TCG BDC, Inc. (together with its consolidated subsidiaries, “we,”

“us,” “our,” “TCG BDC” or the “Company”) (NASDAQ: CGBD) today

announced its financial results for its fourth quarter

ended December 31, 2020.

Linda Pace, TCG BDC’s Chief Executive Officer said, “New deal

activity in the 4th quarter was robust, as M&A demand

accelerated post-Labor Day. Continuing strong portfolio

performance, paired with our proactive balance sheet management

actions in 2020, positioned us well to participate actively in this

attractive originations environment. We enter 2021 with confidence

in our ability to deliver sustainable yield and continued positive

credit migration as the cycle progresses.”

Selected Financial Highlights

| (dollar amounts in thousands,

except per share data) |

|

December 31, 2020 |

|

September 30, 2020 |

|

Total investments, at fair value |

|

$ |

1,825,749 |

|

$ |

1,948,173 |

| Total assets |

|

1,922,613 |

|

2,008,387 |

| Total debt |

|

983,923 |

|

1,074.806 |

| Total net assets |

|

$ |

901,363 |

|

$ |

895,222 |

| Net assets per common share |

|

$ |

15.39 |

|

|

15.01 |

| |

|

For the three month periods

ended |

| |

|

December 31, 2020 |

|

September 30, 2020 |

|

Total investment income |

|

$ |

43,514 |

|

$ |

42,784 |

| Net investment income (loss) |

|

$ |

21,909 |

|

$ |

21,234 |

| Net realized gain (loss) and net

change in unrealized appreciation (depreciation)

on investments and non-investment assets and liabilities |

|

$ |

16,254 |

|

$ |

12,374 |

| Net increase (decrease) in net

assets resulting from operations |

|

$ |

38,163 |

|

$ |

33,608 |

| |

|

|

|

|

| Per weighted-average common

share—Basic: |

|

|

|

|

| Net investment income (loss), net

of preferred dividend |

|

$ |

0.38 |

|

$ |

0.36 |

| Net realized gain (loss) and net

change in unrealized appreciation (depreciation)

on investments and non-investment assets and liabilities |

|

$ |

0.28 |

|

$ |

0.22 |

| Net increase (decrease) in net

assets resulting from operations attributable to common

stockholders |

|

$ |

0.66 |

|

$ |

0.58 |

| Weighted-average shares of common

stock outstanding—Basic |

|

55,961,413 |

|

56,308,616 |

| Regular dividends declared per

common share |

|

$ |

0.32 |

|

$ |

0.32 |

| Supplemental dividends declared

per common share |

|

$ |

0.04 |

|

$ |

0.05 |

Fourth Quarter 2020 Highlights(dollar amounts

in thousands, except per share data)

- Net investment income for the three month period

ended December 31, 2020 was $21,044, or $0.38 per

common share, net of the preferred dividend, as compared to

$21,234, or $0.36 per common share, net of the preferred dividend,

for the three month period ended September 30, 2020;

- Net realized gain (loss) and net change in unrealized

appreciation (depreciation) on investments and non-investment

assets and liabilities for the three month period ended

December 31, 2020 was $16,254,

or $0.28 per share, as compared to $12,374, or $0.22 per

share, for the three month period ended September 30,

2020;

- Net increase (decrease) in net assets resulting from operations

for the three month period ended December 31,

2020 was $38,163, or $0.66 per share, as

compared to $33,608, or $0.58 per common share, for the three

month period ended September 30, 2020;

- On December 8, 2020, the Company issued $75,000 in aggregate

principal amount of 4.500% Senior Unsecured Notes due December 31,

2024;

- During the three month period ended December 31,

2020, the Company repurchased and extinguished 1.0 million shares

of the Company's common stock pursuant to the Company’s previously

announced $150 million stock repurchase program at an average cost

of $10.85 per share, or $11.3 million in the aggregate, resulting

in accretion to net assets per share of $0.08; and

- On February 22, 2021, the Board of Directors declared a regular

quarterly dividend of $0.32 plus a supplemental dividend of $0.05,

which is payable on April 16, 2021 to stockholders of record on

March 31, 2021.

Portfolio and Investment Activity(dollar

amounts in thousands, except per share data, unless otherwise

noted)

As of December 31, 2020, the fair value of our investments

was approximately $1,825,749, comprised of 160 investments in 117

portfolio companies/investment funds across 27 industries with 63

sponsors. This compares to the Company’s portfolio as

of September 30, 2020, as of which date the fair value of

our investments was approximately $1,948,173, comprised of 146

investments in 114 portfolio companies/investment funds across 28

industries with 63 sponsors.

As of December 31, 2020 and September 30, 2020, investments

consisted of the following:

| |

December 31, 2020 |

|

September 30, 2020 |

| Type—% of Fair

Value |

Fair Value |

|

% of Fair Value |

|

Fair Value |

|

% of Fair Value |

|

First Lien Debt (excluding First Lien/Last Out Debt) |

$ |

1,161,881 |

|

|

63.63 |

% |

|

$ |

1,344,575 |

|

|

69.01 |

% |

| First Lien/Last Out Debt |

62,182 |

|

|

3.41 |

|

|

78,616 |

|

|

4.04 |

|

| Second Lien Debt |

284,523 |

|

|

15.58 |

|

|

287,659 |

|

|

14.77 |

|

| Equity Investments |

33,877 |

|

|

1.86 |

|

|

32,987 |

|

|

1.69 |

|

| Investment Funds |

283,286 |

|

|

15.52 |

|

|

204,336 |

|

|

10.49 |

|

|

Total |

$ |

1,825,749 |

|

|

100.00 |

% |

|

$ |

1,948,173 |

|

|

100.00 |

% |

The following table shows our investment activity for the three

month period ended December 31, 2020:

| |

Funded |

|

Sold/Repaid |

| Principal amount of

investments: |

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

First Lien Debt (excluding First Lien/Last Out Debt) |

$ |

137,122 |

|

|

53.42 |

% |

|

$ |

(333,349 |

) |

|

|

83.34 |

% |

| First Lien/Last Out Debt |

9,945 |

|

|

3.88 |

|

|

(26,414 |

) |

|

|

6.60 |

|

| Second Lien Debt |

30,629 |

|

|

11.93 |

|

|

(38,971 |

) |

|

|

9.74 |

|

| Equity Investments |

857 |

|

|

0.33 |

|

|

(1,282 |

) |

|

|

0.32 |

|

| Investment Funds |

78,122 |

|

|

30.44 |

|

|

— |

|

|

|

— |

|

| Total |

$ |

256,675 |

|

|

100.00 |

% |

|

$ |

(400,016 |

) |

|

|

100.00 |

% |

Overall, total investments at fair value decreased by 6.3%, or

$122,424, during the three month period

ended December 31, 2020 after factoring in

repayments and sales, net fundings on revolvers and delayed draws

and net change in unrealized appreciation (depreciation).

As of December 31, 2020, the weighted average

yields for our first and second lien debt investments on an

amortized cost basis were 7.21% and 9.15%, respectively, with a

total weighted average yield of 8.12%. Weighted average yields

include the effect of accretion of discounts and amortization of

premiums and are based on interest rates as of December 31,

2020. As of December 31, 2020, on a fair value basis,

approximately 0.9% of our debt investments bear interest at a fixed

rate and approximately 99.1% of our debt investments bear interest

at a floating rate, which primarily are subject to interest rate

floors.

Total investments at fair value held by Middle Market Credit

Fund, LLC (“Credit Fund”), which is not consolidated with the

Company, decreased by 18.2%, or $235,031, during the three month

period ended December 31, 2020 after factoring in

repayments, sales, net fundings on revolvers and delayed draws and

net change in unrealized appreciation (depreciation). As of

December 31, 2020, Credit Fund had total investments at fair

value of $1,056,381, which comprised 97.5% of first lien senior

secured loans, 2.3% of second lien senior secured loans at fair

value, 0.2% of equity investments at fair value. As of

December 31, 2020, on a fair value basis, approximately 2.3%

of Credit Fund’s debt investments bear interest at a fixed rate and

approximately 97.7% of Credit Fund’s debt investments bear interest

at a floating rate, which primarily are subject to interest rate

floors.

Middle Market Credit Fund II, LLC (“Credit Fund II”) was formed

on November 3, 2020 as a joint venture with Cliffwater Direct

Lending Fund and is not consolidated with the Company. Credit Fund

II's initial portfolio of $250 million in aggregate principal

balance was contributed by the Company. As of December 31,

2020, Credit Fund II had total investments at fair value of

$246,421, which comprised 90.1% of first lien senior secured loans

and 9.9% of second lien senior secured loans at fair value. As of

December 31, 2020, on a fair value basis, approximately 0.9%

of Credit Fund II’s debt investments bear interest at a fixed rate

and approximately 99.1% of Credit Fund II’s debt investments bear

interest at a floating rate, which primarily are subject to

interest rate floors.

As part of the monitoring process, our Investment Adviser has

developed risk policies pursuant to which it regularly assesses the

risk profile of each of our debt investments and rates each of them

based on the following categories, which we refer to as “Internal

Risk Ratings”:

Internal Risk Ratings Definitions

|

Rating |

|

Definition |

| 1 |

|

Borrower is operating above

expectations, and the trends and risk factors are generally

favorable. |

| |

|

| 2 |

|

Borrower is operating

generally as expected or at an acceptable level of performance. The

level of risk to our initial cost bases is similar to the risk to

our initial cost basis at the time of origination. This is the

initial risk rating assigned to all new borrowers. |

| |

|

| 3 |

|

Borrower is operating below

expectations and level of risk to our cost basis has increased

since the time oforigination. The borrower may be out of compliance

with debt covenants. Payments are generally current although there

may be higher risk of payment default. |

| |

|

| 4 |

|

Borrower is operating

materially below expectations and the loan’s risk has increased

materially since origination. In addition to the borrower being

generally out of compliance with debt covenants, loan payments may

be past due, but generally not by more than 120 days. It is

anticipated that we may not recoup our initial cost basis and may

realize a loss of our initial cost basis upon exit. |

| |

|

| 5 |

|

Borrower is operating

substantially below expectations and the loan’s risk has increased

substantially since origination. Most or all of the debt covenants

are out of compliance and payments are substantially delinquent. It

is anticipated that we will not recoup our initial cost basis and

may realize a substantial loss of our initial cost basisupon

exit. |

Our Investment Adviser’s risk rating model is based on

evaluating portfolio company performance in comparison to the base

case when considering certain credit metrics including, but not

limited to, adjusted EBITDA and net senior leverage as well as

specific events including, but not limited to, default and

impairment.

Our Investment Adviser monitors and, when appropriate, changes

the investment ratings assigned to each debt investment in our

portfolio. Our Investment Adviser reviews our investment ratings in

connection with our quarterly valuation process. The following

table summarizes the Internal Risk Ratings of our debt portfolio as

of December 31, 2020 and September 30, 2020:

| |

December 31, 2020 |

|

September 30, 2020 |

| |

Fair Value |

|

% of Fair Value |

|

Fair Value |

|

% of Fair Value |

| (dollar amounts in

millions) |

|

|

|

|

|

|

|

|

Internal Risk Rating 1 |

$ |

19.1 |

|

|

1.27 |

% |

|

$ |

38.8 |

|

|

2.27 |

% |

| Internal Risk Rating 2 |

1,047.5 |

|

|

69.44 |

|

|

1,201.4 |

|

|

70.22 |

|

| Internal Risk Rating 3 |

361.1 |

|

|

23.93 |

|

|

380.8 |

|

|

22.26 |

|

| Internal Risk Rating 4 |

48.1 |

|

|

3.19 |

|

|

48.9 |

|

|

2.86 |

|

| Internal Risk Rating 5 |

32.8 |

|

|

2.17 |

|

|

40.9 |

|

|

2.39 |

|

| Total |

$ |

1,508.6 |

|

|

100.00 |

% |

|

$ |

1,710.8 |

|

|

100.00 |

% |

As of December 31, 2020 and September 30, 2020, the

weighted average Internal Risk Rating of our debt investment

portfolio was 2.4 and 2.3, respectively.

Consolidated Results of Operations(dollar

amounts in thousands, except per share data)

Total investment income for the three month periods ended

December 31, 2020 and September 30, 2020 was $43,514 and

$42,784, respectively. This $730 net increase was primarily due to

an increase in income recognized from OID accretion from

prepayments, higher fee income, and an increase in total dividends

from the credit funds. This was partially offset by lower interest

income from a lower weighted average principal, which was primarily

due to the contribution of assets to Credit Fund II.

Total expenses for the three month periods ended

December 31, 2020 and September 30, 2020 were $21,605 and

$21,550, respectively, a net increase of $55.

During the three month period ended December 31, 2020, the

Company recorded a net realized and unrealized depreciation gain of

$16,254. This was primarily driven by continued tightening of

market yields resulting in increases in fair value, as well as the

successful exit of our investment in Hydrofarm at par.

Liquidity and Capital Resources(dollar amounts

in thousands, except per share data)

As of December 31, 2020, the Company had cash and cash

equivalents of $68,419, notes payable and senior unsecured

notes (before debt issuance costs) of $449,200 and $190,000,

respectively, and secured borrowings outstanding of $347,949.

As of December 31, 2020, the Company had $340,051 of

remaining unfunded commitments and $207,365 available for

additional borrowings under its revolving credit facility, subject

to leverage and borrowing base restrictions. During the three

months ended December 31, 2020, the Company repaid all amounts

outstanding under the revolving credit facility of its wholly owned

subsidiary, and the facility was terminated.

Dividend

On February 22, 2021, the Board of Directors declared a regular

quarterly dividend of $0.32 plus a supplemental dividend of $0.05,

which is payable on April 16, 2021 to stockholders of record on

March 31, 2021.

On December 31, 2020, the Company declared and paid a dividend

on the Preferred Stock for the period from October 1, 2020 to

December 31, 2020 in the amount of $0.438 per Preferred Share to

the holder of record on December 31, 2020.

Conference Call

The Company will host a conference call at 11:00 a.m. EST on

Wednesday, February 24, 2021 to discuss these quarterly

financial results. The call and webcast will be available on the

TCG BDC website at tcgbdc.com. The call may be accessed by dialing

+1 (866) 394-4623 (U.S.) or +1 (409) 350-3158 (international) and

referencing “TCG BDC Financial Results Call.” The conference call

will be webcast simultaneously via a link on TCG BDC’s website and

an archived replay of the webcast also will be available on the

website soon after the live call for 21 days.

TCG BDC, INC.CONSOLIDATED STATEMENTS OF

ASSETS AND LIABILITIES(dollar amounts in

thousands, except per share data)

| |

December 31, 2020 |

|

September 30, 2020 |

| |

(unaudited) |

|

(unaudited) |

| ASSETS |

|

|

|

|

Investments, at fair value |

|

|

|

|

Investments—non-controlled/non-affiliated, at fair value (amortized

cost of $1,574,182 and $1,840,796, respectively) |

$ |

1,509,271 |

|

|

$ |

1,737,044 |

|

|

Investments—non-controlled/affiliated, at fair value (amortized

cost of $37,571 and $0, respectively) |

26,180 |

|

|

— |

|

|

Investments—controlled/affiliated, at fair value (amortized cost of

$311,213 and $233,131, respectively) |

290,298 |

|

|

211,129 |

|

|

Total investments, at fair value (amortized cost of $1,922,966 and

$2,073,927, respectively) |

1,825,749 |

|

|

1,948,173 |

|

|

Cash and cash equivalents |

68,419 |

|

|

37,088 |

|

|

Receivable for investment sold |

4,313 |

|

|

74 |

|

|

Deferred financing costs |

3,633 |

|

|

3,651 |

|

|

Interest receivable from non-controlled/non-affiliated

investments |

12,634 |

|

|

12,791 |

|

|

Interest receivable from non-controlled/affiliated investments |

569 |

|

|

— |

|

|

Interest and dividend receivable from controlled/affiliated

investments |

6,480 |

|

|

5,754 |

|

|

Prepaid expenses and other assets |

816 |

|

|

856 |

|

|

Total assets |

$ |

1,922,613 |

|

|

$ |

2,008,387 |

|

| LIABILITIES |

|

|

|

|

Secured borrowings |

$ |

347,949 |

|

|

$ |

513,332 |

|

|

2015-1R Notes, net of unamortized debt issuance costs of $2,664 and

$2,726, respectively |

446,536 |

|

|

446,474 |

|

|

Senior Notes, net of unamortized debt issuance costs of $562 and

$0, respectively |

189,438 |

|

|

115,000 |

|

|

Payable for investments purchased |

809 |

|

|

— |

|

|

Interest and credit facility fees payable |

2,439 |

|

|

3,405 |

|

|

Dividend payable |

19,892 |

|

|

20,830 |

|

|

Base management and incentive fees payable |

11,549 |

|

|

11,473 |

|

|

Administrative service fees payable |

85 |

|

|

85 |

|

|

Other accrued expenses and liabilities |

2,553 |

|

|

2,566 |

|

|

Total liabilities |

1,021,250 |

|

|

1,113,165 |

|

| |

|

|

|

| NET ASSETS |

|

|

|

|

Cumulative convertible preferred stock, $0.01 par value; 2,000,000

and 2,000,000 shares issued and outstanding as of December 31, 2020

and September 30, 2020, respectively |

50,000 |

|

|

50,000 |

|

|

Common stock, $0.01 par value; 198,000,000 shares authorized;

55,320,309 and 56,308,616 shares issued and outstanding at December

31, 2020 and September 30, 2020, respectively |

553 |

|

|

563 |

|

|

Paid-in capital in excess of par value |

1,081,436 |

|

|

1,093,250 |

|

|

Offering costs |

(1,633 |

) |

|

(1,633 |

) |

|

Total distributable earnings (loss) |

(228,993 |

) |

|

(246,958 |

) |

|

Total net assets |

$ |

901,363 |

|

|

$ |

895,222 |

|

| NET ASSETS PER COMMON

SHARE |

$ |

15.39 |

|

|

$ |

15.01 |

|

TCG BDC, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(dollar amounts in thousands, except per

share data)(unaudited)

| |

|

For the three months ended |

| |

|

December 31, 2020 |

|

September 30, 2020 |

| Investment

income: |

|

|

|

|

| From

non-controlled/non-affiliated investments: |

|

|

|

|

|

Interest income |

|

$ |

34,001 |

|

|

$ |

34,789 |

|

|

Other income |

|

2,973 |

|

|

2,110 |

|

|

Total investment income from non-controlled/non-affiliated

investments |

|

36,974 |

|

|

36,899 |

|

| From non-controlled/affiliated

investments: |

|

|

|

|

|

Interest income |

|

14 |

|

|

— |

|

|

Total investment income from non-controlled/affiliated

investments |

|

14 |

|

|

— |

|

| From controlled/affiliated

investments: |

|

|

|

|

|

Interest income |

|

48 |

|

|

135 |

|

|

Dividend income |

|

6,478 |

|

|

5,750 |

|

|

Total investment income from controlled/affiliated investments |

|

6,526 |

|

|

5,885 |

|

| Total investment

income |

|

43,514 |

|

|

42,784 |

|

| Expenses: |

|

|

|

|

|

Base management fees |

|

7,063 |

|

|

7,134 |

|

|

Incentive fees |

|

4,480 |

|

|

4,322 |

|

|

Professional fees |

|

800 |

|

|

937 |

|

|

Administrative service fees |

|

140 |

|

|

167 |

|

|

Interest expense |

|

6,907 |

|

|

7,291 |

|

|

Credit facility fees |

|

1,655 |

|

|

728 |

|

|

Directors’ fees and expenses |

|

95 |

|

|

86 |

|

|

Other general and administrative |

|

431 |

|

|

498 |

|

| Total

expenses |

|

21,571 |

|

|

21,163 |

|

| Net investment income

(loss) before taxes |

|

21,943 |

|

|

21,621 |

|

|

Excise tax expense |

|

34 |

|

|

387 |

|

|

Net investment income (loss) |

|

21,909 |

|

|

21,234 |

|

| Net realized gain (loss)

and net change in unrealized appreciation (depreciation) on

investments and non-investment assets and

liabilities: |

|

|

|

|

| Net realized gain (loss)

from: |

|

|

|

|

|

Non-controlled/non-affiliated investments |

|

(8,783 |

) |

|

(209 |

) |

|

Currency gains (losses) on non-investment assets and

liabilities |

|

23 |

|

|

(11 |

) |

| Net change in unrealized

appreciation (depreciation) on investments: |

|

|

|

|

|

Non-controlled/non-affiliated |

|

28,425 |

|

|

12,906 |

|

|

Non-controlled/affiliated |

|

(900 |

) |

|

— |

|

|

Controlled/affiliated |

|

1,086 |

|

|

2,134 |

|

| Net change in unrealized currency

gains (losses) on non-investment assets and liabilities |

|

(3,597 |

) |

|

(2,446 |

) |

|

Net realized and unrealized gain (loss) on investments and

non-investment assets and liabilities |

|

16,254 |

|

|

12,374 |

|

| Net increase (decrease)

in net assets resulting from operations |

|

38,163 |

|

|

33,608 |

|

| Preferred stock dividend |

|

865 |

|

|

856 |

|

| Net increase (decrease) in net

assets resulting from operations attributable to Common

Stockholders |

|

$ |

37,298 |

|

|

$ |

32,752 |

|

| Basic and diluted earnings per

common share: |

|

|

|

|

|

Basic |

|

$ |

0.66 |

|

|

$ |

0.58 |

|

|

Diluted |

|

$ |

0.62 |

|

|

$ |

0.55 |

|

| Weighted-average shares of common

stock outstanding: |

|

|

|

|

|

Basic |

|

55,961,413 |

|

|

56,308,616 |

|

|

Diluted |

|

61,224,570 |

|

|

61,571,773 |

|

About TCG BDC, Inc. TCG BDC is an externally

managed specialty finance company focused on lending to

middle-market companies. TCG BDC is managed by Carlyle Global

Credit Investment Management L.L.C., an SEC-registered investment

adviser and a wholly owned subsidiary of The Carlyle Group Inc.

Since it commenced investment operations in May 2013 through

December 31, 2020, TCG BDC has invested approximately $6.3

billion in aggregate principal amount of debt and equity

investments prior to any subsequent exits or repayments. TCG BDC’s

investment objective is to generate current income and capital

appreciation primarily through debt investments in U.S. middle

market companies. TCG BDC has elected to be regulated as a business

development company under the Investment Company Act of 1940, as

amended.

Web: tcgbdc.com CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS This press release may contain

forward-looking statements that involve substantial risks and

uncertainties, including the impact of COVID-19 on the

business. You can identify these statements by the use of

forward-looking terminology such as “anticipates,” “believes,”

“expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,”

“believes,” “seeks,” “estimates,”“would,” “could,” “targets,”

“projects,” “outlook,” “potential,” “predicts” and variations of

these words and similar expressions to identify

forward-looking statements, although not all forward-looking

statements include these words. You should read statements

that contain these words carefully because they discuss our plans,

strategies, prospects and expectations concerning our business,

operating results, financial condition and other similar matters.

We believe that it is important to communicate our future

expectations to our investors. There may be events in the future,

however, that we are not able to predict accurately

or control. You should not place undue reliance on these

forward-looking statements, which speak only as of the date on

which we make it. Factors or events that could cause our

actual results to differ, possibly materially from our

expectations, include, but are not limited to, the risks,

uncertainties and other factors we identify in the sections

entitled “Risk Factors” and “Cautionary Statement Regarding

Forward-Looking Statements” in filings we make with the Securities

and Exchange Commission, and it is not possible for us to

predict or identify all of them. We undertake no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law.

Contacts:

|

Investors: |

Media: |

| L. Allison Rudary |

Brittany Berliner |

|

+1-212-813-4756allison.rudary@carlyle.com |

+1-212-813-4839Brittany.berliner@carlyle.com |

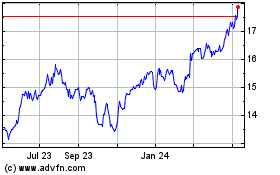

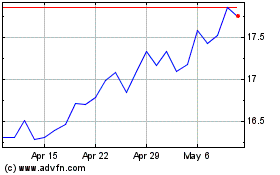

Carlyle Secured Lending (NASDAQ:CGBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carlyle Secured Lending (NASDAQ:CGBD)

Historical Stock Chart

From Apr 2023 to Apr 2024