Summit Therapeutics Inc. (NASDAQ: SMMT) (“Summit,” “we,” or the

“Company”) today announced that we have completed the closing of

our previously announced definitive agreement with Akeso Inc. (HKEX

Code: 9926.HK, “Akeso”) to in-license its breakthrough bispecific

antibody, ivonescimab. Ivonescimab, known as AK112 in China and

Australia, and as SMT112 in the United States, Canada, Europe, and

Japan, is a novel, potential first-in-class bispecific antibody

combining the effects of immunotherapy via a blockade of PD-1 with

the anti-angiogenesis effects associated with blocking VEGF into a

single molecule.

Summit is initiating development activities for SMT112 and will

do so first in non-small cell lung cancer (NSCLC) indications.

The definitive partnership calls for Summit to receive the

rights to develop and commercialize ivonescimab (SMT112) in the

United States, Canada, Europe, and Japan. Akeso will retain

development and commercialization rights for the rest of the world,

including China.

In exchange for these rights, Summit committed to an upfront

payment of $500 million to be paid in two installments. The first

installment worth $300 million has been paid in conjunction with

the closing of the transaction. Of the $300 million paid to Akeso

by Summit, Akeso opted, in accordance with the definitive

agreement, to convert approximately $25.1 million of the payment

into 10 million shares of Summit common stock; the remaining $274.9

million was paid by Summit to Akeso in cash. The second installment

of $200 million will become due on March 5, 2023 and will be paid

by Summit in cash.

Going forward, Akeso will be eligible to receive regulatory and

commercial milestones of up to an additional $4.5 billion. In

addition, Akeso will receive low double-digit royalties on net

sales in the Summit territories.

In conjunction with the closing of the deal, Dr. Michelle Xia,

Co-Founder, Chairwoman, and CEO of Akeso, has been appointed to the

board of directors of Summit.

Update on $500 Million Rights Offering

We continue to plan for our previously announced rights

offering, which will be available to all holders of record of the

Company’s common stock, par value $0.01 (the “Common Stock”) as of

the close of the market on the record date. The record date will be

no earlier than February 2, 2023 (the “Record Date”).

The Company intends to distribute to all holders of Common Stock

as of the Record Date non-transferable subscription rights to

purchase shares of Common Stock at a price per share equal to the

lesser of (i) $1.05, or (ii) the volume weighted-average price of

the Common Stock for the five consecutive trading days through and

including the expiration date of the offering. Assuming that the

rights offering is fully subscribed, the Company will receive gross

proceeds of up to $500 million, less expenses related to the rights

offering.

We will provide additional information as we approach the final

record date.

Summit has filed a registration statement (including a

prospectus) on Form S-3 with the Securities and Exchange Commission

(the “SEC”) on December 21, 2022, which has not yet become

effective. The registration statement covers, among other things,

the rights offering to which this communication relates. Such

securities may not be sold nor may offers to buy be accepted prior

to the time the registration statement becomes effective. Before

you invest, you should read the final prospectus in that

registration statement, together with any prospectus supplement,

that we will file prior to commencing any rights offering, and the

documents incorporated by reference in the prospectus (or any

prospectus supplement), as well as the other documents Summit has

filed with the SEC for more complete information about Summit and

the rights offering. You may get these documents for free by

visiting EDGAR on the SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor will there be

any sale of these securities in any state or other jurisdiction in

which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction. The rights offering will be made pursuant to

an effective registration statement on Form S-3 containing the

detailed terms of the rights offering to be filed with the SEC. Any

offer will be made only by means of a prospectus forming part of

the registration statement.

Summit Therapeutics’ Mission Statement

To build a viable, long-lasting health care organization that

assumes full responsibility for designing, developing, trial

execution and enrollment, regulatory submission and approval, and

successful commercialization of patient, physician, caregiver, and

societal-friendly medicinal therapy intended to: improve quality of

life, increase potential duration of life, and resolve serious

medical healthcare needs. To identify and control promising product

candidates based on exceptional scientific development and

administrational expertise, develop our products in a rapid,

cost-efficient manner, and to engage commercialization and/or

development partners when appropriate.

We accomplish this by building a team of world class

professional scientists and business administrators that apply

their experience and knowledge to this mission. Team Summit exists

to pose, strategize, and execute a path forward in medicinal

therapeutic health care that places Summit in a well-deserved, top

market share, leadership position. Team Summit assumes full

responsibility for stimulating continuous expansion of knowledge,

ability, capability, and well-being for all involved stakeholders

and highly-valued shareholders.

About Summit Therapeutics

Summit was founded in 2003 and our shares are listed on the

Nasdaq Global Market (symbol ‘SMMT’). We are headquartered in Menlo

Park, California, and we have additional offices in Oxford, UK and

Cambridge, UK. For more information, please visit

https://www.smmttx.com and follow us on Twitter @summitplc.

About Akeso Inc.

Akeso (HKEX: 09926) is a commercial-stage biopharmaceutical

company committed to the discovery, development, manufacturing and

commercialization of innovative medicines with high unmet medical

needs worldwide. Founded in 2012, the company has established a

comprehensive in-house drug development platform (ACE Platform) and

know-how, including R&D, clinical development, CMC (Chemistry,

Manufacturing, and Controls), and commercialization capabilities.

With fully integrated multi-functional platform, Akeso is

internally working on a robust pipeline of over 30 innovative

assets in the fields of cancer, autoimmune disease, inflammation,

metabolic disease, and other major therapeutic areas. 17 assets

have entered into clinical stage. Leveraging its in-house developed

bispecific platform technology (“Tetrabody technology”), Akeso has

advanced four potential first-in-class bispecific antibody drugs

into market or clinical development, including cadonilimab (PD-1 /

CTLA-4), ivonescimab (PD-1 / VEGF), PD-1 / LAG-3, and TIGIT /

TGF-Beta bispecific antibodies. In June 2022, cadonilimab was

approved by the NMPA and became the first commercialized PD-1 based

bispecific drug globally. Another Akeso internally discovered and

developed oncology product, penpulimab (a PD-1 antibody), was

granted marketing approval in China in August 2021. Akeso is listed

on the Main Board of the Stock Exchange of Hong Kong Limited.

Summit Forward-looking Statements

Any statements in this press release about the Company’s future

expectations, plans and prospects, including but not limited to,

statements about the clinical and preclinical development of the

Company’s product candidates, entry into and actions related to the

Company’s partnership with Akeso Inc., the therapeutic potential of

the Company’s product candidates, the potential commercialization

of the Company’s product candidates, the timing of initiation,

completion and availability of data from clinical trials, the

potential submission of applications for marketing approvals, the

impact of the COVID-19 pandemic on the Company’s operations and

clinical trials, potential acquisitions and other statements

containing the words "anticipate," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "plan," "potential,"

"predict," "project," "should," "target," "would," and similar

expressions, constitute forward-looking statements within the

meaning of The Private Securities Litigation Reform Act of 1995.

Actual results may differ materially from those indicated by such

forward-looking statements as a result of various important

factors, including the results of our evaluation of the underlying

data in connection with the development and commercialization

activities for SMT112, the outcome of discussions with regulatory

authorities, including the Food and Drug Administration, the

uncertainties inherent in the initiation of future clinical trials,

availability and timing of data from ongoing and future clinical

trials, the results of such trials, and their success, and global

public health crises, including the coronavirus COVID-19 outbreak,

that may affect timing and status of our clinical trials and

operations, whether preliminary results from a clinical trial will

be predictive of the final results of that trial or whether results

of early clinical trials or preclinical studies will be indicative

of the results of later clinical trials, whether business

development opportunities to expand the Company’s pipeline of drug

candidates, including without limitation, through potential

acquisitions of, and/or collaborations with, other entities occur,

expectations for regulatory approvals, laws and regulations

affecting government contracts and funding awards, availability of

funding sufficient for the Company’s foreseeable and unforeseeable

operating expenses and capital expenditure requirements and other

factors discussed in the "Risk Factors" section of filings that the

Company makes with the Securities and Exchange Commission. Any

change to our ongoing trials could cause delays, affect our future

expenses, and add uncertainty to our commercialization efforts, as

well as to affect the likelihood of the successful completion of

clinical development of SMT112. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

In addition, any forward-looking statements included in this press

release represent the Company’s views only as of the date of this

release and should not be relied upon as representing the Company’s

views as of any subsequent date. The Company specifically disclaims

any obligation to update any forward-looking statements included in

this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230120005080/en/

Contact Summit Investor Relations Dave Gancarz Head of

Stakeholder Relations & Corporate Strategy

david.gancarz@smmttx.com

General Inquiries: investors@smmttx.com

Contact Akeso Investor Relations Michael Xi Chief

Financial Officer michael.xi@akesobio.com

General Inquiries: ir@akesobio.com

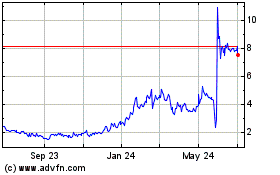

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

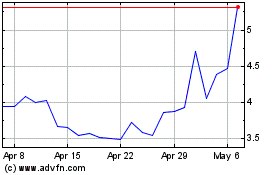

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Apr 2023 to Apr 2024