Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant ý

|

Filed by a Party other than the Registrant o

|

Check the appropriate box:

|

o

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

ý

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

Tetra Tech, Inc.

|

(Name of Registrant as Specified In Its Charter)

|

N/A

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Table of Contents

Table of Contents

|

|

|

|

|

Today, Tetra Tech's high-end consulting and engineering services are more in demand than ever before. With our focus on Leading with Science®, we are ideally positioned to provide the sustainable solutions that are needed in a changing world.

Dan Batrack

Chairman and Chief Executive Officer

|

|

January 14, 2021

Dear Tetra Tech Stockholders:

You are cordially invited to attend the Annual

Meeting of Stockholders of Tetra Tech, Inc., which will be held on Wednesday, February 24, 2021, at 10:00 a.m. Pacific Time.

Details of the business to be conducted at the

Annual Meeting are given in the accompanying Notice of 2021 Annual Meeting of Stockholders and the proxy statement.

We use the internet as our primary means of furnishing

proxy materials to our stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials and will instead receive a notice with instructions for accessing the proxy materials and voting via the internet. The notice

also provides information on how stockholders can obtain paper copies of our proxy materials if they so choose. Internet transmission and voting are designed to be efficient, minimize cost, and conserve natural resources.

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. As an alternative to voting in person at the Annual Meeting, you may vote via the internet, by telephone,

or by mail. Voting by any of these methods will ensure your representation at the Annual Meeting.

Thank you for your continued support of Tetra Tech. We look forward to

seeing you at the Annual Meeting.

Sincerely,

Dan Batrack

Chairman and Chief Executive Officer

|

Table of Contents

|

|

|

|

|

|

|

|

|

|

Notice of 2021 Annual

Meeting of Stockholders

|

|

|

Annual Meeting of Stockholders

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

Wednesday, February 24, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

Time

|

|

10:00 a.m. Pacific Time

|

|

|

|

|

|

|

|

|

|

|

|

|

Place

|

|

Tetra Tech, Inc.

3475 East Foothill Boulevard

Pasadena, California 911071

|

|

|

|

|

|

|

|

|

|

|

|

|

Record Date

|

|

December 30, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items of Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

|

|

|

|

Board

Recommendation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1

|

|

To elect the eight directors nominated by our Board to serve a one-year term

|

|

FOR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 2

|

|

To approve, on an advisory basis, our executive compensation

|

|

FOR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 3

|

|

To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2021

|

|

FOR

|

|

|

|

|

|

|

|

|

|

|

|

|

1 In the event that we are unable to hold the meeting at this location due to COVID-19 pandemic-related government or public health orders, we will

provide further details in a supplement to the proxy statement.

Table of Contents

How to vote: Your vote is important

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet

|

|

Telephone

|

|

Mail

|

|

In Person

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Follow the instructions provided in the Notice, separate proxy card, or voting instruction form you received.

|

|

Follow the instructions provided in the separate proxy card or voting instruction form you received.

|

|

Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form.

|

|

You can vote in person at the Annual Meeting. Beneficial holders must contact their broker or other nominee if they wish to vote in person.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dear Tetra Tech Stockholders:

|

|

|

Your vote is important. Even if you cannot attend the Annual Meeting, it is important that your shares be represented and voted. To ensure your representation at the Annual Meeting, you may submit your

proxy and voting instructions via the internet, by telephone, or by mail by following the instructions listed on your proxy card, notice, or voting instruction form.

|

|

|

Please refer to "Voting Your Shares" in the Meeting and Voting Information section on page 69 of the accompanying proxy statement for a description of each voting method. If your shares are held by a

bank, broker, or other nominee (your record holder) and you have not given your record holder instructions on how to vote your shares, your record holder will not be able to vote your shares on any

matter other than ratification of the appointment of the independent registered public accounting firm. We strongly encourage you to vote.

|

|

|

On behalf of the Board of Directors, management, and associates of Tetra Tech, I thank you for your continued support.

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

|

Preston Hopson

Senior Vice President, General Counsel, and Secretary

|

|

|

Important Notice about the Availability of Proxy Materials. The Notice of the 2021 Annual Meeting, proxy statement, and our 2020 Annual Report on Form 10-K are available at

www.proxyvote.com. You are encouraged to access and review all the important information contained in our proxy materials before voting.

|

Table of Contents

Contents

Table of Contents

Proxy Summary

Proxy Summary

This

section contains summary information explained in greater detail in other parts of this proxy statement and does not contain all the information you should consider before voting. Stockholders

are urged to read the entire proxy statement before voting. On January 14, 2021, we intend to make our proxy materials, including this proxy statement, available to all stockholders entitled to vote

at the Annual Meeting.

Tetra Tech, Inc.

Tetra Tech, Inc. is a leading global provider of high-end consulting and engineering services that focuses on water, the environment,

sustainable infrastructure, resource management, renewable energy, and international development. We are Leading with Science® to provide

innovative solutions for our public and private clients. We typically begin at the earliest stage of a project by identifying technical solutions and developing execution plans tailored to our

clients' needs and resources.

Engineering News-Record (ENR), the leading trade journal for our industry, has ranked us the number one

water services firm for the past 17 years. In 2020, we were also ranked number one in water treatment/desalination, water treatment and supply, environmental management, environmental science,

consulting/studies, solid waste, hydro plants, and wind power. ENR ranks us among the 10 largest firms in numerous other service lines, including

engineering/design, chemical and soil remediation, site assessment and compliance, dams and reservoirs, power, transmission and distribution plants, and hazardous waste.

Our

reputation for providing high-end consulting and engineering services and our ability to develop workable solutions for water and environmental management issues have supported our growth for more

than 50 years. Today, we are proud to be making a difference in people's lives worldwide through broad consulting, engineering, and technology service offerings. We are working on 65,000 projects a

year, in more than 100 countries on seven continents, from 450 offices, with a talent force of 20,000 employees. We are Leading with

Science® throughout our operations, with domain experts across multiple disciplines supported by advanced analytics, artificial intelligence, machine learning, and

digital technologies. Our ability to provide innovative and first-of-kind solutions is enhanced by partnerships with our forward-thinking clients. We are diverse and inclusive, embracing the breadth

of experience across our talent force worldwide with a culture of innovation and entrepreneurship. We are disciplined in our business delivering value to customers and high performance to our

stockholders. In supporting our clients, we seek to add value and provide long-term sustainable consulting, engineering, and technology solutions.

Items Being Voted on at the Annual Meeting

Stockholders will be asked to vote on the following items at the Annual Meeting:

|

|

|

|

|

|

|

|

|

Item

|

|

Board

Recommendation

|

|

Vote Required

|

|

Discretionary

Broker Voting

|

|

|

|

|

|

|

|

|

|

Item 1. Election of directors

|

|

FOR

each nominee

|

|

Majority of votes cast

|

|

No

|

|

|

|

|

|

|

|

|

|

Item 2. Advisory vote to approve executive compensation

|

|

FOR

|

|

Majority of shares represented and entitled to vote on the item

|

|

No

|

|

|

|

|

|

|

|

|

|

Item 3. Ratification of appointment of PricewaterhouseCoopers LLP as independent registered

public accounting firm for fiscal year 2021

|

|

FOR

|

|

Majority of shares represented and entitled to vote on the item

|

|

Yes

|

|

|

|

|

|

|

|

|

Fiscal Year 2020 Performance Highlights

Tetra Tech's fiscal year (FY) 2020 operating results reflected increased performance compared to FY 2019, which was itself a year of strong

operational and financial performance. In FY 2020 we achieved record highs in earnings per share (EPS), cash from operations, and backlog even with the disruption from the global COVID-19 pandemic.

Our focus on providing clients with high-

Tetra Tech 2021 Proxy Statement 1

Table of Contents

Proxy Summary

end

differentiated consulting and engineering services, primarily in the water, environment, and sustainable infrastructure markets, has resulted in increased margins and reduced risk in our business.

We

began FY 2021 with an authorized and funded backlog that reached another all-time high of more than $3.2 billion in the fourth quarter of FY 2020.

Highlights

of our FY 2020 operating results as reported in our FY 2020 Annual Report on Form 10-K are noted in the following table.

FY 2020 Highlights

($ in millions, except EPS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

|

|

|

|

vs. FY 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash from operations

|

|

|

|

$262

|

|

|

|

|

+26%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS

|

|

|

|

$3.16

|

|

|

|

|

+11%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog

|

|

|

|

$3,239

|

|

|

|

|

+5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

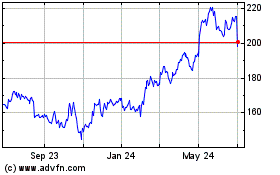

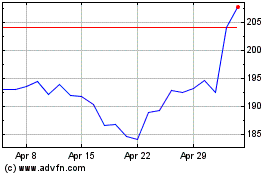

Strong Stock Price Performance

Our strong annual total stockholder return (TSR) of 8% in FY 2020 (September 29, 2019 to September 27, 2020) contributed to our cumulative

three-year TSR of 101% for the FY 2018 through FY 2020 period (September 30, 2018 to September 27, 2020). TSR measures the return we have provided our stockholders, including stock price appreciation

and dividends paid (assuming reinvestment thereof). We compare our TSR to the S&P 1000 and our TSR peer group (listed on page 49 of this proxy statement) for purposes of our long-term incentive (LTI)

program, as more fully explained below. We outperformed both market comparisons in FY 2020 and over the cumulative three-year period.

One- and Three-Year TSRs

Disciplined Capital Allocation

Effectively deploying capital is one of our core strategies, and we have been consistently disciplined in our execution of that strategy by

returning cash to our stockholders through dividends and stock repurchases, while being a strategic and financially disciplined investor with respect to acquisitions. Over the last three years, we

have returned $381 million to stockholders through dividends and stock repurchases.

Corporate Governance Highlights

Our corporate governance policies and practices reflect our principles (discussed below in the Corporate Governance, Sustainability, and

Corporate Social Responsibility section of this proxy statement) and allow our Board to effectively oversee our Company in the interest of creating long-term value. The key elements of our program and

the related benefits to our stockholders are set forth in the following table.

Tetra Tech 2021 Proxy Statement 2

Table of Contents

Proxy Summary

Corporate Governance Highlights

2021 Director Nominees

Our Board has overseen the continuing transformation of our Company, including our strategic decision to focus on our high-end consulting and

engineering business. Further, the Board has overseen the continuation of our capital allocation plan, which included share repurchases of $117 million and cash dividends of $35 million in FY 2020.

Our Board members have demonstrated their commitment to diligently and effectively execute their fiduciary duties on behalf of our stockholders, and we recommend that each of our incumbent directors

(introduced in the table below) be reelected at the Annual Meeting.

Tetra Tech 2021 Proxy Statement 3

Table of Contents

Proxy Summary

2021 Director Nominees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

|

|

Age

|

|

|

|

Director Since

|

|

|

|

Principal Occupation

|

|

|

|

Independent

|

|

|

|

AC

|

|

|

|

CC

|

|

|

|

NC

|

|

|

|

SC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dan L. Batrack

|

|

|

|

62

|

|

|

|

2005

|

|

|

|

Chairman and CEO, Tetra Tech, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gary R. Birkenbeuel

|

|

|

|

63

|

|

|

|

2018

|

|

|

|

Retired Regional Assurance Managing Partner, Ernst & Young LLP

|

|

|

|

·

|

|

|

|

C

|

|

|

|

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patrick C. Haden

|

|

|

|

67

|

|

|

|

1992

|

|

|

|

President, Wilson Avenue Consulting

|

|

|

|

·

|

|

|

|

|

|

|

|

·

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. Christopher Lewis

|

|

|

|

64

|

|

|

|

1988

|

|

|

|

Managing Director, Riordan, Lewis & Haden

|

|

|

|

·

|

|

|

|

·

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joanne M. Maguire

|

|

|

|

66

|

|

|

|

2016

|

|

|

|

Retired Executive Vice President (EVP), Lockheed Martin Space Systems Company

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

C

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kimberly E. Ritrievi

|

|

|

|

62

|

|

|

|

2013

|

|

|

|

President, The Ritrievi Group LLC

|

|

|

|

·

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

C

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. Kenneth Thompson*

|

|

|

|

69

|

|

|

|

2007

|

|

|

|

President and CEO, Pacific Star Energy, LLC

|

|

|

|

·

|

|

|

|

|

|

|

|

C

|

|

|

|

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirsten M. Volpi

|

|

|

|

56

|

|

|

|

2013

|

|

|

|

EVP, Chief Operation Officer, and CFO, Colorado School of Mines

|

|

|

|

·

|

|

|

|

·

|

|

|

|

·

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Meetings Held

|

|

|

|

4

|

|

|

|

4

|

|

|

|

4

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

AC = Audit Committee

CC = Compensation Committee

NC = Nominating and Corporate Governance Committee

SC = Strategic Planning and Enterprise Risk Committee

|

|

|

|

|

|

C = Committee Chair

* = Presiding Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tetra Tech 2021 Proxy Statement 4

Table of Contents

Proxy Summary

Executive Compensation Highlights

Our Board's Compensation Committee designs our executive compensation program to motivate our executives to implement our business strategies

and deliver long-term stockholder value. We pay for performance with compensation dependent on our achieving financial, share price, and business performance objectives while aligning executives with

the long-term interests of our stockholders. The following graphic illustrates the annual and long-term components of executive compensation.

FY 2020 Components of Annual and Long-Term Compensation

FY 2020 Target Total Direct Compensation Mix(1)

1 See the Compensation Discussion and Analysis section on page 31 of this proxy statement for a description of the manner in which these amounts are

determined.

Tetra Tech 2021 Proxy Statement 5

Table of Contents

Proxy Summary

Compensation Best Practices

As summarized below and described in further detail in the Compensation Discussion and Analysis section on page 31 of this proxy statement,

our executive compensation program is aligned with our goals and strategies and reflects what we believe are best practices.

Compensation Best Practices

|

|

|

|

|

|

|

|

|

|

|

|

|

What We Do

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Focus on pay for performance: In FY 2020, 83% of our CEO's target total direct compensation (TDC) and an average of 67% of our other named executive officers' (NEOs') target TDC was at risk; and 58% of our CEO's

target TDC and an average of 51% of our other NEOs' target TDC was tied to Company performance

|

|

|

|

Review the Compensation Committee's charter and evaluate the Compensation Committee's performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emphasize long-term performance: In FY 2020, 61% of our CEO's target TDC and an average of 42% of our other NEOs' target TDC was equity based and, thereby, tied to creating stockholder value

|

|

|

|

Use an independent compensation consultant retained directly by the Compensation Committee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Require double-trigger for change in control equity vesting and cash severance benefits

|

|

|

|

Assess potential risks relating to our compensation policies and practices

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maintain stock ownership guidelines for both executives and the Board of Directors

|

|

|

|

Maintain a clawback policy

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What We Do Not Do

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have employment agreements with our NEOs

|

|

|

|

Grant stock options with an exercise price less than the fair market value on the date of grant

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provide excise tax gross-up payments in connection with change in control severance benefits

|

|

|

|

Reprice or exchange stock options

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provide gross-ups to cover tax liabilities associated with executive perquisites

|

|

|

|

Promise multiyear guarantees for bonus payouts or salary increases

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permit directors, officers, or employees to hedge or pledge Company stock

|

|

|

|

Pay dividends or dividend equivalents on equity awards unless and until the awards vest

|

|

|

|

|

|

|

|

|

|

|

Ratification of Appointment of PricewaterhouseCoopers LLP

Our Board's Audit Committee has appointed PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for the 2021

fiscal year, and our Board is seeking stockholder ratification of the appointment. PwC is knowledgeable about our operations and accounting practices and is well qualified to act as our independent

registered public accounting firm. The Audit Committee considered the qualifications, performance, and independence of PwC; the quality of its discussions with PwC; and the fees charged by PwC for the

level and quality of services provided during FY 2020 and has determined that the reappointment of PwC is in the best interest of our Company and our stockholders.

Tetra Tech 2021 Proxy Statement 6

Table of Contents

Corporate Governance, Sustainability, and Social Responsibility

Corporate Governance, Sustainability, and Social Responsibility

Tetra Tech's Mission, Purpose, and Core Principles

|

|

|

|

|

|

|

|

|

|

Our Mission: To be the premier worldwide high-end consulting and engineering firm, focusing on water, the environment, sustainable infrastructure, resource

management, renewable energy, and international development services.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core Principles

|

|

Purpose

|

|

|

|

|

|

Our core principles form the underpinning of how we work together to serve our clients.

•

Service: Tetra Tech puts our clients

first. We listen to better understand our clients' needs and deliver smart, cost-effective solutions that meet those needs.

•

Value: Tetra Tech takes on our clients'

problems as if they were our own. We develop and implement innovative solutions that are cost-effective, efficient, and practical.

•

Excellence: Tetra Tech brings

superior technical capability, disciplined project management, and excellence in safety and quality to all our work.

•

Opportunity: Our people are our number one

asset. Our workforce is diverse and includes leading experts in our fields. Our entrepreneurial nature and commitment to success provide challenges and opportunities for all our employees.

|

|

Tetra Tech will enhance the quality of life while creating value for customers, employees, investors, and partners.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Governance

Under the oversight of our Board of Directors, we have designed our Corporate Governance Program to ensure continued compliance with

applicable laws and regulations, the rules of the Securities and Exchange Commission (SEC), and the listing standards of the Nasdaq Stock Market (Nasdaq); and to reflect best practices as informed by

the recommendations of our outside advisors, the voting guidelines of our stockholders, the policies of proxy advisory firms, and the policies of other public companies.

We

are committed to operating with honesty and integrity and maintaining the highest level of ethical conduct. We encourage stockholders to visit the Corporate Governance section on our website at

www.tetratech.com/en/corporate-governance, which includes the following corporate governance documents:

-

•

-

Corporate Code of Conduct

-

•

-

Finance Code of Professional Conduct, which applies to our Chief Executive Officer (CEO) and all members of our finance department, including

our Chief Financial Officer (CFO) and principal accounting officer

-

•

-

Corporate Governance Policies (see page 11 of this proxy statement for more detail on our Corporate Governance policies)

-

•

-

Charters for our Board's Audit Committee, Compensation Committee, Nominating and Corporate Governance (NCG) Committee, and Strategic Planning

and Enterprise Risk (SPER) Committee

-

•

-

Stock Ownership Guidelines

Information

on our website is not and should not be considered part of, nor is it incorporated by reference into, this proxy statement. You can also receive copies of these documents, without charge,

by written request mailed to our Corporate Secretary at Tetra Tech, Inc., 3475 E. Foothill Boulevard, Pasadena, California 91107.

Tetra Tech 2021 Proxy Statement 7

Table of Contents

Corporate Governance, Sustainability, and Social Responsibility

We

maintain a 24-hour hotline that is available to all employees for the anonymous submission of employee complaints by telephone and internet. All complaints go directly to our General Counsel and

Chief Compliance Officer, and all complaints relating to accounting, internal controls, or auditing matters also go directly to the Chair of our Audit Committee. We also maintain an audit control

function that provides critical oversight over the key areas of our business and financial processes and controls, and reports directly to the Audit Committee. Our Board has adopted a written "related

person transactions" policy. Under the policy, the Audit Committee (or other committee designated by the NCG Committee) reviews transactions between Tetra Tech and "related persons."

Tetra

Tech conducts our business on the bases of the quality of our services and the integrity of our association with our clients and others. Our Corporate Code of Conduct demonstrates our commitment

to ascribing to the highest standards of ethical conduct in the pursuit of our business and applies to all our directors, officers, and employees. Our policies have been translated into five

languages, and our employees are trained on and affirm their commitment to complying with the policies when they first join our Company and regularly thereafter.

Corporate Sustainability

Tetra Tech supports clients in more than 100 countries around the world, helping them to solve complex problems and achieve solutions that are

technically, socially, and economically resilient. Our high-end consulting and engineering

services focus on using innovative technologies and creative solutions to enhance environmental sustainability. Our greatest contribution toward sustainability is through the projects we perform every

day for our clients. Sustainability is embedded in our projects—from recycling freshwater supplies to recycling waste products, reducing energy consumption, and reducing greenhouse gas

emissions.

Our

Sustainability Program enables us to further expand our commitment to sustainability by encouraging, coordinating, and reporting on actions to minimize our collective impacts on the environment.

The program has four primary pillars: Projects—the solutions we provide for our clients; Procurement—our procurement and subcontracting approaches; Processes—the

internal policies and processes that promote sustainable practices, reduce costs, and minimize environmental impacts; and People—the 20,000 staff at Tetra Tech and our partners, clients,

and communities worldwide. In addition, our program is based on the Global Reporting Initiative (GRI) Sustainability Report Framework, the internationally predominant sustainability reporting protocol

for corporate sustainability plans, which includes three fundamental areas: environmental, economic, and social sustainability.

Our

Sustainability Program is led by our Chief Sustainability Officer (CSO), who has been appointed by executive management, reports directly to the CEO, and is supported by other key corporate and

operations representatives via our Sustainability Council. The CSO provides regular reports to our Board of Directors. The Board of Directors has oversight responsibility for our Sustainability

Program, which includes consideration of environmental issues, climate-related risks and opportunities, health and safety, human rights, and social matters in its regularly scheduled meetings. We have

established a clear set of metrics to evaluate our progress toward our sustainability goals. Each metric corresponds with one or more performance indicators from GRI. These metrics include economics,

health and safety, information technology, human resources, and real estate. We continuously implement sustainability-related policies and practices, and we assess the results of our efforts in order

to improve upon them in the future. Our executive management team develops and implements the Sustainability Program and reports our progress in achieving the goals and objectives outlined in our

corporate sustainability plan. We publish a sustainability report on Earth Day each year that documents our progress and is posted on our website at www.tetratech.com/en/sustainability-report-card.

Corporate Social Responsibility

Tetra Tech seeks clear, sustainable solutions that improve the quality of life for everyone. We take this responsibility seriously because our

work often places us at the center of our clients' environmental, safety, and sustainability challenges. These challenges often involve the opinions of public, industry, and government stakeholders

who seek our advice on complex issues. We have helped thousands of towns, cities, commercial clients, and governments find sustainable solutions to these complex issues concerning resource management

and infrastructure.

Our

professionals are encouraged to participate in outreach programs to help improve the communities in which they live and work. Tetra Tech employees and offices around the globe participate in many

financial, in-kind, volunteer, and pro bono activities each year. In 2020 we advanced our commitment to Leading with Science® through our

Science, Technology, Engineering, and Mathematics (STEM) Program to help shape the next generation of innovators and problem-solvers. As a supporter of the nonprofit humanitarian organizations

Engineers Without Borders USA and Engineers Without Borders Canada, we are committed to helping communities in developing countries meet their basic human needs through lasting, scalable projects and

technologies.

Tetra Tech 2021 Proxy Statement 8

Table of Contents

Corporate Governance, Sustainability, and Social Responsibility

Human Capital Management

Tetra Tech brings together engineers and technical specialists from all backgrounds to solve our clients' most challenging problems. At the

end of FY 2020, we had approximately 20,000 employees worldwide. A large percentage of

our employees have technical and professional backgrounds and undergraduate and/or advanced degrees. Our professional staff includes archaeologists, architects, biologists, chemical engineers,

chemists, civil engineers, data scientists, computer scientists, economists, electrical engineers, environmental engineers, environmental scientists, geologists, hydrogeologists, mechanical engineers,

oceanographers, toxicologists and other technical professionals.

Diversity, Equity and Inclusion

We believe our employees are high-performing individuals who reflect the diversity of the communities in which we work and live, while also

providing a better understanding of our clients' needs and project objectives. With a highly collaborative workforce of thousands of employees working from hundreds of offices around the world, Tetra

Tech truly is a multinational, multicultural organization. Our Diversity and Inclusion Policy guides the Board of Directors, management, employees, subcontractors, and partners in developing an

inclusive culture. Our Diversity & Inclusion (D&I) Council monitors Tetra Tech's diversity, equity and inclusion practices and makes recommendations to the Board and CEO for any changes or

improvements to our program. The Council includes representatives from across the Company who reflect the diversity and values of our employees.

Tetra

Tech values diversity and inclusion and undertakes various efforts throughout our operations to promote these initiatives. Our current efforts are focused in three primary

areas:

-

•

-

Safe work environment—We provide training to

all employees to improve their understanding of behaviors that can be perceived as discriminatory, exclusionary, and/or harassing and provide safe avenues for employees to report such behaviors. We

implement best practices and comply with local regulatory requirements. Our people understand acceptable workplace behavior as covered in our Corporate Code of Conduct.

-

•

-

Equal employment opportunity—Tetra Tech

ensures that our practices and processes attract a diverse range of candidates and that candidates are recruited, hired, assigned, developed, and promoted based on merit and their alignment with our

values.

-

•

-

Learning and development opportunities—To

support our employees in reaching their full potential, Tetra Tech offers a wide range of internal and external learning and development opportunities. Education assistance is offered to financially

support employees who seek to expand their knowledge and skill base.

As

part of Tetra Tech's commitment to a culture of inclusion, in 2020 we launched our global Employee Resource Group (ERG) Program, which broadens and enhances companywide interaction opportunities

for our employees. Tetra Tech's global ERG Program supports our employees and creates collaborative teams, or ERGs, where all voices are heard, all employees feel safe, and each employee has the

opportunity to thrive. Our ERGs are open to all and involve activities for both employees whose background is the focus of the ERG and those who are supportive of the group (also known as allies).

These global networks build on and coordinate with the many local networks already active throughout our operations and include groups focused on the experiences of Black, Latino, Women, Veterans, and

LGBTQ employees. Our D&I Council charters and guides the development of the global ERGs to support our thriving worldwide employee community. For additional information, visit our website at

https://www.tetratech.com/en/diversity-and-inclusion-activities.

Professional Development

Tetra Tech invests in the professional development of our employees. This investment enables us to attract and retain the caliber of talent

that is integral to our success as a high-end professional consulting and engineering company. Professional development is inherently essential to the successful performance of high-end projects and

collaborative multidisciplinary team delivery of responsive solutions. Working on challenging, innovative, and technically cutting-edge projects enhances our employees' professional development and

growth. Our work encompasses many sustainable, societal, and beneficial outcomes that enable our employees to make positive contributions that benefit society. Technically innovative projects also

provide an opportunity for our employees to "advance the science" in leading applications of our expertise to water, environment, sustainable infrastructure, and international development projects

worldwide. We encourage our employees to develop patents, where appropriate, and to

Tetra Tech 2021 Proxy Statement 9

Table of Contents

Corporate Governance, Sustainability, and Social Responsibility

publish

journal articles in their field of expertise, often in collaboration with our clients. With our more than 450 offices, our employees can meaningfully contribute to improving the quality of

life for the communities in which they work and live.

We

provide our employees with developmental opportunities by encouraging collaboration and multidisciplinary teams through Tetra Tech's Growth Initiatives Program. This program facilitates

collaboration across major service sectors such as water, power generation, and high-performance building design. We also support the application and integration of technology and skills development

through internal webcasts and training.

Employees

are also provided with training in leadership development, project management skills, and interpersonal skills development. Our focused programs are designed, taught, and facilitated by

Tetra Tech leadership, consistent with our commitment to talent development. These programs include the following:

-

•

-

Leadership Academy—Tetra Tech's Leadership

Academy develops our high-potential employees from around the world into outstanding business leaders. Instructors for this intensive, year-long program are executive management and operational

leaders from within the Company. Participants are immersed in all aspects of the operations of the Company and complete challenging, real-world assignments designed to hone their leadership and

management skills. Completion is personally certified by the Company's CEO and Chairman of the Board.

-

•

-

Tech 1000 Challenge—The Tech 1000 Challenge is

a competition to create the most innovative, technology-focused solution to a real client challenge. The event brings together employees from around the world to team up and vie for the top technology

solutions that address our clients' needs. Participants from across our markets form teams to focus on client needs, receive briefings on our Tetra Tech Delta technologies from their peers, and hone

their skills in designing strategies and pitching client solutions.

-

•

-

Project Excellence Program—Tetra Tech develops

project managers who are world class in their abilities and performance. The program is led by our Chief Engineer and involves extensive training on how to effectively manage all components of a

project. Completion is certified by a senior member of the Project Excellence Team and leads to participants being assigned more complex projects.

-

•

-

Fearless Entrepreneur Program—Tetra Tech

develops employees into client-oriented, business-minded professionals who are driven to understand and meet the needs of our clients. Developing professionals are challenged and mentored through a

process of building client relationships. Participants take part in group discussions in a classroom setting and then are required to implement learned strategies with actual and potential clients.

This program is led by senior operations management and completion is certified by an executive officer of the Company.

-

•

-

Professional Women's Network—Founded by

Leadership Academy alumnae, the Tetra Tech Professional Women's Network provides a monthly platform for issues that affect women in the workplace. All women across the Company are invited to attend

the monthly presentations, with topics suggested by network members. Tetra Tech women at various levels of leadership share insights and knowledge acquired throughout their careers. This group

provides the opportunity for women at any stage in their careers to ask questions and further their career development by connecting them with mentors across the Company.

-

•

-

Tetra Tech Technology Transfer (T4) and ToolTalk Webcast

Series—Tetra Tech holds monthly webcasts to help employees around the world improve their use of available internal tools and to provide better

service to clients. Through the T4 and ToolTalk Webcast Series, Tetra Tech experts present and lead discussions about new technologies and programs, best practices, and opportunities for growth across

the Company. All employees are invited to participate in the live presentations or view webcast recordings, ensuring that we are growing the knowledge, strength, and leadership of our employees around

the world.

By

offering our employees meaningful work and career development, Tetra Tech is well positioned to continue our growth through recruitment, development, and retention of the best talent in the

industry.

Tetra Tech 2021 Proxy Statement 10

Table of Contents

Our Board of Directors

Our Board of Directors

Our Board of Directors is responsible for overseeing, counseling, and directing management in serving the long-term interests of our Company

and stockholders, with the goal of building long-term stockholder value and ensuring the strength of our Company for our clients, employees, and other stakeholders. In this capacity, the Board's

primary responsibilities include establishing an effective Corporate Governance Program with a board and committee structure that ensures independent oversight; overseeing our business, strategies,

and risks; maintaining the integrity of our financial statements; evaluating the performance of our senior executives and determining their compensation; undertaking succession planning for our CEO,

other senior executives, and directors; and reviewing our Annual Operating Plan (AOP) and significant strategic and operational objectives and actions.

Board Composition

Our bylaws provide that our Board shall consist of between five and 10 directors, with the exact number fixed from time to time by Board

resolution. The Board has fixed the number at eight as of the Annual Meeting. We believe a limited number of directors helps maintain personal and group accountability. Our Board is independent in

composition and outlook, other than our CEO. All our current directors have been nominated for election by the Board of Directors upon recommendation by the NCG Committee.

Board Meetings and Attendance

During FY 2020, our Board of Directors held seven meetings. During that period, all the incumbent directors attended or participated in at

least 75% of the total number of meetings of the Board and of the committees of the Board on which each of those directors served, during the period for which each of them served. Our directors are

strongly encouraged to attend the Annual Meeting of stockholders, and all but one of our directors then in office attended last year's Annual Meeting.

Corporate Governance Policies

Our corporate governance policies, listed in the following table, are reviewed at least annually and amended from time to time to reflect the

beliefs of our Board, changes in regulatory requirements, evolving best practices, and recommendations from our stockholders and advisors.

Corporate Governance Policies

|

|

|

|

|

|

|

Matter

|

|

|

|

Description of Policy

|

|

|

|

|

|

|

|

Board Composition

|

|

|

|

•

Reasonable Size. Our Board shall be between five and 10 directors.

•

No

Overboarded Directors. Our directors sit on three or fewer boards of other public companies.

•

Mandatory Retirement. Our Board has fixed the retirement age for directors at 75.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Independence

|

|

|

|

•

Majority Independent. A majority of our directors satisfy Nasdaq independence standards.

•

Regular Executive Sessions. Our independent directors meet in executive session following each meeting of the Board, each meeting of the Audit Committee, and certain other committee meetings.

|

|

|

|

|

|

|

|

|

|

|

|

|

Tetra Tech 2021 Proxy Statement 11

Table of Contents

Our Board of Directors

|

|

|

|

|

|

|

Matter

|

|

|

|

Description of Policy

|

|

|

|

|

|

|

|

Board Leadership Structure

|

|

|

|

•

Robust

Presiding Director Role. Since our CEO is also Chairman, our independent directors selected one of themselves to serve on a rotating basis as Presiding Director, with established roles and responsibilities. See the Board

Leadership Structure section following this table on page 13 for further details.

•

Annual Review. The Board annually appoints a Chair and determines whether the positions of Chair and CEO will be held by one individual or separated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board Committees

|

|

|

|

•

Independence. Board committees are comprised only of independent directors.

•

Governance. Board committees act under charters evaluated by the Board annually that set forth their purposes and responsibilities. The charters allow for the engagement, at our expense, of independent legal,

financial, or other advisors the directors deem necessary or appropriate.

•

Attendance. Directors prepare for and are expected to attend all meetings of the Board and its committees on which they serve and are strongly encouraged to attend all Annual Meetings of stockholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Qualifications

|

|

|

|

•

Diverse and Relevant Experience. The NCG Committee works with the Board to determine the appropriate characteristics, skills, and experiences for the directors. The Board is committed to selecting the most qualified

candidates regardless of gender, ethnicity, national origin and other underrepresented groups.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board Duties

|

|

|

|

•

Succession Planning. Our Board conducts executive and director succession planning annually, including progress in current job position and career development in terms of strategy, leadership, and execution.

•

Financial Reporting, Legal Compliance, and Ethical Conduct. Our Board maintains governance and oversight functions, but our executive management maintains primary responsibility.

•

Stock Ownership Guidelines. To align the interests of stockholders with the directors and executive officers, our Board has established stock ownership guidelines applicable to executive officers and

directors.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuous Board Improvement

|

|

|

|

•

New

Director Orientation. All new directors participate in an orientation program to familiarize them with our Company.

•

Continuing Education. Directors continue their education through meetings with executive management and other managers to enhance the flow of meaningful financial and business information. They also receive

presentations to assist with their continuing education. Directors also attend outside director education programs to stay informed about relevant issues.

•

Annual Evaluations. The NCG Committee oversees an annual self-assessment process for the Board and Committees to ensure our Board and each of the committees are functioning effectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Independence

Upon recommendation of the NCG Committee, our Board of Directors has determined that Mr. Birkenbeuel, Mr. Haden, Mr. Lewis, Ms. Maguire, Dr.

Ritrievi, Mr. Thompson, and Ms. Volpi each is independent under the criteria established by Nasdaq for director independence. Mr. Batrack is not independent because he is serving as our CEO.

All

members of our Audit, Compensation, NCG, and SPER committees are independent directors. In addition, the members of the Audit Committee and Compensation Committee each meet the additional

independence criteria required for membership on those committees under applicable Nasdaq listing standards. The Board has also determined that each member of the Audit Committee qualifies as an

"audit committee financial expert" under SEC rules.

Tetra Tech 2021 Proxy Statement 12

Table of Contents

Our Board of Directors

Board Leadership Structure

Our Board of Directors does not have a policy with respect to whether the roles of chairman and CEO should be separate or combined. We

currently have a combined Chairman/CEO role as well as an independent Presiding Director. We believe that the combined Chairman/CEO role is appropriate because it allows for one individual to lead our

Company with a cohesive vision, the ability to execute that vision, and the understanding of the significant enterprise risks that need to be mitigated or overcome to achieve that vision. It also

fosters clear accountability, effective decision-making, and alignment on corporate strategy. Combined leadership at the top also provides the necessary flexibility for us to rapidly address the

changing needs of our business.

Balancing

our combined Chairman/CEO is our Presiding Director, who is independent and has critical duties in the boardroom to ensure effective and independent oversight of Board decision-making. The

Board has determined that the role of Presiding Director will rotate to ensure independence and the term will be four years. At a meeting in February 2019, the independent directors elected Mr.

Thompson to serve as Presiding Director for a four-year term ending in January 2023.

Our

governance policies describe the Presiding Director's duties, which delineate clear responsibilities to ensure independent stewardship of our Board, as summarized below.

|

|

|

|

Presiding Director Roles and Responsibilities

|

|

|

|

|

|

•

Schedule meetings of

the independent directors.

•

Chair separate, executive session meetings of the independent directors.

•

Serve as principal liaison between independent directors and Chairman/CEO.

•

Communicate with Chairman/CEO and disseminate information to

remaining directors as appropriate.

•

Provide leadership to the Board of Directors if circumstances arise in which the role of the Chairman may be, or may be perceived to be, in conflict.

•

Be available, as appropriate, for consultation and direct

communication with major stockholders.

•

Oversee, with the NCG Committee, the annual self-evaluation of the Board.

|

|

|

|

|

Supplementing

the Presiding Director are our committee chairs and members, all of whom are independent. With the Compensation Committee conducting a rigorous annual evaluation of the CEO's

performance, which is discussed by all independent directors during executive sessions, we believe our Board leadership structure provides independent oversight of our Company.

Board Committees

Each of our Board committees has a separate written charter that describes its purpose, membership, meeting structure, authority, and

responsibilities. These charters, which can be found in the Corporate Governance section of our website at www.tetratech.com/en/corporate-governance, are reviewed annually by the respective committee,

with any recommended changes adopted upon approval by our Board.

The

Board has four standing committees consisting solely of independent directors, each with a different independent director serving as chair of the committee. Our standing committees are the Audit

Committee, the Compensation Committee, the NCG Committee, and the SPER Committee. Board committee meetings are held sequentially (i.e., committee meetings do not overlap with one another) and enable

each of our Board members to attend each committee meeting. We believe this practice is highly beneficial to our Board specifically and to the Company in general because each of our Board members is

aware of the detailed work conducted by each Board committee. This practice also affords each of our Board members the opportunity to provide input to each committee before any conclusions are

reached.

Tetra Tech 2021 Proxy Statement 13

Table of Contents

Our Board of Directors

The

primary responsibilities, membership, and meeting information for our four standing committees are summarized below.

Standing Committees of the Board of Directors

|

|

|

|

|

|

|

|

Audit Committee

|

|

|

|

|

|

|

|

|

|

Meetings in FY 2020: 4

|

|

Average Attendance in FY 2020: 100%

|

|

|

|

|

|

|

|

|

|

Chair

Gary R. Birkenbeuel

Members

J. Christopher Lewis

Kimberly E. Ritrievi

Kirsten M. Volpi

All members satisfy the audit committee experience and independence standards required by Nasdaq and have been determined to be financially

literate.

Each member of the Audit Committee has been determined to be an "audit committee financial expert" under applicable SEC regulations.

|

|

Responsibilities

•

Review our significant accounting principles, policies, and practices in reporting our financial results under U.S. generally accepted

accounting principles.

•

Review our annual audited financial statements and related disclosures.

•

Review management letters or internal control reports

and review our internal controls over financial reporting.

•

Review the effectiveness of the independent audit effort.

•

Appoint, retain,

and oversee the work of the independent accountants.

•

Pre-approve audit and permissible non-audit services provided by the independent registered public accounting firm.

•

Review our interim financial results for each of the first three fiscal quarters.

•

Be directly responsible for our internal Management Audit Department,

approve its audit plan, and review its reports.

•

Review and discuss financial, liquidity, tax and treasury, litigation, and Sarbanes-Oxley Act of 2002 compliance matters in accordance with our

enterprise risk management (ERM) responsibility matrix.

•

Review and oversee related party transactions.

•

With the Compensation Committee, approve the

compensation of our CFO.

•

Review complaints regarding accounting, internal controls, auditing, employee and other matters.

•

Prepare the annual

Audit Committee Report to be included in the proxy statement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation Committee

|

|

|

|

|

|

|

|

|

|

Meetings in FY 2020: 4

|

|

Average Attendance in FY 2020: 100%

|

|

|

|

|

|

|

|

|

|

Chair

J. Kenneth Thompson

Members

Patrick C. Haden

J. Christopher Lewis

Kirsten M. Volpi

All members satisfy the independence standards required by Nasdaq.

All members qualify as "nonemployee directors" under Rule 16b 3 of the Securities Exchange Act of 1934, as amended, and as "outside directors" under Section 162(m)

of the Internal Revenue Code.

|

|

Responsibilities

•

Review and approve the annual base salaries and annual incentive opportunities of the CEO and other executive officers, including an evaluation

of the performance of the executive officers in light of our performance goals and objectives.

•

Review and approve all other incentive awards and opportunities, any

employment agreements and severance arrangements, any change in control agreements, and any special or supplemental compensation and benefits as they affect the executive officers.

•

Review and discuss

comments provided by stockholders and proxy advisory firms regarding our executive compensation.

•

Oversee our compliance with SEC rules and regulations regarding

stockholder approval of certain executive compensation matters.

•

Review director and executive officer stock ownership under our stock ownership guidelines.

•

Review and discuss incentives and rewards in accordance with our ERM responsibility matrix.

•

Make recommendations to the Board with respect to incentive-based

compensation plans, equity-based plans, and executive benefits.

•

Review and approve all grants of equity awards.

•

Review and discuss the annual

Compensation Discussion and Analysis and Compensation Committee Report to be included in the proxy statement.

•

Retain and work with the independent compensation

consultant.

|

|

|

|

|

|

|

Tetra Tech 2021 Proxy Statement 14

Table of Contents

Our Board of Directors

|

|

|

|

|

|

|

|

Nominating and Corporate Governance Committee

|

|

|

|

|

|

|

|

|

|

Meetings in FY 2020: 4

|

|

Average Attendance in FY 2020: 100%

|

|

|

|

|

|

|

|

|

|

Chair

Joanne M. Maguire

Members

Gary R. Birkenbeuel

Patrick C. Haden

All members satisfy the independence standards required by Nasdaq.

|

|

Responsibilities

•

Develop criteria for nominating and appointing directors, including board size and composition; corporate governance policies; and individual

director expertise, attributes, and skills.

•

Recommend to the Board the individuals to be nominated as directors.

•

Recommend to the

Board the directors to be selected for service on the Board committees.

•

Oversee an annual review of the performance of the Board and each

committee.

•

Review annually the adequacy of the committee charters and recommend to the Board proposed changes.

•

Make

recommendations to the Board on changes in the compensation of nonemployee directors.

•

Review the succession plans relating to the positions held by

executive officers and directors.

•

Review our Corporate Code of Conduct and anti-fraud policies in accordance with our ERM responsibility matrix; and consider any conflict of interest issues between

us and directors or executive officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Planning and Enterprise Risk Committee

|

|

|

|

|

|

|

|

|

|

Meetings in FY 2020: 2

|

|

Average Attendance in FY 2020: 100%

|

|

|

|

|

|

|

|

|

|

Chair

Kimberly E. Ritrievi

Members

Joanne M. Maguire

J. Kenneth Thompson

All members satisfy the independence standards required by Nasdaq.

|

|

Responsibilities

•

Oversee our strategic planning process.

•

Provide oversight of the development of our three-year

strategic plan by the management team.

•

Review and recommend to the Board certain strategic decisions regarding our exit from existing lines of business, entry into new lines of business, acquisitions,

joint ventures, investments in or dispositions of businesses, and review and approval of our capital allocation strategy.

•

Review, as requested by management, our bid and proposal strategy for

high-risk contracts.

•

Oversee our ERM policies and procedures and work with our Corporate Risk Management Officer on ERM reports to the Board.

•

Review, as determined by management, any changes in technology and regulatory trends to assess the impact of those changes on business strategy and resource allocation.

|

|

|

|

|

|

|

Executive Sessions

Our Board believes it is important to have executive sessions without our CEO being present, which are scheduled after every regular meeting

of the Board. Our independent directors have robust and candid discussions at these executive sessions during which they can critically evaluate the performance of our Company, CEO, and management.

In

addition, executive sessions of the Audit Committee are scheduled following each regular meeting of the Audit Committee (with our independent auditors, with the head of our internal audit

department, and with executive management, if deemed necessary). Also, an executive session of the Compensation Committee is scheduled following the Compensation Committee meeting each November at

which executive compensation determinations are made.

Oversight of Risk Management

Enterprise Risk Management and Strategic Risks

We

believe that risk is inherent in the pursuit of long-term growth opportunities. Our management is responsible for day-to-day risk management activities. The Board of Directors, acting directly and

through its committees, is responsible for the oversight of our risk management. With this oversight, we have implemented an enterprise risk management (ERM) program with practices and policies

designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase stockholder value.

Tetra Tech 2021 Proxy Statement 15

Table of Contents

Our Board of Directors

The

SPER Committee is responsible for the oversight of the ERM program. Our Corporate Risk Management Officer reports the status of the ERM program to the Committee on a semiannual basis. The reports

address our risk management effectiveness, projects that might significantly impact our financial condition, and any new risk issues and mitigation measures that have been implemented. The SPER

Committee, as well as other members of the Board, also receive regular updates from our Chief Information Officer on the overall cybersecurity risk environment, including our Company's enterprise-wide

cybersecurity risk assessment results and key initiatives.

Other

committees of the Board oversee certain categories of risk associated with their respective areas of responsibility to better coordinate with management and serve the long-term interests of our

stockholders. The reports the Board receives from the committees covering topics discussed at their meetings include any discussion of the areas of risk overseen primarily by each committee.

In

addition, the Board participates in regular discussions with our senior management on several core subjects in which risk oversight is an inherent element, including strategy, operations, finance,

mergers and acquisitions (M&A), and legal matters. The Board believes the leadership structure described in the Board Leadership Structure section on page 13 of this proxy statement facilitates the

Board's oversight of risk management because it allows the Board, with leadership from the Presiding Director and working through its committees, to participate actively in the oversight of

management's actions.

Major Areas of Oversight of the Board and Standing Committees

Risks Associated with Compensation Policies and Practices

As described in the Compensation Discussion and Analysis section on page 31 of this proxy statement, we maintain what we believe are

best practices in compensation and corporate governance that collectively encourage ongoing risk assessment and mitigation. The Compensation Committee regularly reviews our executive compensation

program to ensure it does not provide incentives that encourage our employees to take excessive risks in managing their respective business or functional areas. Our compensation program includes the

following safeguards:

-

•

-