Current Report Filing (8-k)

July 12 2021 - 8:32AM

Edgar (US Regulatory)

0000061398

false

0000061398

2021-07-12

2021-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported):

|

July 12, 2021

|

Tellurian Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

001-5507

|

06-0842255

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

1201 Louisiana Street, Suite 3100, Houston, TX

|

|

77002

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(832) 962-4000

|

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

|

TELL

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

On July 12, 2021, Tellurian

Inc., a Delaware corporation (“Tellurian”), terminated that certain Common Stock Purchase Agreement dated April 3,

2019 between Tellurian and Total Delaware, Inc., a Delaware corporation and subsidiary of TOTAL SE (“Total”), pursuant

to which Total had agreed to purchase, and Tellurian had agreed to issue and sell in a private placement to Total, 19,872,814 shares of

Tellurian common stock, par value $0.01 per share, in exchange for a cash purchase price of $10.064 per share, subject to the satisfaction

of certain closing conditions (the “CSPA”).

Also on July 12, 2021,

Driftwood Holdings LP, a Delaware limited partnership and wholly owned subsidiary of Tellurian (the “Partnership”),

terminated that certain Equity Capital Contribution Agreement dated July 10, 2019 between the Partnership and Total (the “Contribution

Agreement”). The Contribution Agreement principally governed the terms of Total’s proposed investment in the Partnership,

subject to the satisfaction of certain closing conditions. As a result of the termination of the Contribution Agreement, (i) the

counterparts of the Partnership Agreement, the LNG SPA, and the DOE Agreement (each as defined in the Contribution Agreement) that were

executed and delivered into escrow by Total automatically terminated in accordance with the terms of the Contribution Agreement; and (ii) that

certain LNG Sale and Purchase Agreement dated July 10, 2019 between Tellurian Trading UK Ltd, a wholly owned subsidiary of Tellurian

(“Tellurian Trading”), and Total Gas & Power North America, Inc., an affiliate of Total (“Total Gas &

Power”), pursuant to which Total Gas & Power had the right to purchase from Tellurian Trading approximately 1.5 million

tonnes per annum of liquefied natural gas on a free on board basis at prices based on the Platts Japan Korea Marker index price (the “TTUK

SPA,” and together with the CSPA, Contribution Agreement, Partnership Agreement, LNG SPA, and DOE Agreement, the ”Total

Agreements”), automatically terminated in accordance with its terms.

The Total Agreements were

terminated because they are not consistent with the commercial agreements that Driftwood LNG LLC, a Delaware limited liability company

and wholly owned subsidiary of Tellurian, has reached with other counterparties.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

By:

|

/s/ L. Kian Granmayeh

|

|

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

Date: July 12, 2021

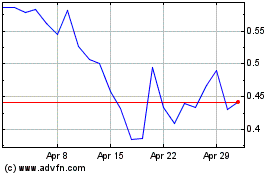

Tellurian (AMEX:TELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

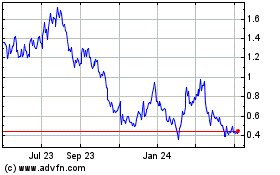

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2023 to Apr 2024