Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260126

PROSPECTUS SUPPLEMENT NO. 5

(TO PROSPECTUS DATED JULY 12, 2022)

TMC THE METALS COMPANY INC.

Up to 264,438,297 Common Shares

Up to 9,500,000 Warrants

This prospectus supplement no. 5 (this “Supplement”)

supplements the prospectus dated July 12, 2022 (the “Prospectus”) relating to the issuance by us of up to an aggregate

of 24,500,000 of our common shares, without par value (“Common Shares”), which consists of (i) up to 9,500,000 Common

Shares that are issuable upon the exercise of private placement warrants (the “Private Placement Warrants”) originally issued

in a private placement in connection with the initial public offering of our predecessor company, Sustainable Opportunities Acquisition

Corp. (“SOAC”), at an exercise price of $11.50 per Common Share, and (ii) up to 15,000,000 Common Shares that are issuable

upon the exercise of 15,000,000 warrants issued in connection with the initial public offering of SOAC (the “Public Warrants,”

and together with the Private Placement Warrants, the “Warrants”).

The Prospectus and this Supplement also relate

to the resale from time to time by the Selling Securityholders named in the Prospectus (the “Selling Securityholders”) of

up to (i) 9,500,000 Private Placement Warrants, (ii) 9,500,000 Common Shares that may be issued upon exercise of the Private

Placement Warrants, (iii) 11,578,620 Common Shares that may be issued upon exercise of the Allseas Warrant (as defined in the Prospectus),

(iv) 6,759,000 Common Shares held by SOAC’s former directors, transferees of SOAC’s sponsor, Sustainable Opportunities

Holdings LLC (the “Sponsor”), and certain of their transferees (collectively, the “Founder Shares”), (v) 11,030,000

Common Shares issued in the PIPE Financing (as defined in the Prospectus), (vi) 131,178,480 Common Shares issued to certain shareholders

of DeepGreen (as defined in the Prospectus) pursuant to the Business Combination Agreement (as defined in the Prospectus), (vii) 77,277,244

Common Shares issuable to certain shareholders of DeepGreen upon the conversion of DeepGreen Earnout Shares (as defined in the Prospectus)

pursuant to the Business Combination Agreement, (viii) 1,241,000 Common Shares issuable to the transferees of the Sponsor and

their transferees upon the conversion of Sponsor Earnout Shares (as defined in the Prospects) and (ix) 873,953 Common Shares issued

to certain service providers to DeepGreen.

The Prospectus provides you with a general description

of such securities and the general manner in which we and the Selling Securityholders may offer or sell the securities. More specific

terms of any securities that we and the Selling Securityholders may offer or sell may be provided in a prospectus supplement that describes,

among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement

may also add, update or change information contained in the Prospectus.

We will not receive any proceeds from the sale

of Common Shares or Private Placement Warrants by the Selling Securityholders or of Common Shares by us pursuant to the Prospectus, except

with respect to amounts received by us upon exercise of the Warrants.

However, we will pay the expenses, other than

any underwriting discounts and commissions, associated with the sale of securities pursuant to the Prospectus.

We registered certain of the securities for resale

pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders.

Our registration of the securities covered by the Prospectus does not mean that either we or the Selling Securityholders will issue, offer

or sell, as applicable, any of the securities. The Selling Securityholders may offer and sell the securities covered by the Prospectus

in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares

or Warrants in the section entitled “Plan of Distribution” in the Prospectus.

This Supplement incorporates into the Prospectus

the information contained in our attached current report on Form 8-K which was filed with the Securities and Exchange Commission

on October 20, 2022.

You should read this Supplement in conjunction

with the Prospectus, including any supplements and amendments thereto. This Supplement is qualified by reference to the Prospectus except

to the extent that the information in this Supplement supersedes the information contained in the Prospectus. This Supplement is not complete

without, and may not be delivered or utilized except in connection with, the Prospectus, including any supplements and amendments thereto.

Our Common Shares and Public Warrants are listed

on Nasdaq under the symbols “TMC” and “TMCWW,” respectively. On October 19, 2022, the closing price of our

Common Shares was $1.01 and the closing price for our Public Warrants was $0.138.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 13 of the Prospectus and in the other documents that are incorporated

by reference in the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this Supplement is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is October 20,

2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 14, 2022

TMC THE METALS COMPANY INC.

(Exact name of registrant as specified in its charter)

|

British Columbia, Canada

(State or other jurisdiction of

incorporation) |

001-39281

(Commission File Number) |

Not Applicable

(IRS Employer

Identification No.) |

| |

|

|

|

595 Howe Street, 10th Floor

Vancouver, British Columbia

(Address of principal executive

offices) |

|

V6C 2T5

(Zip Code) |

Registrant’s telephone number, including

area code: (604) 631-3115

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| TMC Common Shares without par value |

|

TMC |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one TMC Common Share, each at an exercise price of $11.50 per share |

|

TMCWW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 14, 2022, Anthony O’Sullivan

notified TMC the metals company, Inc. (the “Company”) that he was resigning as the Company’s Chief Development

Officer, though he will remain in the position through a twelve-month transition period.

Grant Lindner is also expected to join the Company

on or about November 14, 2022 as the Project Director for the Company’s development of its NORI contract area in the Clarion

Clipperton Zone of the Pacific Ocean where the Company’s wholly-owned subsidiary, Nauru Ocean Resources Inc. (NORI), holds exclusive

rights to explore for polymetallic nodules. Mr. Lindner has over 25 years of experience in the mining industry, including positions

at BHP Group and Bechtel.

On October 20, 2022, the Company issued a

press release announcing Mr. O’Sullivan’s resignation and the hiring of Mr. Lindner. A copy of the press release

is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TMC THE METALS COMPANY INC. |

| |

|

|

| Date: October 20, 2022 |

By: |

/s/ Gerard Barron |

| |

Name: |

Gerard Barron |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

The Metals Company Hires Bechtel Veteran Grant

Lindner as Project Director to Advance its NORI-D Project, as CDO Anthony O’Sullivan Prepares to Step Down

| · | As NORI Project Director, Grant Lindner will oversee the delivery and scaling

of the Company’s first polymetallic nodule project |

| · | Lindner brings deep experience in delivering resource projects with BHP and

Bechtel with an exceptional track record of building safe and capital-efficient greenfield and brownfield projects |

| · | Chief Development Officer Anthony O’Sullivan has resigned as

the Company’s Chief Development Officer (CDO) for personal and health reasons, and will remain TMC’s CDO throughout a twelve-month

transition period |

NEW

YORK, Oct 20, 2022 — The Metals Company (NASDAQ: TMC) (the “Company” or “TMC”), an explorer of lower-impact

battery metals from seafloor polymetallic nodules, today announced that it has appointed Grant Lindner as Project Director for NORI as

the Company looks to bring online its first polymetallic nodule project (NORI-D Project) to supply critical battery metals for the clean

energy transition. Grant will play a key role in advancing all areas of the NORI-D Project including the submission of the Environmental

Impact Assessment and exploitation application to the International Seabed Authority, and the safe delivery of offshore and onshore development

plans. The Company also announced that its CDO Anthony O’Sullivan resigned as of October 14, 2022 for personal and health

reasons, though he will remain in the position through a twelve-month transition period.

Grant brings extensive experience in delivering

complex resource projects in the construction and mining industries and has delivered over $26 billion in project value during his 25-year

career at leading engineering and construction group, Bechtel, and mining major, BHP. He has held senior executive roles for large-scale

mining, smelter and refinery, material handling and marine projects and has a record of building high-performing teams to ensure efficient

project delivery.

Gerard Barron, CEO and Chairman of The Metals

Company, commented: “First I’d like to thank Tony for his considerable contributions to the company since joining us in 2017.

It has been a pleasure to have him alongside me during such an important time in the evolution of the company and the industry. I’m

grateful that he will provide us a year to transition, and I am hoping to count on his expertise and counsel well into the future.”

He

added: “Bringing talent like Grant into the business strengthens our ability to deliver a high-quality exploitation application

for NORI-D and get our first project into production. We are fortunate to have his considerable project leadership experience to

deal with the complexities and uncertainties of doing something that has never been done before.”

Across two of its nodule contract areas in the

Clarion Clipperton Zone of the Pacific Ocean, The Metals Company has identified 1.6 billion tonnes of wet nodules representing the largest

undeveloped source of battery metals on the planet, with enough in situ nickel, cobalt, copper and manganese to electrify 280

million electric vehicles – equivalent to entire U.S. light vehicle fleet. NORI-D, the Company’s first project, is ranked

by Mining.com as the largest undeveloped nickel project on the planet, with a higher nickel equivalent grade (3.2%) than any other major

undeveloped nickel project.

About The Metals Company

TMC the metals company Inc. (The Metals Company)

is an explorer of lower-impact battery metals from seafloor polymetallic nodules, on a dual mission: (1) supply metals for the clean

energy transition with the least possible negative environmental and social impact and (2) accelerate the transition to a circular

metal economy. The company through its subsidiaries holds exploration rights to three polymetallic nodule contract areas in the Clarion

Clipperton Zone of the Pacific Ocean regulated by the International Seabed Authority and sponsored by the governments of Nauru, Kiribati

and the Kingdom of Tonga. More information is available at www.metals.co.

More Info

Media | media@metals.co

Investors | investors@metals.co

Forward Looking Statements

Certain statements made in this press release are not historical facts

but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “should,” “would,”

“plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook”

and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking

statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in

the forward-looking statements. Most of these factors are outside TMC’s control and are difficult to predict. Factors that may cause

such differences include, but are not limited to: regulatory uncertainties and the impact of government regulation and political instability

on TMC’s resource activities; changes to any of the laws, rules, regulations or policies to which TMC is subject; the impact of

extensive and costly environmental requirements on TMC’s operations; environmental liabilities; the impact of polymetallic nodule

collection on biodiversity in the Clarion Clipperton Zone (CCZ) and recovery rates of impacted ecosystems; TMC’s ability to develop

minerals in sufficient grade or quantities to justify commercial operations; the lack of development of seafloor polymetallic nodule deposit;

uncertainty in the estimates for mineral resource calculations from certain contract areas and for the grade and quality of polymetallic

nodule deposits; TMC’s ability to successfully enter into binding agreements with each of Epsilon Carbon and Allseas; risks associated

with natural hazards; uncertainty with respect to the specialized treatment and processing of polymetallic nodules that TMC may recover;

risks associated with collective, development and processing operations, including with respect to the proposed plant in India and Allseas’

expected development efforts; fluctuations in transportation costs; testing and manufacturing of equipment; risks associated with TMC’s

limited operating history; the impact of the COVID-19 pandemic; risks associated with TMC’s intellectual property; and other risks

and uncertainties, including those in the “Risk Factors” section in TMC’s Quarterly Report on Form 10-Q for the

quarter ended September 30, 2021 filed by TMC with the SEC on November 15, 2021, and in TMC’s other future filings with

the Securities and Exchange Commission. TMC cautions that the foregoing list of factors is not exclusive. TMC cautions readers not to

place undue reliance upon any forward-looking statements, which speak only as of the date made. TMC does not undertake or accept any obligation

or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations

or any change in events, conditions, or circumstances on which any such statement is based except as required by law.

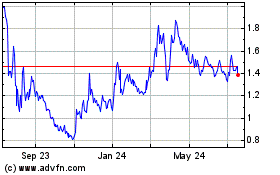

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Apr 2023 to Apr 2024