Statement of Changes in Beneficial Ownership (4)

May 20 2021 - 4:45PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Robertson Stephen |

2. Issuer Name and Ticker or Trading Symbol

Target Hospitality Corp.

[

TH

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

2170 BUCKTHORNE PLACE, SUITE 440 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/18/2021 |

|

(Street)

THE WOODLANDS, TX 77380

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, par value $0.0001 per share | 5/18/2021 | | M | | 196629 | A | (1) | 65159849 (2) | I | See footnote (6)(7)(8)(9)(10) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | (1) | 5/18/2021 | | A | | 96154 | | (3) | (3) | Common Stock | 96154 | $0.00 | 96154 | D | |

| Restricted Stock Units | (1) | 5/18/2021 | | J (4) | | | 96154 | (3) | (3) | Common Stock | 96154 | $0.00 | 331245 (5) | I (6)(7)(8)(9)(10) | by Arrow Holdings S.A.R.L. |

| Restricted Stock Units | (1) | 5/18/2021 | | M | | | 196629 | (3) | (3) | Common Stock | 196629 | $0.00 | 134616 (5) | I (6)(7)(8)(9)(10) | by Arrow Holdings S.A.R.L. |

| Explanation of Responses: |

| (1) | Each restricted stock unit represents a contingent right to receive upon vesting one share of common stock of the Issuer, par value $0.0001 per share ("Common Stock"), or its cash equivalent. |

| (2) | Includes 175,000 shares of Common Stock owned directly by the Reporting Person following the Reported Transaction. The remaining shares of Common Stock beneficially owned following the Reported Transaction are held by Algeco Investments B.V. ("Algeco") and Arrow Holding S.a r.l ("Arrow"). |

| (3) | On May 20, 2020, the Reporting Person was granted 140,449 restricted stock units ("RSUs") which vest in full on the first anniversary of the grant date or, if earlier, the date of the first annual meeting of the stockholders of the Issuer following the grant date, subject to the terms and conditions of the previously disclosed Target Hospitality Corp. 2019 Incentive Award Plan (the "Plan") and the award agreement. Subject to certain exceptions, vested shares will be delivered upon separation of service from the Board of Directors of the Issuer ("BOD"). On May 18, 2021, the Reporting Person was granted 96,154 RSUs which vest in full on the first anniversary of the grant date or, if earlier, the date of the first annual meeting of the stockholders of the Issuer following the grant date, subject to the Plan and award agreement. Subject to certain exceptions, vested shares will be delivered upon separation of service from the BOD. |

| (4) | Immediately following the grant of the restricted stock units, each of Mr. Robertson and Gary Lindsay transferred the restricted stock units to Arrow Holding S.a r.l ("Arrow") which holds certain securities of Target Hospitality Corp. on behalf of TDR Capital II Holdings LP, the investment fund managed by TDR Capital LLP. Upon transfer to Arrow, the restricted stock units will vest in accordance with the same terms and conditions of the initial grant. Mr. Lindsay's grant of 38,462 restricted stock units and subsequent transfer of such units to Arrow are reported on a separate Form 4 filed by Mr. Lindsay on the date hereof. |

| (5) | Total also reflects 140,449 RSUs granted to Mr. Robertson and 56,180 RSUs granted to Mr. Lindsay on May 20, 2020 that vest in full on the first anniversary of the grant date or, if earlier, the date of the first annual meeting of the stockholders of the Issuer following the grant date, subject to the terms and conditions of the Plan and the award agreements entered into between the Issuer and Mr. Robertson and Mr. Lindsay, respectively. |

| (6) | As the controlling shareholder of Arrow, TDR Capital II Investments LP, may be deemed the beneficial owner of the securities of the Issuer held by Arrow. |

| (7) | Algeco Holdings is the controlling shareholder of Algeco Limited Partnership SLP ("Algeco SLP"), which is the controlling shareholder of Algeco Global S.a r.l. ("Algeco Global") which is the controlling shareholder of Algeco Investments 1 S.a r.l. (Lux) ("Algeco Investments 1"), which is the sole shareholder of Algeco Investments 2 S.a r.l. (Lux) ("Algeco Investments 2"), which is the sole shareholder of Algeco Investments 3 S.a r.l. (Lux) ("Algeco Investments 3" and together with Algeco Holdings, Algeco Global, Algeco SLP, Algeco Investments 1 and Algeco Investments 2, the "Algeco Entities"). |

| (8) | Algeco Investments 3 holds 40% of the share capital of Algeco Investments B.V. ("Algeco"), and Algeco Investments 2 holds the remaining 60%. |

| (9) | TDR Capital II Investments LP, as the controlling shareholder of Algeco Holdings may be deemed the beneficial owner of the securities of the Issuer held by Algeco. As manager of TDR Capital II Investments LP, TDR Capital LLP may be deemed the beneficial owner of such securities of the Issuer held by Arrow and Algeco. As founding partners of TDR Capital LLP, Stephen Robertson and Manjit Dale may be deemed the beneficial owners of such securities of the Issuer held by Arrow and Algeco. |

| (10) | Each of TDR Capital II Investments LP, TDR Capital LLP, Stephen Robertson and Manjit Dale (the "TDR Persons") may be deemed to be the beneficial owner of all or a portion of the securities reported herein. Each of the TDR Persons disclaims beneficial ownership of the securities of the Issuer, except to the extent of its or his pecuniary interest therein. The filing of this report shall not be deemed an admission that, for purposes of Section 16 of the Securities Exchange Act of 1934, as amended or otherwise, the TDR Persons are the beneficial owners of any of the securities reported herein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Robertson Stephen

2170 BUCKTHORNE PLACE

SUITE 440

THE WOODLANDS, TX 77380 | X | X |

|

|

Signatures

|

| /s/ Heidi D. Lewis, as Attorney-in-Fact on behalf of Stephen Robertson | | 5/20/2021 |

| **Signature of Reporting Person | Date |

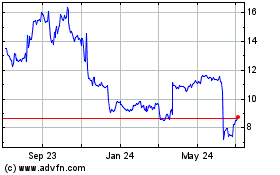

Target Hospitality (NASDAQ:TH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Target Hospitality (NASDAQ:TH)

Historical Stock Chart

From Apr 2023 to Apr 2024