiaries are incorporated or where our assets or the assets of our subsidiaries,

directors or officers and such experts are located (i) would enforce judgments of U.S. courts obtained in actions against us or our subsidiaries,

directors or officers and such experts based upon the civil liability provisions of applicable U.S. federal and state securities laws

or (ii) would enforce, in original actions, liabilities against us or our subsidiaries, directors or officers and such experts based on

those laws.

PROSPECTUS SUMMARY

This summary highlights information that appears elsewhere

in this prospectus or in the documents incorporated by reference herein and is qualified in its entirety by the more detailed information,

including the financial statements that appear in the documents incorporated by reference. This summary may not contain all of the information

that may be important to you. As an investor or prospective investor, you should review carefully the entire prospectus, including the

risk factors, and the more detailed information that is included herein and in the documents incorporated by reference herein.

Unless the context otherwise requires, as used in this

prospectus, the terms “Company,” “we,” “us,” and “our” refer to TOP Ships Inc. and all

of its subsidiaries. We use the term deadweight ton, or dwt, in describing the size of vessels. Dwt, expressed in metric tons each of

which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry. Our reporting currency

is in the U.S. dollar and all references in this prospectus to “$” or “dollars” are to U.S. dollars. Further,

unless otherwise indicated, the information presented in this prospectus gives effect to the following reverse stock splits of our issued

and outstanding common shares: a one-for-twenty reverse stock split of our issued and outstanding common shares effective on August 22,

2019, and a one-for-twenty-five reverse stock split of our issued and outstanding common shares effective on August 10, 2020.

Our Company

We are an international owner and operator of modern,

fuel efficient eco tanker vessels focusing on the transportation of crude oil, petroleum products (clean and dirty) and bulk liquid chemicals.

Our operating fleet has a total capacity of 1,435,000 deadweight tonnes (“dwt”). As of the date of this prospectus, our fleet

consists of one 50,000 dwt product/chemical tanker, the M/T Eco Marina Del Ray, five 157,000 dwt Suezmax tankers, the M/T Eco Oceano CA,

the M/T Eco Malibu, the M/T Eco West Coast, the M/T Eco Bel Air and the M/T Eco Beverly Hills, two 300,000 dwt Very Large Crude Carriers

(“VLCCs”), M/T Julius Caesar and M/T Legio X Equestris, and we also own 50% interests in two 50,000 dwt product/chemical tankers,

M/T Eco Yosemite Park and the M/T Eco Joshua Park. All of our vessels are certified by the International Maritime Organization, the United

Nations agency for maritime safety and the prevention of pollution by vessels (the “IMO”) and are capable of carrying a wide

variety of oil products including chemical cargos, which we believe make our vessels attractive to a wide base of charterers.

Our Fleet

The following tables present our fleet list as of the

date of this prospectus:

Operating MR Tanker Vessels on sale and leaseback financing agreements (“SLBs”)

(treated as financings):

| Name |

Deadweight |

Charterer |

End of firm period |

Charterer’s Optional Periods |

Gross Rate fixed period/ options |

| M/T Eco Marina Del Ray |

50,000 |

Cargill |

March 2024 |

none |

$15,100 |

Operating Suezmax Vessels on SLBs (treated as operating leases):

| Name |

Deadweight |

Charterer |

End of firm period |

Charterer’s Optional Periods |

Gross Rate fixed period/ options |

| M/T Eco Bel Air |

157,000 |

Trafigura |

March 2024 |

9 months |

$24,000 / $24,000 |

| M/T Eco Beverly Hills |

157,000 |

Trafigura |

May 2024 |

7 months |

$24,000 / $24,000 |

Operating Suezmax Vessels on SLBs (treated as financings):

| Name |

Deadweight |

Charterer |

End of firm period |

Charterer’s Optional Periods |

Gross Rate fixed period/ options |

| M/T Eco Oceano CA |

157,000 |

Central Tankers Chartering Inc. |

March 2037 |

none |

$24,500 |

Operating Suezmax Vessels financed via senior loan facilities:

| Name |

Deadweight |

Charterer |

End of firm period |

Charterer’s Optional Periods |

Gross Rate fixed period/ options |

| M/T Eco West Coast |

157,000 |

Clearlake |

March 2024 |

1+1 years |

$33,950 / $34,750 / $36,750 |

| M/T Eco Malibu |

157,000 |

Clearlake |

May 2024 |

1+1 years |

$33,950 / $34,750 / $36,750 |

Operating VLCC Vessels on SLBs (treated as financings):

| Name |

Deadweight |

Charterer |

End of firm period |

Charterer’s Optional Periods |

Gross Rate fixed period/ options |

| M/T Julius Caesar |

300,000 |

Trafigura |

January 2025 |

1+1 years |

$36,000 / $39,000 / $41,500 |

| M/T Legio X Equestris |

300,000 |

Trafigura |

February 2025 |

1+1 years |

$35,750 / $39,000 / $41,500 |

Operating Joint Venture MR Tanker fleet (50% owned):

| Name |

Deadweight |

Charterer |

End of firm period |

Charterer’s Optional Periods |

Gross Rate fixed period/ options |

| M/T Eco Yosemite Park |

50,000 |

Clearlake |

March 2025 |

5+1+1 years |

$17,400 / $18,650 / $19,900 |

| M/T Eco Joshua Park |

50,000 |

Clearlake |

March 2025 |

5+1+1 years |

$17,400 / $18,650 / $19,900 |

All the vessels in our fleet are equipped with engines of modern design with improved Specific Fuel Oil Consumption (“SFOC”)

and in compliance with the latest emission requirements, fitted with energy saving improvements in the hull, propellers and rudder as

well as equipment that further reduces fuel consumption and emissions certified with an improved Energy Efficiency Design Index (Phase

2 compliance level as minimum). Vessels with this combination of technologies, introduced from certain shipyards, are commonly referred

to as eco vessels. We believe that recent advances in shipbuilding design and technology makes these latest generation vessels more fuel-efficient

than older vessels in the global fleet that compete with our vessels for charters, providing us with a competitive advantage. Furthermore,

all of our vessels are fitted with ballast water treatment equipment and exhaust gas cleaning systems (scrubbers).

We believe we have established a reputation in the

international ocean transport industry for operating and maintaining vessels with high standards of performance, reliability and safety.

We have assembled a management team comprised of executives who have extensive experience operating large and diversified fleets of tankers

and who have strong ties to a number of national, regional and international oil companies, charterers and traders.

Corporate Information

Our predecessor, Ocean Holdings Inc., was formed as

a corporation in January 2000 under the laws of the Republic of the Marshall Islands and renamed Top Tankers Inc. in May 2004. In December

2007, Top Tankers Inc. was renamed TOP Ships Inc.

Our common shares are currently listed on the Nasdaq

Capital Market under the symbol “TOPS.” The current address of our principal executive office is 1 Vasilisis Sofias and Megalou

Alexandrou Str, 15124 Maroussi, Greece. The telephone number of our principal executive office is +30 210 812 8127. Our corporate website

address is www.topships.org. The information contained on our website does not constitute part of this prospectus. The Commission maintains

a website that contains reports, proxy and information statements, and other information that we file electronically at www.sec.gov.

THE OFFERING

| Issuer |

|

TOP Ships Inc., a Marshall Islands corporation |

| |

|

|

| Common shares outstanding as of the date of this prospectus |

|

47,120,820 common shares |

| |

|

|

| Common shares offered by the Selling Shareholders |

|

14,303,000 common shares. These are the shares underlying the Warrants, issued by us in a private placement pursuant to the Securities Purchase Agreement. |

| |

|

|

| Common shares to be outstanding immediately after this offering (1) |

|

61,423,820 common shares, assuming the exercise of all of the Warrants

for cash without adjustment.

|

| |

|

|

| Terms of the offering |

|

The Selling Shareholders, including their transferees, donees, pledgees, assignees and successors-in-interest, may sell, transfer or otherwise dispose of any or all of the common shares offered by this prospectus from time to time on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The common shares may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices. |

| |

|

|

| Use of proceeds |

|

The Selling Shareholders will receive all of the proceeds from the sale of any ordinary shares sold by them pursuant to this prospectus. We will not receive any proceeds from the sale of the common shares by the Selling Shareholders. See “Use of Proceeds” in this prospectus. |

| |

|

|

| Risk factors |

|

Investing in our securities involves a high degree of risk. See “Risk Factors” below, beginning on page 8, and in our Annual Report on Form 20-F for the year ended December 31, 2021, which is incorporated by reference herein, to read about the risks you should consider before investing in our securities. |

| |

|

|

| Listing |

|

Our common shares are traded on the Nasdaq Capital Market under the symbol “TOPS.” There is no established trading market for the Warrants and we do not intend to list the Warrants on any exchange or other trading system. |

| |

|

|

| (1) | | The number of our common shares that will be outstanding immediately after this offering

as shown above excludes |

| · | 9,603,000 common shares issuable upon exercise of pre-funded warrants issued on June 7, 2022 in a registered offering. |

| · | 22,420,000 common shares issuable upon conversion of the Series E Preferred Shares, calculated as of the date of this prospectus. |

RISK FACTORS

An investment in our securities involves

a high degree of risk. Before making an investment in our securities, you should carefully consider all of the information included or

incorporated by reference into this prospectus, including the risks described under the heading “Item 3. Key Information—D.

Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2021, which is incorporated by reference herein,

and as updated by annual and other reports and documents we file with the Commission after the date of this prospectus and that are incorporated

by reference herein. Please see the section of this prospectus entitled “Where You Can Find Additional Information.”

The occurrence of one or more of those risk factors could adversely impact our business, financial condition or results of operations.

When we offer and sell any securities pursuant to this prospectus, we may include additional risk factors relevant to such securities

in future filings.

Risks Relating to this Offering and Our Common Shares and Warrants

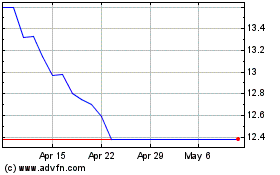

Our share price may continue to be highly volatile, which could lead

to a loss of all or part of a shareholder’s investment.

The market price of our common shares has fluctuated

widely since our common shares began trading in July of 2004 on the Nasdaq Stock Market LLC.

The market price of our common shares is affected

by a variety of factors, including:

| · | fluctuations in interest rates; |

| · | fluctuations in the availability or the price of oil and chemicals; |

| · | fluctuations in foreign currency exchange rates; |

| · | announcements by us or our competitors; |

| · | changes in our relationships with customers or suppliers; |

| · | actual or anticipated fluctuations in our semi-annual and annual results and those

of other public companies in our industry; |

| · | changes in United States or foreign tax laws; |

| · | international sanctions, embargoes, import and export restrictions, nationalizations,

piracy and wars or other conflicts, including the war in Ukraine. |

| · | actual or anticipated fluctuations in our operating results from period to period; |

| · | shortfalls in our operating results from levels forecast by securities analysts; |

| · | market conditions in the shipping industry and the general state of the securities

markets; |

| · | business interruptions caused by the ongoing outbreak of COVID-19; |

| · | mergers and strategic alliances in the shipping industry; |

| · | changes in government regulation; |

| · | a general or industry-specific decline in the demand for, and price of, shares of

our common shares resulting from capital market conditions independent of our operating performance; |

| · | the loss of any of our key management personnel; |

| · | our failure to successfully implement our business plan; |

| · | stock splits / reverse stock splits. |

In addition, over the last few years, the

stock market has experienced price and volume fluctuations, including due to factors relating to the ongoing outbreak of COVID-19 and

the war in Ukraine, and this volatility has sometimes been unrelated to the operating performance of particular companies. As a result,

there is a potential for rapid and substantial decreases in the price of our common shares, including decreases unrelated to our operating

performance or prospects. During 2022, the price of our common shares experienced a high of $1.64 in March and a low of $0.38 in June.

This market and share price volatility relating to the effects of COVID-19, as well as general economic, market or political conditions,

has and could further reduce the market price of our common shares in spite of our operating performance and could also increase our cost

of capital, which could prevent us from accessing debt and equity capital on terms acceptable to us or at all.

In addition, a possible “short squeeze”

due to a sudden increase in demand of our common stock that largely exceeds supply may lead to further price volatility in our common

shares. Investors may purchase our common shares to hedge existing exposure in our common shares or to speculate on the price of our common

shares. Speculation on the price of our common shares may involve long and short exposures. To the extent aggregate short exposure exceeds

the number of common shares available for purchase in the open market, investors with short exposure may have to pay a premium to repurchase

our common shares for delivery to lenders of our common shares. Those repurchases may in turn, dramatically increase the price of our

common shares until investors with short exposure are able to purchase additional common shares to cover their short position. This is

often referred to as a “short squeeze.” Following such a short squeeze, once investors purchase the shares necessary to cover

their short position, the price of our common shares may rapidly decline. A short squeeze could lead to volatile price movements in our

shares that are not directly correlated to the performance or prospects of our company.

There is no guarantee of a continuing public market for you to resell

our common shares.

Our common shares currently trade on the Nasdaq Capital

Market. We cannot assure you that an active and liquid public market for our common shares will continue and you may not be able to sell

your common shares in the future at the price that you paid for them or at all. The price of our common shares may be volatile and may

fluctuate due to factors such as:

| • | actual or anticipated fluctuations in our quarterly and annual results and those of other public companies

in our industry; |

| • | mergers and strategic alliances in the shipping industry; |

| • | market conditions in the shipping industry and the general state of the securities markets; |

| • | changes in government regulation; |

| • | shortfalls in our operating results from levels forecast by securities analysts; and |

| • | announcements concerning us or our competitors. |

Further, a lack of trading volume in our stock may

affect investors’ ability to sell their shares. Our common shares have periodically had low daily trading volumes in the market.

As a result, investors may be unable to sell all or any of their shares in the desired time period, or may only be able to sell such shares

at a significant discount to the previous closing price.

We issued common shares in the past through various transactions,

and we may do so in the future without shareholder approval, which may dilute our existing shareholders, depress the trading price of

our securities and impair our ability to raise capital through subsequent equity offerings.

We have already sold large quantities of our common

shares, and securities convertible into common shares, pursuant to previous public and private offerings of our equity and equity-linked

securities. We currently have an effective registration statement on Form F-3 (333-234281), for the registered sale of $200 million of

our securities, of which we have sold $134.7 million. We also have 13,452 Series E Preferred Shares outstanding, which are convertible

into approximately 22,420,000 shares, calculated as of the date of this prospectus. All of the Series E Preferred Shares and the common

shares issuable on conversion of the Series E Preferred Shares are beneficially owned by the Lax Trust, an irrevocable trust established

for the benefit of certain family members of Mr. Evangelos J. Pistiolis, our President, Chief Executive Officer and Director.

Purchasers of the common shares we sell, as well as

our existing shareholders, will experience significant dilution if we sell shares at prices significantly below the price at which they

invested. In addition, we may issue additional common shares or other equity securities of equal or senior rank in the future in connection

with, among other things, debt prepayments, future vessel acquisitions, redemptions of our Series E or Series F Preferred Shares, or any

future equity incentive plan, without shareholder approval, in a number of circumstances. Our existing shareholders may experience significant

dilution if we issue shares in the future at prices below the price at which previous shareholders invested. Our issuance of additional

common shares upon the exercise of the pre-funded warrants would cause the proportionate ownership interest in us of our existing shareholders,

other than the exercising warrant holders, to decrease; the relative voting strength of each previously outstanding common share held

by our existing shareholders to decrease; and the market price of our common shares could decline.

Our issuance of additional shares of common shares

or other equity securities of equal or senior rank would have the following effects:

| |

● |

our existing shareholders’ proportionate ownership interest in us will decrease; |

| |

● |

the amount of cash available for dividends payable on the shares of our common shares may decrease; |

| |

● |

the relative voting strength of each previously outstanding common share may be diminished; and |

| |

● |

the market price of the shares of our common shares may decline. |

The market price of our common shares could decline

due to sales, or the announcements of proposed sales, of a large number of common shares in the market, including sales of common shares

by our large shareholders or by holders of securities convertible into common shares, or the perception that these sales could occur.

These sales or the perception that these sales could occur could also depress the market price of our common shares and impair our ability

to raise capital through the sale of additional equity securities or make it more difficult or impossible for us to sell equity securities

in the future at a time and price that we deem appropriate. We cannot predict the effect that future sales of common shares or other equity-related

securities would have on the market price of our common shares.

Our Third Amended and Restated Articles of Incorporation,

as amended, authorizes our Board of Directors to, among other things, issue additional shares of common or preferred stock or securities

convertible or exchangeable into equity securities, without shareholder approval. We may issue such additional equity or convertible securities

to raise additional capital. The issuance of any additional shares of common or preferred stock or convertible securities could be substantially

dilutive to our shareholders. Moreover, to the extent that we issue restricted stock units, stock appreciation rights, options or warrants

to purchase our common shares in the future and those stock appreciation rights, options or warrants are exercised or as the restricted

stock units vest, our shareholders may experience further dilution. Holders of shares of our common shares have no preemptive rights that

entitle such holders to purchase their pro rata share of any offering of shares of any class or series and, therefore, such sales or offerings

could result in increased dilution to our shareholders.

Future issuances or sales, or the potential for future issuances

or sales, of our common shares may cause the trading price of our securities to decline and could impair our ability to raise capital

through subsequent equity offerings.

We have issued a significant number of our common shares,

and securities convertible into common shares, and we may do so in the future. Shares to be issued in future equity offerings could cause

the market price of our common shares to decline, and could have an adverse effect on our earnings per share. In addition, future sales

of our common shares or other securities in the public markets, or the perception that these sales may occur, could cause the market price

of our common shares to decline, and could materially impair our ability to raise capital through the sale of additional securities.

Nasdaq may delist our common shares from its exchange which could

limit your ability to make transactions in our securities and subject us to additional trading restrictions.

On March 11, 2019, we received written notification

from Nasdaq, indicating that because the closing bid price of our common shares for the last 30 consecutive business days was below $1.00

per share, we no longer met the minimum bid price requirement for the Nasdaq Capital Market, set forth in Nasdaq Listing Rule 5450(a)(1).

On August 22, 2019 we effectuated a 20 to 1 reverse stock split in order to regain compliance with Nasdaq Listing Rule 5450(a)(1). As

a result, we regained compliance on September 5, 2019.

On December 26,

2019, we received a written notification from Nasdaq indicating that because the closing bid price of our common shares for the last 30

consecutive business days was below $1.00 per share, we no longer met the minimum bid price requirement under Nasdaq rules. On April 17,

2020 we received a written notification from Nasdaq granting an extension to the grace period for regaining compliance. On August 7, 2020

we effectuated a 25 to 1 reverse stock split in order to regain compliance with Nasdaq Listing Rule 5450(a)(1). As a result, we regained

compliance on August 25, 2020.

On January 26,

2022, we received a written notification from Nasdaq indicating that because the closing bid price of our common shares for the preceding

30 consecutive business days was below $1.00 per share, we no longer met the minimum bid price requirement under Nasdaq rules. On March

22, 2022, we announced that Nasdaq had notified us that we had regained compliance with the minimum bid price requirement.

On May 18, 2022,

we received a written notification from Nasdaq indicating that because the closing bid price of our common shares for the last 30 consecutive

business days was below $1.00 per share, we no longer met the minimum bid price requirement under Nasdaq rules. Pursuant to

the Nasdaq Listing Rules, the applicable grace period to regain compliance is 180 days, or until November 14, 2022.

A continued decline in the closing price of our common

shares on Nasdaq could result in suspension or delisting procedures in respect of our common shares. The commencement of suspension or

delisting procedures by an exchange remains, at all times, at the discretion of such exchange and would be publicly announced by the exchange.

If a suspension or delisting were to occur, there would be significantly less liquidity in the suspended or delisted securities. In addition,

our ability to raise additional necessary capital through equity or debt financing would be greatly impaired. Furthermore, with respect

to any suspended or delisted common shares, we would expect decreases in institutional and other investor demand, analyst coverage, market

making activity and information available concerning trading prices and volume, and fewer broker-dealers would be willing to execute trades

with respect to such common shares. We expect this would cause the trading volume of our common shares to decline, which could result

in a further decline in the market price of our common shares.

Finally, if the volatility in the market continues

or worsens, it could have a further adverse effect on the market price of our common shares, regardless of our operating performance.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common shares by the Selling Shareholders.

The Selling Shareholders will

receive all of the net proceeds from the sale of any common shares offered by them under this prospectus. See “Selling Shareholders”.

The Selling Shareholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Shareholders for brokerage,

accounting, tax, legal services or any other expenses incurred by the Selling Shareholders in disposing of these common shares. We will

bear all other costs, fees and expenses incurred in effecting the registration of the common shares covered by this prospectus.

PLAN OF DISTRIBUTION

We are registering the shares

offered by this prospectus on behalf of the Selling Shareholders. The Selling Shareholders, which, as used herein, includes donees, pledgees,

transferees, or other successors-in-interest selling common shares or interests in common shares received after the date of this prospectus

from the Selling Shareholders as a gift, pledge, partnership distribution, or other non-sale related transfer, may, from time to time,

sell, transfer, or otherwise dispose of any or all of their common shares on any stock exchange, market or trading facility on which the

shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale,

at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Shareholders may,

from time to time, pledge or grant a security interest in some or all of the common shares owned by such shareholder and, if he defaults

in the performance of his secured obligations, the pledgees or secured parties may offer and sell the common shares, from time to time,

under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act

amending the list of Selling Shareholders to include the pledgee, transferee, or other successors in interest as Selling Shareholders

under this prospectus. The Selling Shareholders may use any one or more of the following methods when disposing of their shares:

| • | | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| • | | block trades in which the broker-dealer will attempt to sell the shares as agent, but may

position and resell a portion of the block as principal to facilitate the transaction; |

| • | | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| • | | an exchange distribution in accordance with the rules of the applicable exchange; |

| • | | privately negotiated transactions; |

| • | | short sales effected after the effective date of the registration statement of which this

prospectus forms a part; |

| • | | through the writing or settlement of options or other hedging transactions, whether through

an options exchange or otherwise; |

| • | | broker-dealers may agree with the Selling Shareholders to sell a specified number of such

shares at a stipulated price per share; |

| • | | a combination of any such methods of sale; and |

| • | | any other method permitted pursuant to applicable law. |

In connection with the sale

of common shares or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the common shares in the course of hedging the positions they assume. The Selling

Shareholders may also sell common shares short and deliver these securities to close out their short positions, or loan or pledge the

common shares to broker-dealers that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions

with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to

such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as amended to reflect such transaction).

If the common shares are sold

through broker dealers, the Selling Shareholders will be responsible for discounts or commissions or agent’s commissions. The aggregate

proceeds to the Selling Shareholders from the sale of the common shares offered by them will be the purchase price of the common shares

less discounts or commissions, if any. The Selling Shareholders reserve the right to accept and, together with their respective agents

from time to time, to reject, in whole or in part, any proposed purchase of common shares to be made directly or through agents. We will

not receive any of the proceeds from this offering.

The Selling Shareholders also

may resell all or a portion of the common shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided

that they meet the criteria and conform to the requirements of that rule.

The Selling Shareholders and

any underwriters, broker-dealers, or agents that participate in the sale of our common shares or interests therein may be deemed to be

“underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions, or profit

they earn on any resale of the shares may be deemed to be underwriting discounts and commissions under the Securities Act. If a Selling

Shareholder is deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act, he will be subject to

the prospectus delivery requirements of the Securities Act. We will make copies of this prospectus (as it may be amended from time to

time) available to the Selling Shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

To the extent required, the

common shares to be sold, the respective purchase prices and public offering prices, the names of any agents, dealers, or underwriters,

and any applicable commissions or discounts with respect to a particular offer will be set forth, if appropriate, in a post-effective

amendment to the registration statement that includes this prospectus.

In order to comply with the

securities laws of some states, if applicable, the common shares may be sold in these jurisdictions only through registered or licensed

brokers or dealers. In addition, in some states the common shares may not be sold unless they have been registered or qualified for sale

or an exemption from registration or qualification requirements is available and is complied with.

The Selling Shareholders and

any other person participating in a distribution of the common shares covered by this prospectus will be subject to the applicable provisions

of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules and regulations thereunder, including Regulation

M, which may limit the timing of purchases and sales of any of the common shares by the Selling Shareholders and any other such person.

To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the common shares to

engage in market-making activities with respect to the common shares.

REGISTERED DIRECT AND PRIVATE PLACEMENT TRANSACTIONS

On June 7, 2022, we issued

4,700,000 of our common shares and pre-funded warrants to purchase up to 9,603,000 common shares, or the Pre-Funded Warrants, in a registered

direct offering concurrently with a private placement of 14,303,000 Warrants, each exercisable to purchase one common share for an exercise

price of $0.50, for a purchase price of $0.50 per common share and Warrant (or $0.4999 per pre-funded warrant and Warrant). This private

placement transaction, or the Private Placement Transaction, was conducted pursuant to the Securities Purchase Agreement.

Pre-Funded Warrants

The following is a summary of the material terms and

provisions of the Pre-Funded Warrants that were sold in the registered direct offering. This summary is subject to and qualified in its

entirety by the form of Pre-Funded Warrants, which was filed with the SEC as an exhibit to a Report on Form 6-K on June 10, 2022 and is

incorporated by reference herein.

Exercisability. The Pre-Funded Warrants

are exercisable at any time after their original issuance until exercised in full. The Pre-Funded Warrants will be exercisable, at the

option of each holder, in whole or in part by delivering to us a duly executed exercise notice with payment in full in immediately available

funds for the number of common shares purchased upon such exercise. In lieu of making the cash payment otherwise contemplated to be made

to us upon the exercise of a Pre-Funded Warrant in payment of the aggregate exercise price, the holder may, in its sole discretion, elect

to exercise the Pre-Funded Warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number

of common shares determined according to the formula set forth in the Pre-Funded Warrant. If we do not issue the shares in a timely fashion,

the Pre-Funded Warrant contains certain damages provisions. No fractional common shares will be issued in connection with the exercise

of a Pre-Funded Warrant.

Exercise Limitation. A holder will not have

the right to exercise any portion of the Pre-Funded Warrants if the holder (together with its affiliates) would beneficially own in excess

of 9.99% of the number of our Common Shares outstanding immediately after giving effect to the exercise, as such percentage of beneficial

ownership is determined in accordance with the terms of the Pre-Funded Warrants. However, any holder may increase or decrease such percentage,

but not in excess of 9.99%, provided that any increase will not be effective until the 61st day after such election.

Exercise Price. The exercise price for

the Pre-Funded Warrants is $0.0001 per share and the exercise price and number of common shares issuable upon exercise of our Pre-Funded

Warrants will adjust in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or

similar events affecting our common shares.

Exchange Listing. There is no established

trading market for the Pre-Funded Warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing

of the Pre-Funded Warrants on any national securities exchange or other trading market.

Fundamental Transactions. If a fundamental

transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that

we may exercise and will assume all of our obligations under the Pre-Funded Warrants with the same effect as if such successor entity

had been named in the Pre-Funded Warrants itself. If holders of our common shares are given a choice as to the securities, cash or property

to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any

exercise of the Pre-Funded Warrants following such fundamental transaction.

Rights as a Shareholder. Except as otherwise

provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of our common shares, the holder of Pre-Funded Warrants

will not have the rights or privileges of a holder of our common shares, including any voting rights, until the holder exercises the Pre-Funded

Warrants. Holders of Pre-Funded Warrants have the right to participate in dividends and certain distributions as specified in the Pre-Funded

Warrants.

Transferability. Subject to applicable

laws, the Pre-Funded Warrants may be offered for sale, sold, transferred or assigned without our consent.

Governing Law. The Pre-Funded Warrants are governed

by New York law.

The Warrants

The following is a summary

of the material terms and provisions of the Warrants that were sold in the Private Placement. This summary is subject to and qualified

in its entirety by the form of Warrants, which was filed with the SEC as an exhibit to a Report on Form 6-K on June 10, 2022 and is incorporated

by reference herein.

The Warrants sold in the Private

Placement were not registered under the Securities Act and were sold pursuant to the exemption provided in Section 4(a)(2) under the Securities

Act and Rule 506(b) promulgated thereunder. Accordingly, the holders of the Warrants may only sell common shares issued upon exercise

of the Warrants pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption

under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Exercisability. The

Warrants are exercisable for a period of five years commencing on the date of issuance. The Warrants will be exercisable, at the option

of each holder, in whole or in part by delivering to us a duly executed exercise notice with payment in full in immediately available

funds for the number of common shares purchased upon such exercise. If a registration statement registering the resale of the common shares

underlying the Warrants under the Securities Act is not effective or available at any time after the six month anniversary of the date

of issuance of the Warrants, the holder may, in its sole discretion, elect to exercise the Warrant through a cashless exercise, in which

case the holder would receive upon such exercise the net number of common shares determined according to the formula set forth in the

Warrant.

Exercise Limitation.

A holder will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates) would beneficially

own in excess of 4.99% of the number of our common shares outstanding immediately after giving effect to the exercise, as such percentage

of beneficial ownership is determined in accordance with the terms of the warrants. However, any holder may increase or decrease such

percentage, but not in excess of 4.99%, provided that any increase will not be effective until the 61st day after such election.

Exercise Price Adjustment.

The exercise price of the Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock

splits, stock combinations, reclassifications or similar events affecting our common shares and also upon any distributions of assets,

including cash, stock or other property to our stockholders.

Exchange Listing. There

is no established trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to apply for

the listing of the Warrants on any national securities exchange or other trading market.

Fundamental Transactions.

If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right

and power that we may exercise and will assume all of our obligations under the Warrants with the same effect as if such successor entity

had been named in the Warrant itself. If holders of our common shares are given a choice as to the securities, cash or property to be

received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise

of the Warrant following such fundamental transaction. In addition, the successor entity, at the request of warrant holders, will be obligated

to purchase any unexercised portion of the Warrants in accordance with the terms of such warrants. Additionally, as more fully described

in the Warrants, in the event of certain fundamental transactions, the holders of those warrants will be entitled to receive consideration

in an amount equal to the Black Scholes value of the warrants on the date of consummation of such transaction.

Rights as a Shareholder.

Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of our common shares, the holder of a Warrant

will not have the rights or privileges of a holder of our common shares, including any voting rights, until the holder exercises the Warrant.

Resale/Registration Rights.

Pursuant to the Securities Purchase Agreement, we are required to file a registration statement

providing for the resale of the common shares issued and issuable upon the exercise of the Warrants. Subject to certain exceptions, we

are required to use commercially reasonable efforts to cause such registration to become effective and to keep such registration statement

effective at all times until no investor owns any Warrants or common shares issuable upon exercise thereof.

SELLING SHAREHOLDERS

This prospectus relates to up to 14,303,000 common shares

that the Selling Shareholders may sell in one or more offerings upon exercise of some or all of the Warrants that the Selling Shareholders

have purchased from us in the Private Placement Transaction.

Prior to the closing

of the Private Placement Transaction, the Company had 42,420,820 common shares issued and outstanding. We issued the Warrants,

exercisable to purchase an aggregate of 14,303,000 common shares, on June 7, 2022, the closing date of the Private Placement Transaction.

In addition, as part of the registered direct offering conducted concurrently with the Private Placement Transaction, we issued and sold

4,700,000 common shares and pre-funded warrants to purchase up to 9,603,000 common shares to

the Selling Shareholders. See “Private Placement Transactions”.

The registration of these

common shares does not mean that the Selling Shareholders will sell or otherwise dispose of all or any of those securities. The Selling

Shareholders may sell or otherwise dispose of all, a portion or none of such common shares from time to time. We do not know the number

of common shares, if any, that will be offered for sale or other disposition by any of the Selling Shareholders under this prospectus.

The Selling Shareholders identified below may currently hold or acquire our common shares or warrants to purchase our common shares in

addition to the Warrants or the common shares registered hereby. In addition, the Selling Shareholders identified below may sell, transfer,

assign or otherwise dispose of some or all of the common shares covered hereby in private placement transactions exempt from or not subject

to the registration requirements of the Securities Act.

To our knowledge, the Selling

Shareholders do not have nor have had within the past three years, any position, office or other material relationship with us or any

of our predecessors or affiliates, other than their ownership of our common shares.

The following table sets

forth certain information with respect to each Selling Shareholder, including (i) the common shares beneficially owned by the Selling

Shareholder prior to this offering (excluding the common shares underlying the Warrants), (ii) the number of common shares underlying

the Warrants and being offered by the Selling Shareholder pursuant to this prospectus and (iii) the Selling Shareholder’s beneficial

ownership after completion of this offering, assuming that all of the common shares covered hereby (but none of the other common shares,

if any, held by the Selling Shareholders) are sold.

We have prepared the following

table based on information supplied to us by the Selling Shareholders on or prior to the date hereof, and we have not sought

to verify such information. Ownership and percentage ownership are determined in accordance with the rules and regulations of the SEC

regarding beneficial ownership and include voting or investment power with respect to common shares. This information does not necessarily

indicate beneficial ownership for any other purpose. In computing the number of common shares beneficially owned by a Selling Shareholder

and the percentage ownership of that Selling Shareholder, common shares underlying warrants held by that selling stockholder that are

exercisable as of the date hereof, or exercisable within 60 days after the date hereof, are deemed outstanding. Such

common shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. The calculation

of percentage of beneficial ownership is based on 47,120,820 common shares issued and outstanding as of the date hereof. The

number of common shares owned prior to this offering and the number of common shares owned following this offering in the table below

do not give effect to the beneficial ownership blockers contained in the Warrants and Pre-Funded Warrants held by the Selling Shareholders,

but the percentages in the table below do give effect to such beneficial ownership blockers.

| Selling Shareholder | |

Total Number of Common Shares Owned Prior to This Offering(1) | |

Total Number of Common Shares Underlying the Warrants and Offered Hereby | |

Percentage of Outstanding Shares Owned Prior to This Offering(2) | |

Maximum

Number of

Common

Shares Which

May Be Sold in

This Offering | |

Number of Shares

Owned Following

This Offering | |

Percentage of Outstanding Shares Owned Following This Offering(2) |

| Armistice Capital Master Fund Ltd.(3) | |

25,738,962 | |

14,303,000 | |

9.99% | |

14,303,000 | |

11,435,962 | |

9.99% |

| (1) |

The number of common shares owned prior to this offering and the number of common shares owned following this offering in the table do not give effect to the beneficial ownership blockers contained in the Warrants and Pre-Funded Warrants held by the Selling Shareholders, but the percentages in the table do give effect to such beneficial ownership blockers. |

|

(2)

|

The terms of the Warrants and Pre-Funded Warrants held by the Selling

Shareholders include a blocker provision that restricts exercise to the extent the securities beneficially owned by the selling stockholder

and its affiliates would represent beneficial ownership in excess of 9.99%, in the case of the Pre-Funded Warrants, or 4.99%, in the

case of the Warrants, our common shares outstanding immediately after giving effect to such exercise, subject to the holder’s option

upon notice to us to increase or decrease this beneficial ownership limitation; provided that any increase of such beneficial limitation

percentage shall only be effective upon 61 days’ prior notice to us and such increased beneficial ownership percentage shall not

exceed 9.99% of our common shares. |

| (3) |

The common shares are directly held by Armistice Capital Master Fund

Ltd. (the “Master Fund”), a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned by Armistice

Capital, LLC (“Armistice”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of

Armistice Capital. Armistice and Steven Boyd disclaim beneficial ownership of the reported securities except to the extent of their respective

pecuniary interest therein. The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY

10022. |

CAPITALIZATION

The following table sets forth our consolidated capitalization

as of December 31, 2021:

| |

2. |

on an as adjusted basis to give effect to the following transactions which occurred between December 31, 2021 and June 30, 2022: |

| |

· |

The issuance of 7,200,000 Series F Preferred Shares with a value of $10 per share to Africanus Inc, a company affiliated with our CEO, with a redemption premium of $14.4 million, in exchange for the assumption by Africanus Inc of an amount of $47.6 million of shipbuilding costs for our newbuilding vessels M/T Eco Oceano CA (Hull No. 871), M/T Julius Caesar (Hull No. 3213) and M/T Legio X Equestris (Hull No. 3214) as well as and the settlement of $24.4 million of our remaining payment obligations relating to the VLCC Transaction; |

| |

· |

the issuance of 2,588,848 common shares pursuant to the Equity Distribution Agreement we entered into with Maxim Group LLC on April 15, 2022, with aggregate net proceeds of $2.0 million; |

| · | The sale on June 7, 2022 of 4,700,000 of our common shares and pre-funded warrants to purchase up to 9,603,000 common shares via a

registered direct offering at a public offering price of $0.50 per share resulting in aggregate net proceeds of $6.7 million; |

| |

· |

the drawdown of $108.0 million from the sale and leaseback of M/T Julius Caesar and M/T Legio X Equestris ($54.0 million per vessel) from China Merchants Bank Financial Leasing (“CMBFL”) (the sale and leaseback will be accounted as a financing transaction); |

| |

· |

the drawdown of $48.2 million from the sale and leaseback of M/T Eco Oceano CA from AVIC International Leasing Co., Ltd ("AVIC") (the sale and leaseback will be accounted as a financing transaction, “the second AVIC facility”); |

| |

· |

the prepayment of $54.2 million of the outstanding AVIC Facility (“the first AVIC facility”) due to the sale of M/T’s Eco Los Angeles and Eco City of Angels; |

| |

· |

$6.9 million of scheduled debt repayments under the ABN Amro, the Cargill, the first and second AVIC, second CMBFL and the Alpha Bank facilities; and |

| 3. | on an as further adjusted basis to give effect to the exercise of all of the 14,303,000 Warrants

for cash without adjustment resulting in the issuance of 14,303,000 common shares and in net proceeds of $7.1 million. |

| (Unaudited, Expressed in thousands of U.S. Dollars, except number of shares and per share data) | |

Actual | | |

As Adjusted | | |

As Further Adjusted | |

| Debt:(1) (2) | |

| | |

| | |

| |

| Current portion of long term debt | |

| 7,205 | | |

| 15,360 | | |

| 15,360 | |

| Non-current portion of long term debt | |

| 90,163 | | |

| 231,790 | | |

| 231,790 | |

| Debt related to vessels held for sale | |

| 53,202 | | |

| - | | |

| - | |

| Total debt | |

| 150,570 | | |

| 247,150 | | |

| 247,150 | |

| Mezzanine equity: | |

| | | |

| | | |

| | |

| Preferred stock Series E, $0.01 par value; 13,452 shares issued and outstanding at December 31, 2021, as adjusted and as further adjusted and Preferred stock Series F, $0.01 par value; 0 shares issued and outstanding at December 31, 2021 and 7,200,000 as adjusted and as further adjusted | |

| 16,142 | | |

| 102,542 | | |

| 102,542 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Common stock, $0.01 par value, 1,000,000,000 shares authorized; 39,831,972 shares issued and outstanding at December 31, 2021, 47,120,820 common shares issued and outstanding as adjusted and 61,423,820 common shares issued and outstanding as further adjusted | |

| 398 | | |

| 471 | | |

| 614 | |

| Preferred stock Series D, $0.01 par value; 100,000 shares issued and outstanding at December 31, 2021 as adjusted and as further adjusted | |

| 1 | | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 429,577 | | |

| 423,788 | | |

| 430,756 | |

| Accumulated deficit | |

| (336,754 | ) | |

| (336,754 | ) | |

| (336,754 | ) |

| Total Shareholders’ and Mezzanine equity | |

| 109,364 | | |

| 190,048 | | |

| 197,159 | |

| Total capitalization | |

| 259,934 | | |

| 437,198 | | |

| 444,309 | |

| (1) |

The capitalization table does not take into account any loan fees for the new loans and sale and leaseback financings or any amortization of deferred finance fees incurred after December 31, 2021 or any write-offs of deferred fees in respect of loans fully repaid. |

| |

|

| (2) |

Our indebtedness (both current and non-current portions), is secured by titles on our vessels and/or by mortgages on our vessels and is guaranteed by us. |

DESCRIPTION OF CAPITAL STOCK

Our authorized capital stock consists of 1,000,000,000

common shares, par value $0.01 per share, of which 47,120,820 common shares were issued and outstanding as of the date of this prospectus,

and 20,000,000 preferred shares with par value of $0.01, of which 100,000 Series D Preferred Shares, 13,452 Series E Preferred Shares,

and 7,200,000 Series F Preferred Shares were issued and outstanding as of the date of this prospectus.

For a description of our capital stock, please

see “Item 10. Additional Information” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2021 which

is incorporated by reference herein.

EXPENSES

We estimate the expenses in connection with the issuance

and distribution of the common shares being registered under the registration statement of which this prospectus forms a part, all of

which will be paid by us.

| Commission registration fee | |

$ | 663 | |

| Legal fees and expenses | |

$ | 20,000 | |

| Accounting fees and expenses | |

$ | 15,000 | |

| Miscellaneous fees and expenses | |

$ | 4,337 | |

| Total | |

$ | 40,000 | |

LEGAL MATTERS

The validity of the securities offered by this prospectus

and certain other legal matters relating to United States and Marshall Islands law are being passed upon for us by Watson Farley &

Williams LLP, New York, New York.

EXPERTS

The consolidated financial statements of Top Ships Inc.

as of December 31, 2021 and 2020, and for each of the three years in the period ended December 31, 2021, incorporated by reference in

this Prospectus, and the effectiveness of Top Ship Inc.’s internal control over financial reporting have been audited by Deloitte

Certified Public Accountants S.A., an independent registered public accounting firm, as stated in their reports. Such financial statements

are incorporated by reference in reliance upon the reports of such firm, given their authority as experts in accounting and auditing.

The offices of Deloitte Certified Public Accountants S.A. are located at Fragoklissias 3a & Granikou Str., 15125 Maroussi, Athens,

Greece.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Commission a registration statement

on Form F-1 under the Securities Act, with respect to the common shares offered hereby. For the purposes of this section, the term registration

statement on Form F-1 means the original registration statement on Form F-1 and any and all amendments including the schedules and exhibits

to the original registration statement or any amendment. This prospectus does not contain all of the information set forth in the registration

statement on Form F-1 we filed. Each statement made in this prospectus concerning a document filed as an exhibit to the registration statement

on Form F-1 is qualified by reference to that exhibit for a complete statement of its provisions. The registration statement on Form F-1,

including its exhibits and schedules, may be inspected and copied at the public reference facilities maintained by the Commission at 100

F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling 1 (800) SEC-0330,

and you may obtain copies at prescribed rates from the Public Reference Section of the Commission at its principal office in Washington,

D.C. 20549. The Commission maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other

information regarding registrants that file electronically with the Commission.

Information Provided by the Company

We will furnish holders of our common shares with annual

reports containing audited financial statements and a report by our independent registered public accounting firm. The audited financial

statements will be prepared in accordance with U.S. generally accepted accounting principles. As a “foreign private issuer,”

we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders. While

we furnish proxy statements to shareholders in accordance with the rules of the Nasdaq Capital Market, those proxy statements do not conform

to Schedule 14A of the proxy rules promulgated under the Exchange Act. In addition, as a “foreign private issuer,” our officers

and directors are exempt from the rules under the Exchange Act relating to short swing profit reporting and liability.

DOCUMENTS INCORPORATED BY REFERENCE

The Commission allows us to “incorporate by reference”

into this prospectus the information we file with, and furnish to it, which means that we can disclose important information to you by

referring you to those filed or furnished documents. The information incorporated by reference is considered to be a part of this prospectus.

However, statements contained in this prospectus or in documents that we file with or furnish to the Commission and that are incorporated

by reference into this prospectus will automatically update and supersede information contained in this prospectus, including information

in previously filed or furnished documents or reports that have been incorporated by reference into this prospectus, to the extent the