UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Amendment No. 3)

RULE 13e-3 TRANSACTION STATEMENT

(Pursuant to Section 13(e) of the

Securities Exchange Act of 1934)

Tarena International, Inc.

(Name of the Issuer)

Tarena International, Inc.

Mr. Shaoyun Han

Kidedu Holdings Limited

Kidarena Merger Sub

Kidtech Limited

Ascendent Capital Partners III, L.P.

Connion Capital Limited

Learningon Limited

Moocon Education Limited

Techedu Limited

Titanium Education (Cayman) Limited

(Names of Persons Filing Statement)

Class A Ordinary Shares, par value $0.001

per share

American Depositary Shares, each representing

one Class A Ordinary Share

(Title of Class of Securities)

G8675B 105*

876108101**

(CUSIP Number)

Tarena International, Inc.

6/F, No. 1 Andingmenwai Street, Litchi Tower,

Chaoyang District, Beijing 100011,

People’s Republic of China

Telephone: +86 10 6213 5687

|

Mr. Shaoyun Han

Kidedu Holdings Limited

Kidarena Merger Sub

Kidtech Limited

Connion Capital Limited

Learningon Limited

Moocon Education Limited

Techedu Limited

6/F, No. 1 Andingmenwai Street,

Litchi Tower,

Chaoyang District, Beijing 100011,

People’s Republic of China

Telephone: +86 10 6213 5687

|

Ascendent Capital Partners III, L.P.

Titanium Education (Cayman) Limited

Suite 3501,

35/F Jardine House, 1

Connaught Place, Central, Hong Kong

Telephone: +852 2165 9000

|

|

|

|

|

|

With

copies to:

|

|

|

Fang Xue, Esq.

Gibson, Dunn & Crutcher LLP

Unit 1301, Tower 1, China Central Place

No. 81 Jianguo Road

Chaoyang District

Beijing 100025

People’s Republic of China

+86 10 6502 8500

|

Z. Julie

Gao, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 42/F, Edinburgh Tower

The Landmark

15 Queen’s

Road Central

Hong Kong

+852 3740 4700

|

Peter X.

Huang, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

30/F, China World Office 2

No. 1, Jianguomenwai

Avenue

Chaoyang District

Beijing 100004

People’s Republic of China

+86 10 6535 5500

|

This statement is filed in

connection with (check the appropriate box):

|

a

|

¨ The

filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14-C or Rule 13e-3(c) under

the Securities Exchange Act of 1934.

|

|

b

|

¨ The

filing of a registration statement under the Securities Act of 1933.

|

Check

the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies:

¨

Check the following box if

the filing is a final amendment reporting the results of the transaction: x

Calculation of Filing Fee

|

Transaction

Valuation***

|

Amount

of Filing Fee****

|

|

US$128,877,533.90

|

US$14,060.54

|

|

*

|

This CUSIP applies to class

A ordinary shares.

|

|

|

|

|

**

|

This CUSIP applies to American

depositary shares, each representing one class A ordinary share.

|

|

|

|

|

***

|

Calculated solely for the

purpose of determining the filing fee in accordance with Rule 0-11(b)(1) under the Securities Exchange Act of 1934, as

amended. The filing fee is calculated based on the sum of (a) the aggregate cash payment for the proposed per share cash payment

of US$4.00 for 30,977,536 issued and outstanding ordinary shares of the issuer (including shares represented by American depositary

shares) subject to the transaction, plus (b) the product of 242,539 restricted share units of the issuer subject to the transaction

multiplied by US$4.00 per unit, plus (c) the product of 1,480,457 shares issuable under all outstanding and unexercised options

with per share exercise price lower than US$4.00 multiplied by US$2.70 per share (which is the difference between the US$4.00 per

share merger consideration and the weighted average exercise price of US$1.30 per share of such options) ((a), (b), and (c) together,

the “Transaction Valuation”).

|

|

****

|

The amount of the filing

fee, calculated in accordance with Exchange Act Rule 0-11(b)(1) and the Securities and Exchange Commission Fee Rate Advisory

#1 for Fiscal Year 2021, was calculated by multiplying the Transaction Valuation by 0.0001091.

|

|

¨

|

Check box if any part of

the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting of the fee was previously

paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously

Paid:

|

$14,060.54

|

Filing Party:

|

|

|

Form or Registration

No.:

|

|

Date Filed:

|

|

INTRODUCTION

This

Amendment No. 3 (this “Amendment”) to the Rule 13e-3 transaction statement on Schedule 13E-3, together with the

exhibits hereto (this “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”)

pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), jointly

by the following persons (each, a “Filing Person,” and collectively, the “Filing Persons”): (a) Tarena International,

Inc., an exempted company with limited liability incorporated under the laws of the Cayman Islands (the “Company”), the issuer

of the ordinary shares, par value US$0.001 per share (each, a “Share,” and collectively, the “Shares”), including

Shares represented by American depositary shares, each representing one Class A ordinary share that is subject to the transaction pursuant

to Rule 13e-3 under the Exchange Act; (b) Mr. Shaoyun Han, the chairman of the board of directors of the Company (the “Chairman”);

(c) Kidedu Holdings Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands (“Parent”);

(d) Kidarena Merger Sub, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly owned

subsidiary of Parent (“Merger Sub”); (e) Kidtech Limited, an exempted company with limited liability incorporated under the

laws of the Cayman Islands controlled by the Chairman; (f) Ascendent Capital Partners III, L.P., an exempted limited partnership formed

under the laws of the Cayman Islands (the “Sponsor,” collectively with the Chairman, Parent, Merger Sub, and Kidtech Limited,

the “Buyer Group Parties”); (g) Connion Capital Limited, a company organized and existing under the laws of the British Virgin

Islands; (h) Learningon Limited, a company organized and existing under the laws of the British Virgin Islands; (i) Moocon Education

Limited, a company organized and existing under the laws of the British Virgin Islands; (j) Techedu Limited, a company organized and

existing under the laws of the British Virgin Islands; and (k) Titanium Education (Cayman) Limited, an exempted company with limited

liability incorporated under the laws of the Cayman Islands and a wholly owned subsidiary of the Sponsor (the “Investor”).

This Amendment amends and

restates in its entirety information set forth in the Rule 13e-3 transaction statement on Schedule 13E-3, together with the exhibits

thereto including the preliminary proxy statement, filed with the SEC on July 6, 2021, and information set forth in the Amendment No.

2 to the Rule 13e-3 transaction statement on Schedule 13E-3, together with the exhibits thereto. Capitalized terms used but not defined

in this Amendment shall have the meanings given to them in the Transaction Statement.

The information contained

in (i) the Press Release issued by the Company, dated November 15, 2021, (ii) the Termination and Settlement Agreement among the Buyer

Group Parties and the Company dated November 15, 2021 (the “Termination Agreement”), and (iii) the Termination Agreement

among the Chairman, Parent, Kidtech Limited, the Sponsor and the Investor dated November 15, 2021 (the “Buyer Group Termination

Agreement”), each attached hereto, is incorporated herein by reference.

By filing this Transaction

Statement, the Filing Persons hereby withdraw the Schedule 13E-3 filed with the SEC on May 25, 2021, Amendment No. 1 to Schedule 13E-3

filed with the SEC on July 6, 2021, and Amendment No. 2 to Schedule 13E-3 filed with the SEC on October 4, 2021.

|

|

Item 15

|

Additional Information

|

Item 15 is hereby amended and restated in its

entirety as follows:

(c) Other Material Information.

On November 15, 2021, the

Buyer Group Parties and the Company entered into the Termination Agreement. Pursuant to the Termination Agreement, the Buyer Group Parties

will pay a settlement payment of US$3.53 million to the Company by November 26, 2021. The previously announced Agreement and Plan of

Merger, dated April 30, 2021, among the Company, Parent and Merger Sub, will be terminated upon receipt by the Company of the full amount

of the settlement payment within the aforementioned time period. The Termination Agreement also includes customary mutual releases and

non-disparagement provisions.

Concurrently

with the execution of the Termination Agreement, the Chairman, Parent, Kidtech Limited, the Sponsor and the Investor entered into the

Buyer Group Termination Agreement, pursuant to which the consortium agreement, dated January 21, 2021 between the Chairman and the Investor,

the interim investor agreement, dated April 30, 2021 among the Chairman, Kidtech Limited, Parent and the Investor, the personal guarantee,

dated April 30, 2021, executed and delivered by the Chairman to the Sponsor and the Investor, including all schedules and exhibits thereto,

and all ancillary agreements contemplated thereby or entered pursuant thereto, were terminated with immediate effect in their entirety.

(a)(9) Press Release issued by the Company, dated November 15, 2021, incorporated herein by reference to Exhibit 99.1 to the Report on Form 6-K furnished by the Company to the SEC on November 15, 2021.

(d)(13) Termination and Settlement Agreement among the Chairman, Parent, Merger Sub, the Sponsor, Kidtech Limited, and the Company, dated November 15, 2021, incorporated herein by reference to Exhibit 99.2 to the Report on Form 6-K furnished by the Company to the SEC on November 15, 2021.

(d)(14) Termination Agreement among the Chairman, Parent, Kidtech Limited, the Sponsor and the Investor, dated November 15, 2021.

SIGNATURES

After due inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Date: November 15, 2021

|

|

|

|

|

|

TARENA INTERNATIONAL, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Wing Kee Lau

|

|

|

|

Name:

|

Wing Kee Lau

|

|

|

|

Title:

|

Chief Financial Officer

|

[Signature Page to Schedule

13E-3 Transaction Statement]

|

|

SHAOYUN HAN

|

|

|

|

|

|

|

|

|

/s/ Shaoyun Han

|

|

|

|

|

|

KIDEDU HOLDINGS LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

KIDARENA MERGER SUB

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

KIDTECH LIMITED

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

CONNION CAPITAL LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

LEARNINGON LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

|

|

|

|

MOOCON EDUCATION LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

[Signature Page to Schedule

13E-3 Transaction Statement]

|

|

TECHEDU LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaoyun Han

|

|

|

|

Name:

|

Shaoyun Han

|

|

|

|

Title:

|

Director

|

[Signature Page to Schedule

13E-3 Transaction Statement]

|

|

ASCENDENT CAPITAL PARTNERS III, L.P.

|

|

|

By:

|

Ascendent Capital Partners III GP, L.P., its general partner

|

|

|

By:

|

Ascendent Capital Partners III GP Limited, its general partner

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Meng Liang

|

|

|

|

Name:

|

Meng Liang

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

TITANIUM EDUCATION (CAYMAN) LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Meng Liang

|

|

|

|

Name:

|

Meng Liang

|

|

|

|

Title:

|

Authorized Signatory

|

[Signature Page to Schedule

13E-3 Transaction Statement]

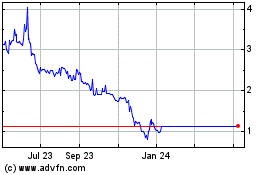

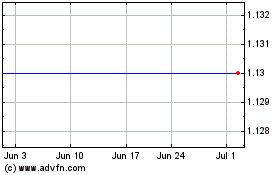

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Apr 2023 to Apr 2024