SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.__)

|

|

|

|

|

Filed by the Registrant

|

☒

|

|

|

Filed by a Party other than the Registrant

|

☐

|

|

Check the appropriate box:

☒Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material Pursuant to § 240.14a-12

Tilray, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

☒No fee required.

☐Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction applies:

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

Proposed maximum aggregate value of transaction:

Total fee paid:

☐Fee paid previously with preliminary materials.

☐Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

Amount Previously Paid:

Form, Schedule or Registration Statement No.:

Filing Party:

Date Filed:

TILRAY, INC.

1100 MAUGHAN ROAD

NANAIMO, BC, CANADA, V9X IJ2

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 28, 2020

The 2020 Annual Meeting of Stockholders of Tilray, Inc., a Delaware corporation (the “Company”), will be held online on Thursday, May 28, 2020 at 10:00 AM Pacific Time. There will be no physical location for stockholders to attend. Stockholders may only participate by logging in at www.virtualshareholdermeeting.com/TLRY2020. To participate in the Annual Meeting, you will need your unique control number included on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials.

Items of business at the Annual Meeting will be the following:

|

|

1.

|

To elect the two nominees for director named herein to the Board of Directors to hold office until the 2023 Annual Meeting of Stockholders.

|

|

|

2.

|

To approve the issuance of securities for purposes of Nasdaq Listing Rule 5635(d).

|

|

|

3.

|

To ratify the selection by the Audit Committee of the Board of Directors of Deloitte LLP as our independent registered public accounting firm of the Company for its fiscal year ending December 31, 2020.

|

|

|

4.

|

To approve a non-binding advisory resolution on the frequency of future advisory votes on the compensation of named executive officers.

|

|

|

5.

|

To conduct any other business properly brought before the meeting.

|

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 30, 2020. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors,

Dara Redler

General Counsel and Corporate Secretary

Nanaimo, BC, Canada

April , 2020

|

|

|

You are cordially invited to attend the meeting virtually via the following internet link: www.virtualshareholdermeeting.com/TLRY2020. Whether or not you expect to attend the meeting virtually, please complete, date, sign and return the enclosed proxy, or vote over the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person by attending the meeting virtually.

|

|

|

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held Virtually on May 28, 2020 at 10:00 a.m. PDT by visiting www.proxyvote.com.

The proxy statement and annual report to stockholders are available electronically at www.proxyvote.com

|

TABLE OF CONTENTS

TILRAY, INC.

1100 MAUGHAN ROAD

NANAIMO, BC, CANADA, V9X IJ2

Proxy Statement

FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 28, 2020

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these proxy materials?

We have sent you these proxy materials because the Board of Directors (the “Board”) of Tilray, Inc. (sometimes referred to as the “Company,” “Tilray,” “we,” “us” or “our”) is soliciting your proxy to vote at the 2020 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy through the internet.

We intend to mail these proxy materials on or about April , 2020 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

The Annual Meeting will be held “virtually” through an audio webcast on Thursday, May 28, 2020, at 10:00 AM Pacific Time. There will be no physical meeting location. The meeting will only be conducted via an audio webcast. To participate in the Annual Meeting, you will need your unique control number included on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials. Information on how to vote by “virtually” attending the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 30, 2020 will be entitled to vote at the Annual Meeting. On this record date, there were 16,666,665 shares of Class 1 common stock and 107,984,477 of Class 2 common stock (collectively, the “common stock”) outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 30, 2020 your shares were registered directly in your name with Tilray’s transfer agent, Philadelphia Stock Transfer, Inc., then you are a stockholder of record. As a stockholder of record, you may vote by virtually attending the meeting or vote by proxy. Whether or not you plan to attend the meeting virtually, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 30, 2020 your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting via the following link: www.virtualshareholdermeeting.com/TLRY2020. However, since you are not the stockholder of record, you may not vote your shares via the link at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

1

What am I voting on?

There are four matters scheduled for a vote:

|

|

•

|

Election of two directors to serve for a term expiring at the 2023 Annual Meeting (Proposal No. 1);

|

|

|

•

|

Approval of the issuance of securities for purposes of Nasdaq Listing Rule 5635(d) (Proposal No. 2);

|

|

|

•

|

Ratification of selection by the Audit Committee of the Board of Deloitte LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2020 (Proposal No. 3); and

|

|

|

•

|

Non-binding, advisory resolution on the frequency of future advisory votes on the compensation of named executive officers (Proposal No. 4).

|

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For the approval of the issuance of securities for purposes of Nasdaq Listing Rule 5635(d), you may vote “For,” “Against,” or abstain from voting. For the ratification of the selection of Deloitte LLP as the Company’s independent registered public accounting firm, you may vote “For” or “Against” or abstain from voting. For the non-binding, advisory resolution on the frequency of future advisory votes on the compensation of named executive officers, you may vote “For Every Year,” “For Every Two Years,” or “For Every Three Years” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by “virtually” attending the Annual Meeting (via the following link: www.virtualshareholdermeeting.com/TLRY2020), vote by proxy through the internet or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote even if you have already voted by proxy.

|

|

•

|

To vote by “virtually” attending the Annual Meeting, login to the link: www.virtualshareholdermeeting.com/TLRY2020, and follow the instructions provided.

|

|

|

•

|

To vote using the enclosed proxy card, simply complete, sign and date the enclosed proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

|

|

|

•

|

To vote through the internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy cards. Your internet vote must be received by 11:59 PM, prevailing time, on May 27, 2020 to be counted.

|

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, these proxy materials along with a voting instruction form are being provided by that organization rather than Tilray. Follow the voting instructions in such instruction form to ensure that your vote is counted. To vote by “virtually” attending the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact that organization to request a proxy form.

|

|

|

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

|

2

How many votes do I have?

On each matter to be voted upon, you have ten (10) votes for each share of Class 1 common stock and one (1) vote for each share of Class 2 common stock you own as of March 30, 2020. The Class 1 common stock and Class 2 common stock will vote together as a single class on all proposals described in this Proxy Statement.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, through the internet or by “virtually” attending the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of both nominees for director, “For” the approval of the issuance of securities for purposes of Nasdaq Listing Rule 5635(d), “For” the ratification of selection by the Audit Committee of the Board of Deloitte LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2020 and “For Every Two Years” as to the frequency of future non-binding, advisory votes on the compensation of named executive officers. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of various national and regional securities exchanges, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on the election of either nominee for directors, approval of the issuance of securities for purposes of Nasdaq Listing Rule 5635(d), or the frequency of stockholder votes on executive compensation without your instructions, but may vote your shares on the ratification of the selection of Deloitte LLP as our independent registered public accounting firm of the Company for its fiscal year ending December 31, 2020 without your instructions.

If you are beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all your shares are voted.

3

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

|

|

•

|

You may submit another properly completed proxy card with a later date.

|

|

|

•

|

You may grant a subsequent proxy through the internet.

|

|

|

•

|

You may send a timely written notice that you are revoking your proxy to Tilray’s Corporate Secretary at 1100 Maughan Road, Nanaimo, BC, Canada, V9X IJ2.

|

|

|

•

|

You may “virtually” attend the Annual Meeting and vote. Simply attending the meeting will not, by itself, revoke your proxy.

|

Your most current proxy card or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December , 2020, to our Corporate Secretary at 1100 Maughan Road, Nanaimo, BC, Canada, V9X IJ2, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); provided, however, that if our 2021 Annual Meeting of stockholders is held before April 28, 2021 or after June 27, 2021, then the deadline is a reasonable amount of time prior to the date we begin to print and mail our proxy statement for the 2021 Annual Meeting of stockholders. If you wish to submit a proposal (including a director nomination) at the 2021 Annual Meeting of stockholders that is not to be included in next year’s proxy materials, the proposal must be received by our Corporate Secretary not later than the close of business on February 27, 2021 nor earlier than the close of business on January 28, 2021; provided, however, that if our 2021 Annual Meeting of stockholders is held before April 28, 2021 or after June 27, 2021, then the proposal must be received no earlier than the close of business on the 120th day prior to such meeting and not later than the close of business on the later of the 90th day prior to such meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to the proposal to approve the issuance of securities for purposes of Nasdaq Listing Rule 5635(d) and the proposal to ratify the selection of Deloitte LLP as the Company’s independent registered public accounting firm, votes “For,” “Against” and abstentions; and, with respect to the non-binding, advisory vote on the frequency of future advisory votes on the compensation of named executive officers, votes “For Every Year,” “For Every Two Years,” “For Every Three Years,” abstentions and broker-non votes.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under applicable rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.”

4

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

How many votes are needed to approve each proposal?

For the election of directors, the two nominees receiving the most “For” votes from the holders of shares present or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” will affect the outcome.

To be approved, Proposal No. 2, approval of the issuance of securities for purposes of Nasdaq Listing Rule 5635(d), must receive “For” votes from the holders of shares representing a majority of the voting power of the shares present or represented by proxy and entitled to vote on the matter. If you select to “Abstain” from voting on Proposal No. 2, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

To be approved, Proposal No. 3, ratification of the selection of Deloitte LLP as the Company’s independent registered public accounting firm for fiscal year ending December 31, 2020, must receive “For” votes from the holders of shares representing a majority of the voting power of the shares present or represented by proxy and entitled to vote on the matter. If you select to “Abstain” from voting on Proposal No. 3, it will have the same effect as an “Against” vote. Broker non-votes will have no effect; however, Proposal No. 3 is considered a routine matter, and therefore no broker non-votes are expected to exist in connection with Proposal No. 3.

For Proposal No. 4, the frequency receiving the highest number of votes from the holders of shares present at the Annual Meeting or represented by proxy and entitled to vote on the matter will be considered the frequency preferred by the stockholders. Abstentions and broker non-votes will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if shares representing a majority of the aggregate voting power of shares of Class 1 common stock and Class 2 common stock (voting together as a single class) entitled to vote are present at the Annual Meeting or represented by proxy. On each matter to be voted upon, you have ten (10) votes for each share of Class 1 common stock and one (1) vote for each share of Class 2 common stock you own as of March 30, 2020. The Class 1 common stock and Class 2 common stock will vote together as a single class on all proposals described in this Proxy Statement. On the record date, there were 16,666,665 shares of Class 1 common stock and 107,984,477 shares of Class 2 common stock outstanding and entitled to vote. Thus, the holders of shares representing an aggregate of 137,325,564 votes must be present or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote by “virtually” attending the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of shares representing a majority of the voting power present at the Annual Meeting or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8‑K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement, Form 10-K and annual report to stockholders are available at www.proxyvote.com.

5

Proposal No. 1

Election Of Directors

Tilray’s Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has five members. There are two directors in the class whose term of office expires in 2020. If elected at the Annual Meeting, each of these nominees would serve until the 2023 annual meeting and until her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is the Company’s policy to invite directors and nominees for director to attend the Annual Meeting. All of our board members attended our 2019 Annual Meeting of stockholders.

The following table sets forth information as of March 30, 2020 with respect to the two nominees for election at the Annual Meeting and the directors whose terms of office will continue after the Annual Meeting:

|

Name

|

|

Age

|

|

Director

Since

|

|

Position(s)

|

|

Class II Directors—Nominees for Election at the 2020 Annual Meeting

|

|

|

|

|

|

|

|

Maryscott Greenwood

|

|

54

|

|

May 2018

|

|

Director

|

|

Christine St.Clare

|

|

69

|

|

June 2018

|

|

Director

|

|

Class III Directors—Continuing in Office until the 2021 Annual Meeting

|

|

|

|

|

|

|

|

Brendan Kennedy

|

|

47

|

|

January 2018

|

|

President, Chief Executive Officer and Director

|

|

Class I Directors—Continuing in Office until the 2022 Annual Meeting

|

|

|

|

|

|

|

|

Michael Auerbach

|

|

44

|

|

February 2018

|

|

Director

|

|

Rebekah Dopp

|

|

43

|

|

May 2018

|

|

Director

|

Each of the nominees listed below is currently a director of the Company who was previously elected by the then current members of the Board to fill a vacant seat.

Nominees for Election for a Three-Year Term Expiring at the 2023 Annual Meeting

Maryscott “Scotty” Greenwood has served as a member of our Board since May 2018. Ms. Greenwood is currently the Partner and Managing Director of Crestview Strategy US LLC, serving in such role since June 2019. She has served as the Chief Executive Officer of the Canadian American Business Council since 2016, where she previously served as Executive Director from 2001 to 2016. She previously served as a principal at Dentons from July 2015 to May 2019 and as the Senior Managing Director at McKenna, Long & Aldridge LLP from April 2001 to June 2015. Ms. Greenwood holds a BA in Political Science from the University of Vermont.

The Nominating and Corporate Governance Committee believes Ms. Greenwood is qualified to serve on our Board due to her background in government and policy and her extensive regulatory knowledge.

Christine St.Clare has served as a member of our Board since June 2018. Ms. St.Clare is President of St.Clare Advisors, LLC, a company she founded in January 2012. In 2010, Ms. St.Clare completed a 35-year career with KPMG, during which time she served in various capacities, including as Audit Partner from 1986 until 2005; as Advisory Partner in Internal Audit, Risk and Compliance from 2005 until 2010; and as a member of KPMG’s board of directors for four years, chairing the Audit and Finance Committee. From February 2013 to December 2019, Ms. St.Clare served on the board of directors of Fibrocell Science, Inc. and chaired its Audit Committee until its sale to a

6

strategic buyer. Ms. St.Clare has served on the board of directors of AquaBounty Technologies, Inc. and as Chairperson of its Audit Committee since May 2014. From February 2013 through December 2016, Ms. St.Clare served on the board of directors and as Audit Committee Chairperson for Polymer Group, Inc (aka Avintiv), a global manufacturing company. Ms. St.Clare holds a BS in Accounting from California State University, Long Beach, and attended Executive Education courses at The Wharton School of the University of Pennsylvania. In March 2019, Ms. St.Clare was named to The National Association of Corporate Directors (NACD) 2019 NACD Directorship 100, which is a list of the most influential leaders in the boardroom and corporate governance community.

The Nominating and Corporate Governance Committee believes Ms. St.Clare is qualified to serve on our Board due to her extensive accounting, business and finance knowledge and experience.

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

Director Continuing in Office Until the 2021 Annual Meeting

Brendan Kennedy has served as our President and Chief Executive Officer and member of our Board since January 2018. Mr. Kennedy has also served as a member of the board of directors and Chief Executive Officer of Tilray Canada, Ltd., our Canadian subsidiary, since 2016. Mr. Kennedy served as the Executive Chairman and member of the board of directors of Privateer Holdings, a private investment firm focused exclusively on the cannabis industry, beginning October 2011 until December 2019. Mr. Kennedy also served as Chief Executive Officer of Privateer Holdings from its founding until June 2018. Prior to founding Privateer Holdings, Mr. Kennedy served as the Chief Operating Officer of Silicon Valley Bank Analytics from 2010 to 2011 and Managing Director from 2006 to 2010. Mr. Kennedy holds a BA from the University of California, Berkeley, an MS in Engineering from the University of Washington and an MBA from the Yale School of Management.

The Nominating and Corporate Governance Committee believes Mr. Kennedy is qualified to serve on our Board due to his role as a founder.

Directors Continuing in Office Until the 2022 Annual Meeting

Michael Auerbach has served as a member of our Board since February 2018. He served on the board of directors of Privateer Holdings from January 2014 to December 2019. He is the Founder of Subversive Capital, Chairman of Subversive Capital Acquisition Corp., Chairman of Subversive Capital REIT, LP and General Partner of Subversive Capital’s venture platform and Opportunity Fund. Mr. Auerbach is an entrepreneur, investor, business consultant, and private diplomat. He is a Senior Vice President at Albright Stonebridge Group (“ASG”), the global consulting firm of former secretary of state Madeleine Albright, where he has worked since 2012. Before joining ASG, Mr. Auerbach created Social Risks, which provided investors with assessments of companies' social impact. Social Risks was bought out by global consulting giant Control Risks, where Mr. Auerbach served as a Vice President for five years. Michael began his career founding Panopticon Inc, a VC incubator concentrating on internet and mobile technology. He has an MA in International Relations from Columbia University and a BA in Critical Theory from the New School.

The Nominating and Corporate Governance Committee believes Mr. Auerbach is qualified to serve on our Board due to his extensive knowledge of our company and industry.

Rebekah Dopp has served as a member of our Board since May 2018. Ms. Dopp currently works at Google, where she is the founder of Exponent – the company’s gender equality incubator; she joined Google in 2016 as Head of Local TV Partnerships and was the architect of the local TV engagement strategy for YouTube TV. She previously served as Senior Vice President, Advanced Digital Services for CBS Corporation from 2014 to 2016 and in several leadership positions at HBO from 2001 to 2014. She is a CEO coach, keynote speaker and has led global product, engineering, strategy, and distribution teams. She served as a senior leader on the launch teams for HBO GO, CBS All Access, and YouTube TV. Ms. Dopp holds a BA in Business Administration with a concentration in finance from The College of William and Mary and participated in Directors’ College at Stanford Law School and the TV Executive Leadership Program at Harvard Business School.

The Nominating and Corporate Governance Committee believes Ms. Dopp is qualified to serve on our Board due to her extensive corporate leadership experience and deep expertise in strategic partnerships and transactions.

7

Information Regarding The Board Of Directors And Corporate Governance

Independence of The Board of Directors

On December 12, 2019, Privateer Holdings, Inc., our former controlling stockholder, merged with and into a wholly owned subsidiary of Tilray, Inc., and ceased to exist. This transaction is referred to in this proxy statement as the “Downstream Merger.” Accordingly, we are no longer a “controlled company” within the meaning of the listing rules of the Nasdaq Global Select Market. As a result, we are now required to have a majority of independent directors on the Board. Our Board has made a determination that each of Ms. Dopp, Ms. Greenwood and Ms. St.Clare is independent under the listing rules of the Nasdaq Global Select Market. In determining that Ms. Greenwood was independent, our Board considered her current employment at Crestview Strategy USA LLC, a Delaware limited liability company (“Crestview US”), and Tilray’s previous engagement with Crestview Strategy Inc., an Ontario corporation and an indirect majority owner of Crestview US (“Crestview Canada”). Crestview Canada provided lobbying and advisory services to Tilray from November 2014 to March 2020. Our Board has also determined that Mr. Kennedy, due to his employment as our President and Chief Executive Officer and his prior affiliation with Privateer Holdings, Inc., and Mr. Auerbach, due to his prior consulting relationship with the Company and his prior affiliation with Privateer Holdings, Inc., are not independent under the listing rules of the Nasdaq Global Select Market.

Board Leadership Structure

Our Board is currently chaired by our President and Chief Executive Officer, Mr. Kennedy.

The Company believes that combining the positions of Chief Executive Officer and Board Chair helps to ensure that the Board and management act with a common purpose. In the Company’s view, separating the positions of Chief Executive Officer and Board Chair has the potential to give rise to divided leadership, which could interfere with good decision-making or weaken the Company’s ability to develop and implement strategy. Instead, the Company believes that combining the positions of Chief Executive Officer and Board Chair provides a single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, the Company believes that a combined Chief Executive Officer/Board Chair is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information. The Company also believes that it is advantageous to have a Board Chair with an extensive history with and knowledge of the Company (as is the case with the Company’s Chief Executive Officer) as compared to a relatively less informed independent Board Chair.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Meetings of The Board of Directors

The Board met nine times during 2019. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which she or he served or held during the portion of 2019 for which she or he was a director or committee member.

8

Information Regarding Committees of the Board of Directors

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership as of December 31, 2019 and meeting information for 2019 for each of the Board committees.

|

Name

|

|

Audit

|

|

Compensation

|

|

Nominating

and

Corporate

Governance

|

|

Michael Auerbach (1)

|

|

|

|

|

|

|

|

Rebekah Dopp (2)

|

|

X

|

|

X

|

|

X

|

|

Maryscott Greenwood (3)

|

|

X

|

|

X

|

|

X

|

|

Christine St.Clare (4)

|

|

X

|

|

X

|

|

X

|

|

Brendan Kennedy

|

|

|

|

|

|

|

|

Total meetings in 2019

|

|

9

|

|

7

|

|

6

|

|

|

(1)

|

Mr. Auerbach served as a member of the Compensation Committee and Nominating and Corporate Governance Committee through December 12, 2019. Mr. Auerbach also served as Chairperson of the Compensation Committee and Nominating and Corporate Governance Committee through August 2019.

|

|

|

(2)

|

Ms. Dopp has served as Chairperson of the Compensation Committee since August 2019.

|

|

|

(3)

|

Ms. Greenwood has served as Chairperson of the Nominating and Corporate Governance Committee since August 2019.

|

|

|

(4)

|

Ms. St.Clare serves as Chairperson of the Audit Committee. Ms. St.Clare has served as a member of the Compensation Committee since December 12, 2019.

|

Below is a description of each standing committee of the Board.

Audit Committee

Our Audit Committee currently consists of Ms. Dopp, Ms. Greenwood and Ms. St.Clare. Our Board has determined each member of our Audit Committee to be independent under the listing standards and Rule 10A-3(b)(1) of the Exchange Act. The chairperson of our Audit Committee is Ms. St.Clare. Our Board has determined that Ms. St.Clare is an “Audit Committee financial expert” within the meaning of SEC regulations. Our Board has also determined that each member of our Audit Committee has the requisite financial expertise required under the applicable requirements of Nasdaq. In arriving at this determination, the Board has examined each Audit Committee member’s scope of experience and the nature of their current and prior employment. The Audit Committee met nine times during 2019. The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at https://ir.tilray.com/.

The primary purpose of the Audit Committee is to discharge the responsibilities of our Board with respect to our accounting, financial and other reporting and internal control practices and to oversee our independent registered accounting firm. Specific responsibilities of our Audit Committee include:

|

|

•

|

selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

|

|

|

•

|

helping to ensure the independence and performance of the independent registered public accounting firm;

|

|

|

•

|

discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent accountants, our interim and year-end operating results;

|

|

|

•

|

developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

|

9

|

|

•

|

reviewing our policies on financial risk assessment and risk management;

|

|

|

•

|

reviewing related-party transactions;

|

|

|

•

|

obtaining and reviewing a report by the independent registered public accounting firm, at least annually, that describes their internal quality-control procedures, any material issues with such procedures and any steps taken to deal with such issues when required by applicable law; and

|

|

|

•

|

approving (or, as permitted, pre-approving) all audit and all permissible non-audit service to be performed by the independent registered public accounting firm.

|

Compensation Committee

Our Compensation Committee currently consists of Ms. Dopp, Ms. Greenwood and Ms. St.Clare. Our Board has determined each of Ms. Dopp, Ms. Greenwood and Ms. St.Clare meets the independence requirements under the Nasdaq listing rules. The chairperson of our Compensation Committee is Ms. Dopp. The Compensation Committee met seven times during 2019. The Board has adopted a written Compensation Committee charter that is available to stockholders on the Company’s website at https://ir.tilray.com/.

The primary purpose of our Compensation Committee is to discharge the responsibilities of our Board to oversee our compensation policies, plans and programs and to review and determine the level of compensation to be paid to our executive officers and other senior management, as appropriate. Specific responsibilities of our Compensation Committee include:

|

|

•

|

reviewing and approving, or recommending to our Board for approval the compensation of our executive officers;

|

|

|

•

|

reviewing and approving, or recommending to our Board for approval the terms of compensatory arrangements with our executive officers;

|

|

|

•

|

administering our stock and equity incentive plans;

|

|

|

•

|

selecting compensation advisors and assessing whether there are any conflicts of interest with any of the committee’s compensation advisors;

|

|

|

•

|

reviewing and approving, or recommending to our Board for approval of the incentive compensation and equity plans, severance agreements, change-of-control protections and any other compensatory arrangements for our executive officers and other senior management, as appropriate;

|

|

|

•

|

reviewing and establishing general policies relating to compensation and benefits of our employees; and

|

|

|

•

|

reviewing our overall compensation philosophy.

|

Compensation Committee Process and Procedures

|

|

•

|

Typically, the Compensation Committee meets at least semiannually and with greater frequency if necessary and appropriate. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with management.

|

|

|

•

|

From time to time, various members of management and other employees as well as external advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings.

|

|

|

•

|

The Chief Executive Officer may not participate in-camera, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives.

|

|

|

•

|

The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company.

|

|

|

•

|

In addition, under the charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from compensation advisors and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties.

|

10

|

|

•

|

The Compensation Committee has direct responsibility for the oversight of the work of external advisors engaged for the purpose of advising the Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, external compensation advisors to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms.

|

|

|

•

|

Under the charter, the Compensation Committee may select, or receive advice from, an external compensation advisor, legal counsel or other advisor to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

|

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee currently consists of Ms. Dopp, Ms. St.Clare and Ms. Greenwood. The chairperson of our Nominating and Corporate Governance Committee is Ms. Greenwood. The Board has determined that each of the members of the Nominating and Corporate Governance Committee meets the independence requirements under the Nasdaq listing rules. The Nominating and Corporate Governance Committee met six times during 2019. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Company’s website at https://ir.tilray.com/.

Specific responsibilities of our Nominating and Corporate Governance Committee include:

|

|

•

|

reviewing and recommending to our Board for approval the compensation of our directors;

|

|

|

•

|

reviewing periodically and evaluating director performance on our Board and its applicable committees and recommending to our Board and management areas for improvement;

|

|

|

•

|

interviewing, evaluating, nominating and recommending individuals for membership on our Board;

|

|

|

•

|

reviewing developments in corporate governance practices;

|

|

|

•

|

overseeing and reviewing our processes and procedures to provide information to our Board and its committees;

|

|

|

•

|

reviewing and recommending to our Board any amendments to our corporate governance policies; and

|

|

|

•

|

reviewing and assessing, at least annually, the performance of the Nominating and Corporate Governance Committee and the adequacy of its charter.

|

The Board believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Board retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee, if it deems appropriate, will use a professional search firm to compile a list of potential candidates. The Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable

11

SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 1100 Maughan Road, Nanaimo, BC, Canada, V9X IJ2. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of the Company’s stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Stockholder Communications With The Board Of Directors

Historically, the Company has not provided a formal process related to stockholder communications with the Board. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. The Company believes its responsiveness to stockholder communications to the Board has been excellent.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The Code of Business Conduct and Ethics is available on our website at https://ir.tilray.com/. Information contained on or accessible through our website is not a part of this report, and the inclusion of our website address in this report is an inactive textual reference only. We intend to disclose any amendments to the Code of Business Conduct and Ethics, or any waivers of its requirements, on our website to the extent required by the applicable rules and exchange requirements.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to assure that the Board has the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and to make decisions that are independent of the Company’s management. The guidelines are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning, and board committees and compensation. The Corporate Governance Guidelines, as well as the charters for each standing committee of the Board, may be viewed at https://ir.tilray.com/.

Hedging Policy

Under the Company's Insider Trading and Trading Window Policy, directors, officers and other members of management of the Company are prohibited from engaging in short-term or speculative transactions in Company securities including the common stock. Such transactions may include buying and selling options (puts or calls) of Company securities on an exchange or in any other organized market, holding Company securities in a margin account, or pledging the Company securities. The Company maintains this policy because hedging transactions, which might be considered short-term bets on the movements of the common stock, could create the appearance that the person is trading on inside information. In addition, transactions in options may also focus the person's attention on short-term performance at the expense of our long-term objectives.

12

Proposal no. 2

Stockholder Approval of Issuance of Securities For Purposes of Nasdaq Listing Rule 5635(d)

Background

As a result of a price protection feature (which we refer to as the “anti-dilution feature”) included in warrants issued in March 2020, we are seeking stockholder approval of this Proposal No. 2 under applicable rules promulgated by The Nasdaq Stock Market LLC, or the Nasdaq Listing Rules. Obtaining this approval will enable us to issue additional shares of Class 2 common stock in the future, or to issue securities convertible or exercisable for shares of our Class 2 common stock in the future, for consideration, or with an exercise price or conversion price, as applicable, per share less than the exercise price per share of these warrants. Although we will not necessarily issue any Class 2 common stock or other securities below the designated “floor price” under the anti-dilution feature, we need the approval of stockholders in order to maintain maximum flexibility in our capital raising abilities. Therefore, our Board is strongly urging all stockholder to vote in favor of this Proposal No. 2.

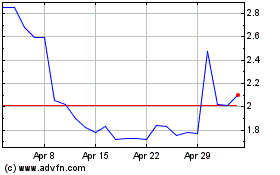

On March 13, 2020, we entered into an underwriting agreement (the “Underwriting Agreement”) with Canaccord Genuity LLC relating to the issuance and sale of 7,250,000 shares of the Company’s Class 2 common stock, pre-funded warrants to purchase 11,750,000 shares of the Company’s Class 2 common stock (the “Pre-Funded Warrants”), and accompanying warrants to purchase 19,000,000 shares of the Company’s Class 2 common stock (the “Accompanying Warrants” and together with the Pre-Funded Warrants, the “Warrants”, and the Warrants together with the shares of Class 2 common stock issued under the Underwriting Agreement and shares of Class 2 common stock issuable upon exercise of the Warrants, the “Securities”) at a price to the public of $4.76 per share for Class 2 common stock and Accompanying Warrant and $4.7599 per Pre-Funded Warrant and Accompanying Warrant. The closing of the purchase and sale of the Securities occurred on March 17, 2020. The Securities were issued pursuant to the Company’s automatically effective shelf registration statement on Form S-3 (File No. 333- 233703) filed with the Securities and Exchange Commission (the “Commission”) on September 11, 2019. A prospectus supplement and accompanying prospectus relating to the offering were filed with the Commission.

Each Pre-Funded Warrant has an exercise price per share of Class 2 common stock equal to $0.0001. The Pre-Funded Warrants were exercisable at any time after their original issuance and will expire five years from the date of issuance. As of the date of this proxy statement, all Pre-Funded Warrants have been fully exercised. Each Accompanying Warrant has an exercise price per share of Class 2 common stock equal to $5.95, which was equal to our last reported sale price on the Nasdaq Global Select Market prior to the offering. Each Accompanying Warrant will be exercisable at any time after the first trading day following the six-month anniversary of the issuance and will expire five years from the date of issuance.

Reasons for Requesting Stockholder Approval

Our Class 2 common stock is listed on the Nasdaq Global Select Market and, therefore, we are subject to the Nasdaq Listing Rules. Pursuant to Nasdaq Listing Rule 5635(d), in transactions other than public offerings, stockholder approval is required prior to the issuance or potential issuance of securities equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance. As the offering did not constitute a public offering under the Nasdaq Listing Rules due to the limited public marketing efforts and number of participating investors, the offering is subject to these stockholder approval rules.

The aggregate number of shares of Class 2 common stock issued in the offering, together with the shares issuable upon exercise of the Pre-Funded Warrants, were less than 20% of the outstanding common stock and voting power prior to the issuance. In accordance with Nasdaq Listing Rules, the Accompanying Warrants were not included in this 20% calculation, as such Accompanying Warrants have an exercise price of $5.95 per share, which was equal to our last reported sale price on Nasdaq Global Select Market prior to the offering, and are not exercisable until six-months after the date of issuance. However, the Warrants contain an anti-dilution feature, pursuant to which, to the extent such Warrants have not been exercised previously, if we sell or issue shares of Class 2 common stock in the future, or securities convertible or exercisable for shares of our Class 2 common stock are sold or issued in the future, for consideration, or with an exercise price or conversion price, as applicable, per share less than the exercise price per share then in effect for the Warrants, the exercise price of such Warrants is reduced to the consideration paid for,

13

or the exercise price or conversion price of, as the case may be, the securities sold or issued. Certain exceptions apply to this anti-dilution feature, including the requirement that the exercise price per share of the Accompanying Warrants cannot be below $5.95 per share (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events) prior to obtaining stockholder approval.

As a result of the anti-dilution feature of the Accompanying Warrants, subject to obtaining stockholder approval, the exercise price of the Accompanying Warrants may end up being lower than $5.95 per share (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events), which would cause such Accompanying Warrants to be included in the 20% calculation for Nasdaq purposes. In addition, the Accompanying Warrants prohibit our ability to issue additional shares prior to obtaining stockholder approval at a price lower than $11.90 per share (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events). The Warrants also include a requirement that we seek stockholder approval of the issuance of the Securities prior to June 30, 2020.

We are seeking your approval of this Proposal No. 2 in order to satisfy the requirements of Nasdaq Listing Rule 5635(d) with respect to the issuance of the Securities and the anti-dilution feature of the Warrants and to enable us to issue shares below the applicable floor price in the future. If approved, the anti-dilution feature would be effective with respect to any dilutive issuances during the time the Warrants are outstanding.

The information set forth in this Proposal No. 2 is qualified in its entirety by reference to the actual terms of the underwriting agreement, the prospectus supplement and accompanying prospectus, the registration statement, and the forms of Pre-Funded Warrant and Accompanying Warrant filed as Exhibits 4.1 and 4.2, respectively, to our Current Report on Form 8-K filed with the SEC on March 16, 2020. Stockholders are urged to carefully read these documents.

Possible Effects if Proposal No. 2 is Not Approved

Our Board is not seeking the approval of our stockholders to authorize our entry into the underwriting agreement. The issuance and sale of the Securities has already occurred and the underwriting agreement and related agreements are binding obligations on us. The Class 2 common stock and the Accompanying Warrants will continue to be outstanding, and the terms of the Accompanying Warrants will remain outstanding obligations of ours in favor of the holders of such securities. However, if Proposal No. 2 is not approved by our stockholders, then the anti-dilution feature of the Warrants would not be effective. In addition, however, until stockholder approval is obtained, we would not be able to issue additional shares of Class 2 common stock or other securities in a “dilutive” issuance with a per share price less than $11.90 (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events) and we would be required to cause an additional stockholder meeting quarterly after the Annual Meeting seeking stockholder approval until such approval is obtained.

Recommendation and Vote

Pursuant to Nasdaq Listing Rule 5635, the affirmative vote of a majority of the total votes cast affirmatively or negatively (excluding abstentions and broker non-votes) on this proposal is required for stockholder approval of the proposal to approve the issuance of the Securities and the anti-dilution feature of the Warrants. Abstentions are not considered votes cast and therefore will not have an effect on the proposal. Brokers that do not receive instructions from the beneficial owners on this Proposal No. 2 will not have discretion to vote such shares, resulting in broker non-votes. Any such broker non-votes are not considered votes cast and will have no effect on the proposal.

Vote Required and Board Recommendation

The affirmative vote of a majority of the total votes cast affirmatively or negatively (excluding abstentions and broker non-votes) on this proposal is required for approval of this Proposal No. 2. in accordance with applicable Nasdaq rules. Our holders and their affiliates shall not be entitled to vote the shares of our Class 2 common stock issued pursuant to the underwriting agreement, including shares of Class 2 common stock issued or issuable upon the exercise of Warrants held by such holders, on this Proposal No. 2.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE ISSUANCE OF SECURITIES, INCLUDING THE ANTI-DILUTION FEATURE, FOR PURPOSES OF NASDAQ LISTING RULE 5635(d).

14

Proposal No. 3

Ratification of Selection of Independent Registered Public Accounting Firm

The Audit Committee of the Board has selected Deloitte LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Deloitte LLP has audited the Company’s financial statements since 2017. Representatives of Deloitte LLP are expected to virtually attend the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Deloitte LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of Deloitte LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present or represented by proxy and entitled to vote on the matter at the Annual Meeting will be required to ratify the selection of Deloitte LLP.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2019 and December 31, 2018 by Deloitte LLP, the Company’s principal accountant.

|

|

|

Fiscal Year Ended December 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Audit Fees (1)

|

|

$

|

2,146,000

|

|

|

$

|

639,000

|

|

|

Audit-related Fees (2)

|

|

|

186,000

|

|

|

|

342,000

|

|

|

Tax Fees

|

|

|

—

|

|

|

|

—

|

|

|

All Other Fees (3)

|

|

|

576,000

|

|

|

|

—

|

|

|

Total Fees

|

|

$

|

2,908,000

|

|

|

$

|

981,000

|

|

|

|

(1)

|

“Audit Fees” relate to the services that are provided by the independent public accountant for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s Form 10-Q for those fiscal years.

|

|

|

(2)

|

“Audit-related Fees” relate to assurance services that are typically performed by the independent public accountant.

|

|

|

(3)

|

“All Other Fees” relate to fees incurred that are not audit, audit related or tax fees. In 2019, these fees related to the preparation of a customer segmentation study.

|

All fees described above were pre-approved by the Audit Committee.

In connection with the audit of the 2019 financial statements, the Company entered into an engagement agreement with Deloitte LLP that sets forth the terms by which Deloitte LLP will perform audit services for the Company.

15

Pre-Approval Policies and Procedures.

The Audit Committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by the Company’s independent registered public accounting firm, Deloitte LLP. The policy generally pre-approves specified services in the defined categories of audit services, audit-related services and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual, explicit, case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

The Audit Committee of the Board has determined that the rendering of services other than audit services by Deloitte LLP is compatible with maintaining the principal accountant’s independence.

The Board Of Directors Recommends

A Vote In Favor Of Proposal No. 3.

16

Proposal No. 4

Advisory Vote on Frequency of Solicitation of Advisory Stockholder Approval of Executive Compensation

The Dodd-Frank Wall Street Reform and Consumer Protection Act, and Section 14A of the Exchange Act enable the Company’s stockholders, at least once every six years, to indicate their preference regarding how frequently the Company should solicit a non-binding advisory vote on the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement. Accordingly, the Company is asking stockholders to indicate whether they would prefer an advisory vote every year, every other year or every three years by being asked to vote on the following advisory resolution:

Resolved, that the stockholders of the Company advise that an advisory resolution with respect to executive compensation should be presented every year, every two years or every three years as reflected by their votes for each of these alternatives in connection with this resolution.

In voting on this resolution, you should mark your proxy for every year, every two years or every three years based on your preference as to the frequency with which an advisory vote on executive compensation should be held. If you have no preference you should abstain.

The optimal frequency of the vote necessarily is based on a judgment about the relative benefits and burdens of each of the options. There are different views as to the best approach. The Compensation Committee and the Board recognize that there is a reasonable basis for each of the options.

Some believe that a less frequent vote would: (i) permit stockholders to focus on overall design issues rather than on the details of individual decisions, (ii) align with the goals of our compensation arrangements which are designed to reward performance that promotes long-term stockholder value, and (iii) avoid the burdens that annual votes would impose on stockholders required to evaluate the compensation programs of a large number of companies each year.

Others believe that an annual vote affords stockholders the opportunity to react promptly to emerging trends in compensation, provides feedback before those trends become pronounced over time, and gives the Compensation Committee and the Board an opportunity to evaluate individual compensation decisions each year in light of ongoing feedback from stockholders.

After careful consideration of the benefits and consequences of each alternative, the Compensation Committee and the Board believe that, initially, the Board should solicit a vote every two years from our stockholders. For that reason, the Board recommends a vote for an advisory vote on executive compensation every two years.

The alternative among one year, two years, or three years that receives the highest number of votes from the holders of shares present or represented by proxy and entitled to vote on the matter at the Annual Meeting will be deemed to be the frequency preferred by the stockholders.

The Board and the Compensation Committee value the opinions of the stockholders in this matter and, to the extent there is any significant vote in favor of one frequency over the other options, even if less than a majority, the Board will consider the stockholders’ concerns and evaluate any appropriate next steps. However, because this vote is advisory and, therefore, not binding on the Board or the Company, the Board may decide that it is in the best interests of the stockholders that the Company hold an advisory vote on executive compensation more or less frequently than the option preferred by the stockholders. The vote will not be construed to create or imply any change or addition to the fiduciary duties of the Company or the Board.

The Board Of Directors Recommends

A Vote In Favor Of “Every Two Years” On Proposal No. 4.

17

Report of the Audit Committee of the Board of Directors (1)

Our Audit Committee consists of Ms. Dopp, Ms. Greenwood and Ms. St.Clare. Our Board has determined each member of our Audit Committee to be independent under the listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The Audit Committee was constituted in July 2018. The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at https://ir.tilray.com/. The Board and the Audit Committee review and assess the adequacy of the charter of the Audit Committee on an annual basis.

The primary purpose of the Audit Committee is to discharge the responsibilities of our Board with respect to our accounting, financial and other reporting and internal control practices and to oversee our independent registered accounting firm.

It is not the duty of the Audit Committee to plan or conduct audits or to prepare our consolidated financial statements. Management is responsible for preparing our consolidated financial statements and has the primary responsibility for assuring their accuracy and completeness, and the independent registered public accounting firm is responsible for auditing those consolidated financial statements and expressing their opinion as to the fair presentation of our financial condition, results of operations, and cash flows, in accordance with GAAP. However, the Audit Committee does consult with management and our independent registered public accounting firm prior to the presentation of consolidated financial statements to stockholders and, as appropriate, initiates inquiries into various aspects of our financial affairs. In addition, the Audit Committee is responsible for the oversight of the independent registered public accounting firm; considering and approving the appointment of and approving all engagements of, and fee arrangements with, our independent registered public accounting firm; and the evaluation of the independence of our independent registered public accounting firm.

In the absence of their possession of information that would give them a reason to believe that such reliance is unwarranted, the members of the Audit Committee rely without independent verification on the information provided to them, and on the representations made, by our management and our independent registered public accounting firm. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal control over financial reporting and disclosure controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Audit Committee’s authority and oversight responsibilities do not independently assure that the audits of our consolidated financial statements are conducted in accordance with auditing standards generally accepted in the United States, or that our consolidated financial statements are presented in accordance with GAAP.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2019 with management of the Company. The Audit Committee has reviewed and discussed the quality, not just the acceptability, of our accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements with our management and our independent registered public accounting firm. The Audit Committee has discussed with our independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”).

The Audit Committee has also received the written disclosures and the letter from our independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with our independent registered public accounting firm the accounting firm’s independence.