TOMI Environmental Solutions, Inc.® (“TOMI”) (NASDAQ:TOMZ), a

global company specializing in disinfection and decontamination

utilizing its premier Binary Ionization Technology (BIT) platform

through its SteraMist brand of products, today announced its

financial results for the first quarter 2021.

TOMI Chief Executive Officer, Dr. Halden Shane stated, “Our

first quarter 2021 revenues had a steep comparison to last year’s

first quarter, when the onset of COVID-19 pandemic created an

unprecedented demand in the marketplace for disinfection and

decontamination solutions, including demand for our products. While

the economy has begun to reopen, this year’s first quarter results

reflect headwinds from the impact of many of our customers’

continued remote work environment as well as delays in capital

expenditure projects across our customer base. As a result, it has

been difficult for us to fully implement our strategies to generate

sustained growth following the spike of demand we experienced in

2020. For example, our in-person demos with potential customers

remained suspended in the quarter and many custom engineered

systems (CES) were postponed. That said, we made considerable

progress advancing key building blocks for our long term growth,

including expanding our internal sales force and continuing the

development of three exciting new products. We are particularly

excited about the upcoming launch of our SteraPak product, a much

anticipated offering which further differentiates our 6-log kill

solutions in the marketplace and better position us to continue our

mission to make the world a safer place.”

Dr. Shane continued, “The pandemic accelerated the introduction

of our product to a broader, highly satisfied customer base, many

of whom ordered our hardware and solution quickly at the outset of

the pandemic and are beginning to integrate our solution into their

ongoing disinfection procedures. This pandemic has truly changed

how people think about proactive decontamination and we are

optimistic about our ability to capitalize on that new thinking as

we continue to execute our long term plan to become the standard in

decontamination worldwide. We believe these factors will drive

sustained, higher margin sales at levels above pre-pandemic levels

as more businesses reopen and commercial activities

accelerate.”

Financial Results for the Three Months Ended March 31,

2021 compared to March 31, 2020

- Total net revenue was $2.1 million compared to $7.1 million, a

decrease of 70%.

- SteraMist® equipment-based revenues were $1.7 million and $6.6

million respectively, a decrease of 74%.

- SteraMist® BIT Solution-based revenues were $0.4 million and

$1.0 million, respectively, a decrease of 60%.

- Service-based revenues were $0.4 million for both 2021 and

2020.

- Domestic revenues were $1.8 million and $3.6 million,

respectively, a decrease of 50%; International revenues were

approximately $0.3 million and $3.5 million, respectively, a

decrease of 91%.

- Gross margin was 59.6% compared to 63.6%. The decline in gross

margin is attributable to product mix.

- Operating loss was ($1.5 million) compared to operating income

of $2.7 million.

- Net loss was ($1.5 million) or ($0.09) per basic and diluted

share, compared to net income of $2.6 million or $0.17 per basic

share.

- EBITDA was a loss of ($1.4 million) compared to EBITDA of $2.8

million. A table reconciling EBITDA to the appropriate GAAP

financial measure is included with the Company's financial

information below.

- Adjusted EBITDA was a loss of ($1.4 million) compared to

Adjusted EBITDA of $3.0 million. A table reconciling Adjusted

EBITDA to the appropriate GAAP financial measure is included with

the Company's financial information below.

Balance sheet highlights

as of March 31, 2021

- Cash and cash equivalents were approximately $3.9 million

compared to $5.2 million at December 31, 2020, a decrease of $1.3

million.

- Working capital was $10.1 million compared to $11.5 million at

December 31, 2020.

- Shareholders’ equity was $11.9 million compared to $13.2

million at December 31, 2020, a decrease of $1.3 million.

Current Business Highlights To Date

- Ongoing development of new products such as SteraBox and

SteraPack, with the latter to have a tentative launch set for mid

year 2021.

- TOMI’s Custom Engineered System (CES ) in Pfizer Missouri was

recently showcased in a New York Times article about Pfizer’s COVID

vaccine processes.

- Added two Vice Presidents of Sales to oversee the Company’s

sales efforts and capitalize on the growing pipeline of

opportunities across the Commercial, Healthcare Divisions.

- The iHP Corporate Service team treated one of four fill lines

in a North Carolina pharmaceutical company that manufacturers one

of the COVID vaccines. The remaining three lines are expected to be

decontaminated at a later date with SteraMist

- An increase in health system purchasing during the first

quarter, including the expansion of sales to a third Mercy hospital

in Ohio, with a fourth Mercy facility expected to implement

SteraMist soon. Zimmer, a medical device company, had multiple

location purchases, demonstrating that referrals from existing

relationships is one of the Company’s highest lead generation

methods.

- TOMI continues to work with premium companies in testing and

validating SteraMist® technology in the Food Safety and seed

industries. In the first quarter of 2021, TOMI increased brand

awareness through promotions and marketing in this division. A

majority of the independent marketing representatives recently

onboarded are part of this division

- In the second half of 2021, as conferences and tradeshows

reopen for in-person exhibition, TOMI’s sales team will attend

these events across the country to perform live demonstrations to

showcase the difference between our SteraMist iHP technology and

our competitors. These in-person conferences and trade shows are a

key component of our marketing strategy.

- The Company continues to work with its German aircraft partner

and Boeing in a third-party test required for the aviation industry

and anticipates the testing will be completed in the second quarter

of 2021. TOMI will incur no expense for this work as both testing

partners are clients.

- TOMI has engaged HYGCEN Germany GmbH to perform a quantitative

test of germ carriers for airborne room disinfection and testing of

the effectiveness of a method for disinfecting room air to meet the

new EU norm (standard) EN 17272. Certification that Binary

Ionization Technology meets the new standard will continue to

position iHP as the premier decontamination/disinfection technology

available on the market today.

- The Company continues to work with the Virginia State

University Agricultural Research Station and its partner, Arkema on

a food safety pilot study based on novel, nonthermal, and

environmentally friendly technology to control foodborne pathogens

on industrial hemp seed and strawberry as representative model

foods. TOMI anticipates the pilot will be completed by the second

quarter of 2021.

- TOMI is working with University of Virginia on two separate

studies. The first, which explored SteraMist’s efficacy against

SARS-CoV-2, has reported successful results and is currently

awaiting the final published paper. The second, using the handheld

SteraMist Surface Unit and testing spray and contact time variables

against Adenovirus is currently awaiting results. TOMI anticipates

the testing will be completed by the third quarter of 2021.

- TOMI has partnered with the Department of Chemistry and

Biochemistry of Texas Tech University to conduct a wide range of

studies on spray pattern, deposition, and hydrogen peroxide content

in order to compare its 1% label to other similar products on the

market.

- TOMI's long term relationship with USDA Agricultural Research

Service continues to progress. In March 2021, "Hydrogen peroxide

residue on tomato, apple, cantaloupe, and Romaine lettuce after

treatments with cold plasma-activated hydrogen peroxide" was

accepted for publication in the Journal of Food Microbiology. TOMI

has also begun discussions with another ARS facility to evaluate

the benefits of iHP on blueberries to prevent rot and reduce

post-harvest losses.

Conference Call Information

TOMI will hold a conference call to discuss first quarter 2021

results at 4:30 p.m. ET today, May 17, 2021.

To participate in the call by phone, dial (877) 545-0320 and

entry code 408875 approximately five minutes prior to the scheduled

start time. International callers please dial (973) 528-0016 and

entry code 408875. To access the live webcast or view the press

release, please visit the Investor Relations section of the TOMI

website at:

http://investor.tomimist.com/TOMZ/webcasts_and_events/2145

A replay of the teleconference will be available until May 28,

2021 and may be accessed by dialing (877) 481-4010. International

callers may dial (919) 882-2331. Callers should use replay access

code: 41341 A replay of the webcast will be available for at least

90 days on the company’s website, starting approximately one hour

after the completion of the call.

TOMI™ Environmental Solutions, Inc.: Innovating for

a safer world®TOMI™ Environmental Solutions,

Inc. (NASDAQ:TOMZ) is a global decontamination and infection

prevention company, providing environmental solutions for indoor

surface disinfection through the manufacturing, sales and licensing

of its premier Binary Ionization Technology® (BIT™) platform.

Invented under a defense grant in association with the Defense

Advanced Research Projects Agency (DARPA) of the U.S. Department of

Defense, BIT™ solution utilizes a low percentage Hydrogen

Peroxide as its only active ingredient to produce a fog of ionized

Hydrogen Peroxide (iHP™). Represented by the SteraMist® brand

of products, iHP™ produces a germ-killing aerosol that works

like a visual non-caustic gas.TOMI products are designed to

service a broad spectrum of commercial structures, including, but

not limited to, hospitals and medical facilities, cruise ships,

office buildings, hotel and motel rooms, schools, restaurants, meat

and produce processing facilities, military barracks, police and

fire departments, and athletic facilities. TOMI products

and services have also been used in single-family homes and

multi-unit residences.

TOMI develops training programs and application protocols

for its clients and is a member in good standing with The American

Biological Safety Association, The American Association of Tissue

Banks, Association for Professionals in Infection Control and

Epidemiology, Society for Healthcare Epidemiology of America,

America Seed Trade Association, and The Restoration Industry

Association.

For additional information, please

visit http://www.tomimist.com/ or contact us

at info@tomimist.com.

Forward-Looking Statements

This press release contain forward-looking statements that are

based on current expectations, estimates, forecasts and projections

of future performance based on management’s judgment, beliefs,

current trends, and anticipated product performance. These

forward-looking statements include, without limitation, statements

relating to anticipated financial performance and operating

results; upcoming launch of new products; expected growth in sales

and market demand; timing and process relating to research studies

and testing; impact of COVID-19 pandemic on our business operation;

and our ability to execute sale strategies. Forward-looking

statements involve risks and uncertainties that may cause actual

results to differ materially from those contained in the

forward-looking statements. These factors include, but are not

limited to, the impact of COVID-19 pandemic on our business and

customers; our ability to maintain and manage growth and generate

sales, our reliance on a single or a few products for a majority of

revenues; the general business and economic conditions; and other

risks as described in our SEC filings, including our Annual Report

on Form 10-K for the fiscal year ended December 31, 2020 filed by

us with the SEC and other periodic reports we filed with the SEC.

The information provided in this document is based upon the facts

and circumstances known at this time. Other unknown or

unpredictable factors or underlying assumptions subsequently

proving to be incorrect could cause actual results to differ

materially from those in the forward-looking statements. Although

we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

level of activity, performance, or achievements. You should not

place undue reliance on these forward-looking statements. All

information provided in this press release is as of today’s date,

unless otherwise stated, and we undertake no duty to update such

information, except as required under applicable law.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

presented on a basis consistent with U.S. GAAP, we disclose certain

non-GAAP financial measures for our historical performance,

including EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin. We

define EBITDA as net income (loss), adjusted to exclude: interest,

taxes, depreciation and amortization (EBITDA) is a non-GAAP

financial measure and is intended to serve as a supplement to our

results provided in accordance with GAAP. We define Adjusted EBITDA

as net income (loss), adjusted to exclude: interest, taxes,

depreciation and amortization; stock-based compensation expense. We

define Adjusted EBITDA margin as Adjusted EBITDA divided by net

revenue. We believe that these historical non-GAAP financial

measures provide useful information to both management and

investors by excluding certain items and expenses that are not

indicative of our core operating results or do not reflect our

normal business operations. In addition, our management uses

non-GAAP measures to evaluate our performance internally and to

benchmark our performance externally against competitors. Our use

of non-GAAP financial measures has certain limitations in that such

non-GAAP financial measures may not be directly comparable to those

reported by other companies. Although we believe that the use of

non-GAAP financial measures enhances its investors’ understanding

of its business and performance, our use of non-GAAP financial

measures should not be considered an alternative to GAAP basis

financial measures and should be read in conjunction with the

relevant GAAP financial measures. Other companies may use the same

or similarly named measures, but exclude different items, which may

not provide investors with a comparable view of our performance in

relation to other companies. Because of these limitations, the

non-GAAP financial measure used in this release should not be

considered in isolation or as a substitute for performance measures

calculated in accordance with GAAP. We seek to compensate for the

limitation of our non-GAAP presentation by providing a detailed

reconciliation of the non-GAAP financial measures to the most

directly comparable U.S. GAAP as set forth below. Investors are

encouraged to review the related U.S. GAAP financial measures and

the reconciliation of these non-GAAP financial measures to their

most directly comparable U.S. GAAP financial measures.

|

|

|

TOMI ENVIRONMENTAL SOLUTIONS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEET |

| |

| |

|

|

|

|

ASSETS |

|

|

|

|

|

March 31, 2021 |

|

|

|

Current Assets: |

(Unaudited) |

|

December 31, 2020 |

|

Cash and Cash Equivalents |

$ |

3,945,658 |

|

|

$ |

5,198,842 |

|

| Accounts Receivable - net |

|

3,743,430 |

|

|

|

3,716,701 |

|

| Other Receivables |

|

- |

|

|

|

198,951 |

|

| Inventories |

|

4,765,455 |

|

|

|

3,781,515 |

|

| Vendor Deposits |

|

146,130 |

|

|

|

388,712 |

|

| Prepaid Expenses |

|

316,439 |

|

|

|

421,305 |

|

|

Total Current Assets |

|

12,917,114 |

|

|

|

13,706,027 |

|

| |

|

|

|

| Property and Equipment –

net |

|

1,235,483 |

|

|

|

1,298,103 |

|

| |

|

|

|

| Other Assets: |

|

|

|

| Intangible Assets – net |

|

720,494 |

|

|

|

722,916 |

|

| Operating Lease - Right of Use

Asset |

|

619,989 |

|

|

|

631,527 |

|

| Capitalized Software

Development Costs - net |

|

41,902 |

|

|

|

52,377 |

|

| Other Assets |

|

516,230 |

|

|

|

358,935 |

|

|

Total Other Assets |

|

1,898,614 |

|

|

|

1,765,755 |

|

| Total Assets |

$ |

16,051,211 |

|

|

$ |

16,769,885 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| |

|

|

|

| Current Liabilities: |

|

|

|

|

Accounts Payable |

$ |

2,046,667 |

|

|

$ |

1,501,469 |

|

|

Accrued Expenses and Other Current Liabilities |

|

629,797 |

|

|

|

501,849 |

|

|

Customer Deposits |

|

28,949 |

|

|

|

118,880 |

|

|

Current Portion of Long-Term Operating Lease |

|

83,768 |

|

|

|

81,223 |

|

|

Total Current Liabilities |

|

2,789,181 |

|

|

|

2,203,421 |

|

| |

|

|

|

| Long-Term Liabilities: |

|

|

|

|

Loan Payable |

|

410,700 |

|

|

|

410,700 |

|

|

Long-Term Operating Lease, Net of Current Portion |

|

931,697 |

|

|

|

953,190 |

|

|

Total Long-Term Liabilities |

|

1,342,397 |

|

|

|

1,363,890 |

|

|

Total Liabilities |

|

4,131,577 |

|

|

|

3,567,311 |

|

| |

|

|

|

| Commitments and

Contingencies |

|

- |

|

|

|

- |

|

| |

|

|

|

| Shareholders’ Equity: |

|

|

|

|

Cumulative Convertible Series A Preferred Stock; |

|

|

|

|

par value $0.01 per share, 1,000,000 shares authorized; 63,750

shares issued |

|

|

|

and outstanding at March 31, 2021 and December 31, 2020 |

|

638 |

|

|

|

638 |

|

|

Cumulative Convertible Series B Preferred Stock; $1,000 stated

value; |

|

|

|

7.5% Cumulative dividend; 4,000 shares authorized; none issued |

|

|

|

and outstanding at March 31, 2021 and December 31, 2020 |

|

- |

|

|

|

- |

|

|

Common stock; par value $0.01 per share, 250,000,000 shares

authorized; |

|

|

|

16,811,513 and 16,761,513 shares issued and outstanding |

|

|

|

at March 31, 2021 and December 31, 2020, respectively. |

|

168,115 |

|

|

|

167,615 |

|

|

Additional Paid-In Capital |

|

52,369,899 |

|

|

|

52,142,399 |

|

|

Accumulated Deficit |

|

(40,619,018 |

) |

|

|

(39,108,078 |

) |

|

Total Shareholders’ Equity |

|

11,919,634 |

|

|

|

13,202,574 |

|

| Total Liabilities and

Shareholders’ Equity |

$ |

16,051,211 |

|

|

$ |

16,769,885 |

|

| |

|

|

|

|

TOMI ENVIRONMENTAL SOLUTIONS, INC. |

|

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

(UNAUDITED) |

| |

|

|

|

| |

For The Three Months Ended |

| |

March 31, |

| |

2021 |

|

2020 (1) |

| |

|

|

|

|

Sales, net |

$ |

2,073,455 |

|

|

$ |

7,053,418 |

|

|

Cost of Sales |

|

838,297 |

|

|

|

2,565,410 |

|

|

Gross Profit |

|

1,235,158 |

|

|

|

4,488,008 |

|

| |

|

|

|

| Operating Expenses: |

|

|

|

|

Professional Fees |

|

173,493 |

|

|

|

136,125 |

|

|

Depreciation and Amortization |

|

83,449 |

|

|

|

171,909 |

|

|

Selling Expenses |

|

474,389 |

|

|

|

378,645 |

|

|

Research and Development |

|

195,620 |

|

|

|

59,458 |

|

|

Equity Compensation Expense |

|

- |

|

|

|

182,772 |

|

|

Consulting Fees |

|

106,174 |

|

|

|

81,545 |

|

|

General and Administrative |

|

1,712,366 |

|

|

|

818,145 |

|

| Total Operating Expenses |

|

2,745,491 |

|

|

|

1,828,599 |

|

| Income (loss) from

Operations |

|

(1,510,333 |

) |

|

|

2,659,409 |

|

| |

|

|

|

| Other Income (Expense): |

|

|

|

|

Interest Income |

|

427 |

|

|

|

542 |

|

|

Interest Expense |

|

(1,035 |

) |

|

|

(40,689 |

) |

| Total Other Income

(Expense) |

|

(608 |

) |

|

|

(40,147 |

) |

| |

|

|

|

| Income (loss) before income

taxes |

|

(1,510,940 |

) |

|

|

2,619,261 |

|

| Provision for Income

Taxes |

|

- |

|

|

|

- |

|

| Net Income (loss) |

$ |

(1,510,940 |

) |

|

$ |

2,619,261 |

|

| |

|

|

|

| Net income (loss) Per Common

Share |

|

|

|

|

Basic |

$ |

(0.09 |

) |

|

$ |

0.17 |

|

|

Diluted |

$ |

(0.09 |

) |

|

$ |

0.14 |

|

| |

|

|

|

| Basic Weighted Average Common

Shares Outstanding |

|

16,805,402 |

|

|

|

15,850,352 |

|

| Diluted Weighted Average

Common Shares Outstanding |

|

16,805,402 |

|

|

|

18,117,710 |

|

(1) Share amounts with respect to the common stock and

Convertible Series A Preferred Stock have been retroactively

restated to reflect the reverse split thereof, which was effected

as of the close of business on September 10, 2020.

The following is a reconciliation of net income (loss) to EBITDA

and Adjusted EBITDA (in thousands, except percentages;

unaudited):

| |

|

| |

For The Three Months Ended |

| |

March 31, |

| |

2021 |

|

2020 |

| |

(Unaudited) |

|

(Unaudited) |

|

Net income (loss) |

$ |

(1,510,940 |

) |

|

$ |

2,619,261 |

|

| |

|

|

|

|

Interest Income |

|

(427 |

) |

|

|

(542 |

) |

|

Interest Expense |

|

1,035 |

|

|

|

40,689 |

|

|

Depreciation and Amortization |

|

83,449 |

|

|

|

171,909 |

|

|

Other |

|

- |

|

|

|

- |

|

|

EBITDA |

$ |

(1,426,883 |

) |

|

$ |

2,831,317 |

|

|

|

|

|

|

|

Equity Compensation Expense |

|

- |

|

|

|

182,772 |

|

|

Adjusted EBITDA |

$ |

(1,426,883 |

) |

|

$ |

3,014,089 |

|

|

|

|

|

|

|

Net revenue |

$ |

2,073,455 |

|

|

$ |

7,053,418 |

|

|

Adjusted EBITDA Margin |

|

(69 |

%) |

|

|

43 |

% |

| |

|

|

|

|

|

|

|

INVESTOR RELATIONS CONTACT:

John Nesbett/Jennifer BelodeauIMS Investor

Relationsjnesbett@imsinvestorrelations.com

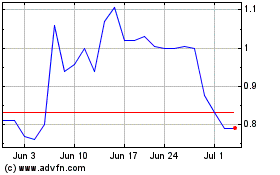

TOMI Environmental Solut... (NASDAQ:TOMZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

TOMI Environmental Solut... (NASDAQ:TOMZ)

Historical Stock Chart

From Apr 2023 to Apr 2024