UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

|

|

|

|

¨

|

Preliminary Proxy Statement

|

|

|

|

|

|

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

|

|

|

þ

|

Definitive Proxy Statement

|

|

|

|

|

|

|

|

|

¨

|

Definitive Additional Materials

|

|

|

|

|

|

|

|

|

¨

|

Soliciting Material Pursuant to § 240.14a-12

|

Tiptree Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

|

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

2021

|

|

|

|

|

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

TIPTREE INC.

|

299 Park Avenue, 13th Floor

New York, New York 10171

April 22, 2021

Dear Stockholder:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Tiptree Inc. (the “Company” or “Tiptree”) will be held virtually only via live audio webcast at www.virtualshareholdermeeting.com/TIPT2021, on Tuesday, June 8, 2021, at 4:00 p.m. Eastern time (EST). You will be able to attend the meeting online and submit questions during the meeting by visiting the website listed above. You will also be able to vote your shares electronically at the Annual Meeting. As always, we encourage you to authorize a proxy to vote your shares prior to the annual meeting.

We are delivering the attached proxy statement, with the accompanying formal notice of the meeting, which describes the matters expected to be acted upon at the meeting. We urge you to review these materials carefully and to vote on the matters described in the accompanying proxy statement.

Virtual Meeting Admission. Stockholders of record as of April 16, 2021 will be able to participate in the Annual Meeting by visiting our Annual Meeting website at www.virtualshareholdermeeting.com/TIPT2021. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will begin promptly at 4:00 p.m. EST on Tuesday, June 8, 2021. Online check-in will begin at 3:45 p.m. EST, and you should allow approximately 15 minutes for the online check-in procedures. Additional details regarding requirements for admission to the Annual Meeting are described in the attached proxy statement under the heading “How can I attend the virtual Annual Meeting?”

Your vote is important. Whether you plan to virtually attend the meeting or not, please authorize a proxy to vote your shares either over the Internet, by toll-free telephone or by completing the enclosed proxy card and returning it as promptly as possible. You may continue to have your shares of common stock voted as instructed over the Internet, by toll-free telephone or in the proxy card, or you may change your vote either by authorizing a proxy to vote your shares again before 11:59 p.m., Eastern Time, on June 7, 2021, the time at which the Internet and telephone proxy authorization facilities close, or, if you attend the Annual Meeting virtually, by voting at the virtual meeting.

|

|

|

|

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

/s/ Jonathan Ilany

|

|

|

Jonathan Ilany

|

|

|

Chief Executive Officer

|

TIPTREE INC.

299 Park Avenue, 13th Floor

New York, NY 10171

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are hereby invited to attend the 2021 Annual Meeting of Stockholders of Tiptree Inc.

|

|

|

|

|

|

|

|

WHEN

|

Tuesday, June 8, 2021, at 4:00 p.m., EST.

|

|

|

|

|

WHERE

|

Virtually via audio webcast

Participate in the Annual Meeting by visiting our Annual Meeting website at www.virtualshareholdermeeting.com/TIPT2021.

There will not be a physical meeting in New York or anywhere else

Additional details regarding requirements for admission to the Annual Meeting are described in the attached proxy statement under the heading “How can I attend the virtual Annual Meeting?”

|

|

|

|

|

RECORD DATE

|

Stockholders of record as of the close of business on April 16, 2021 will be entitled to notice of and to vote at the 2021 Annual Meeting of Stockholders.

|

|

|

|

|

ITEMS OF BUSINESS

|

(1) To elect two (2) Class II directors to serve for a term expiring at the 2024 Annual Meeting (Proposal 1);

|

|

(2) To ratify the selection of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal 2); and

|

|

(3) To conduct such other business as may properly come before the meeting or any

adjournment or postponement thereof.

|

|

|

|

|

VOTING BY PROXY OR PROXY AUTHORIZATION

|

Tiptree Inc., on behalf of the Board of Directors, is soliciting your proxy to ensure that a quorum is present and that your shares are represented and voted at the 2021 Annual Meeting of Stockholders. Whether or not you plan to virtually attend the Annual Meeting, please authorize a proxy to vote either over the Internet, by toll-free telephone or by completing, signing, dating and promptly returning the enclosed proxy card in the postage-prepaid envelope provided. For specific instructions on voting, please refer to the instructions on the proxy card or the information forwarded by your broker, bank or other holder of record. If you attend the Annual Meeting virtually, you may vote in person (virtually) if you wish, even if you have previously given your proxy. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person (virtually) at the virtual meeting, you must obtain a proxy issued in your name from such broker, bank or other nominee.

|

Important Notice Regarding the Availability of Proxy Materials for our Annual Meeting to be held on June 8, 2021: Financial and other information concerning Tiptree Inc. (“Tiptree”) is contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, including financial statements, filed with the SEC on March 11, 2021 (the “2020 10-K”). Under rules issued by the SEC, we are providing access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials and our Annual Report at http://www.proxyvote.com.

|

|

|

|

|

|

|

|

|

By Order of our Board of Directors,

|

|

|

|

|

|

/s/ Neil C. Rifkind

|

|

|

Neil C. Rifkind

|

|

|

Secretary

|

New York, New York

April 22, 2021

PROXY STATEMENT

SUMMARY

2021 Annual Meeting Information

|

|

|

|

|

|

|

|

Date and Time:

|

Tuesday, June 8, 2021, at 4:00 p.m., EST.

|

|

|

|

|

Location:

|

Virtually via audio webcast

Participate in the Annual Meeting by visiting our Annual Meeting website at www.virtualshareholdermeeting.com/TIPT2021.

There will not be a physical meeting in New York or anywhere else

|

|

|

|

|

Record Date:

|

April 16, 2021

|

|

|

|

|

Mailing Date:

|

On or about April 22, 2021

|

Meeting Agenda and Board Recommendations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSALS

|

THE BOARD’S VOTING RECOMMENDATIONS:

|

Page

|

|

1.

|

To elect two (2) Class II directors to serve for a term expiring at the 2024 Annual Meeting (Proposal 1); and

|

“FOR” each nominee for director (Proposal 1)

|

|

|

2.

|

To ratify the selection of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal 2).

|

“FOR” (Proposal 2)

|

|

|

|

|

|

|

How to Vote

You can vote by any of the following methods:

|

|

|

|

|

|

|

|

|

|

|

By Internet:

|

|

Go to www.proxyvote.com

|

|

|

|

|

|

By Phone:

|

|

Call 1-800-690-6903

|

|

|

|

|

|

By Mail:

|

|

Complete, sign, date and mail the proxy card in the postage paid envelope provided.

|

|

|

|

|

|

In Person:

|

|

Attend the Annual Meeting virtually and vote in person (virtually)

|

If you authorize a proxy to vote your shares by Internet or phone, you must do so no later than 11:59 p.m. Eastern Time on June 7, 2021.

Tiptree Performance in 2020

Financial Results for 2020:

Overall:

•Net loss for total year 2020 of $29.2 million was driven by unrealized losses on equities, primarily our holding of Invesque, partially offset by growth in insurance underwriting operations and growth in volume and margins in our mortgage business.

•Adjusted net income(1) in 2020 increased 86.4% to $51.4 million, from $27.6 million in 2019, driven by growth and improved margins in our insurance and mortgage operations. Adjusted return on average equity(1) was 13.1% in 2020, as compared to 6.8% in 2019.

•Book value per share(1) of $10.90 as of December 31, 2020, when combined with dividends paid, decreased 4.0% from 2019, driven by a combination of net losses, partially offset by share repurchases at discounts to book value per share.

•In 2020, 2019 and 2018, we purchased and retired 2,384,286, 1,472,730 and 2,177,235 shares of our common stock, respectively, for $37.1 million in aggregate, at an average 42% discount to book value per share.

•Cash and cash equivalents of $136.9 million as of December 31, 2020, of which $80.0 million resides outside our statutory insurance subsidiaries.

Insurance (Fortegra Group):

•Gross written premiums and premium equivalents were $1,666.9 million in 2020, as compared to $1,297.0 million in 2019, up 28.5% as a result of growth in our U.S. Insurance programs including commercial, warranty, and niche personal lines, and the acquisition of Smart AutoCare.

•Income before taxes in 2020 of $26.9 million decreased 27.2% as compared to $37.0 million in 2019, primarily driven by net realized and unrealized losses on investments as compared to gains in the prior year. Return on average equity was 8.1% in 2020 as compared to 10.7% in 2019.

•Adjusted net income(1) increased 32.4% to $43.4 million in 2020, as compared to $32.8 million in 2019. Adjusted return on average equity(1) was 15.2% in 2020, as compared to 12.3% in 2019 driven by growth in commercial, warranty and niche personal lines programs.

•For total year 2020, the combined ratio improved to 91.5%, as compared to 92.4% in 2019, driven by the shift in business mix toward more profitable warranty and commercial programs.

•In January 2020, we acquired Smart AutoCare, a growing vehicle warranty and service contract administrator in the U.S. which contributed $248.8 million of gross written premiums and premium equivalents in 2020. The acquisition expanded our distribution channels and dramatically increased our presence in the auto warranty sector.

•In September 2020, we formed a new excess and surplus lines subsidiary, Fortegra Specialty Insurance Company, which we expect will broaden our product reach and scope within the U.S.

•On December 31, 2020, we acquired Sky Auto for approximately $25 million of cash consideration to further expand our presence in the auto warranty sector. The acquisition supplements our distribution with direct marketing capabilities.

Mortgage:

•Income before taxes of $31.1 million in 2020, as compared to $3.0 million in 2019. Adjusted net income(1) of $28.6 million in 2020, an increase of $24.6 million from 2019, driven by growth in volumes and margins as interest rates dropped and home prices increased in 2020.

•Return on average equity of 50.9% and adjusted return on average equity(1) of 60.5% in 2020, as compared to 7.1% and 12.0%, respectively, in 2019.

_______________________________

(1) For a reconciliation to GAAP financials, see “Annex A: Non-GAAP Measures”

Additional information on our 2020 results is contained in our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC.

TIPTREE LONG TERM PERFORMANCE

We believe that our performance is best measured over the long term and that long term growth in book value per share plus dividends paid is the best metric for evaluating our performance. The table below shows growth in book value per share plus dividends paid annually and since inception (July 2007) during the five year period from December 31, 2015 to December 31, 2020:

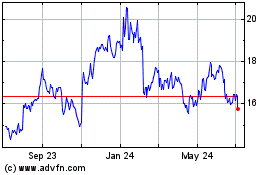

The chart below(1) summarizes our book value per share growth and stock price performance over the five year period from December 31, 2015 to December 31, 2020, compared with the Russell 2000 and S&P 500, with all values indexed to December 31, 2015. All values are calculated with dividends reinvested.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Return

|

|

Annualized Return From July 2007

|

|

Year

|

|

Book Value Per Share(1)

|

|

Dividends Paid

|

|

Tiptree

|

|

S&P 500

|

|

Russell 2000

|

|

Tiptree

|

|

S&P 500

|

|

Russell 2000

|

|

2015

|

|

$

|

8.90

|

|

|

$

|

0.10

|

|

|

0.0

|

%

|

|

1.4%

|

|

-4.4%

|

|

10.2

|

%

|

|

6.0

|

%

|

|

5.3%

|

|

2016

|

|

$

|

10.14

|

|

|

$

|

0.10

|

|

|

15.1

|

%

|

|

12.0%

|

|

21.3%

|

|

10.7

|

%

|

|

6.6

|

%

|

|

6.9%

|

|

2017

|

|

$

|

9.97

|

|

|

$

|

0.12

|

|

|

-0.5

|

%

|

|

21.9%

|

|

14.7%

|

|

9.6

|

%

|

|

8.0

|

%

|

|

7.6%

|

|

2018

|

|

$

|

10.79

|

|

|

$

|

0.135

|

|

|

9.6

|

%

|

|

-4.4%

|

|

-11.0%

|

|

9.6

|

%

|

|

6.8

|

%

|

|

5.8%

|

|

2019

|

|

$

|

11.52

|

|

|

$

|

0.155

|

|

|

8.2

|

%

|

|

31.5%

|

|

25.5%

|

|

9.5

|

%

|

|

8.6

|

%

|

|

7.3%

|

|

2020

|

|

$

|

10.90

|

|

|

$

|

0.160

|

|

|

-4.0

|

%

|

|

18.3%

|

|

19.9%

|

|

8.6

|

%

|

|

9.3

|

%

|

|

8.2

|

%

|

________________________________

(1) At inception in 2007, book value per share was $5.36. For periods prior to April 10, 2018, book value per share assumes full exchange of the limited partner units of Tiptree Financial Partners, L.P. (“TFP”) for common stock.

During this five year period, our book value per share plus dividends paid increased at a compounded annual rate of return of 5.4%, compared with a compounded annual rate of return of 13.3% for the Russell 2000. Our stock has continued to trade at a discount to book value and has not followed the trajectory of our growth in book value per share. At year end 2020, our common stock was trading at 46% of book value. The graph and related data were furnished by ICR, LLC.

________________________________

(1) This disclosure is in addition to the SEC required performance graph, which is included on page 45. All values are calculated with dividends reinvested.

COMPENSATION HIGHLIGHTS

Our executive compensation program is intended to provide competitive compensation to our named executive officers that is aligned with the interests of our stockholders on a short- and long-term basis. We measure performance for compensation purposes primarily based on Adjusted EBITDA and growth in book value per share.

•Executive Committee (collectively, the Executive Chairman and Chief Executive Officer) total compensation was $2.1 million for 2020 or 0.26% of total revenues.

•28% of Executive Committee 2020 compensation was variable compensation

Executive Committee compensation for 2020 consisted of base salary and annual cash incentive. Base salaries are fixed and set by our CNG Committee.

During the three-year period set forth in the chart below, we believe that total Executive Committee compensation has been well aligned with our financial performance. The chart below excludes amounts reported in the “All Other Compensation” column of the Summary Compensation Table for the applicable year. It also presents incentive compensation awarded to our Executive Committee in the manner that it was considered by the CNG Committee. See “Compensation Discussion and Analysis — Named Executive Officers — Executive Compensation (CNG Perspective)” on page 26 for additional information.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the meeting and how does the Board recommend I vote on these proposals?

The purpose of the Annual Meeting is for stockholders to vote on the following proposals, which are included in this Proxy Statement. Tiptree’s Board recommends that you vote your shares as indicated below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSALS

|

THE BOARD’S VOTING RECOMMENDATIONS:

|

Page

|

|

1.

|

To elect two (2) Class II directors to serve for a term expiring at the 2024 Annual Meeting (Proposal 1); and

|

“FOR” each nominee for director (Proposal 1)

|

|

|

2.

|

To ratify the selection of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal 2).

|

“FOR” (Proposal 2)

|

|

|

|

|

|

|

Other than the proposals described in this Proxy Statement, the Board is not aware of any other matters to be presented for a vote at the Annual Meeting. If you grant a proxy by telephone, Internet, or by signing and returning your proxy card, any of the persons appointed by the Board of Directors as proxy holders — Sandra Bell and Neil C. Rifkind — will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If any of our nominees is unavailable as a candidate for director, the above-named proxy holders will vote your proxy for another candidate or candidates as may be nominated by the Board of Directors.

Who is entitled to vote at the meeting?

If our records show that you were a holder of our common stock at the close of business on April 16, 2021, which is referred to in this proxy statement as the “record date,” you are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that you held on the record date.

How many shares can vote?

As of the close of business on the record date of April 16, 2021, there were 32,551,770 shares of common stock of Tiptree Inc. (“Tiptree” or the “Company”) issued and outstanding. There are no other classes of voting securities outstanding. You are entitled to one (1) vote for each share of common stock you held as of the close of business on the record date.

What constitutes a quorum?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented at the Annual Meeting. As of the close of business on the record date of April 16, 2021, there were 32,551,770 shares outstanding and entitled to vote. Thus, 16,275,886 shares must be represented at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum if you vote in person (virtually) at the Annual Meeting or if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee). Additionally, abstentions and broker non-votes will also be counted towards the quorum requirement. If there is no quorum, the Chairman of the Annual Meeting may adjourn the meeting until a later date.

How can I attend the virtual Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders conducted exclusively by a live audio webcast.

If you are a stockholder of record as of the close of business on April 16, 2021, the record date for the Annual Meeting, you will be able to virtually attend the Annual Meeting, vote your shares and submit your questions online during the meeting by visiting www.virtualshareholdermeeting.com/TIPT2021. You will need to enter the 16-digit control number included on your notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you are a stockholder holding your shares in “street name” as of the close of business on April 16, 2021, you may gain access to the meeting by following the instructions in the voting instruction card provided by your broker, bank or other nominee. You may not vote your shares electronically at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank, broker dealer or other nominee holder.

The online meeting will begin promptly at 4:00 p.m., EST on June 8, 2021. We encourage you to access the meeting prior to the start time. Online check-in will begin at 3:45 p.m., EST, and you should allow approximately 15 minutes for the online check-in procedures.

If you wish to submit a question for the Annual Meeting, you may do so in advance at www.virtualshareholdermeeting.com/TIPT2021, or you may type it into the dialog box provided at any point during the virtual meeting (until the floor is closed to questions).

What can I do if I need technical assistance during the Annual Meeting?

If you encounter any difficulties accessing the virtual Annual Meeting webcast please call the technical support number that will be posted on the Annual Meeting website log-in page.

How do I vote?

•For Proposal 1 (election of directors), you may either vote “FOR” all of the nominees to the Board of Directors or you may “WITHHOLD” your vote for all of the nominees or for any nominee that you specify.

•For Proposal 2 (ratification of the appointment of Deloitte), you may vote “FOR” or “AGAINST” such proposal or “ABSTAIN” from voting.

The procedures for voting are set forth below:

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote in person (virtually) at the Annual Meeting or vote by giving your proxy authorization over the Internet, by telephone or by properly completing, signing and dating the accompanying proxy card where indicated and mailing the card in the postage paid envelope provided. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to vote by proxy or to give your proxy authorization to ensure that your votes are counted. You may still virtually attend the Annual Meeting and vote in person (virtually) if you have already given your proxy authorization.

•VOTE BY INTERNET — You may authorize a proxy to vote your shares by Internet at www.proxyvote.com. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 PM EST on June 7, 2021. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

•VOTE BY PHONE — You may authorize a proxy to vote your shares by calling 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions up until 11:59 PM EST on June 7, 2021. Have your proxy card in hand when you call and then follow the instructions.

•VOTE BY MAIL — Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Tiptree Inc., Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

•VOTE IN PERSON (VIRTUALLY) — You may vote in person (virtually) during the Annual Meeting at www.virtualshareholdermeeting.com/TIPT2021 by using the 16-digit control number included with these proxy materials.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Nominee. If your shares of common stock are held by a broker, bank or other nominee (i.e., in “street name”), you will receive instructions from your nominee, which you must follow in order to have your shares of common stock voted.

We encourage you to receive all proxy materials in the future electronically to help us save printing costs and postage fees, as well as natural resources in producing and distributing these materials. If you wish to receive these materials electronically next year, please follow the instructions on the proxy card.

How is my vote counted?

If you authorize a proxy to vote your shares through the Internet, by phone or properly execute the accompanying proxy card, and if we receive it by 11:59 p.m., Eastern Time, on June 7, 2021, the shares of common stock that the proxy represents will be voted in the manner specified on the proxy. If no specification is made in the proxy, your shares of common stock that the proxy represents will be voted in accordance with the recommendations of our Board of Directors set forth in this proxy statement. It is not anticipated that any matters other than those set forth in the proxy statement will be presented at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders. In addition, no stockholder proposals or nominations were received on a timely basis, so no such matters may be brought to a vote at the Annual Meeting.

What vote is needed to approve each proposal?

•For Proposal 1 (election of directors), the vote of a plurality of all of the votes cast at the Annual Meeting, assuming a quorum is present, is required for the election of a director. Therefore, the two nominees for director receiving the most “FOR” votes will be elected. For purposes of the vote on Proposal 1, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

•For Proposal 2 (ratification of the appointment of Deloitte), the affirmative vote of a majority of all of the votes cast at the Annual Meeting, assuming a quorum is present, is required for approval of Proposal 2. For purposes of the vote on Proposal 2, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

How are “broker non-votes” and abstentions treated for purposes of the proposals?

Under the laws of Maryland, the state of Tiptree’s incorporation, abstentions generally do not constitute a vote “for” or “against” any matter being voted on at the Annual Meeting and generally will not be counted as “votes cast.” Therefore, abstentions and “broker non-votes” will have no effect on any of the proposals.

Brokers, banks, or other nominees that have not received voting instructions from their clients cannot vote on their clients’ behalf with respect to “non-routine” proposals, but may vote their clients’ shares on “routine” proposals. Proposal 1 (election of directors) is a non-routine proposal. Proposal 2 (ratification of appointment of

Deloitte) is a routine proposal. In the event that a broker, bank, or other nominee indicates on a proxy that it does not have discretionary authority to vote certain shares on a non-routine proposal, then those shares will be treated as broker non-votes. Abstentions and broker non-votes will be treated as present for the purpose of determining the presence of a quorum.

What other information is part of this proxy statement?

The proxy materials include a letter to stockholders and our 2020 Annual Report which is comprised of the 2020 10-K. The 2020 10-K and this Notice and Proxy Statement and Form of Proxy are available, free of charge, on our website at http://www.tiptreeinc.com. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this proxy statement. You may also obtain a copy of our 2020 Annual Report or the 2020 10-K, free of charge, by directing your request in writing to Tiptree Inc., 299 Park Avenue, 13th Floor, New York, New York 10171, Attn: Secretary, or by calling our corporate number at (212) 446-1400. Our other filings made with the SEC are also accessible on our website and available at no charge on the SEC’s website at http://www.sec.gov.

Can I change my vote after I submit my proxy card or give instructions over the Internet or telephone?

Yes. If you are the record holder of your shares, you may revoke your proxy in one of three ways:

•filing a written notice (via e-mail) revoking the proxy with our Secretary at legal@tiptreeinc.com;

•signing and forwarding to us a properly executed proxy with a later date or authorizing another proxy over the Internet or telephone; or

•appearing in person (virtually) and voting at the Annual Meeting at

www.virtualshareholdermeeting.com/TIPT2021 by using the 16-digit control number included with these proxy materials.

Whether or not you vote using a traditional proxy card, through the Internet or by telephone, you may use any of those three methods to change your vote. Accordingly, you may change your vote either by submitting a proxy card prior to or at the Annual Meeting or by authorizing a proxy again before 11:59 p.m., Eastern Time, on June 7, 2021, the time at which the Internet and telephone proxy authorization facilities close. The later submitted vote will be recorded and the earlier vote revoked. If you virtually attend the Annual Meeting, you may vote in person (virtually) whether or not you have previously given a proxy, but your presence, virtually or otherwise, without further action at the Annual Meeting will not constitute revocation of a previously given proxy.

If your shares are held by your broker, bank or other nominee, you should follow the instructions provided by your broker, bank or nominee.

How can I determine the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final results will be announced in a Current Report on Form 8-K, which will be filed with the SEC within four business days after the conclusion of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

Who is soliciting my proxy?

This solicitation of proxies is made by and on behalf of our Board of Directors. We will pay the cost of the solicitation of proxies. In addition to the solicitation of proxies by mail, our directors, officers and employees may solicit proxies personally or by telephone.

We have hired Morrow Sodali LLC, 470 West Ave., Stamford, CT 06902 (“Morrow”), to help us distribute and solicit proxies. We will pay approximately $2,500 in fees, plus expenses and disbursements, to Morrow for its proxy solicitation services.

No person is authorized on our behalf to give any information or to make any representations with respect to the proposals other than the information and representations contained in this proxy statement, and, if given or made, such information and/or representations must not be relied upon as having been authorized and the delivery of this proxy statement shall, under no circumstances, create any implication that there has been no change in our affairs since the date hereof.

Who should I contact if I have any questions?

If you have any questions about the Annual Meeting, this proxy statement, our proxy materials or your ownership of the Company’s common stock, please direct your request in writing to Tiptree Inc., 299 Park Avenue, 13th Floor, New York, NY, 10171, Attn: Secretary, or call our corporate number at (212) 446-1400.

|

|

|

|

|

CORPORATE GOVERNANCE MATTERS

|

This section of our proxy statement contains information about our corporate governance policies and practices. You can visit the governance documents section of our corporate website at http://www.tiptreeinc.com to view or to obtain copies of the Company’s Bylaws, Charter, CNG Committee Charter, Audit Committee Charter, Code of Business Conduct and Ethics and Corporate Governance Guidelines. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this proxy statement or any other report or document we file with or furnish to the SEC. You may also obtain, free of charge, a copy of our Bylaws, Charter, CNG Committee Charter, Audit Committee Charter, Code of Business Conduct and Ethics Corporate Governance Guidelines and Securities Trading Policy by directing your request in writing to Tiptree Inc., 299 Park Avenue, 13th Floor, New York, NY, 10171, Attn: Secretary or by calling our corporate number at (212) 446-1400.

The Board of Directors and its Committees

Our business and affairs are overseen by our Board of Directors pursuant to the Maryland General Corporation Law (the “MGCL”) and our Charter and Bylaws. Members of the Board of Directors are kept informed of the Company’s business by participating in Board and committee meetings, by reviewing materials provided to them and through discussions with the Chairman and CEO and with key members of management.

The Company has elected to be subject to Section 3-804(c) of the MGCL (the “Opt-In”), which is a common practice among Maryland corporations with classified boards. As a result of the Opt-In, the Board has the exclusive power to fill vacancies on the Board, and any director elected by the Board to fill a vacancy will hold office for the remainder of the full term of the class of directors in which the vacancy occurred and until his or her successor is elected and qualified.

The average age of our directors, including our director nominees, is 60 years. The average tenure of our directors, including our director nominees as of the 2021 Annual Meeting, is expected to be approximately 6 years.

Our Board of Directors presently consists of six members: Michael G. Barnes, Paul M. Friedman, Lesley Goldwasser, Jonathan Ilany, Dominique Mielle and Bradley E. Smith. The Board of Directors has affirmatively determined that Messrs. Friedman and Smith and Mses. Goldwasser and Mielle are independent as that term is defined in NASDAQ Marketplace Rules and SEC regulations.

The Board of Directors currently has two standing committees: an Audit Committee and a Compensation, Nominating and Governance Committee (the “CNG Committee”).

During fiscal 2020, our Board of Directors held seven meetings, the Audit Committee held seven meetings and the CNG Committee held seven formal meetings and several informal discussions among the members of the CNG Committee and its independent compensation consultant. All of our directors during fiscal 2020 attended at least 75% of the aggregate number of meetings of our Board of Directors and each committee of the Board of Directors on which they served during fiscal 2020, except John Mack, our former director who attended two of the seven formal meetings. Mr. Mack ceased to be a director when he passed in August 2020.

Audit Committee

Our Board of Directors has established an audit committee that meets the definition provided by Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Currently the Audit Committee is comprised of our four independent directors: Messrs. Friedman and Smith and Mses. Goldwasser and Mielle. The current Audit Committee members satisfy the definition of independence set forth in the NASDAQ Marketplace Rules and Rule 10A-3 under the Exchange Act. Mr. Friedman was appointed as the Chairman of the Audit Committee on August 24, 2020. He was determined by our Board of Directors to be an “audit committee financial expert” as that term is defined in the Exchange Act.

|

|

|

|

|

The Audit Committee is responsible for overseeing:

|

|

• our accounting and financial reporting processes;

|

|

• the quality and integrity and audits of our consolidated financial statements, and accounting and reporting processes;

|

|

• our compliance with legal and regulatory requirements;

|

|

• the qualifications and independence of our independent registered public accounting firm; and

|

|

• the performance of our independent registered public accounting firm and any internal auditors.

|

The Audit Committee is also responsible for engaging the independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm and considering the range of audit and non-audit fees.

Compensation, Nominating and Governance Committee

The CNG Committee is comprised of our four independent directors: Messrs. Friedman and Smith and Mses. Goldwasser and Mielle. Mr. Friedman served as the Chairman of the CNG Committee from 2016 until Ms. Mielle was appointed as the Chairman of the CNG Committee on August 24, 2020.

|

|

|

|

|

The CNG Committee is responsible for:

|

|

• establishing our corporate goals and objectives relevant to the Executive Committee’s compensation, reviewing the Executive Committee’s performance in light of such goals and objectives and evaluating and approving the performance of, and the compensation paid by the Company to, the Executive Committee in light of such goals and objectives;

|

|

• reviewing and evaluating the performance of, and recommending to the Board of Directors the compensation of, our executive officers other than the Executive Committee, considering our corporate goals and objectives and evaluating the performance of such executive officers in light of such goals and objectives;

|

|

• overseeing the compensation policies and programs of our non-executive officer employees to determine whether such compensation policies and programs are functioning effectively and do not create any unreasonable risk to the Company, as well as reviewing the appropriateness of the compensation practices to determine if they are reasonably likely to have a material adverse effect on the Company;

|

|

• reviewing, evaluating and recommending to the Board of Directors any incentive plan or material revision thereto, and administering the same;

|

|

• reviewing and approving the disclosure regarding our compensation and benefit matters in our proxy statement and Annual Report;

|

|

• identifying, recruiting and recommending to the full Board of Directors qualified candidates for election as directors and recommending a slate of nominees for election as directors at the annual meeting of stockholders;

|

|

• developing and recommending to the Board of Directors corporate governance guidelines and policies;

|

|

• recommending to the Board of Directors compensation for service as directors in accordance with our corporate governance guidelines;

|

|

• overseeing the evaluation of the structure, duties, size, membership and functions of the Board of Directors and its committees and recommending appropriate changes to the Board of Directors; and

|

|

|

|

|

|

• establishing procedures to exercise oversight of the evaluation of the Board of Directors and its committees and members (including a self-evaluation).

|

The CNG Committee has the authority to retain, at the Company’s expense, independent legal, accounting and other consultants, advisors and experts that it reasonably determines to be necessary or appropriate to assist the committee in the performance of its responsibilities. For 2020, the CNG Committee engaged Compensation Advisory Partners LLC (“CAP”) as its independent compensation consultant to help advise it on the design of our executive compensation program and the compensation opportunities thereunder. See “Use of Independent Compensation Consultant” below for further details on the services provided by our independent compensation consultant in 2020.

Director Compensation

The following table sets forth information regarding the compensation paid to, or earned by our directors, during fiscal 2020:

Director Compensation Fiscal 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned or Paid in Cash ($)

|

|

Stock

Awards

($)(1)(2)

|

|

Total

($)

|

|

Michael G. Barnes(3)

|

|

—

|

|

—

|

|

—

|

|

Paul M. Friedman

|

|

$111,779

|

|

$103,497

|

|

$215,276

|

|

Lesley Goldwasser

|

|

$100,011

|

|

$124,201

|

|

$224,212

|

|

Jonathan Ilany(3)

|

|

—

|

|

—

|

|

—

|

|

John E. Mack

|

|

$115,013

|

|

$103,497

|

|

$218,510

|

|

Dominique Mielle

|

|

$103,546

|

|

$103,497

|

|

$207,043

|

|

Bradley E. Smith

|

|

$100,013

|

|

$103,497

|

|

$203,510

|

(1)Includes amount paid, or granted, as applicable, to our independent directors under our Non-Employee Director Compensation Program described below, including amounts that were instead paid in shares of our common stock as a result of a director’s election to receive shares.

(2)Represents the grant date fair value of shares granted, as recognized by the Company for financial statement reporting purposes in the fiscal year ended December 31, 2020 in accordance with Accounting Standards Codification 718 — Compensation — Stock Compensation. See Note 19 to the consolidated financial statements contained in the 2020 10-K.

(3)Messrs. Barnes and Ilany receive no compensation in connection with their service on our Board. The compensation that they receive in their capacity as Executive Chairman and Chief Executive Officer, respectively, is included in the Summary Compensation Table below.

Non-Employee Director Compensation Program

In fiscal 2020, each director other than Messrs. Barnes and Ilany received an annual retainer of $75,000, plus $6,250 per quarter for attending each quarterly Board of Directors meeting (for total meeting fees of $25,000 per year), plus $100,000 in immediately vested shares of our common stock, which are paid in quarterly installments. These shares are granted in arrears with the number of shares based on the volume weighted average price for the ten trading days prior to the end of the quarter. The grant date closing market price of our common stock for each quarterly payment on each of 4/8/2020, 7/2/2020, 10/9/2020 and 1/7/2021 was $5.27, $6.39, $5.18, and $5.03, respectively. The Lead Director receives an additional $20,000 annual retainer, the Chair of the Audit Committee receives an additional annual retainer of $15,000 and the Chair of the CNG Committee receives an additional annual retainer of $10,000. The annual retainer payable to our independent directors is payable quarterly in arrears. In addition, we reimburse all directors for reasonable out-of-pocket expenses incurred in connection with their services on our Board of Directors.

Principal Executive Officer Pay Ratio

Set forth below is a reasonable estimate of the ratio of annual total compensation of the Company’s principal executive officer (“PEO”) to the median of the annual total compensation of all employees, other than the PEO. The Company views the Executive Committee, consisting of Mr. Barnes, its Executive Chairman, and Mr. Ilany, its Chief Executive Officer, collectively as the Company’s PEO.

In 2020, we identified the median employee (such person, the “Median Employee”) by using as our consistently applied compensation measure, 2020 gross earnings, as reported on Form W-2 (“W-2 gross earnings”), for all individuals who were employed by the Company and its subsidiaries on December 31, 2020, other than our principal executive officers. We included all employees, whether employed on a full-time, part-time or seasonal basis, and we did not annualize the compensation of any full-time employee who was employed for less than the full 2020 calendar year. We believe that the use of W-2 gross earnings is an appropriate measure by which to determine the Median Employee because it accurately represents annual compensation earned by our employees.

Messrs. Barnes and Ilany had 2020 annual total compensation of $1,853,328 and $2,579,448, respectively, as reflected in the Summary Compensation Table included in this Proxy Statement under “Executive Compensation—Summary Compensation”. Using the same methodology used to calculate Messrs. Barnes and Ilany’s 2020 total compensation in the Summary Compensation Table, our Median Employee’s total compensation for 2020 was $68,666. As a result, we estimate that Messrs. Barnes’s and Ilany’s 2020 annual total compensation was approximately 27 times and 37.6 times, respectively, that of our Median Employee.

Because the SEC rules for identifying the median of the annual total compensation of our employees and calculating the pay ratio based on the employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their employee populations and compensation practices, the pay ratio reported by other companies may not be comparable to the pay ratio for the Company.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth procedures by which our Board of Directors carries out its responsibilities. Among the areas addressed by the Corporate Governance Guidelines are director qualification standards, director responsibilities, director relationships and access to management and independent advisors, director compensation, director orientation and continuing education, management succession, annual performance evaluation of the Board of Directors and management responsibilities. Our CNG Committee is responsible for assessing and periodically reviewing the adequacy of the Corporate Governance Guidelines and will recommend, as appropriate, proposed changes to the Board of Directors.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to our directors, executive officers (including our principal executive officer and principal financial and accounting officer) and employees, as well as employees of any person or its affiliates that provide services to us. The Code of Business Conduct and Ethics was designed to assist our directors, executive officers and employees, as well as employees of any person or its affiliates that provide services to us, in complying with the law, resolving moral and ethical issues that may arise and in complying with our policies and procedures. Among the areas addressed by the Code of Business Conduct and Ethics are compliance with applicable laws, conflicts of interest, use and protection of our Company’s assets, confidentiality, communications with the public, accounting matters, record keeping and discrimination and harassment.

We intend to satisfy our disclosure obligations under Item 5.05 of Form 8-K related to amendments or waivers of the Code of Business Conduct and Ethics by posting such information on our corporate website.

Stockholder Engagement and Communications with our Board of Directors

We have discussions with a variety of our stockholders throughout the year including one-on-one meetings and participation at investor conferences. In addition, we have a process by which stockholders and other parties may communicate with our Board of Directors, our independent directors as a group or our individual directors. Any such communications may be sent to our Board of Directors in writing and should be directed to the Board of Directors, a committee, the independent directors as a group, or an individual director at Tiptree Inc., 299 Park Avenue, 13th Floor, New York, NY, 10171, Attn: Secretary, who will forward all such communications on to the intended recipient. In addition, stockholder communications can be directed to our Board of Directors, a committee, the independent directors as a group or an individual director by calling our Corporate Governance Hotline at (844) 877-5474. Any such communications may be made anonymously.

Director Attendance at Annual Meetings

Pursuant to our Corporate Governance Guidelines, we expect each member of our Board of Directors to attend each annual meeting of stockholders. Last year, all of the directors except Mr. Mack attended the annual meeting of stockholders.

Identification of Director Candidates

As stated in the CNG Committee Charter, the CNG Committee assists our Board of Directors in identifying and reviewing director candidates to determine whether they qualify for membership on the Board and for recommending to the Board nominees to be considered for election at our annual meeting of stockholders.

In making recommendations to our Board of Directors, the CNG Committee considers such factors as it deems appropriate. Though the Company does not have a formal policy addressing diversity, the Board of Directors and the CNG Committee believe that diversity is an important attribute of the members who comprise our Board of Directors and that members should represent an array of backgrounds and experiences and should be capable of articulating a variety of viewpoints. As such, directors should have diversity with respect to background, skills and expertise, industry knowledge and experience. The CNG Committee uses the following general criteria for identifying director candidates:

•Directors should possess senior level management and decision-making experience;

•Directors should have a reputation for integrity and abiding by exemplary standards of business and professional conduct;

•Directors should have the commitment and ability to devote the time and attention necessary to fulfill their duties and responsibilities to the Company and its stockholders;

•Directors should be highly accomplished in their respective fields, with leadership experience in corporations or other complex organizations, including government, educational and military institutions;

•In addition to satisfying the independence criteria described in the Corporate Governance Guidelines, independent directors should be able to represent all stockholders of the Company;

•Directors who are expected to serve on a committee of the Board of Directors shall satisfy applicable legal requirements and other criteria established by any securities exchange on which our common stock is listed; and

•Directors should have the ability to exercise sound business judgment to provide advice and guidance to the Chief Executive Officer and Executive Chairman with candor.

The foregoing general criteria apply equally to the evaluation of all potential independent and management director nominees, including those individuals recommended by stockholders.

The Board of Directors’ assessment of a director candidate’s qualifications also includes consideration of diversity, age, skills and experience in the context of the needs of the Board of Directors.

Our CNG Committee may solicit and consider suggestions of our directors or our management regarding possible nominees. Our CNG Committee may also procure the services of outside sources or third parties to assist in the identification of director candidates.

Our CNG Committee may consider director candidates recommended by our stockholders. Our CNG Committee will apply the same standards in considering candidates submitted by stockholders as it does in evaluating candidates submitted by members of our Board of Directors or our management. Any recommendations by stockholders should follow the procedures outlined under “Additional Information — Stockholder Proposals” in this proxy statement and in our Bylaws.

Executive Sessions of Independent Directors

In accordance with our Corporate Governance Guidelines, the independent directors serving on our Board of Directors are given an opportunity at each meeting to meet in executive session without the presence of any directors or other persons who are part of our management. Our executive sessions were chaired by our Lead Director, Ms. Goldwasser. Interested parties may communicate directly with our Lead Director or our independent directors as a group through the process set forth above under “Communications with our Board of Directors.”

Current Board Leadership Structure

Our Board of Directors is led by Michael G. Barnes, the Chairman of our Board of Directors, and our Executive Chairman.

Because the Chairman of the Board of Directors is not independent, the Board of Directors appointed Ms. Goldwasser to serve as the Company’s Lead Director and preside at executive sessions of the independent directors and at meetings of the Board of Directors when the Chairman is not present.

To help ensure that the Board of Directors carries out its oversight responsibilities, our Corporate Governance Guidelines require the Board of Directors as a whole to maintain independence from management. Pursuant to the Corporate Governance Guidelines, a majority of the Board of Directors must be independent. As of the date hereof, four of our current six directors have been determined to be independent.

Board’s Role in Risk Oversight

Our Board of Directors oversees our business in general, including risk management and performance of the Executive Chairman, Chief Executive Officer and other members of senior management, to assure that the long-term interests of the stockholders are being served. Each committee of our Board of Directors is also responsible for reviewing the risk exposure related to such committee’s areas of responsibility and providing input to senior management on such risks.

Management and our Board of Directors have a process to identify, analyze, manage and report all significant risks facing us. Our Executive Chairman and Chief Executive Officers will regularly report to the Board of Directors on significant risks facing us, including legal, financial, operational and strategic risks. The Audit Committee reviews with senior management significant risks related to the Company and periodically reports to the Board of Directors on such risks.

In addition, pursuant to its charter, the Audit Committee is responsible for reviewing and discussing the Company’s business risk management process, including the quality and integrity of the Company’s financial statements, and accounting and reporting processes, the Company’s compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of the Company’s internal audit function. Furthermore, the Audit Committee evaluates key financial statement issues and risks, their impact or potential effect on reported financial information and the process used by management to address such matters. At each Audit Committee meeting, management briefs the committee on the current business and financial position of the Company, as well as such items as internal audits and independent audits.

Compensation Risk Assessment

The CNG Committee assessed our compensation policies and practices to evaluate whether they create risks that are reasonably likely to have a material adverse effect on the Company. Based on its assessment, the CNG Committee concluded that the Company’s compensation policies and practices, in conjunction with the Company’s existing processes and controls, do not create incentives to take risks that are reasonably likely to have a material adverse effect on the Company.

CNG Committee Interlocks and Insider Participation

The following non-employee directors are the current members of the CNG Committee of the Board of Directors: Messrs. Friedman and Smith and Mses. Goldwasser and Mielle. During 2020, none of the Company’s executive officers served as a director or member of the corporate governance committee of any other entity whose executive officers served on the Company’s Board of Directors or CNG Committee.

Prohibition of Hedging and Pledging Transactions

Our Tiptree Inc. Securities Trading Policy (“Insider Trading Policy”) prohibits short sales of and option trading on Tiptree stock and prohibits our directors and officers, other employees of Tiptree subject to the Insider Trading Policy and their respective designees from engaging in hedging transactions, such as (but not limited to) zero-cost collars, equity swaps, exchange funds and forward sale contracts, that may allow such individual to continue to own Tiptree securities without the full risks and rewards of ownership. Our Insider Trading Policy also prohibits holding Tiptree securities in a margin account or otherwise pledging Tiptree securities as collateral for a loan.

CONTINUING DIRECTORS

The following table and biographical descriptions set forth certain information, as of March 31, 2021, with respect to each continuing director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Director Since

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class I

|

|

|

|

|

|

Paul M. Friedman (Chairman of the Audit Committee)

|

|

65

|

|

August 2016

|

|

Bradley E. Smith

|

|

64

|

|

July 2013

|

|

Class III

|

|

|

|

|

|

Lesley Goldwasser (Lead Independent Director)

|

|

59

|

|

January 2015

|

|

Jonathan Ilany

|

|

67

|

|

August 2010

|

Paul M. Friedman has been a member of our Board of Directors since August 2016 and was appointed Chairman of the Audit Committee in August 2020. He was the Chairman of the CNG Committee from 2016 until August 2020. From November 2009 to March 2015, Mr. Friedman served as the Senior Managing Director and Chief Operating Officer of Guggenheim Securities LLC. From June 2008 to October 2009, Mr. Friedman served as a Managing Director of Mariner. Mr. Friedman spent 27 years at Bear Stearns from 1981 to 2008, most recently holding the position of Chief Operating Officer of its Fixed Income Division. Mr. Friedman serves as the Lead Director and the chairman of the Compliance Committee of Oppenheimer Holdings Inc. and on the board of directors of Great Ajax Corp., where he is a member of both the audit and compensation committees. He also joined the board of Intelligo in 2020. Mr. Friedman has a M.S. in Finance and Accounting from New York University, Stern School of Business, and a B.A. in Economics from Colgate University.

Mr. Friedman was selected and qualified to serve as a member of our Board of Directors because of his diverse and extensive business and financial experience as well as his experience on the boards of other public companies.

Bradley E. Smith has been a member of our Board of Directors since July 2013. Mr. Smith was a member of the board of directors of Tiptree Financial Partners, L.P. (“TFP”) from June 2007 to July 2013. He is the founder of Kahala Capital Advisors LLC, a private investment firm, and of Kahala Aviation Ltd., a commercial aircraft leasing company. Prior to Kahala Capital, Mr. Smith worked for almost 20 years in banking in New York and Asia. He was employed from 1995 until 2000 at Bear Stearns, where he started that company’s credit derivatives businesses in New York; and later as a Senior Managing Director, based in Tokyo, managing the firm’s fixed income and derivative businesses. Before Bear Stearns, Mr. Smith spent 10 years with Bankers Trust Company (“Bankers Trust”) as a syndicate manager in its loan syndications group, where he was responsible for the syndication of some

of the largest leveraged loan financings ever completed. Afterwards, he transferred to Tokyo and Hong Kong, where he was involved in Bankers Trust’s credit trading businesses in Asia. In his last position at Bankers Trust, Mr. Smith was one of the founders of that bank’s credit derivatives business. Mr. Smith holds a B.A. from St. Joseph’s University and an M.B.A. from the American Graduate School of International Management.

Mr. Smith was selected and qualified to serve as a member of our Board of Directors because of his knowledge as a private investor and entrepreneur, experience involving large complex financial transactions and his extensive international relationships.

Lesley Goldwasser has been a member of our Board of Directors since January 2015. Ms. Goldwasser has been a Managing Partner of GreensLedge Capital Markets LLC (“GreensLedge”) since September 2013. Prior to joining GreensLedge, Ms. Goldwasser was associated with Credit Suisse Group AG (“Credit Suisse”) as a Managing Director from September 2010 to November 2013, where she had global responsibility for the Hedge Fund Strategic Services unit. Before Credit Suisse, Ms. Goldwasser spent 12 years at Bear Stearns where she was co-head of Global Debt and Equity Capital Markets units and had global responsibility for structured products. Prior to her tenure at Bear Stearns, Ms. Goldwasser spent 12 years at Credit Suisse in a variety of management positions, including responsibility for both the Asset Backed and Non-Agency Mortgage Trading Desks. She is on the Board of Directors of Liquid Telecom and FinTech Acquisition Corp. V. Ms. Goldwasser is a graduate of the University of Cape Town, South Africa.

Ms. Goldwasser was selected and qualified to serve as a member of our Board of Directors because of her diverse and extensive business and financial experience across a variety of investment banking disciplines.

Jonathan Ilany is our Chief Executive Officer and a member of our Executive Committee. He is also a member of our Board of Directors. From February 2015 to November 2015, Mr. Ilany was our Co-Chief Executive Officer. From October 2014 until February 2015, he was our Executive Vice President, Head of Mortgage Finance and Asset Management. Mr. Ilany served as a director of Rescap, a subsidiary of Ally Bank from November 2011 until December 2013. From 2005 until 2018, Mr. Ilany was a private investor and passive partner at Mariner Investment Group (“Mariner”). Mr. Ilany was a partner at Mariner from 2000 until 2005, responsible for hiring and setting up new trading groups, overseeing risk management, and serving as a senior member of the Investment Committee and Management Committee. From 1996 until 2000, Mr. Ilany was a private investor. From 1982 until 1995, Mr. Ilany held various senior management roles at Bear Stearns, including as a Senior Managing Director and a member of the board of directors. From 1980 until 1982, Mr. Ilany worked at Merrill Lynch. From 1971 until 1975, Mr. Ilany served in the armored corps of the Israeli Defense Forces, and he was honorably discharged holding the rank of First Lieutenant. Mr. Ilany received his B.A. and M.B.A. from the University of San Francisco.

Mr. Ilany was selected and qualified to serve as a member of our Board of Directors because of his extensive risk management and senior managerial experience in the financial services industry, his board experience and his experience with investing in real estate and real estate-related assets and extensive knowledge of our business and industries.

EXECUTIVE OFFICERS

Set forth below is the background information regarding each of our executive officers as of March 31, 2020, other than Messrs. Barnes and Ilany, whose biography are above, under “Continuing Directors”.

Sandra Bell, age 63, has been our Chief Financial Officer since July 2015. Ms. Bell brings over 35 years of business experience in the financial services and energy industries, both as a public company Chief Financial Officer and as an investment banker. Prior to joining the company, Ms. Bell served as Chief Financial Officer of Prospect Mortgage, LLC (“Prospect”), a private equity owned mortgage originator and servicer, overseeing all financial activities, including strategic planning, treasury, financial reporting, bank and rating agency relationships and investor relations. Prior to joining Prospect, from 2008 to 2011, Ms. Bell served as Chief Financial Officer of PHH Corporation (“PHH”), a publicly traded, multi-divisional financial services company engaged in the private label mortgage services and fleet management businesses. Prior to PHH, Ms. Bell served as Executive Vice President and Chief Financial Officer of the Federal Home Loan Bank of Cincinnati. Prior to assuming her position at the Federal Home Loan Bank, Ms. Bell had been a Managing Director at Deutsche Bank Securities, where she had been

employed for 13 years. Ms. Bell received a Bachelor of Arts degree in Economics from The Ohio State University and a Masters in Business Administration from Harvard Business School.

Neil C. Rifkind, age 54, has been our Vice President, General Counsel and Secretary since July 2013. From 2011 until July 2013, Mr. Rifkind was Special Counsel at the law firm of Schulte Roth & Zabel LLP, specializing in mergers and acquisitions and securities law. From 2006 through 2010, he was an associate at Schulte Roth & Zabel LLP. From 1998 until 2006, Mr. Rifkind was an associate at the law firm of Fried, Frank, Harris, Shriver & Jacobson LLP. Mr. Rifkind received a J.D. from Boston University School of Law, an M.A. in Philosophy from the University of Toronto and an A.B. in Philosophy from the University of Chicago.

PROPOSALS TO BE VOTED ON

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors is classified into three classes: Class I, consisting of Paul M. Friedman and Bradley E. Smith, to hold office for a term expiring at the 2023 annual meeting; Class II, consisting of Michael G. Barnes and Dominique Mielle, to hold office for a term expiring at this Annual Meeting of stockholders; and Class III, consisting of Jonathan Ilany and Lesley Goldwasser, to hold office for a term expiring at the 2022 annual meeting.

Our Fourth Amended and Restated Bylaws (“Bylaws”) provide that a majority of the entire Board of Directors may establish, increase or decrease the number of directors, provided that the number of directors shall never be less than one (1), which is the minimum number required by the Maryland General Corporation Law, nor more than fifteen (15).

Information Regarding the Nominees for Election

The following table and biographical descriptions set forth certain information, as of March 31, 2021, with respect to each nominee for election as director at the Annual Meeting. Mr. Barnes and Ms. Mielle each currently serve as a director.

All nominees for director have consented to be named and have agreed to serve as directors if elected. We have no reason to believe that any of the nominees will be unable to accept election as a director. However, in the event that one or more nominees are unable or unwilling to accept election or are unable to serve for any reason, the persons named as proxies or their substitutes will have authority, according to their judgment, to vote or refrain from voting for such substitute as may be designated by the Board of Directors.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominees for Election as Class II Directors

|

|

Age

|

|

Director Since

|

|

Michael G. Barnes (Chairman)

|

|

54

|

|

August 2010

|

|

Dominique Mielle

|

|

52

|

|

January 2020

|

Michael G. Barnes has been a member of our Board of Directors since August 2010, and he currently serves as the Chairman of our Board of Directors. He is also the Company’s Executive Chairman and a member of the management executive committee. In 2007 Mr. Barnes founded Tiptree Financial Partners, L.P. (“TFP”), Tiptree’s predecessor, and served as Chief Executive Officer until 2012 and Chairman until its merger with Tiptree in 2018. In addition, Mr. Barnes is a founding partner and principal of Corvid Peak Holdings, L.P., formerly known as Tricadia Holdings, L.P., and its affiliated companies. Prior to the formation of Corvid Peak in 2003, Mr. Barnes spent two years as Head of Structured Credit Arbitrage within UBS Principal Finance LLC, a wholly owned subsidiary of UBS Warburg, which conducted proprietary trading on behalf of the firm. Mr. Barnes joined UBS in 2000 as part of the merger between UBS and PaineWebber Inc. Prior to joining UBS, Mr. Barnes was a Managing Director and Global Head of the Structured Credit Products Group of PaineWebber. Prior to joining PaineWebber in 1999, he spent 12 years at Bear Stearns & Co. Inc. (“Bear Stearns”), the last five of which he was head of their Structured Transactions Group. Mr. Barnes was the Chairman of the Board of Philadelphia Financial Group, Inc., a private placement life insurance, annuity and administration company, from June 2010 until June 2015 and Care Investment Trust Inc., a

senior living real estate company, from August 2010 until February 2018. Mr. Barnes received his A.B. from Columbia College.

Mr. Barnes was selected and qualified to serve as a member of our Board of Directors because of his extensive senior level experience in the investment management industry and his extensive knowledge of our business and industries.

Dominique Mielle has been a member of our Board of Directors since January 2020 and was appointed as the Chairperson of the CNG Committee in August 2020. Ms. Mielle was a partner and senior portfolio manager at Canyon Partners, where she worked from 1998 to 2017, focusing on the transportation, technology, retail and consumer products sectors, corporate and municipal bond securitizations and leading Canyon’s collateralized loan obligations business. She was named one of the “Top 50 Women in Hedge Funds” by Ernst & Young in 2017. Prior to joining Canyon in 1998, Ms. Mielle worked at Libra Investments, Lehman Brothers and Credit Lyonnais. Ms. Mielle was a director of PG&E Corporation and Pacific Gas and Electric Company from April 2019 until June 2020, where she was the chair of the audit committee. Since 2018, she has been a director of Anworth Mortgage Asset Corporation, a mortgage REIT investment firm, where she was the chair of the compensation committee and served on the audit and compensation, nominating and corporate governance committees until its merger with Ready Capital Corp. in March 2021. In connection with the merger, Ms. Mielle became a director of Ready Capital Corp. Ms. Mielle also has been a director of Studio City International since 2018, where she is the chair of the nominating and corporate governance committee and serves on the compensation and audit and risk committees. She joined the board of Digicel Group in July 2020. Ms. Mielle graduated with an M.B.A. (Finance) from Stanford University and a Master in Management degree from Ecole des Hautes Etudes Commerciales in France (HEC Paris).

Ms. Mielle was selected and qualified to serve as a member of our Board of Directors because of her extensive financial services industry experience on Wall Street, investing in fixed income and leading capital structure optimizations and restructurings.

Vote Required and the Recommendation of the Board

The vote of a plurality of all of the votes cast at the Annual Meeting, assuming a quorum is present, is necessary for the election of each Class II director. Therefore, the two nominees for director receiving the most “FOR” votes will be elected. For purposes of the election of directors, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR”

ALL DIRECTOR NOMINEES.

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We are asking our stockholders to ratify our audit committee's appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Deloitte has audited our financial statements as of and for the years ended December 31, 2020 and 2019. A representative of Deloitte will be present at the Annual Meeting, will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Audit and Non-Audit Fees

The following table presents the approximate aggregate fees billed by Deloitte, our independent registered public accounting firm for services performed with respect to fiscal 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|