Current Report Filing (8-k)

December 05 2022 - 7:09AM

Edgar (US Regulatory)

0001395937false00013959372022-12-012022-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 01, 2022 |

SYNDAX PHARMACEUTICALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37708 |

32-0162505 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Building D Floor 3 35 Gatehouse Drive |

|

Waltham, Massachusetts |

|

02451 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (781) 419-1400 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

SNDX |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 2, 2022, Syndax Pharmaceuticals, Inc. (the “Company”) issued a press release announcing that Steve Sabus will join the Company as Chief Commercial Officer, effective December 5, 2022. Prior to joining the Company, Mr. Sabus served as Chief Commercial Officer of Turning Point Therapeutics, a publicly traded company, from May 2022 through the closing of the Company’s acquisition by Bristol-Myers Squibb in August 2022. From 2007 through 2022, prior to joining Turning Point, Mr. Sabus spent 15 years in roles with increasing levels of sales responsibility at Astellas Pharma, most recently serving as the Senior Vice President, Head of Oncology. Mr. Sabus received a B.A.in Marketing & Sales Management from the University of Northern Iowa.

There are no arrangements or understandings with the Company pursuant to which Mr. Sabus was appointed to serve as Chief Commercial Officer. There are no family relationships between Mr. Sabus and any director or executive officer of the Company and there are no related party transactions of the kind described in Item 404(a) of Regulation S-K in which Mr. Sabus was a participant.

In connection with his appointment, the Company entered into an employment agreement with Mr. Sabus, effective December 1, 2022 (the “Employment Agreement”), providing for the terms of his employment, including (i) an annual base salary of $495,000; (ii) an annual target bonus equal to 40% of his base salary; and (iii) a one-time grant of an option to purchase 220,000 shares of the Company’s common stock, exercisable at a price per share equal to the closing price of the Company’s common stock on the Nasdaq Global Select Market on December 5, 2022, the date of grant. Twenty-five percent (25%) of the shares subject to such option shall vest on the one-year anniversary of the vesting commencement date, and one forty-eighth (1/48th) of the shares of common stock subject to such option shall vest monthly thereafter on the last day of each month over the following thirty-six (36) months until all of the shares subject to such option are fully vested, subject to continued service.

Mr. Sabus’ employment agreement further provides that in the event his employment is terminated without “cause,” as defined in his employment agreement, or he terminates his employment for “good reason,” as defined in his employment agreement, he is entitled to (i) a lump sum severance payment equal to nine months base salary, (ii) payment on his behalf of up to nine months of health insurance benefits continuation and (iii) with respect to equity awards granted to Mr. Sabus prior to the date of his termination, accelerated vesting and the lapse of any reacquisition or repurchase rights that the Company holds with respect to such equity awards for the portion of such equity awards that would have otherwise vested within the 12-month period following the date of Mr. Sabus’ termination were he to remain employed with the Company during such 12-month period. If Mr. Sabus’ employment is terminated without cause or he terminates his employment for good reason within three months prior to, or 12 months after, a “change in control” of the Company, as defined in his employment agreement, he is instead entitled to (a) a lump sum severance payment equal to the sum of 12 months base salary and 100% of the greater of (1) the average annual target performance bonus paid to him for the preceding three years or (2) his annual target performance bonus in effect as of the change in control, (b) payment on his behalf of up to 12 months of health insurance benefits continuation and (c) full accelerated vesting on all of his unvested options and the lapse of any reacquisition or repurchase rights that the Company holds with respect to any other equity award granted to him pursuant to any of the Company’s equity incentive plans. In order to receive his severance benefits, Mr. Sabus must sign a general release of claims.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the complete text of such agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SYNDAX PHARMACEUTICALS, INC. |

|

|

|

|

Date: |

December 5, 2022 |

By: |

/s/ Michael A. Metzger |

|

|

|

Michael A. Metzger

Chief Executive Officer |

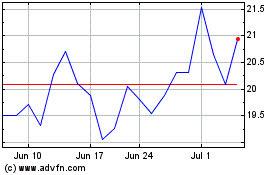

Syndax Pharmaceuticals (NASDAQ:SNDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Syndax Pharmaceuticals (NASDAQ:SNDX)

Historical Stock Chart

From Apr 2023 to Apr 2024