Current Report Filing (8-k)

January 09 2023 - 4:35PM

Edgar (US Regulatory)

0001599298FALSE00015992982023-01-062023-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 6, 2023

| | | | | | | | |

| Summit Therapeutics Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | |

| Delaware | 001-36866 | 37-1979717 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| |

2882 Sand Hill Road, Suite 106, Menlo Park, CA | 94025 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 617-514-7149

| | |

| Not applicable |

| (Former Name or Former Address, If Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common stock, $0.01 par value per share | SMMT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

As of December 31, 2022, the Company’s preliminary unaudited balance of cash, cash equivalents and amounts included in escrow was no less than $648 million (which includes the $300 million upfront payment to Akeso, Inc. (“Akeso”), to be paid by the Company pursuant to the Collaboration and License Agreement (the “License Agreement”) which the Company entered into with Akeso on December 5, 2022, and which amount was transferred by the Company into an escrow account, to be released to Akeso (less certain deductions) at such time as all applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and any comparable extension periods with respect to the transactions contemplated by the License Agreement have expired or been terminated). This $648 million amount is preliminary and is subject to completion of financial closing procedures. As a result, this amount may differ materially from the amount that will be reflected in the Company’s consolidated financial statements for the year ended December 31, 2022.

The information in Item 2.02 of this Current Report on Form 8-K is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

On January 6, 2023, Summit Therapeutics Inc. (the “Company”) held a Special Meeting of Stockholders (the “Special Meeting”). The following matters were submitted to a vote of the Company’s stockholders at the Special Meeting: (i) an amendment to the Company’s Restated Certificate of Incorporation, dated September 18, 2020, as amended on July 27, 2022 (the “Restated Certificate”), to increase the number of authorized shares of common stock by 650,000,000 (from 350,000,000 to 1,000,000,000); and (ii) an amendment to the Restated Certificate to effect a reverse stock split of all of the outstanding shares of the Company’s common stock at a ratio in the range of 1-for-5 to 1-for-10.

Each of the matters submitted to a vote of the Company’s stockholders at the Special Meeting was approved by the requisite vote of the Company’s stockholders in accordance with the recommendation of the Company’s Board of Directors. The final decision of whether to proceed with the amendments shall be determined by our board of directors, in its discretion, at any time prior to January 6, 2024. Set forth below is the number of votes cast for, against or withheld as to each such matter (no broker non-votes were received):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal 1 | | For | | Against | | Abstain | | Broker |

| Amendment No. 2 to Restated Certificate of Incorporation to increase the number of authorizes shares of common stock | | 188,470,028 | | 1,585,907 | | 165,798 | | — |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal 2 | | For | | Against | | Abstain | | Broker |

| Amendment No. 2 to Restated Certificate of Incorporation to effect a reverse stock split of the outstanding common stock | | 186,585,821 | | 3,607,721 | | 28,191 | | — |

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

Summit Therapeutics Inc. (the “Company”) will participate in and present at the 41st Annual J.P Morgan Healthcare Conference on Monday, January 9, 2023, at 3:45 p.m. (PST). Robert W. Duggan, Chairman and Chief Executive Officer, and Dr. Maky Zanganeh, Co-Chief Executive Officer and President, will provide details regarding the Company following the announcement of the agreement to in-license the breakthrough innovative bispecific antibody, ivonescimab (SMT112).

A live audio link of the Company’s presentation (the “Presentation”) will be available from the Company’s website at www.summittxinc.com.

Pursuant to Regulation FD, the Company hereby furnishes the presentation slides from the Presentation.

The information furnished by the Company pursuant to this item, including Exhibit 99.1 and any information provided at the Presentation, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any Company filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | SUMMIT THERAPEUTICS INC. |

| | |

| | |

| Date: January 9, 2023 | By: | /s/ Ankur Dhingra |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

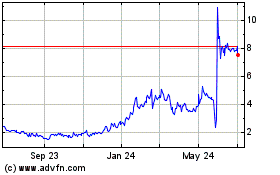

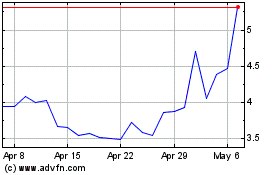

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Apr 2023 to Apr 2024