Former Indiana Congressman Charged With Insider Trading

July 25 2022 - 11:43AM

Dow Jones News

By Connor Hart

The Securities and Exchange Commission on Monday filed insider

trading charges against Stephen Buyer, a former U.S. Representative

for Indiana's 4th congressional district.

After leaving Congress in 2011, Mr. Buyer formed a consulting

group which provided services to T-Mobile, among other clients. Mr.

Buyer learned of T-Mobile's then-non-public plan to acquire Sprint

while attending a golf outing with a T-Mobile executive and began

accruing Sprint securities the next day, according to the SEC's

complaint.

The SEC said that ahead of the merger's announcement, Mr. Buyer

had acquired $568,000 of Sprint common stock between his own

personal accounts, a joint account with his cousin and an

acquaintance's account. After news of the merger leaked, Mr. Buyer

saw an immediate profit of more than $107,000, according to the

complaint.

In 2019, Mr. Buyer profited more than $227,000 after he sold

nearly all his shares of Navigant Consulting Inc., following the

announcement of the company's acquisition by Guidehouse LLP,

another of Mr. Buyer's consulting clients, according to the SEC's

complaint. Mr. Buyer had spread the purchases across multiple

accounts, including family members and acquaintances, according to

the complaint.

"When insiders like Buyer--an attorney, a former prosecutor, and

a retired Congressman--monetize their access to material, nonpublic

information, as alleged in this case, they not only violate the

federal securities laws, but also undermine public trust and

confidence in the fairness of our markets," said Gurbir Grewal,

director of the SEC's enforcement division.

Write to Connor Hart at connor.hart@wsj.com

(END) Dow Jones Newswires

July 25, 2022 11:28 ET (15:28 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

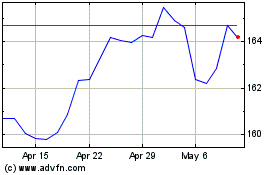

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

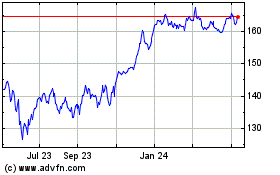

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024