Amended Statement of Beneficial Ownership (sc 13d/a)

November 18 2021 - 8:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Tarena

International, Inc.

(Name of Issuer)

Class A Ordinary Shares, par value $0.001 per share

(Title of Class of Securities)

G8675B 105

(CUSIP

Number)

New Oriental Education & Technology Group Inc.

No. 6 Hai Dian Zhong Street

Haidian District, Beijing 100080

People’s Republic of China

+(86 10) 6090-8000

With a copy to:

Stephen Besen, Esq.

Allen & Overy LLP

1221 Avenue of the Americas

New York, NY 10020

(212)

610-6300

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications)

November 15, 2021

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule

13d-1(f) or Rule 13d-1(g), check the following box. ☐

|

*

|

This statement on Schedule 13D (the “Schedule 13D”) constitutes Amendment No. 1 to the initial

Schedule 13D (the “Original Schedule 13D”) filed on May 10,2021 on behalf of New Oriental Education and Technology Group Inc. with respect to the Class A ordinary shares, par value $0.001 per share (“Class A Ordinary

Shares”) of Tarena International, Inc., a Cayman Islands company (the “Company”). Except as amended hereby, the Original Schedule 13D remains in full force and effect. Capitalized terms used but not defined in this Amendment

No. 1 to the Schedule 13D have the meanings ascribed to them in the Original Schedule 13D.

|

The information required on the

remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

CUSIP No. G8675B 105

|

|

SCHEDULE 13D/A

|

|

Page 2 of 5 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

New Oriental Education & Technology Group Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

OO (See Item 3)

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Cayman

Islands

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

1,000,000 Class A Ordinary Shares

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

1,000,000 Class A Ordinary

Shares

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,000,000 Class A Ordinary Shares

|

|

12

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11)

2.1%1

|

|

14

|

|

TYPE OF REPORTING

PERSON

CO

|

|

1

|

Percentage calculated based on 48,439,184 Class A Ordinary Shares outstanding as of February 28,

2021, as reported in the Issuer’s Annual Report on Form 20-F, filed with the SEC on April 13, 2021 (the “Form 20-F”). If the percentage

ownership of the Reporting Person was to be calculated in relation to the Issuer’s outstanding Class A Ordinary Shares and Class B Ordinary Shares, such percentage would be 1.8%, based on 55,645,243 Ordinary Shares outstanding as of

February 28, 2021, as reported in the Form 20-F. The voting power of the Issuer’s outstanding Ordinary Shares beneficially owned by the Reporting Person represents 0.8% of the voting power of all

Class A Ordinary Shares and Class B Ordinary Shares, based on 48,439,184 Class A Ordinary Shares and 7,206,059 Class B Ordinary Shares outstanding as of February 28, 2021, as reported in the Form 20-F.

|

|

|

|

|

|

|

|

CUSIP No. G8675B 105

|

|

SCHEDULE 13D/A

|

|

Page 3 of 5 Pages

|

|

Item 4.

|

Purpose of Transaction

|

On November 15, 2021, the Issuer, Parent, Merger Sub and certain other parties (together with Parent and Merger Sub, the “Buyer

Group Parties”) entered into the termination and settlement agreement (the “Merger Termination Agreement”). Pursuant to the Merger Termination Agreement, the Buyer Group Parties will pay a settlement payment of US$3.53 million to

the Company by November 26, 2021. Upon receipt by the Company of the full amount of the settlement payment within the aforementioned time period, the agreement and plan of merger, dated April 30, 2021, among the Company, Parent and Merger

Sub (the “Merger Agreement”), pursuant to which the Company was to be merged with and into Merger Sub on the terms and subject to the conditions set forth in the Merger Agreement (the “Merger”), will be terminated.

Concurrently with the termination of the Merger Agreement, the Rollover and Support Agreement between the Reporting Person and Parent will be

automatically terminated and the Reporting Person will no longer have any obligations thereunder and, as a result, will no longer be deemed to be part of a “group” for purposes of Section 13(d) of the Act with Parent or the Other

Rollover Shareholders.

Other than as described in Item 4 above, neither the Reporting Person nor, to the best knowledge of the Reporting

Person, any of the persons named in Item 2, has any plans or proposals which relate to or would result in any of the actions specified in clauses (a) through (j) of Item 4 of Schedule 13D. The Reporting Person may, at any time and from time to

time, formulate other purposes, plans or proposals regarding the Issuer, or any other actions that could involve one or more of the types of transactions or have one or more of the results described in clauses (a) through (j) of Item 4 of

Schedule 13D.

|

Item 5.

|

Interest in Securities of the Issuer

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of

Class A Ordinary Shares and percentages of Class A Ordinary Shares beneficially owned by the Reporting Person.

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule D for the number of Class A

Ordinary Shares as to which the Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

|

|

(c)

|

Except as set forth herein, the Reporting Person has not engaged in any transactions in the

Issuer’s securities during the past 60 days prior to the obligation to file this Amendmtnet No. 1 to the Schedule 13D. To the knowledge of the Reporting Person, none of any director or executive officer of the Reporting Person listed on

Schedule A hereto has effected any transactions in the Issuer’s securities during the past 60 days prior to the obligation to file this Schedule 13D.

|

|

(d)

|

To the best knowledge of the Reporting Person, no person other than the Reporting Person has the right

to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the Class A Ordinary Shares reported herein.

|

|

|

|

|

|

|

|

CUSIP No. G8675B 105

|

|

SCHEDULE 13D/A

|

|

Page 4 of 5 Pages

|

|

(e)

|

Upon termination of the Merger Agreement, the Rollover and Support Agreement will automatically

terminate and the Reporting Person will no longer deemed to be part of a “group” with Parent and the Other Rollover Shareholders for purposes of Section 13(d) under the Act and as a result the Reporting Person will cease to be deemed

to be the beneficial owner of more than five percent of the Class A Ordinary Shares of the Issuer and will cease to have any reporting obligations under Schedule 13D.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this Schedule

13D is true, complete and correct.

Date: November 18, 2021

|

|

|

New Oriental Education & Technology Group Inc.

|

|

|

|

/s/ Yang Zhihui

|

|

Name: Yang Zhihui

|

|

Title: Executive President & Chief Financial Officer

|

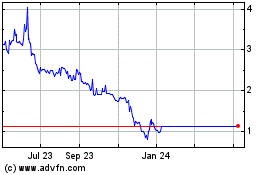

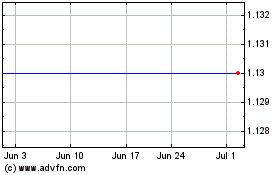

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Apr 2023 to Apr 2024