Titan Machinery Announces Entry into New Amended and Restated Credit Agreement

April 06 2020 - 8:00AM

Titan Machinery Inc. (Nasdaq: TITN), a leading network of

full-service agricultural and construction equipment stores,

announced today that it has entered into a new five-year Amended

and Restated Credit Agreement, maturing April 2025, arranged by

Bank of America, with a syndicate of lenders consisting of Bank of

America, Wells Fargo Bank, Regions Bank, BBVA USA, AgCountry Farm

Credit Services, and Sterling National Bank.

The new Amended and Restated Credit Agreement

provides for an aggregate $250 million financing commitment by the

lenders, consisting of an aggregate floorplan financing commitment

of $185 million and an aggregate working capital commitment of $65

million. The floorplan facility may be used to advance up to 85% of

the value of eligible new inventory and up to 75% of the value of

eligible used inventory, which compares to the previous floorplan

facility that allowed for an advance up to 70% of the value of both

new and used eligible inventory. The working capital facility may

be used to advance up to 85% of eligible accounts, 75% of the value

of eligible rental equipment, 75% of the Company’s eligible parts

inventory, and a percentage of other unencumbered assets such as

vehicles and real estate. The working capital advance rates

are up to 5% higher than the previous facility and can include

assets in the borrowing base that were not allowed under the old

facility.

The Amended and Restated Credit Agreement does

not obligate the Company to maintain financial covenants, except in

the event that excess availability is less than 15% of the lower of

the borrowing base or the size of the full credit line. If

excess availability levels are not met, then the Company is

required to maintain a fixed charge coverage ratio of at least

1.10:1.00. These terms are similar to those in the previous

credit facility but favorably impacted by the increased advanced

rates, which adds to the Company’s excess availability amount.

The interest rate for loans under the credit

facility will be equal to LIBOR (subject to a floor of 0.5%) plus

an applicable margin based on the Company’s excess availability.

The initial applicable margin is 1.5%, resulting in an

effective initial interest rate of 2.49%.

Mark Kalvoda, Chief Financial Officer stated,

"We believe this Amended and Restated Credit Agreement validates

the strength of our overall financial position and provides ample

financial flexibility to support our continued long-term profitable

growth. The improved terms and rates of the credit facility

lowers our borrowing costs by approximately 50 basis points, while

simultaneously increasing our liquidity position through enhanced

flexibility, allowing us to meet the needs of our business.

We are fortunate to have partnered with such a supportive bank

group."

About Titan Machinery Inc.

Titan Machinery Inc., founded in 1980 and

headquartered in West Fargo, North Dakota, owns and operates a

network of full service agricultural and construction equipment

dealer locations in North America and Europe. The network consists

of US locations in Arizona, Colorado, Iowa, Minnesota, Montana,

Nebraska, North Dakota, South Dakota, Wisconsin and Wyoming and its

European stores are located in Bulgaria, Germany, Romania, Serbia

and Ukraine. The Titan Machinery locations represent one or more of

the CNH Industrial Brands, including Case IH, New Holland

Agriculture, Case Construction, New Holland Construction, and CNH

Industrial Capital. Additional information about Titan

Machinery Inc. can be found at www.titanmachinery.com.

Forward Looking Statements

Except for historical information contained

herein, the statements in this release are forward-looking and made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. The words “potential,” “believe,”

“estimate,” “expect,” “intend,” “may,” “could,” “will,” “plan,”

“anticipate,” and similar words and expressions are intended to

identify forward-looking statements. Such statements are based upon

the current beliefs and expectations of our management.

Forward-looking statements made herein, which include statements

regarding growth and profitability expectations financial liquidity

expectations, and future borrowing costs, involve known and unknown

risks and uncertainties that may cause Titan Machinery’s actual

results in current or future periods to differ materially from the

forecasted assumptions and expected results. The Company’s risks

and uncertainties include, among other things, a substantial

dependence on a single equipment supplier, the continued

availability of organic growth and acquisition opportunities,

potential difficulties integrating acquired stores, industry supply

levels, fluctuating agriculture and construction industry economic

conditions, the success of recently implemented initiatives within

the Company’s operating segments, the uncertainty and fluctuating

conditions in the capital and credit markets, difficulties in

conducting international operations, foreign currency risks,

governmental agriculture policies, seasonal fluctuations, the

ability of the Company to reduce inventory levels, climate

conditions, disruption in receiving ample inventory financing, and

increased competition in the geographic areas served. These and

other risks are more fully described in Titan Machinery’s filings

with the Securities and Exchange Commission, including the

Company’s most recently filed Annual Report on Form 10-K, as

updated in subsequently filed Quarterly Reports on Form 10-Q, as

applicable. Titan Machinery conducts its business in a highly

competitive and rapidly changing environment. Accordingly, new risk

factors may arise. It is not possible for management to predict all

such risk factors, nor to assess the impact of all such risk

factors on Titan Machinery’s business or the extent to which any

individual risk factor, or combination of factors, may cause

results to differ materially from those contained in any

forward-looking statement. Other than required by law, Titan

Machinery disclaims any obligation to update such factors or to

publicly announce results of revisions to any of the

forward-looking statements contained herein to reflect future

events or developments.

Investor Relations Contact:

ICR, Inc.

John Mills, jmills@icrinc.com

Managing Partner

646-277-1254

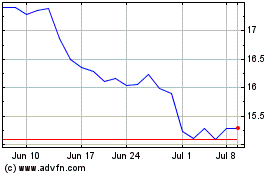

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Mar 2024 to Apr 2024

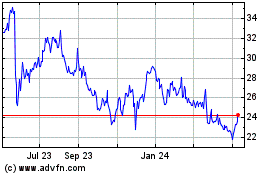

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Apr 2023 to Apr 2024