Titan Machinery Inc. (Nasdaq: TITN), a leading network of

full-service agricultural and construction equipment stores, today

reported financial results for the fiscal fourth quarter and full

year ended January 31, 2021.

David Meyer, Titan Machinery’s Chairman and

Chief Executive Officer, stated, "We completed fiscal 2021 with a

strong finish in fourth quarter, driven by our equipment business

which grew 35% for the quarter. From a segment perspective, our

Agriculture segment was the standout performer for the quarter and

fiscal year, generating very strong top and bottom line

performance. We are also pleased with the operating improvement in

our Construction segment this fiscal year, which generated positive

pre-tax income in fourth quarter and full year. While the pandemic

and adverse weather conditions have created additional obstacles

across our international store footprint, we experienced growth in

our International segment parts and service business during the

fourth quarter and full year, which has been a focus for us.

Looking ahead to fiscal 2022, Titan Machinery is in a great

position — we are benefiting from renewed strength in the

commodities cycle, we've stayed close to our customers with

exceptional service, and we've carefully managed our cost structure

and balance sheet to ensure that we drive profitability and remain

nimble to react to future opportunities."

Fiscal 2021 Fourth Quarter

Results

Consolidated ResultsFor the fourth quarter of

fiscal 2021, revenue was $436.7 million, compared to revenue of

$351.0 million in the fourth quarter last year. Equipment revenue

was $354.0 million for the fourth quarter of fiscal 2021, compared

to $262.8 million in the fourth quarter last year. Parts revenue

was $49.8 million for the fourth quarter of fiscal 2021, compared

to $52.3 million in the fourth quarter last year. Revenue generated

from service was $22.9 million for the fourth quarter of fiscal

2021, compared to $22.0 million in the fourth quarter last year.

Revenue from rental and other was $9.9 million for the fourth

quarter of fiscal 2021, compared to $13.9 million in the fourth

quarter last year.

Gross profit for the fourth quarter of fiscal

2021 increased to $67.7 million compared to $61.1 million in the

fourth quarter last year. The Company's gross profit margin

decreased to 15.5% in the fourth quarter of fiscal 2021, compared

to 17.4% in the fourth quarter last year. Gross profit margin

decreased primarily due to mix, with a greater proportion of

equipment revenue in the fourth quarter of fiscal 2021 compared to

a greater proportion of higher margin parts and service revenue in

the fourth quarter last year.

Operating expenses were essentially flat at

$60.5 million for the fourth quarter of fiscal 2021, compared to

$60.1 million in the fourth quarter last year. Operating expenses

as a percentage of sales improved 320 basis points to 13.9% for the

fourth quarter of fiscal 2021, compared to 17.1% of revenue in the

prior year period. The Company recognized impairments related to

intangible and long-lived assets of $0.4 million in the quarter

compared to $3.6 million in the prior year quarter.

Floorplan and other interest expense was $1.5

million for the fourth quarter of fiscal 2021, compared to $2.5

million for the same period last year. The decrease was due to a

lower interest rate environment, a lower interest rate spread under

our new five-year Amended and Restated Credit Agreement that was

finalized in April 2020, and lower borrowings on our lines of

credit.

In the fourth quarter of fiscal 2021, net income

was $0.8 million, or earnings per diluted share of $0.03, compared

to $0.7 million, or earnings per diluted share of $0.03 for the

fourth quarter of fiscal 2020.

On an adjusted basis, net income for the fourth

quarter of fiscal 2021 was $5.3 million, or $0.23 per diluted

share, compared to net income of $0.6 million, or $0.02 per diluted

share for the fourth quarter of fiscal 2020. The adjusted fourth

quarter fiscal 2021 net income of $5.3 million excludes a $3.3

million charge for Ukraine income tax valuation allowance

adjustments, while the adjusted fourth quarter fiscal 2020 net

income excludes a $4.6 million benefit for domestic income tax

valuation adjustments.

The Company generated $13.7 million in adjusted

EBITDA in the fourth quarter of fiscal 2021, compared to $8.1

million for the fourth quarter of fiscal 2020.

Segment ResultsAgriculture Segment - Revenue for

the fourth quarter of fiscal 2021 was $303.2 million, compared to

$215.5 million in the fourth quarter last year. Pre-tax income for

the fourth quarter of fiscal 2021 was $7.9 million, compared to a

pre-tax loss of $0.3 million in the fourth quarter last year.

Adjusted pre-tax income for the fourth quarter of fiscal 2021 was

$8.0 million, compared to $2.5 million in the fourth quarter last

year.

Construction Segment - Revenue for the fourth

quarter of fiscal 2021 was $88.9 million, compared to $87.2 million

in the fourth quarter last year. Pre-tax income for the fourth

quarter of fiscal 2021 was $0.2 million, compared to a pre-tax loss

of $1.8 million in the fourth quarter last year. Adjusted pre-tax

income for the fourth quarter of fiscal 2021 was $0.6 million,

compared to a pre-tax loss of $1.0 million in the fourth quarter

last year. At the end of fiscal 2021, the Company divested its

Phoenix and Tucson, Arizona construction equipment store

locations.

International Segment - Revenue for the fourth

quarter of fiscal 2021 was $44.6 million, compared to $48.2 million

in the fourth quarter last year. Pre-tax loss for the fourth

quarter of fiscal 2021 was $2.9 million, compared to $2.3 million

in the fourth quarter last year. Adjusted pre-tax loss for the

fourth quarter of fiscal 2021 was $2.7 million, compared to $2.3

million in the fourth quarter last year.

Fiscal 2021 Full Year

Results

Revenue increased 8.1% to $1.4 billion for

fiscal 2021. Net income for fiscal 2021 was $19.4 million, or $0.86

per diluted share, compared to $14.0 million, or $0.63 per diluted

share, for the prior year. Adjusted net income for fiscal 2021 was

$28.2 million, or $1.26 per diluted share, compared to an adjusted

net income of $18.6 million, or $0.84 per diluted share, for the

prior year. The Company generated adjusted EBITDA of $65.4 million

in fiscal 2021, representing an increase of 24.6% compared to

adjusted EBITDA of $52.5 million in fiscal 2020.

Balance Sheet and Cash Flow

Cash at the end of the fourth quarter of fiscal

2021 was $79.0 million. Inventories decreased to $418.5 million as

of January 31, 2021, compared to $597.4 million as of

January 31, 2020. This inventory decrease includes a $177.8

million decrease in equipment inventory, which reflects a decrease

in new equipment inventory of $151.7 million and a $26.1 million

decrease in used equipment inventory. The lower year-end inventory

also reflects the divestiture of the Company's two Arizona

construction stores. Outstanding floorplan payables were

$161.8 million on $773.0 million total available

floorplan lines of credit as of January 31, 2021, compared to

$371.8 million outstanding floorplan payables as of

January 31, 2020.

For the fiscal year ended January 31, 2021,

the Company’s net cash provided by operating activities was $173.0

million, compared to $1.0 million for the fiscal year ended

January 31, 2020. The Company evaluates its cash flow from

operating activities net of all floorplan payable activity and

maintaining a constant level of equity in its equipment inventory.

Taking these adjustments into account, adjusted net cash provided

by operating activities was $148.5 million for the fiscal year

ended January 31, 2021, compared to $17.8 million for the

fiscal year ended January 31, 2020.

Mr. Meyer concluded, "We expect another strong

year of growth in fiscal 2022. While fiscal 2021 was a great

success, especially in light of the unforeseen challenges brought

about by the global pandemic, we believe there are additional areas

of opportunity in this new fiscal year. Our entire organization has

done an amazing job and we are ideally positioned to take advantage

of the improving industry conditions with our healthy inventory

position, which helped drive a record $148 million in adjusted

operating cash flow during fiscal 2021 and is supporting our

business in a variety of ways such as improved equipment margins

and lowering our floorplan interest expense. These dynamics have

improved our cash flow, reduced our debt, and put the business on a

strong foundation to generate profitable growth across our segments

in fiscal 2022."

Fiscal 2022 Modeling

Assumptions

The following are the Company's current

expectations for fiscal 2022 modeling assumptions. We believe

modeling assumptions will continue to be impacted by the

challenging global economy due to the COVID-19 pandemic, creating a

higher degree of uncertainty in these assumptions compared to a

normal environment.

| |

Current Assumptions |

| Segment

Revenue |

|

|

Agriculture(1) |

Up 10-15% |

|

Construction(2) |

Down 0-5% |

|

International |

Up 12-17% |

| |

|

| Diluted

EPS(3) |

$1.25 - $1.45 |

|

|

|

| (1) Includes the

full year impact of the HorizonWest acquisition completed in May

2020. |

| (2) Includes the

full year impact of the Phoenix and Tucson, AZ store divestitures

in January 2021. Adjusting full year fiscal 2021 net sales by $27

million, representing the 2021 net sales of these divested stores,

results in a same-store sales assumption of up 3-8%. |

| (3) Includes

expenses related to ERP implementation. |

Conference Call Information

The Company will host a conference call and

audio webcast today at 7:30 a.m. Central time (8:30 a.m. Eastern

time). Investors interested in participating in the live call can

dial (877) 705-6003 from the U.S. International callers can dial

(201) 493-6725. A telephone replay will be available approximately

two hours after the call concludes and will be available through

Thursday, April 1, 2021, by dialing (844) 512-2921 from the U.S.,

or (412) 317-6671 from international locations, and entering

confirmation code 13716797.

A copy of the presentation that will accompany

the prepared remarks from the conference call is available on the

Company’s website under Investor Relations at

www.titanmachinery.com. An archive of the audio webcast will be

available on the Company’s website under Investor Relations at

www.titanmachinery.com for 30 days following the audio webcast.

Non-GAAP Financial

Measures

Within this release, the Company refers to

certain adjusted financial measures, which have directly comparable

GAAP financial measures as identified in this release. The Company

believes that non-GAAP financial measures, when reviewed in

conjunction with GAAP financial measures, can provide more

information to assist investors in evaluating current period

performance and in assessing future performance. For these reasons,

internal management reporting also includes non-GAAP measures.

Generally, the non-GAAP measures include adjustments for items such

as valuation allowances for income tax, impairment charges, Ukraine

remeasurement gains/losses and costs associated with our Enterprise

Resource Planning (ERP) system transition. The non-GAAP financial

measures should be considered in addition to, and not superior to

or as a substitute for the GAAP financial measures presented in

this release and the Company's financial statements and other

publicly filed reports. Non-GAAP measures as presented herein may

not be comparable to similarly titled measures used by other

companies. Investors are encouraged to review the reconciliations

of adjusted financial measures used in this release to their most

directly comparable GAAP financial measures. These reconciliations

are attached to this release. The tables included in the Non-GAAP

Reconciliations section reconcile net income, diluted earnings per

share, income (loss) before income taxes, and net cash provided by

operating activities (all GAAP financial measures) for the periods

presented to adjusted net income, adjusted EBITDA, adjusted diluted

earnings per share, adjusted income (loss) before income taxes, and

adjusted net cash provided by operating activities (all non-GAAP

financial measures) for the periods presented.

About Titan Machinery Inc.

Titan Machinery Inc., founded in 1980 and

headquartered in West Fargo, North Dakota, owns and operates a

network of full service agricultural and construction equipment

dealer locations in North America and Europe. The network consists

of US locations in Colorado, Iowa, Minnesota, Montana, Nebraska,

North Dakota, South Dakota, Wisconsin and Wyoming and its European

stores are located in Bulgaria, Germany, Romania, Serbia and

Ukraine. The Titan Machinery locations represent one or more of the

CNH Industrial Brands, including Case IH, New Holland Agriculture,

Case Construction, New Holland Construction, and CNH Industrial

Capital. Additional information about Titan Machinery Inc. can be

found at www.titanmachinery.com.

Forward Looking Statements

Except for historical information contained

herein, the statements in this release are forward-looking and made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. The words “potential,” “believe,”

“estimate,” “expect,” “intend,” “may,” “could,” “will,” “plan,”

“anticipate,” and similar words and expressions are intended to

identify forward-looking statements. Such statements are based upon

the current beliefs and expectations of our management.

Forward-looking statements made herein, which include statements

regarding Agriculture, Construction, and International segment

initiatives and improvements, segment revenue realization, growth

and profitability expectations, inventory expectations, leverage

expectations, agricultural and construction equipment industry

conditions and trends, and modeling assumptions and expected

results of operations for the fiscal year ending January 31, 2022,

involve known and unknown risks and uncertainties that may cause

Titan Machinery’s actual results in current or future periods to

differ materially from the forecasted assumptions and expected

results. The Company’s risks and uncertainties include, among other

things, the duration, scope and impact of the COVID-19 pandemic on

the Company's operations, a substantial dependence on a single

distributor, the continued availability of organic growth and

acquisition opportunities, potential difficulties integrating

acquired stores, industry supply levels, fluctuating agriculture

and construction industry economic conditions, the success of

recently implemented initiatives within the Company’s operating

segments, the uncertainty and fluctuating conditions in the capital

and credit markets, difficulties in conducting international

operations, foreign currency risks, governmental agriculture

policies, seasonal fluctuations, the ability of the Company to

reduce inventory levels, weather conditions, disruption in

receiving ample inventory financing, and increased competition in

the geographic areas served. These and other risks are more fully

described in Titan Machinery’s filings with the Securities and

Exchange Commission, including the Company’s most recently filed

Annual Report on Form 10-K, as updated in subsequently filed

Quarterly Reports on Form 10-Q, as applicable. Titan Machinery

conducts its business in a highly competitive and rapidly changing

environment. Accordingly, new risk factors may arise. It is not

possible for management to predict all such risk factors, nor to

assess the impact of all such risk factors on Titan Machinery’s

business or the extent to which any individual risk factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Other than as

required by law, Titan Machinery disclaims any obligation to update

such factors or to publicly announce results of revisions to any of

the forward-looking statements contained herein to reflect future

events or developments.

Investor Relations Contact:ICR, Inc.John Mills,

jmills@icrinc.comManaging Partner646-277-1254

|

|

|

TITAN MACHINERY INC. |

|

Consolidated Balance Sheets |

|

(in thousands) |

|

(Unaudited) |

| |

|

|

|

| |

January 31, 2021 |

|

January 31, 2020 |

| Assets |

|

|

|

| Current Assets |

|

|

|

|

Cash |

$ |

78,990 |

|

|

$ |

43,721 |

|

|

Receivables, net of allowance for expected credit losses |

69,109 |

|

|

72,776 |

|

|

Inventories |

418,458 |

|

|

597,394 |

|

|

Prepaid expenses and other |

13,677 |

|

|

13,655 |

|

|

Total current assets |

580,234 |

|

|

727,546 |

|

| Noncurrent Assets |

|

|

|

|

Property and equipment, net of accumulated depreciation |

147,165 |

|

|

145,562 |

|

|

Operating lease assets |

74,445 |

|

|

88,281 |

|

|

Deferred income taxes |

3,637 |

|

|

2,147 |

|

|

Goodwill |

1,433 |

|

|

2,327 |

|

|

Intangible assets, net of accumulated amortization |

7,785 |

|

|

8,367 |

|

|

Other |

1,090 |

|

|

1,113 |

|

|

Total noncurrent assets |

235,555 |

|

|

247,797 |

|

| Total

Assets |

$ |

815,789 |

|

|

$ |

975,343 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current Liabilities |

|

|

|

|

Accounts payable |

$ |

20,045 |

|

|

$ |

16,976 |

|

|

Floorplan payable |

161,835 |

|

|

371,772 |

|

|

Current maturities of long-term debt |

4,591 |

|

|

13,779 |

|

|

Current maturities of operating leases |

11,772 |

|

|

12,259 |

|

|

Deferred revenue |

59,418 |

|

|

40,968 |

|

|

Accrued expenses and other |

48,791 |

|

|

38,360 |

|

|

Income taxes payable |

11,048 |

|

|

49 |

|

|

Total current liabilities |

317,500 |

|

|

494,163 |

|

| Long-Term Liabilities |

|

|

|

|

Long-term debt, less current maturities |

44,906 |

|

|

37,789 |

|

|

Operating lease liabilities |

73,567 |

|

|

88,387 |

|

|

Deferred income taxes |

— |

|

|

2,055 |

|

|

Other long-term liabilities |

8,535 |

|

|

7,845 |

|

|

Total long-term liabilities |

127,008 |

|

|

136,076 |

|

| Stockholders' Equity |

|

|

|

|

Common stock |

— |

|

|

— |

|

|

Additional paid-in-capital |

252,913 |

|

|

250,607 |

|

|

Retained earnings |

116,869 |

|

|

97,717 |

|

|

Accumulated other comprehensive income (loss) |

1,499 |

|

|

(3,220 |

) |

|

Total stockholders' equity |

371,281 |

|

|

345,104 |

|

| Total Liabilities and

Stockholders' Equity |

$ |

815,789 |

|

|

$ |

975,343 |

|

|

|

|

|

|

TITAN MACHINERY INC. |

|

Consolidated Statements of Operations |

|

(in thousands, except per share data) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended January 31, |

|

Twelve Months Ended January 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Revenue |

|

|

|

|

|

|

|

|

Equipment |

$ |

354,011 |

|

|

$ |

262,826 |

|

|

$ |

1,016,071 |

|

|

$ |

917,202 |

|

|

Parts |

49,830 |

|

|

52,289 |

|

|

244,676 |

|

|

234,217 |

|

|

Service |

22,947 |

|

|

21,950 |

|

|

107,229 |

|

|

99,165 |

|

|

Rental and other |

9,890 |

|

|

13,899 |

|

|

43,246 |

|

|

54,587 |

|

| Total Revenue |

436,678 |

|

|

350,964 |

|

|

1,411,222 |

|

|

1,305,171 |

|

| Cost of Revenue |

|

|

|

|

|

|

|

|

Equipment |

318,122 |

|

|

235,362 |

|

|

911,170 |

|

|

818,707 |

|

|

Parts |

35,668 |

|

|

36,810 |

|

|

171,873 |

|

|

165,190 |

|

|

Service |

8,429 |

|

|

8,276 |

|

|

36,692 |

|

|

33,446 |

|

|

Rental and other |

6,745 |

|

|

9,398 |

|

|

30,125 |

|

|

37,010 |

|

| Total Cost of Revenue |

368,964 |

|

|

289,846 |

|

|

1,149,860 |

|

|

1,054,353 |

|

| Gross Profit |

67,714 |

|

|

61,118 |

|

|

261,362 |

|

|

250,818 |

|

| Operating Expenses |

60,523 |

|

|

60,128 |

|

|

220,774 |

|

|

225,722 |

|

| Impairment of Goodwill |

— |

|

|

— |

|

|

1,453 |

|

|

— |

|

| Impairment of Intangible and

Long-Lived Assets |

409 |

|

|

3,578 |

|

|

1,727 |

|

|

3,764 |

|

| Income (Loss) from

Operations |

6,782 |

|

|

(2,588 |

) |

|

37,408 |

|

|

21,332 |

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

Interest and other income (expense) |

194 |

|

|

439 |

|

|

527 |

|

|

3,126 |

|

|

Floorplan interest expense |

(528 |

) |

|

(1,630 |

) |

|

(3,339 |

) |

|

(5,354 |

) |

|

Other interest expense |

(959 |

) |

|

(890 |

) |

|

(3,843 |

) |

|

(4,452 |

) |

| Income (Loss) Before Income

Taxes |

5,489 |

|

|

(4,669 |

) |

|

30,753 |

|

|

14,652 |

|

| Provision for (Benefit from)

Income Taxes |

4,707 |

|

|

(5,342 |

) |

|

11,397 |

|

|

699 |

|

| Net Income |

782 |

|

|

673 |

|

|

19,356 |

|

|

13,953 |

|

| |

|

|

|

|

|

|

|

| Diluted Earnings per

Share |

$ |

0.03 |

|

|

$ |

0.03 |

|

|

$ |

0.86 |

|

|

$ |

0.63 |

|

| Diluted Weighted Average

Common Shares |

22,143 |

|

|

21,977 |

|

|

22,104 |

|

|

21,953 |

|

|

|

|

|

|

TITAN MACHINERY INC. |

|

Consolidated Condensed Statements of Cash

Flows |

|

(in thousands) |

|

(Unaudited) |

| |

|

|

|

| |

Year Ended January 31, |

| |

2021 |

|

2020 |

| Operating Activities |

|

|

|

|

Net income |

$ |

19,356 |

|

|

$ |

13,953 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

|

Depreciation and amortization |

23,701 |

|

|

28,067 |

|

|

Impairment |

3,180 |

|

|

3,764 |

|

|

Other, net |

9,313 |

|

|

13,284 |

|

|

Changes in assets and liabilities |

|

|

|

|

Inventories |

199,245 |

|

|

(99,469 |

) |

|

Manufacturer floorplan payable |

(110,084 |

) |

|

49,601 |

|

|

Other working capital |

28,285 |

|

|

(8,245 |

) |

| Net Cash Provided by Operating

Activities |

172,996 |

|

|

955 |

|

| Investing Activities |

|

|

|

|

Property and equipment purchases |

(20,089 |

) |

|

(25,016 |

) |

|

Proceeds from sale of property and equipment |

6,592 |

|

|

2,415 |

|

|

Acquisition consideration, net of cash acquired |

(6,790 |

) |

|

(13,887 |

) |

|

Other, net |

(10 |

) |

|

19 |

|

| Net Cash Used for Investing

Activities |

(20,297 |

) |

|

(36,469 |

) |

| Financing Activities |

|

|

|

|

Net change in non-manufacturer floorplan payable |

(106,414 |

) |

|

50,158 |

|

|

Repurchase of senior convertible notes |

— |

|

|

(45,644 |

) |

|

Net proceeds from (payments on) long-term debt |

(10,616 |

) |

|

18,864 |

|

|

Other, net |

(909 |

) |

|

(509 |

) |

| Net Cash Provided by (Used

for) Financing Activities |

(117,939 |

) |

|

22,869 |

|

| Effect of Exchange Rate

Changes on Cash |

509 |

|

|

(379 |

) |

| Net Change in Cash |

35,269 |

|

|

(13,024 |

) |

| Cash at Beginning of

Period |

43,721 |

|

|

56,745 |

|

| Cash at End of Period |

$ |

78,990 |

|

|

$ |

43,721 |

|

|

|

|

|

|

TITAN MACHINERY INC. |

|

Segment Results |

|

(in thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended January 31, |

|

Twelve Months Ended January 31, |

| |

2021 |

|

2020 |

|

Change |

|

2021 |

|

2020 |

|

Change |

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Agriculture |

$ |

303,161 |

|

|

$ |

215,508 |

|

|

40.7 |

% |

|

$ |

886,485 |

|

|

$ |

749,042 |

|

|

18.3 |

% |

|

Construction |

88,883 |

|

|

87,220 |

|

|

1.9 |

% |

|

305,745 |

|

|

320,034 |

|

|

(4.5) |

% |

|

International |

44,634 |

|

|

48,236 |

|

|

(7.5) |

% |

|

218,992 |

|

|

236,095 |

|

|

(7.2) |

% |

| Total |

$ |

436,678 |

|

|

$ |

350,964 |

|

|

24.4 |

% |

|

$ |

1,411,222 |

|

|

$ |

1,305,171 |

|

|

8.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss) Before

Income Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

Agriculture |

$ |

7,933 |

|

|

$ |

(275 |

) |

|

n/m |

|

$ |

34,422 |

|

|

$ |

18,036 |

|

|

90.9 |

% |

|

Construction |

236 |

|

|

(1,750 |

) |

|

n/m |

|

186 |

|

|

(2,290 |

) |

|

n/m |

|

International |

(2,890 |

) |

|

(2,279 |

) |

|

(26.8) |

% |

|

(6,025 |

) |

|

504 |

|

|

n/m |

|

Segment income before income taxes |

5,279 |

|

|

(4,304 |

) |

|

n/m |

|

28,583 |

|

|

16,250 |

|

|

75.9 |

% |

|

Shared Resources |

210 |

|

|

(365 |

) |

|

n/m |

|

2,170 |

|

|

(1,598 |

) |

|

n/m |

| Total |

$ |

5,489 |

|

|

$ |

(4,669 |

) |

|

n/m |

|

$ |

30,753 |

|

|

$ |

14,652 |

|

|

109.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TITAN MACHINERY INC. |

|

Non-GAAP Reconciliations |

|

(in thousands, except per share data) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended January 31, |

|

Twelve Months Ended January 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Adjusted Net

Income |

|

|

|

|

|

|

|

|

Net Income |

$ |

782 |

|

|

$ |

673 |

|

|

$ |

19,356 |

|

|

$ |

13,953 |

|

| Adjustments |

|

|

|

|

|

|

|

|

ERP transition costs |

740 |

|

|

2,397 |

|

|

2,990 |

|

|

7,175 |

|

|

Impairment charges |

409 |

|

|

3,578 |

|

|

3,180 |

|

|

3,764 |

|

|

Ukraine remeasurement (gain) / loss |

201 |

|

|

(28 |

) |

|

1,174 |

|

|

(616 |

) |

|

Total Pre-Tax Adjustments |

1,350 |

|

|

5,947 |

|

|

7,344 |

|

|

10,323 |

|

| Tax Effect of Adjustments

(1) |

386 |

|

|

(1,452 |

) |

|

(2,227 |

) |

|

(1,036 |

) |

| Adjustment for Tax Valuation

Allowance |

2,741 |

|

|

(4,611 |

) |

|

3,759 |

|

|

(4,611 |

) |

|

Total Adjustments |

4,477 |

|

|

(116 |

) |

|

8,876 |

|

|

4,676 |

|

| Adjusted Net Income |

$ |

5,259 |

|

|

$ |

557 |

|

|

$ |

28,232 |

|

|

$ |

18,629 |

|

| |

|

|

|

|

|

|

|

| Adjusted Diluted

EPS |

|

|

|

|

|

|

|

| Diluted EPS |

$ |

0.03 |

|

|

$ |

0.03 |

|

|

$ |

0.86 |

|

|

$ |

0.63 |

|

| Adjustments (2) |

|

|

|

|

|

|

|

|

ERP transition costs |

0.03 |

|

|

0.11 |

|

|

0.13 |

|

|

0.32 |

|

|

Impairment charges |

0.02 |

|

|

0.16 |

|

|

0.14 |

|

|

0.17 |

|

|

Ukraine remeasurement (gain) / loss |

0.01 |

|

|

(0.01 |

) |

|

0.05 |

|

|

(0.02 |

) |

|

Total Pre-Tax Adjustments |

0.06 |

|

|

0.26 |

|

|

0.32 |

|

|

0.47 |

|

| Tax Effect of Adjustments

(1) |

0.02 |

|

|

(0.06 |

) |

|

(0.10 |

) |

|

(0.05 |

) |

| Adjustment for Tax Valuation

Allowance |

0.12 |

|

|

(0.21 |

) |

|

0.18 |

|

|

(0.21 |

) |

|

Total Adjustments |

0.20 |

|

|

(0.01 |

) |

|

0.40 |

|

|

0.21 |

|

| Adjusted Diluted EPS |

$ |

0.23 |

|

|

$ |

0.02 |

|

|

$ |

1.26 |

|

|

$ |

0.84 |

|

| |

|

|

|

|

|

|

|

| Adjusted Income Before

Income Taxes |

|

|

|

|

|

|

|

| Income (Loss) Before Income

Taxes |

$ |

5,489 |

|

|

$ |

(4,669 |

) |

|

$ |

30,753 |

|

|

$ |

14,652 |

|

| Adjustments |

|

|

|

|

|

|

|

|

ERP transition costs |

740 |

|

|

2,397 |

|

|

2,990 |

|

|

7,175 |

|

|

Impairment charges |

409 |

|

|

3,578 |

|

|

3,180 |

|

|

3,764 |

|

|

Ukraine remeasurement (gain) / loss |

201 |

|

|

(28 |

) |

|

1,174 |

|

|

(616 |

) |

|

Total Adjustments |

1,350 |

|

|

5,947 |

|

|

7,344 |

|

|

10,323 |

|

| Adjusted Income Before Income

Taxes |

$ |

6,839 |

|

|

$ |

1,278 |

|

|

$ |

38,097 |

|

|

$ |

24,975 |

|

| |

|

|

|

|

|

|

|

| Adjusted Income Before

Income Taxes - Agriculture |

|

|

|

|

|

|

|

| Income (Loss) Before Income

Taxes |

$ |

7,933 |

|

|

$ |

(275 |

) |

|

$ |

34,422 |

|

|

$ |

18,036 |

|

|

Impairment charges |

28 |

|

|

2,807 |

|

|

272 |

|

|

2,807 |

|

| Adjusted Income Before Income

Taxes |

$ |

7,961 |

|

|

$ |

2,532 |

|

|

$ |

34,694 |

|

|

$ |

20,843 |

|

| |

|

|

|

|

|

|

|

| Adjusted Income (Loss)

Before Income Taxes - Construction |

|

|

|

|

|

|

|

| Income (Loss) Before Income

Taxes |

$ |

236 |

|

|

$ |

(1,750 |

) |

|

$ |

186 |

|

|

$ |

(2,290 |

) |

|

Impairment charges |

381 |

|

|

771 |

|

|

597 |

|

|

957 |

|

| Adjusted Income (Loss) Before

Income Taxes |

$ |

617 |

|

|

$ |

(979 |

) |

|

$ |

783 |

|

|

$ |

(1,333 |

) |

| |

|

|

|

|

|

|

|

| Adjusted Loss Before

Income Taxes - International |

|

|

|

|

|

|

|

| Income (Loss) Before Income

Taxes |

$ |

(2,890 |

) |

|

$ |

(2,279 |

) |

|

$ |

(6,025 |

) |

|

$ |

504 |

|

| Adjustments |

|

|

|

|

|

|

|

|

Impairment charges |

— |

|

|

— |

|

|

2,311 |

|

|

— |

|

|

Ukraine remeasurement (gain) / loss |

201 |

|

|

(28 |

) |

|

1,174 |

|

|

(616 |

) |

|

Total Adjustments |

201 |

|

|

(28 |

) |

|

3,485 |

|

|

(616 |

) |

| Adjusted Loss Before Income

Taxes |

$ |

(2,689 |

) |

|

$ |

(2,307 |

) |

|

$ |

(2,540 |

) |

|

$ |

(112 |

) |

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

|

|

|

|

|

|

| Net Income |

$ |

782 |

|

|

$ |

673 |

|

|

$ |

19,356 |

|

|

$ |

13,953 |

|

| Adjustments |

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

884 |

|

|

815 |

|

|

3,574 |

|

|

4,121 |

|

|

Provision for income taxes |

4,707 |

|

|

(5,342 |

) |

|

11,397 |

|

|

699 |

|

|

Depreciation and amortization |

5,970 |

|

|

7,006 |

|

|

23,701 |

|

|

28,067 |

|

| EBITDA |

12,343 |

|

|

3,152 |

|

|

58,028 |

|

|

46,840 |

|

| Adjustments |

|

|

|

|

|

|

|

|

ERP transition costs |

740 |

|

|

1,384 |

|

|

2,990 |

|

|

2,497 |

|

|

Impairment charges |

409 |

|

|

3,578 |

|

|

3,180 |

|

|

3,764 |

|

|

Ukraine remeasurement (gain) / loss |

201 |

|

|

(28 |

) |

|

1,174 |

|

|

(616 |

) |

|

Total Adjustments |

1,350 |

|

|

4,934 |

|

|

7,344 |

|

|

5,645 |

|

| Adjusted EBITDA |

$ |

13,693 |

|

|

$ |

8,086 |

|

|

$ |

65,372 |

|

|

$ |

52,485 |

|

| |

|

|

|

|

|

|

|

| Adjusted Net Cash

Provided by Operating Activities |

|

|

|

|

|

|

|

| Net Cash Provided by Operating

Activities |

|

|

|

|

$ |

172,996 |

|

|

$ |

955 |

|

| Net Change in Non-Manufacturer

Floorplan Payable |

|

|

|

|

(106,414 |

) |

|

50,158 |

|

| Adjustment for Constant Equity

in Inventory |

|

|

|

|

81,900 |

|

|

(33,359 |

) |

|

Adjusted Net Cash Provided by Operating Activities |

|

|

|

|

$ |

148,482 |

|

|

$ |

17,754 |

|

|

|

|

|

|

|

|

|

|

| |

| (1) The tax effect

of U.S. related adjustments was calculated using a 26% tax rate,

determined based on a 21% federal statutory rate and a 5% blended

state income tax rate. The tax effect of the Germany related

adjustments was calculated using a 29% tax rate. Included in the

tax effect of the adjustments is the tax impact of foreign currency

changes in Ukraine of ($0.1 million) for the three months ended

January 31, 2021 and $1.2 million for the fiscal year ended January

31, 2021. |

| (2) Adjustments are

net of amounts allocated to participating securities where

applicable. |

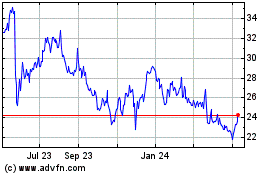

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Mar 2024 to Apr 2024

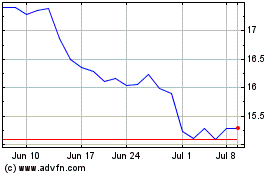

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Apr 2023 to Apr 2024