Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 29 2021 - 4:32PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-252978

Texas Capital Bancshares, Inc.

$375,000,000

4.000% Fixed-to-Fixed Rate Subordinated Notes due 2031

Pricing Term

Sheet

April 29, 2021

The

following information relates only to Texas Capital Bancshares, Inc.’s offering (the “Offering”) of its 4.000% Fixed-to-Fixed Rate Subordinated Notes due

2031 and should be read together with the preliminary prospectus supplement dated April 29, 2021 relating to this Offering and the accompanying prospectus dated February 11, 2021, including the documents incorporated and deemed to be

incorporated by reference therein.

|

|

|

|

|

|

|

|

Issuer:

|

|

Texas Capital Bancshares, Inc. (Nasdaq: TCBI)

|

|

|

|

|

Title of Security:

|

|

4.000%

Fixed-to-Fixed Rate Subordinated Notes due 2031

|

|

|

|

|

Type of Offering:

|

|

SEC Registered

|

|

|

|

|

Expected Ratings

(Moody’s / S&P)*:

|

|

Baa3/BB

|

|

|

|

|

Principal Amount:

|

|

$375,000,000

|

|

|

|

|

Trade Date:

|

|

April 29, 2021

|

|

|

|

|

Settlement Date (T+5):

|

|

May 6, 2021

|

|

|

|

|

Benchmark Treasury:

|

|

UST 0.750% due March 31, 2026

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

99-163⁄4 ; 0.849%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

315 bps

|

|

|

|

|

Yield to Maturity:

|

|

4.000%

|

|

|

|

|

Interest Rates:

|

|

(i) From and including May 6, 2021 to, but excluding, the Reset Date, or the date of earlier redemption at a rate per annum equal to 4.000% and (ii) from and including the Reset Date to, but excluding, the Maturity Date or

date of earlier redemption at a rate per annum equal to the Five-Year U.S. Treasury Rate as of the Reset Determination Date as described in the preliminary prospectus supplement plus 3.150% per annum.

|

|

|

|

|

Maturity Date:

|

|

May 6, 2031

|

|

|

|

|

Reset Date:

|

|

May 6, 2026

|

|

|

|

|

Denomination:

|

|

$2,000 x $1,000

|

|

|

|

|

Interest Payment Dates:

|

|

May 6 and November 6

|

|

|

|

|

First Interest Payment Date:

|

|

November 6, 2021

|

|

|

|

|

|

|

|

|

Optional Redemption:

|

|

The issuer may at its option redeem the notes in whole or in part, (i) on the Reset Date, and on any interest payment date thereafter,

or (ii) at any time during the three month period prior to the maturity date, in each case subject to obtaining the prior approval of the Federal Reserve to the extent such approval is then required under the rules of the Federal Reserve, at a

redemption price equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date. See “Description of the Notes—Optional Redemption.”

The issuer may also redeem the notes at any time prior to their maturity, in whole, but

not in part, subject to obtaining the prior approval of the Federal Reserve to the extent such approval is then required under the rules of the Federal Reserve, within 90 days of the occurrence of a “Tax Event”, a “Tier 2 Capital

Event” or the Company being required to register as an investment company pursuant to the Investment Company Act of 1940 (the “1940 Act”), in each case, at a redemption price equal to 100% of the principal amount of the notes, plus

any accrued and unpaid interest to, but excluding, the redemption date.

|

|

|

|

|

Coupon:

|

|

4.000%

|

|

|

|

|

Price to Public:

|

|

100.00% of principal amount

|

|

|

|

|

Underwriting Discount:

|

|

0.875% of principal amount

|

|

|

|

|

Proceeds, Before Expenses:

|

|

$371,718,750.00

|

|

|

|

|

Use of Proceeds:

|

|

The issuer intends to use the net proceeds of this offering for general corporate purposes, which may include, among other uses, redeeming in whole or in part its 6.50% Subordinated Notes due 2042.

|

|

|

|

|

CUSIP / ISIN:

|

|

88224QAA5 / US88224QAA58

|

|

|

|

|

Joint Book-Running Managers:

|

|

J.P. Morgan Securities LLC

Goldman

Sachs & Co. LLC

|

|

*

|

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time.

|

The issuer has filed a registration statement (including a prospectus and preliminary prospectus

supplement) with the SEC for the offering to which this communication relates. Before you invest, you should read each of these documents and the other documents the issuer has filed with the SEC and incorporated by reference in such documents for

more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will

arrange to send you the prospectus if you request it by contacting J.P. Morgan Securities LLC collect at 1-212-834-4533 or

Goldman Sachs & Co. LLC at 1-866-471-2526.

Settlement Period: The closing will occur on May 6, 2021, which will be more than two U.S. business days after the date of this pricing term sheet.

Rule 15c6-1 under the Securities Exchange Act of 1934 generally requires that securities trades in the secondary market settle in two business days, unless the parties to a trade expressly agree otherwise.

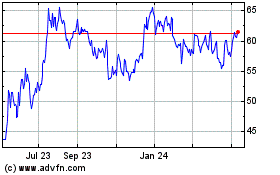

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

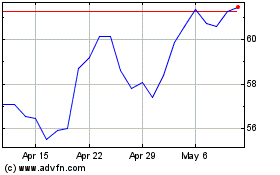

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024