New Contracts and Market Strength Fuel 2021

Outlook

Sypris Solutions, Inc. (Nasdaq/GM: SYPR) today reported

financial results for its fourth quarter and full-year ended

December 31, 2020. Having completed a series of strategic

initiatives over the past several years, Sypris Solutions is now

well positioned to achieve long-term growth and increasing margins.

These initiatives have included reducing and realigning the

Company’s cost structure while diversifying its book of business in

terms of both customers and markets.

The Company’s results for 2020 fundamentally reflected these

expectations, highlighted by the improved performance of Sypris

Electronics. The essential nature of the defense and communication

programs served by Sypris Electronics continued to enable this

segment to sustain operations at planned levels throughout the

year. The commercial vehicle and automotive markets served by

Sypris Technologies recovered during the second half of 2020 from

the sharp reduction in demand during the second quarter, as the

global economic impact of the COVID-19 pandemic continued to

lessen. Favorable market conditions for both segments are

forecasted in 2021, positioning the Company for top line growth and

expanding margins.

HIGHLIGHTS

─────────────────────

- Consolidated

gross margin for the full year 2020 increased 280 basis points from

2019 to 14.0% despite a 6.3% decrease in revenue primarily

attributable to the impact of COVID-19 in the second

quarter.

- Consolidated

gross profit for the full year 2020 improved 17.0% from 2019 and,

when combined with lower spending for selling, general and

administrative expenses, contributed to a 102.1% increase in

operating income compared to 2019.

- Earnings per

diluted share for the full year 2020 increased to $0.08 compared to

a loss of $0.19 per share for the prior year, reflecting the

improvement in operating income and the release of a valuation

allowance on certain foreign deferred tax assets.

- Full year

2020 revenue for Sypris Electronics increased 41.3% from the prior

year, reflecting its strong backlog and improved electronic

component availability. Gross margin improved 1,420 basis points

from the prior year to 14.6% in 2020.

- Subsequent

to quarter-end, Sypris Electronics announced a contract award to

manufacture and test a variety of electronic power supply modules

for a mission-critical, long-range, precision-guided anti-ship

missile system, with production to begin during 2021.

- Subsequent

to quarter-end, Sypris Technologies announced a long-term contract

extension with a leading commercial vehicle manufacturer. The new

contract continues the existing product lines and includes the

award of two additional axle shaft model lines to begin production

in 2021 and the adoption of certain Sypris Ultra® series

lightweight axle shaft design features.

- Subsequent

to quarter-end, Sypris Technologies also announced awards from two

high-pressure energy projects. The contracts, which provide for the

use of closures in the Anchor Field development project in the Gulf

of Mexico and the planned upgrade of a natural gas pipeline system

in North America, call for shipments to begin prior to year-end

2021.

- The impact

of these recent contract wins, when combined with current positive

market conditions, is forecast to fuel an increase of 20% in

revenue, a 200 to 300 basis point expansion of margins and strong

double-digit percentage growth in cash flow from operations for the

year.

────────────────────

“While the economic headwinds and disruptions in 2020 had an

impact on our results, we are pleased with our performance during

the year. Our operations performed extremely well during 2020 and

returned to profitability, despite the adverse conditions incurred

during the second quarter, which continued during the course of the

year,” commented Jeffrey T. Gill, President and Chief Executive

Officer. “Last year presented historic challenges brought on by the

pandemic, yet our businesses pulled together to protect our

employees, while balancing the needs of our customers, communities

and business partners during these difficult times. The effort and

execution by our people resulted in a strong performance for the

year.

“Full year revenue for Sypris Electronics increased 41.3% from

the prior year, reflecting its strong backlog and improved

electronic component availability. Gross margin improved 1,420

basis points from the prior year to 14.6% in 2020, and recent

contact wins are expected to provide important support for the

growth of the business during the coming year. We have been

designated as an essential supplier to our customers serving the

defense and communications industries and as such, our team has

done an excellent job making sure that we were able to provide for

their increasing needs during 2020.

“Demand from customers serving the automotive, commercial

vehicle, sport utility, and off-highway markets recovered in the

second half of 2020, with Class 8 North American production up

almost 32% over the first half. The recent announcement of the

long-term contract extension with one of our key customers combined

with the improved outlook for these markets, gives us a clear path

to support our growth objectives in the coming year.

“The energy markets faced unprecedented pressures in 2020, with

the COVID-19 outbreak driving depressed demand, uncertainty and

spending reductions for the entire oil and gas industry. We have

remained vigilant in our pursuit of new opportunities in these

markets, which has resulted in recent contract awards. While we

expect activity levels in this market to remain challenging during

the first half of 2021, steadily improving commodity prices,

gradually reopening economies and increasing pipeline activity is

anticipated to lead to year-over-year growth.

“Gross profit for 2020 was $11.6 million, or 14.0% of revenue,

as compared to gross margin of 11.2% for 2019. Given 2020 margin

performance includes the burden of the pandemic’s impact on the

second quarter, we are pleased to be maintaining this trend line.

Our margins have improved steadily since 2016, and we expect

further improvement in 2021.”

Concluding, Mr. Gill said, “Our customer base and the markets we

serve are considerably more diversified than at any point in our

recent history. As an essential business, we have a responsibility

to ensure that our defense, communications, energy, and

transportation sectors remain vibrant. We will continue to monitor

developments, act promptly to mitigate risks and take the necessary

steps required to ensure deliveries continue to be made to our

customers in a timely manner.”

Fourth Quarter and Full-Year Results

The Company reported revenue of $20.6 million for the fourth

quarter ended December 31, 2020, compared to $21.6 million for the

prior-year period. Additionally, the Company reported a net loss of

$1.2 million for the fourth quarter of 2020, or $0.06 per share,

compared to a net loss of $0.9 million, or $0.04 per share, for the

prior-year period. Results for the quarter ended December 31, 2020,

include a loss of $0.6 million on the disposal of assets. Results

for the quarter ended December 31, 2019, include a $0.2 million

gain on the sale of assets.

For the full-year 2020, the Company reported revenue of $82.3

million compared with $87.9 million for the prior year. The Company

reported net income of $1.7 million, or $0.08 per diluted share,

for 2020 compared with a net loss of $3.9 million, or $0.19 per

share, for the prior-year. Results for 2020 include an income tax

benefit of $3.0 million, primarily from the release of a valuation

allowance on certain foreign deferred tax assets and net gains of

$0.2 million from the sale or disposal of idle assets. Results for

2019 include a gain of $1.5 million in connection with a contract

settlement with a customer and net gains of $0.7 million from the

sale of idle assets, partially offset by costs of $0.5 million

related to preparing the Broadway facility for sale.

Sypris Technologies

Revenue for Sypris Technologies was $12.1 million in the fourth

quarter of 2020 compared to $13.0 million for the prior-year

period, primarily reflecting reduced demand in the oil and gas

market partially offset by a rebound in the commercial vehicle

market. Gross profit for the fourth quarter of 2020 was $1.5

million, or 12.7% of revenue, compared to $2.0 million, or 15.4% of

revenue, for the same period in 2019.

Sypris Electronics

Revenue for Sypris Electronics was $8.5 million in the fourth

quarter of 2020 compared to $8.6 million for the prior-year period.

Shipments during the fourth quarter of 2020 were impacted by delays

on certain programs due to customer design modifications. However,

management was able to largely offset these delays by increasing

production on other programs, reflecting the impact of a growing

backlog. Additionally, many of the challenges faced during the

prior year with electronic component shortages and extensive

lead-times have been resolved. Gross profit for the fourth quarter

of 2020 was $1.0 million, or 11.9% of revenue, compared to $0.7

million, or 8.2% of revenue, for the same period in 2019.

Outlook

Commenting on the future, Mr. Gill added, “First and foremost,

we remain focused on the health and safety of our employees, their

families and our customers. While the future potential impact of

the pandemic remains unknown, we are optimistic regarding the

current economic outlook for 2021.

“Demand has strengthened significantly from customers serving

the automotive, commercial vehicle and sport utility markets, with

Class 8 forecasts showing year-over-year production increases of

over 41% for 2021. Similarly, demand from customers in the defense

and communications sector remains robust. While the energy market

continues to be volatile, we continue to secure new orders on

important projects around the world.

“The continuing momentum of new contract awards, when combined

with increasingly positive market conditions, provide important

support for our financial outlook for 2021, which includes 20%

growth in the Company’s top line, 200 to 300 basis points of

further expansion in the Company’s gross margin and strong double

digit percentage growth in cash flow generated from operations.

“As we prepare for 2021, we remain focused on meeting the

important needs of our customers who serve defense, communications,

energy, transportation, and other critical infrastructure

industries. With a strong backlog and recovering markets, we

believe that the outlook for the coming year has the potential to

be very positive for Sypris and we approach our new fiscal year

with optimism.”

About Sypris Solutions

Sypris Solutions is a diversified provider of truck components,

oil and gas pipeline components and aerospace and defense

electronics. The Company produces a wide range of manufactured

products, often under multi-year, sole-source contracts. For more

information about Sypris Solutions, visit its Web site at

www.sypris.com.

Forward Looking Statements

This press release contains “forward-looking” statements

within the meaning of the federal securities laws.

Forward-looking statements include our plans and expectations of

future financial and operational performance. Such statements

may relate to projections of the company’s revenue, earnings, and

other financial and operational measures, our liquidity, our

ability to mitigate or manage disruptions posed by the current

coronavirus disease (“COVID-19”), and the impact of COVID-19 and

economic conditions on our future operations, among other matters.

In March 2020, the President of the United States declared the

COVID-19 outbreak a national emergency. COVID-19 continues to

spread throughout the United States and other countries across the

world, and the duration and severity of its effects are currently

unknown. The COVID-19 pandemic has resulted, and is likely to

continue to result, in significant economic disruption and has and

will likely adversely affect our business. The Company has

continued to operate at each location and sought to remain

compliant with government regulations imposed due to the COVID-19

pandemic.

Each forward-looking statement herein is subject to risks and

uncertainties, as detailed in our most recent Form 10-K and Form

10-Q and other SEC filings. Briefly, we currently believe that

such risks also include the following: the impact of COVID-19 and

economic conditions on our future operations; possible public

policy response to the pandemic, including legislation or

restrictions that may impact our operations or supply chain; our

failure to successfully complete final contract negotiations with

regard to our announced contract “orders”, “wins” or “awards”; our

failure to successfully win new business; the termination or

non-renewal of existing contracts by customers; our failure to

achieve and maintain profitability on a timely basis by steadily

increasing our revenues from profitable contracts with a

diversified group of customers, which would cause us to continue to

use existing cash resources or require us to sell assets to fund

operating losses; breakdowns, relocations or major repairs of

machinery and equipment, especially in our Toluca Plant; the cost,

quality, timeliness, efficiency and yield of our operations and

capital investments, including the impact of tariffs, product

recalls or related liabilities, employee training, working capital,

production schedules, cycle times, scrap rates, injuries, wages,

overtime costs, freight or expediting costs; dependence on,

retention or recruitment of key employees and distribution of our

human capital; disputes or litigation involving governmental,

supplier, customer, employee, creditor, stockholder, product

liability, warranty or environmental claims; our failure to achieve

targeted gains and cash proceeds from the anticipated sale of

certain equipment; the fees, costs and supply of, or access to,

debt, equity capital, or other sources of liquidity; our ability to

comply with the requirements of the SBA and seek forgiveness of all

or a portion of our Paycheck Protection Program loan; our inability

to develop new or improved products or new markets for our

products; cost, quality and availability or lead times of raw

materials such as steel, component parts (especially electronic

components), natural gas or utilities; our ability to maintain

compliance with the NASDAQ listing standards minimum closing bid

price; our reliance on a few key customers, third party vendors and

sub-suppliers; inventory valuation risks including excessive or

obsolescent valuations or price erosions of raw materials or

component parts on hand or other potential impairments,

non-recoverability or write-offs of assets or deferred costs; other

potential weaknesses in internal controls over financial reporting

and enterprise risk management; failure to adequately insure or to

identify product liability, environmental or other insurable risks;

unanticipated or uninsured disasters, public health crises, losses

or business risks; unanticipated or uninsured product liability

claims; volatility of our customers’ forecasts, scheduling demands

and production levels which negatively impact our operational

capacity and our effectiveness to integrate new customers or

suppliers, and in turn cause increases in our inventory and working

capital levels; the costs of compliance with our auditing,

regulatory or contractual obligations; labor relations; strikes;

union negotiations; pension valuation, health care or other benefit

costs; costs associated with environmental claims relating to

properties previously owned; our inability to patent or otherwise

protect our inventions or other intellectual property from

potential competitors; adverse impacts of new technologies or other

competitive pressures which increase our costs or erode our

margins; U.S. government spending on products and services that

Sypris Electronics provides, including the timing of budgetary

decisions; changes in licenses, security clearances, or other legal

rights to operate, manage our work force or import and export as

needed; risks of foreign operations; currency exchange rates; war,

terrorism, or political uncertainty; cyber security threats and

disruptions; inaccurate data about markets, customers or business

conditions; risk related to owning our common stock including

increased volatility; or unknown risks and uncertainties. We

undertake no obligation to update our forward-looking statements,

except as may be required by law.

SYPRIS SOLUTIONS, INC. Financial Highlights (In

thousands, except per share amounts) Three

Months Ended December 31,

2020

2019

(Unaudited) Revenue

$

20,614

$

21,624

Net loss

$

(1,174

)

$

(859

)

Loss per common share: Basic

$

(0.06

)

$

(0.04

)

Diluted

$

(0.06

)

$

(0.04

)

Weighted average shares outstanding: Basic

21,259

20,974

Diluted

21,259

20,974

Year Ended December

31,

2020

2019

(Unaudited) Revenue

$

82,346

$

87,891

Net income (loss)

$

1,668

$

(3,949

)

Income (loss) per common share: Basic

$

0.08

$

(0.19

)

Diluted

0.08

(0.19

)

Weighted average shares outstanding: Basic

21,084

20,865

Diluted

21,086

20,865

Sypris Solutions, Inc. Consolidated Statements of

Operations (in thousands, except for per share data)

Three Months Ended Year Ended December

31, December 31,

2020

2019

2020

2019

(Unaudited) (Unaudited) Net revenue: Sypris

Technologies

$

12,087

$

13,010

$

45,321

$

61,683

Sypris Electronics

8,527

8,614

37,025

26,208

Total net revenue

20,614

21,624

82,346

87,891

Cost of sales: Sypris Technologies

10,552

11,006

39,157

51,898

Sypris Electronics

7,512

7,910

31,624

26,110

Total cost of sales

18,064

18,916

70,781

78,008

Gross profit: Sypris Technologies

1,535

2,004

6,164

9,785

Sypris Electronics

1,015

704

5,401

98

Total gross profit

2,550

2,708

11,565

9,883

Selling, general and administrative

2,721

3,474

11,351

13,680

Severance, relocation and other costs

-

118

124

509

Operating (loss) income

(171

)

(884

)

90

(4,306

)

Interest expense, net

202

227

838

903

Other expense (income), net

658

(100

)

544

(1,256

)

Loss before income taxes

(1,031

)

(1,011

)

(1,292

)

(3,953

)

Income tax expense (benefit), net

143

(152

)

(2,960

)

(4

)

Net (loss) income

$

(1,174

)

$

(859

)

$

1,668

$

(3,949

)

(Loss) income per common share: Basic

$

(0.06

)

$

(0.04

)

$

0.08

$

(0.19

)

Diluted

$

(0.06

)

$

(0.04

)

$

0.08

$

(0.19

)

Dividends declared per common share

$

-

$

-

$

-

$

-

Weighted average shares outstanding: Basic

21,259

20,974

21,084

20,865

Diluted

21,259

20,974

21,086

20,865

Sypris Solutions, Inc. Consolidated Balance Sheets

(in thousands, except for share data) December

31, December 31,

2020

2019

(Unaudited) ASSETS Current assets: Cash and cash

equivalents

$

11,606

$

5,095

Accounts receivable, net

7,234

7,444

Inventory, net

16,236

20,784

Other current assets

3,948

4,282

Assets held for sale

412

2,233

Total current assets

39,436

39,838

Property, plant and equipment, net

10,161

11,675

Operating lease right-of-use assets

6,103

7,014

Other assets

5,008

1,529

Total assets

$

60,708

$

60,056

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable

$

6,734

$

9,346

Accrued liabilities

13,409

12,495

Operating lease liabilities, current portion

965

841

Finance lease obligations, current portion

393

684

Note payable - PPP loan, current portion

1,186

-

Total current liabilities

22,687

23,366

Operating lease liabilities, net of current portion

5,941

6,906

Finance lease obligations, net of current portion

1,927

2,351

Note payable - related party

6,477

6,463

Note payable - PPP Loan, net of current portion

2,372

-

Other liabilities

6,529

7,539

Total liabilities

45,933

46,625

Stockholders’ equity: Preferred stock, par value $0.01 per share,

975,150 shares authorized; no shares issued

-

-

Series A preferred stock, par value $0.01 per share, 24,850 shares

authorized; no shares issued

-

-

Common stock, non-voting, par value $0.01 per share, 10,000,000

shares authorized; no shares issued

-

-

Common stock, par value $0.01 per share, 30,000,000 shares

authorized; 21,302,194 shares issued and 21,300,958 outstanding in

2020 and 21,324,618 shares issued and 21,298,426 outstanding in

2019

213

213

Additional paid-in capital

155,025

154,702

Accumulated deficit

(115,765

)

(117,433

)

Accumulated other comprehensive loss

(24,698

)

(24,051

)

Treasury stock, 1,236 and 26,192 in 2020 and 2019

-

-

Total stockholders’ equity

14,775

13,431

Total liabilities and stockholders’ equity

$

60,708

$

60,056

Sypris Solutions, Inc. Consolidated Cash Flow

Statements (in thousands) Year Ended,

December 31,

2020

2019

(Unaudited) Cash flows from operating activities: Net income

(loss)

$

1,668

$

(3,949

)

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: Depreciation and amortization

2,503

2,671

Deferred income taxes

(3,070

)

(260

)

Stock-based compensation expense

426

469

Deferred loan costs recognized

14

11

Net gain on the disposal or abandonment of assets

(236

)

(654

)

Provision for excess and obsolete inventory

222

616

Non-cash lease expense

911

650

Other noncash items

(1

)

52

Contributions to pension plans

(862

)

(382

)

Changes in operating assets and liabilities: Accounts receivable

214

2,425

Inventory

4,230

(2,621

)

Prepaid expenses and other assets

(204

)

756

Accounts payable

(2,591

)

(4,100

)

Accrued and other liabilities

424

(1,537

)

Net cash provided by (used in) operating activities

3,648

(5,853

)

Cash flows from investing activities: Capital expenditures

(1,542

)

(859

)

Proceeds from sale of assets

1,969

1,858

Net cash provided by investing activities

427

999

Cash flows from financing activities: Principal payments on finance

lease obligations

(715

)

(632

)

Proceeds from Paycheck Protection Program loan

3,558

-

Indirect repurchase of shares for minimum statutory tax

withholdings

(103

)

(156

)

Net cash provided by (used in) financing activities

2,740

(788

)

Effect of exchange rate changes on cash balances

(304

)

33

Net increase (decrease) in cash and cash equivalents

6,511

(5,609

)

Cash and cash equivalents at beginning of period

5,095

10,704

Cash and cash equivalents at end of period

$

11,606

$

5,095

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210318005188/en/

Anthony C. Allen Chief Financial Officer (502)

329-2000

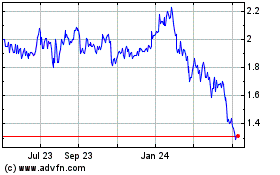

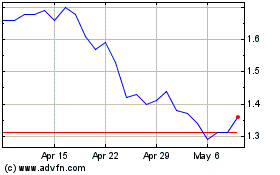

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Apr 2023 to Apr 2024