Current Report Filing (8-k)

May 15 2020 - 12:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

May 15, 2020

TD Holdings, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-36055

|

|

45-4077653

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

Room 104, No. 33 Section D,

No. 6 Middle Xierqi Road,

Haidian District, Beijing, China

(Address of Principal Executive Offices)

+86 (010) 59441080

(Issuer’s telephone number)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.001

|

|

GLG

|

|

Nasdaq Capital Market

|

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Change of Directors

On May 14, 2020, Mr.

Jiaxi Gao resigned from his position as a director of TD Holdings, Inc.’s (the “Company”) board of directors

(the “Board”). Mr. Gao’s resignation is not as a result of any disagreement with the Company relating

to its operations, policies or practices.

On May 14, 2020, the

Board appointed Ms. Wei Sun as a director of the Board to fill the vacancy created by the resignation of Mr. Gao.

The biographical information

of Ms. Sun is set forth below.

Ms. Sun has been serving

as the executive director of China National Culture Group Limited in Hong Kong since 2014. She served as the financial accounting

manager of China Highways Holdings Limited in Hong Kong from 2011 to 2014. She obtained her Bachelor’s Degree in English

Education from Shanghai International Studies University and her Master’s Degree in Finance from Clark University in 2009.

Ms. Sun does not have

a family relationship with any director or executive officer of the Company and has not been involved in any transaction with the

Company during the past two years that would require disclosure under Item 404(a) of Regulation S-K.

Ms. Sun has also entered

into a director agreement (the “Sun’s Offer Letter”) with the Company, pursuant to which she shall receive

annual compensation of $100,000, and establishes other terms and conditions governing her service on the Company’s Board.

The Offer Letter is qualified in its entirety by reference to the complete text of the agreement, which is filed hereto as Exhibits

10.1.

Item 7.01 Regulation FD Disclosure.

As disclosed on TD Holdings, Inc.’s

(the “Company”) Current Report on Form 8-K filed on March 27, 2020, the Company availed itself of the Order

(Release No. 34-88318) issued by the Securities and Exchange Commission (the “Commission”) on March 4, 2020

under Section 36 of the Exchange Act granting exemptions from specified provisions of the Securities Exchange Act of 1934, as amended,

(the “Exchange Act”) and certain rules thereunder (the “Order”) to extend the filing deadline

of its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “10-K”).

Due to the additional time spent in preparation

for the filing of its Annual Report, the Company is unable to timely prepare its Quarterly Report on Form 10-Q for the fiscal quarter

ended March 31, 2020 (the “10-Q”). The Company had initially planned to avail itself of the five day filing

extension provided by Rule 12b-25 under the Exchange Act to file its 10-Q, but the Company now believes that it will not be able

to file the 10-Q by the prescribed date, taking into account the extension normally available under Rule 12b-25 under the Exchange

Act, without unreasonable effort or expense.

The Order provides that a registrant subject

to the reporting requirements of Exchange Act Section 13(a) or 15(d), and any person required to make any filings with respect

to such a registrant, is exempt from any requirement to file or furnish materials with the Commission under Exchange Act Sections

13(a), 13(f), 13(g), 14(a), 14(c), 14(f), 15(d) and Regulations 13A, Regulation 13D-G (except for those provisions mandating the

filing of Schedule 13D or amendments to Schedule 13D), 14A, 14C and 15D, and Exchange Act Rules 13f-1, and 14f-1, as applicable,

where certain conditions are satisfied.

Based on the foregoing, the Company is

hereby relying on the Order and expects to file the 10-Q on or around June 5, 2020 but no later than June 29, 2020.

Item 8.01 Other Events.

The Company is supplementing the risk factors

previously disclosed in its most recent periodic reports filed under the Exchange Act with the following risk factor:

Our business, results of operations

and financial condition may be adversely affected by global public health epidemics, including the strain of coronavirus known

as COVID-19.

In light of the uncertain and rapidly evolving

situation relating to the spread of the coronavirus (COVID-19), we have taken temporary precautionary measures intended to help

minimize the risk of the virus to our employees, our customers, and the communities in which we participate, which could negatively

impact our business. To this end, we are evaluating alternative working arrangements, including requiring all employees to work

remotely, and we have suspended all non-essential travel for our employees and limiting in-person work-related meetings.

In addition, with the extended Chinese

business shutdowns that resulted from the outbreak of COVID-19, we may experience delays or the inability to service our customers

on a timely basis in both our Luxury Car Business and our Commodities Trading Business. The disruptions to our supply chain and

business operations, or to our suppliers’ or customers’ supply chains and business operations, could include disruptions

from the closure of our luxury car rental facilities, interruptions in the supply of commodities, personnel absences, and restrictions

on the luxury car rental services or delivery and storage of commodities, any of which could have adverse ripple effects on our

Luxury Car Business and our Commodities Trading Business. If we need to close any of our facilities or a critical number of our

employees become too ill to work, our ability to provide our products and services to our customers could be materially adversely

affected in a rapid manner. Similarly, if our customers experience adverse business consequences due to COVID-19, or any other

pandemic, demand for our products and services could also be materially adversely affected in a rapid manner. Global health concerns,

such as COVID-19, could also result in social, economic, and labor instability in the localities in which we or our suppliers and

customers operate within China.

While the potential economic impact brought

by and the duration of COVID-19 may be difficult to assess or predict, a widespread pandemic could result in significant disruption

of global financial markets, reducing our ability to access capital, which could in the future negatively affect our liquidity.

In addition, a recession or market correction resulting from the spread of COVID-19 could materially affect our business and the

value of our common stock. While it is too early to tell whether COVID-19 will have a material effect on our business over time,

we continue to monitor the situation as it unfolds. The extent to which COVID-19 affects our results will depend on many factors

and future developments, including new information about COVID-19 and any new government regulations which may emerge to contain

the virus, among others.

Forward-Looking

Statements

Statements in

this Current Report on Form 8-K are “forward-looking statements” as the term is defined under applicable

securities laws. These statements include the anticipated timing of the filing of Company’s quarterly and annual statements

under the Exchange Act; the expected impact of the COVID-19 virus outbreak on the Company’s financial reporting

capabilities and its operations generally and the potential impact of such virus on the Company’s customers, distribution

partners, advertisers and production facilities and other third parties. These and other forward-looking statements are subject

to risks, uncertainties and other factors that could cause actual results to differ materially from those statements. Such risks

and uncertainties are, in many instances, beyond the Company’s control. Forward-looking statements, which are presented as

of the date of this filing, will not be updated to reflect events or circumstances after the date of this statement except as required

by law.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

TD HOLDINGS, INC.

|

|

|

|

|

|

Date: May 15, 2020

|

By:

|

/s/ Renmei Ouyang

|

|

|

Name:

|

Renmei Ouyang

|

|

|

Title:

|

Chief Executive Officer

|

3

TD (NASDAQ:GLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

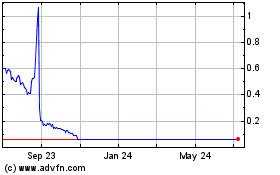

TD (NASDAQ:GLG)

Historical Stock Chart

From Apr 2023 to Apr 2024