UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

SUMMIT THERAPEUTICS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

SUMMIT THERAPEUTICS INC.

2882 Sand Hill Road, Suite 106

Menlo Park, California 94025

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD AT 1:00 P.M. EASTERN TIME ON JANUARY 6, 2023

Dear Summit Therapeutics Inc. Stockholders:

Notice is hereby given that Summit Therapeutics Inc. (the “Company,” “Summit,” “we,” “us” or “our”) will hold a special meeting of stockholders (the “Special Meeting”) on January 6, 2023 at 1:00 P.M. Eastern Time. The Special Meeting will be conducted virtually via live webcast. You will be able to vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SMMT2023SM. Please have your notice or proxy card in hand when you visit the website. During the Special Meeting, stockholders will be asked to vote on the following proposals, as more fully described in the accompanying proxy statement:

| | |

1. To approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock by 650,000,000 (from 350,000,000 to 1,000,000,000), with the final decision of whether to proceed with the amendment to be determined by our board of directors, in its discretion, following stockholder approval (if obtained), but no later than January 6, 2024. 2. To approve an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of all of the outstanding shares of our Common Stock at a ratio in the range of 1-for-5 to 1-for-10, with the final decision of whether to proceed with the reverse stock split and the exact ratio and timing of the reverse split to be determined by our board of directors , in its discretion, following stockholder approval (if obtained), but no later than January 6, 2024.

3. To transact any other business as may properly come before the Special Meeting or any adjournments or postponements thereof. |

Our Board of Directors has fixed the close of business on December 5, 2022 as the record date for the Special Meeting (the “Record Date”). Only stockholders of record on December 5, 2022 are entitled to notice of and to vote at the Special Meeting. It is important that your shares are represented and voted at the Special Meeting. For specific voting instructions, please refer to the information provided in the proxy statement, together with your proxy card or the voting instructions you received with the proxy statement.

Your vote must be received by 11:59 p.m. Eastern Time, on January 5, 2023. For specific voting instructions, please refer to the information provided in the proxy statement, together with your proxy card or the voting instructions you received with the proxy statement. This proxy statement is being mailed to stockholders on or about December 13, 2022.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the virtual Special Meeting, we request that you submit your vote via the Internet, telephone or mail.

Thank you for your continued support of Summit Therapeutics Inc.

By Order of the Board of Directors,

/s/ Robert W. Duggan

Robert W. Duggan

Chief Executive Officer and Executive Chairman

Menlo Park, California

December 13, 2022

PROXY STATEMENT

FOR SPECIAL MEETING OF STOCKHOLDERS

SUMMIT THERAPEUTICS INC.

______________________

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To Be Held at 1:00 p.m. Eastern Time on January 6, 2023

______________________

GENERAL INFORMATION

We are providing you with this Proxy Statement and the enclosed form of proxy in connection with the solicitation by our Board of Directors for use at our 2023 special meeting of stockholders (the “Special Meeting”). The Special Meeting will be conducted virtually via live audio webcast by visiting www.virtualshareholdermeeting.com/SMMT2023SM on January 6, 2023 at 1:00 p.m. Eastern Time. This Proxy Statement contains important information regarding our Special Meeting, the proposals on which you are being asked to vote, information you may find useful in determining how to vote, and information about voting procedures. As used herein, “we,” “us,” “our,” “Summit,” or the “Company” refers to Summit Therapeutics Inc., a Delaware corporation.

This Proxy Statement and the accompanying proxy card or voting instruction form will first be made available to our stockholders on or about December 13, 2022.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully. Information contained on or that can be accessed through our website is not intended to be incorporated by reference into this Proxy Statement and references to our website address in this Proxy Statement are inactive textual references only.

QUESTIONS AND ANSWERS

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the enclosed proxy card, or if available, voting by telephone or the Internet. We have designated Robert W. Duggan, Makham Zanganeh or Ankur Dhingra to serve as proxies for the Special Meeting.

What matters will be voted on at the Special Meeting?

The following matters will be voted on at the Special Meeting:

•Proposal 1: To approve an amendment to authorize the Board, in its discretion but prior to the one-year anniversary of the date on which the increase in the number of authorized shares is approved by the Company’s stockholders at the Annual Meeting, to amend the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock by 650,000,000 (from 350,000,000 to 1,000,000,000), with the final decision of whether to proceed with the amendment to be determined by our board of directors, in its discretion, following stockholder approval (if obtained), but no later than January 6, 2024 (the “Capitalization Increase”);

•Proposal 2: To approve an amendment to authorize the Board, in its discretion but prior to the one-year anniversary of the date on which the reverse stock split is approved by the Company’s stockholders at the Annual Meeting, to amend our Restated Certificate of Incorporation to effect a reverse stock split of all of the outstanding shares of our Common Stock, at a ratio in the range of 1-for-5 to 1-for-10, with the final decision of whether to proceed with the reverse stock split and the exact ratio and timing of the reverse split to be determined by our board of directors, in its discretion, following stockholder approval (if obtained), but no later than January 6, 2024 (the “Reverse Stock Split”); and

•Such other business as may properly come before the Special Meeting or any adjournment or postponement of the Special Meeting.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote:

•“FOR” the approval of the authorization of the Board to amend the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock by 650,000,000 (from 350,000,000 to 1,000,000,000), as described in Proposal 1.

•“FOR” the approval of the authorization of the Board to amend the Company’s Restated Certificate of Incorporation for the Reverse Stock Split, as described in Proposal 2.

Will the Board be able to adopt both proposals assuming they are both approved by stockholders?

The Board has submitted for stockholder approval both the Capitalization Increase, as described in Proposal 1, and the Reverse Stock Split, as described in Proposal 2. The Board has submitted both proposals to stockholders to provide the Board with maximum flexibility to determine which proposal it believes would be in the best interests of stockholders. In the event of stockholder approval of both proposals, the Board will have discretion as to whether to adopt neither, one or both proposals at any time prior to the one year anniversary of the stockholder approval date.

Will there be any other items of business on the agenda?

If any other items of business or other matters are properly brought before the Special Meeting, your proxy gives discretionary authority to the persons named on the proxy card with respect to those items of business or other matters. The persons named on the proxy card intend to vote the proxy in accordance with their best judgment. Our Board of Directors does not intend to bring any other matters to be voted on at the Special Meeting. We are not currently aware of any other matters that may properly be presented by others for action at the Special Meeting.

Who is entitled to vote at the Special Meeting?

Holders of our common stock at the close of business on December 5, 2022, which we refer to as the record date, may vote at the Special Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the record date. In deciding all matters at the Special Meeting, each stockholder will be entitled to one vote for each share of our common stock held by them on the record date.

A list of stockholders entitled to vote at the Special Meeting will be available for inspection at our principal executive offices for at least ten days prior to the Special Meeting and at the Special Meeting. A stockholder may examine the list for any legally valid purpose related to the Special Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholders of Record. You are a stockholder of record if at the close of business on the record date your shares were registered directly in your name with Computershare Trust Company, N.A., our transfer agent. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the Special Meeting.

Beneficial Owner. You are a beneficial owner if, at the close of business on the record date, your shares were held by a brokerage firm, bank or other nominee and not in your name. Being a beneficial owner means that, like many of our stockholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares by following the voting instructions your broker, bank or other nominee provides. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock at the Special Meeting unless you follow your broker’s procedures for obtaining a legal proxy. Please see “What if I do not specify how my shares are to be voted?” for more information.

Do I have to do anything in advance if I plan to attend the Special Meeting?

The Special Meeting will be a virtual audio meeting of stockholders, which will be conducted via live audio webcast. You are entitled to participate in the Special Meeting only if you were a holder of our common stock as of the close of business on December 5, 2022 or if you hold a valid proxy for the Special Meeting.

To participate in the Special Meeting, you will need the control number included on your notice or proxy card. The live audio webcast will begin promptly at 1:00 p.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 p.m. Eastern Time and you should allow ample time for the check-in procedures.

How do I ask questions during the Special Meeting?

We are committed to ensuring our stockholders have the same rights and opportunities to participate in the Special Meeting as if it had been held in a physical location. If you wish to submit a question during the meeting, you may log into www.virtualshareholdermeeting.com/SMMT2023SM and enter your 16-digit control number. Once past the login screen, click on “Question for Management,” type in your question, and click “Submit.”

Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions regarding personal matters are not pertinent to meeting matters and therefore will not be answered.

How can I get help if I have trouble checking in or listening to the meeting online?

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the log-in page at www.virtualshareholdermeeting.com/SMMT2023SM.

How do I vote and what are the voting deadlines?

Stockholders of Record. If you are a stockholder of record, there are several ways for you to vote your shares:

•By mail. If you received printed proxy materials, you may submit your vote by completing, signing and dating each proxy card received and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Your completed, signed and dated proxy card must be received prior to the Special Meeting.

•By telephone or via the Internet. You may vote your shares by telephone or via the Internet by following the instructions provided in the proxy card. We recommend that you have your proxy card in hand when voting by telephone or via the Internet. If you vote by telephone or via the Internet, you do not need to return a proxy card by mail. Internet and telephone voting are available 24 hours a day. Votes submitted by telephone or via the Internet must be received by 11:59 p.m. Eastern Time on January 5, 2023.

•Attend the Special Meeting. You may vote at the Special Meeting by following the instructions at www.virtualshareholdermeeting.com/SMMT2023SM. Please have your notice or proxy card in hand when you visit the website.

Beneficial Owners. If you are a beneficial owner of your shares, you will receive voting instructions from the broker, bank or other nominee holding your shares. You should follow the voting instructions provided by your broker, bank or nominee in order to instruct your broker, bank or other nominee on how to vote your shares. The availability of telephone and Internet voting will depend on the voting process of the broker, bank or nominee. Shares held beneficially may be voted at the Special Meeting only if you obtain a legal proxy from the broker, bank or nominee giving you the right to vote the shares.

Whether or not you plan to attend the Special Meeting, we request that you vote by proxy to ensure your vote is counted. To vote, you will need the control number. The control number will be included in the notice or on

your proxy card if you are a stockholder of record, or included with your voting instructions received from your broker, bank or other nominee if you hold your shares of common stock in a “street name”.

Internet proxy voting is provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. Please be aware that you must bear any costs associated with your Internet access.

Can I revoke or change my vote after I submit my proxy?

Stockholders of Record. If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the Special Meeting by:

•signing and returning a new proxy card with a later date;

•entering a new vote by telephone or via the Internet by 11:59 p.m. Eastern Time on January 5, 2023;

•delivering a written revocation to our Chief Financial Officer at Summit Therapeutics Inc., 2882 Sand Hill Road, Suite 106, Menlo Park, California 94025 by 5:00 p.m. Eastern Time on January 5, 2023; or

•following the instructions at www.virtualshareholdermeeting.com/SMMT2023SM.

Beneficial Owners. If you are a beneficial owner of your shares, you must contact the broker, bank or other nominee holding your shares and follow their instructions on changing your vote.

What if I do not specify how my shares are to be voted?

Stockholders of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” the approval of the amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock by 650,000,000 (from 350,000,000 to 1,000,000,000);

•“FOR” the approval of the amendment to the Company’s Restated Certificate of Incorporation to effect the Reverse Stock Split;

•In the discretion of the named proxies regarding any other matters properly presented for vote at the Special Meeting.

Beneficial Owners. If you are a beneficial owner and you do not provide your broker, bank or other nominee with voting instructions, your broker, bank or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of The Nasdaq Capital Market, brokers, banks and other nominees do not have discretion to vote on non-routine matters absent direction from you.

What constitutes a quorum, and why is a quorum required?

A quorum is the minimum number of shares required to be present at the Special Meeting for the Special Meeting to be properly held under our bylaws and Delaware law. The presence (including by proxy) of a majority of all issued and outstanding shares of our common stock entitled to vote at the Special Meeting will constitute a quorum at the Special Meeting. As of the close of business on the record date of December 5, 2022, we had 201,321,175 shares of common stock outstanding and entitled to vote at the Special Meeting, meaning that 100,660,588 shares of common stock must be represented at the Special Meeting to constitute a quorum.

Your shares will be counted towards the quorum if you submit a proxy or vote at the Special Meeting. Abstentions and broker non-votes will also count towards the quorum requirement. If there is not a quorum, a majority of the shares present at the Special Meeting may adjourn the meeting to a later date.

What is the effect of a broker non-vote?

Brokers, banks or other nominees who hold shares of our common stock for a beneficial owner have the discretion to vote on routine proposals when they have not received voting instructions from the beneficial owner at least ten days prior to the Special Meeting. A broker non-vote occurs when a broker, bank or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Special Meeting but will not be counted for purposes of determining the number of votes present and entitled to vote with respect to a particular proposal. A broker or other nominee cannot vote without instructions on non-routine matters.

| | | | | | | | | | | | | | |

| Proposal | | Vote Required | | Broker

Discretionary

Voting Allowed |

| Proposal 1: Approval of the amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock. | | The affirmative vote of the holders of a majority of outstanding stock entitled to vote. | | Yes |

| Proposal 2: Approval of the amendment to the Company’s Restated Certificate of Incorporation to effect the Reverse Stock Split. | | The affirmative vote of the holders of a majority of outstanding stock entitled to vote. | | Yes |

What is the vote required for each proposal?

With respect to Proposal 1, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on this proposal, your abstention will act as a vote against approval of the Charter Amendment. Shares represented by executed, but unmarked, proxies will be voted “FOR” the approval of the Charter Amendment.

With respect to Proposal 2, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on this proposal, your abstention will act as a vote against approval of the Charter Amendment to effect the Reverse Stock Split. Shares represented by executed, but unmarked, proxies will be voted “FOR” the approval of the Charter Amendment to effect the Reverse Stock Split.

Broker non-votes are not anticipated to be received since both proposals are routine matters.

Who will count the votes?

Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”) has been engaged to receive and tabulate stockholder votes. Broadridge will separately tabulate FOR and AGAINST votes, abstentions, and broker non-votes. Broadridge will also certify the election results and perform any other acts required by the Delaware General Corporation Law.

Who is paying for the costs of this proxy solicitation?

We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Solicitations may be made personally or by mail, facsimile, telephone, messenger, or via the Internet by our personnel who will not receive additional compensation for such solicitation. In addition, we will reimburse brokerage firms and other custodians for their reasonable out-of-pocket expenses for forwarding the proxy materials to stockholders.

How can I find the results of the Special Meeting?

Preliminary results will be announced at the Special Meeting. Final results also will be published in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (the “SEC”) after the Special Meeting.

What does it mean if I receive more than one set of printed materials?

If you receive more than one set of printed materials, your shares may be registered in more than one name and/or are registered in different accounts.

Please follow the voting instructions on each set of printed materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

The SEC has adopted rules that allow a company to deliver a single proxy statement to an address shared by two or more of its stockholders. This method of delivery, known as “householding,” permits us to realize significant cost savings, reduces the amount of duplicate information stockholders receive, and reduces the environmental impact of printing and mailing documents to our stockholders. Under this process, certain stockholders will receive only one copy of our proxy materials and any additional proxy materials that are delivered until such time as one or more of these stockholders notifies us that they want to receive separate copies. Any stockholders who object to or wish to begin householding may notify our Investor Relations Department at investors@summitplc.com or Investor Relations, Summit Therapeutics Inc., 2882 Sand Hill Road, Suite 106, Menlo Park, California 94025.

Beneficial owners may contact their broker, bank or other nominee to request information about householding.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals for 2023 Annual Meeting. The submission deadline for stockholder proposals to be included in our proxy materials for the 2023 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended is December 30, 2022 except as may otherwise be provided in Rule 14a-8. All such proposals must be in writing and received by our Corporate Secretary at Summit Therapeutics Inc., 2882 Sand Hill Road, Suite 106, Menlo Park, California 94025 by close of business on the required deadline in order to be considered for inclusion in our proxy materials for the 2023 annual meeting of stockholders. Submission of a proposal before the deadline does not guarantee its inclusion in our proxy materials.

Advance Notice Procedure for 2023 Annual Meeting. Under our Bylaws, director nominations and other business may be brought at an annual meeting of stockholders in accordance with the requirements of our Bylaws as in effect from time to time. For the 2023 annual meeting of stockholders, a stockholder notice must be received by our Corporate Secretary at Summit Therapeutics Inc., 2882 Sand Hill Road, Suite 106, Menlo Park, California 94025, not later than the close of business on the 90th day nor earlier than the close of business on the 120th day before the one-year anniversary of the date of our 2022 annual meeting of stockholders. However, if the 2023 annual meeting of stockholders is advanced by more than 30 days prior to, or delayed by more than 60 days after, the one-year anniversary of the 2022 annual meeting of stockholders, then, for notice by the stockholder to be timely, it must be received by our Corporate Secretary not earlier than the close of business on the 120th day prior to the 2023 annual meeting of stockholders and not later than the close of business on the later of (i) the 90th day prior to the 2023 annual meeting of stockholders, or (ii) the 10th day following the day on which notice of the date of such annual meeting was mailed or the day of public disclosure of the date of such annual meeting, whichever first occurs. Please refer to the full text of our Bylaw provisions for additional information and requirements. A copy of our current Bylaws has been filed with the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and may be obtained by writing to our Corporate Secretary at the address listed in our proxy materials.

PROPOSAL 1

AMENDMENT TO THE CHARTER TO INCREASE

THE AUTHORIZED NUMBER OF SHARES OF COMMON STOCK

Our Board of Directors has unanimously adopted, and is submitting for stockholder approval, an amendment to our Charter to increase the number of authorized shares of our common stock by 650,000,000 (from 350,000,000 to 1,000,000,000) with the final decision of whether to proceed with the increase in the number of authorized shares to be determined by our Board of Directors, in its discretion, following stockholder approval (if obtained), but no later than January 6, 2024.

The additional shares of common stock to be authorized for issuance under the Charter would be a part of the existing class of common stock and, if and when issued, would have the same rights and privileges as the common stock presently issued and outstanding. Our common stock has no preemptive rights to purchase common stock or other securities.

If this Proposal 1 is approved by the requisite vote of the stockholders, the proposed Capitalization Increase will be subject to the final Board determination of whether to implement, which may be at any time prior to the one year anniversary of the stockholder approval date. In the event of stockholder approval of both the Capitalization Increase and the Reverse Stock Split, the Board will have discretion as to whether to adopt neither, one or both proposals at any time prior to the one year anniversary of the stockholder approval date. If adopted by the Board following approval by the requisite vote of the stockholders, the Capitalization Increase will become effective upon its filing and recording with the Secretary of State of Delaware.

Form of the Amendment

The Board has deemed the Capitalization Increase advisable and in the best interests of the Company and is accordingly submitting it to stockholders for approval. The Capitalization Increase would revise the Company’s Restated Certificate of Incorporation, dated September 18, 2020, as amended by that Amendment to the Restated Certificate of Incorporation, dated July 27, 2022, by replacing the first paragraph of its FOURTH Article with the following language:

“The total number of shares of all classes of capital stock that the Corporation shall have authority to issue is 1,020,000,000 shares, consisting of (i) 1,000,000,000 shares of common stock, $0.01 par value per share (the “Common Stock”), and (ii) 20,000,000 shares of Preferred stock, $0.01 par value per share (the “Preferred Stock”).”

The full text of the proposed Charter Amendment is set forth in Annex A of this proxy statement. No changes are proposed to the number of authorized shares of preferred stock.

Reasons for the Increase in the Number of Authorized Shares

The proposed increase in the authorized number of shares of common stock is intended to ensure that we will continue to have an adequate number of authorized and unissued shares of common stock for future use. As of December 5, 2022, the Company had 201,321,175 shares of common stock issued and outstanding and an aggregate of 25,417,955 shares reserved for potential future issuance upon exercise of outstanding awards under its 2020 Stock Incentive Plan, 2016 Long Term Incentive Plan, and its outstanding warrants. The Company may also issue up to an additional 8,438,161 authorized shares reserved for potential issuance of future awards under its 2020 Stock Incentive Plan and 2020 Employee Stock Purchase Plan.

On December 5, 2022, we entered into a Collaboration and License Agreement (the “License Agreement”) with Akeso, Inc. and its affiliates (“Akeso”) and certain ancillary transaction documents as set forth in the License Agreement. Pursuant to the License Agreement, the Company is partnering with Akeso to in-license its breakthrough bispecific antibody, ivonescimab. Ivonescimab, known as AK112 in China and Australia, and also as SMT112 in the United States, Canada, Europe, and Japan, is a novel, potential first-in-class bispecific antibody combining the power of immunotherapy via a blockade of PD-1 with the anti-angiogenesis benefits of an anti-VEGF into a single molecule. Ivonescimab was engineered to bring two well established oncology targeted mechanisms together. In connection with the License Agreement, the Company has also entered into a Supply Agreement with

Akeso, pursuant to which Summit agreed to purchase a certain portion of drug substance for clinical and commercial.

The definitive partnership memorialized in the License Agreement calls for Summit to receive the rights to develop and commercialize ivonescimab (SMT112) in the United States, Canada, Europe, and Japan. Akeso will retain development and commercialization rights for the rest of the regions including China. In exchange for these rights, Summit will make an upfront payment of $500 million, $300 million of which is payable within the later of 15 days or upon the earliest date on which the parties have actual knowledge that all applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and any comparable extension periods with respect to the transactions contemplated by the License Agreement have expired or been terminated (of which 16 million shares of Company common stock may be issued in lieu of cash) and $200 million of which is payable within 90 days. The total value of the upfront payment and potential milestone payments is $5.0 billion, as Akeso will be eligible to receive regulatory and commercial milestones of up to $4.5 billion. In addition, Akeso will be eligible to receive low double-digit royalties on net sales.

On December 6, 2022, the Company entered into a Note Purchase Agreement (the “Note Purchase Agreement”) and promissory notes with the Company’s Chief Executive Officer, Chairman of the Board, and beneficial owner of approximately 81% of the Company’s common stock, Robert W. Duggan and Dr. Maky Zanganeh, the Company’s co-Chief Executive Officer, President, member of the Board and beneficial owner of approximately 6.4% of the Company’s common stock. Pursuant to the Note Purchase Agreement, the Company agreed to sell to Mr. Duggan and Dr. Zanganeh unsecured promissory notes in the aggregate amount of $520 million.

The Company expects to use the proceeds of the Note Purchase Agreement (i) for payment of the upfront obligation associated with the License Agreement, (ii) for activities to support clinical development and regulatory approval for SMT112; (iii) to pursue business development opportunities to expand our pipeline of drug candidates; and (iv) for general corporate purposes.

Pursuant to the Note Purchase Agreement, the Company has issued to Mr. Duggan and Dr. Zanganeh unsecured promissory notes in the amount of $400 million and $20 million, respectively (the “February Notes”), which will mature and become due on February 15, 2023 (the “February Maturity Date”) and an unsecured promissory note to Mr. Duggan in the amount of $100 million (together with the February Notes, the “Notes”), which will mature and become due on September 15, 2023 (together with the February Maturity Date, the “Maturity Dates”). The Maturity Dates may be extended one or more times at the Company’s election, but in no event to a date later than September 6, 2024. The Notes accrue interest at an initial rate of 7.5%. In addition, if the Company shall consummate a public offering, then upon the later to occur of (i) five business days after the Company receives the net cash proceeds therefrom or (ii) May 15, 2023, the February Notes shall be prepaid by an amount equal to the lesser of (a) 100% of the amount of the net proceeds of such offering and (b) the outstanding principal amount on such Notes. The Company may prepay any portion of the Notes at its option without penalty. It is anticipated that the February Notes will be repaid in connection with the consummation of the anticipated rights offering announced by the Company, as described below.

On December 6, 2022, the Company issued a press release announcing the approval by the Board of a rights offering to its stockholders. The rights offering will be made through the distribution of non-transferable subscription rights to purchase shares of Common Stock as of the close of the market on the record date to be determined by the Board, but which will be no earlier than January 23, 2023, at a price per share equal to the lesser of (i) $1.05, or (ii) the volume weighted-average price of the Common Stock for the five consecutive trading days through and including the expiration date of the offering. Assuming that the rights offering is fully subscribed, the Company expects to receive gross proceeds of up to $500 million, less expenses related to the rights offering. The Company intends to register the rights offering with the Securities and Exchange Commission (the “SEC”) by filing a prospectus on Form S-1. The proposed increase in the authorized number of shares of common stock is a condition to closing the rights offering. In addition, the proposed Capitalization Increase will also provide the Company with the ability to offer additional equity securities in the future.

Our Board recommends the proposed increase in the authorized number of shares of common stock to facilitate issuing shares in the event that, in addition to the proposed rights offering, the Board determines that it is necessary or appropriate to (i) provide financial flexibility to raise additional capital through the sale of equity securities, convertible securities or other equity-linked securities, (ii) enter into additional strategic business

transactions, (iii) provide equity incentives to directors, officers and employees pursuant to equity compensation plans or (iv) other general corporate purposes. The availability of additional shares of common stock is particularly important in the event that the Board needs to undertake any of the foregoing actions on an expedited basis, as market conditions permit and favorable financing and business opportunities become available, and thus without the potential delay and expense associated with convening a special stockholders’ meeting. In considering and planning for our current and future corporate needs, our Board believes that the current number of authorized and unreserved shares of common stock available for issuance is inadequate. If stockholders do not vote to approve this Proposal 1, the Company may be unable to issue shares when needed; approving this Proposal 1 will help avoid that issue.

The Board has not authorized the Company to take any action with respect to the shares that would be authorized under this proposal, however, authorization will be required in connection with closing the above-referenced rights offering.

Effects of the Increase in the Number of Authorized Shares

If our stockholders approve this proposal to increase the number of authorized shares of common stock, unless otherwise required by applicable law or stock exchange rules, our Board will be able to issue the additional shares of common stock from time to time in its discretion without further action or authorization by stockholders. The newly authorized shares of common stock would be issuable for any proper corporate purposes, including future capital raising transactions of equity or convertible debt securities, acquisitions, investment opportunities, the establishment of collaborations or other strategic agreements, stock splits, stock dividends, issuance under current or future equity incentive plans or for other general corporate purposes.

The proposed increase in the number of authorized shares of common stock will not, by itself, have an immediate dilutive effect on our current stockholders. However, the future issuance of additional shares of common stock or securities convertible into our common stock could, in the proposed rights offering or otherwise, depending on the circumstances, have a dilutive effect on the earnings per share, book value per share, voting power and percentage interest of our existing stockholders, none of whom have preemptive rights to subscribe for additional shares of common stock that we may issue, and could depress the market price of the common stock. In addition to the proposed rights offering, we may sell shares of common stock at a price per share that is less than the current price per share and less than the price per share paid by our current stockholders. We may also sell securities in the future that could have rights superior to existing stockholders.

Potential Anti-Takeover Effect

An increase in the number of authorized shares of common stock may also, under certain circumstances, be construed as having an anti-takeover effect. Although not designed or intended for such purposes, the effect of the proposed increase might be to render more difficult or to discourage a merger, tender offer, proxy contest or change in control of us and the removal of management, which stockholders might otherwise deem favorable. For example, the authority of our Board to issue common stock might be used to create voting impediments or to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional shares of common stock would dilute the voting power of the common stock then outstanding. Our common stock could also be issued to purchasers who would support our Board in opposing a takeover bid which our Board determines not to be in our best interests and those of our stockholders.

The Board is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the proposed Charter Amendment to increase the number of authorized shares of common stock is not part of any plan by our Board to recommend or implement a series of anti-takeover measures.

Effectiveness of the Charter Amendment and Required Vote

Upon receipt of the necessary stockholder approval, the Board will make a final determination as to whether to proceed and file with the Secretary of State of the State of Delaware the amendment to its Charter to implement the Capitalization Increase. The amendment to the Charter to effect the Capitalization Increase would become effective upon such filing. Our Board reserves the right, notwithstanding stockholder approval of the

Capitalization Increase and without further action by our stockholders, not to proceed with the amendment at any time before the filing of the Capitalization Increase.

Vote Required

In accordance with Delaware law, approval and adoption of this proposal requires the affirmative vote of at least a majority of our issued and outstanding shares entitled to vote either in person or by proxy at the meeting. Accordingly, abstentions will have the same effect as a vote against the proposal. Shares represented by valid proxies and not revoked will be voted at the meeting in accordance with the instructions given. If no voting instructions are given, such shares will be voted “FOR” this proposal.

The Board of Directors unanimously recommends a vote “FOR” the amendment to the Charter to increase the authorized number of shares of Common Stock.

PROPOSAL 2

APPROVAL OF AMENDMENT TO THE CHARTER TO EFFECT A REVERSE STOCK SPLIT

Background and Proposed Amendment

Our Board of Directors has unanimously adopted, and is submitting for stockholder approval, an amendment to our Charter, as amended, in substantially the form attached hereto as Annex B (the “Reverse Stock Split Charter Amendment”) to effect the Reverse Stock Split at a ratio of between 1-for-5 and 1-for-10, with the final decision of whether to proceed with the Reverse Stock Split and the exact ratio of the Reverse Stock Split to be determined by our Board of Directors, in its discretion, following stockholder approval (if obtained), but no later than January 6, 2024. If the stockholders approve the Reverse Stock Split, and the Board decides to implement it, the Reverse Stock Split will become effective upon the filing of the Reverse Stock Split Charter Amendment with the Delaware Secretary of State. In the event of stockholder approval of both the Capitalization Increase and the Reverse Stock Split, the Board will have discretion as to whether to adopt neither, one or both proposals at any time prior to the one year anniversary of the stockholder approval date.

The Reverse Stock Split will be realized simultaneously for all outstanding common stock. The Reverse Stock Split will affect all holders of common stock uniformly and no stockholder’s interest in the Company will be diluted as each stockholder will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The Reverse Stock Split Charter Amendment will not reduce the number of authorized shares of common stock (which will remain at 350,000,000) and will not change the par value of the common stock (which will remain at $0.01 per share).

Reasons for the Reverse Stock Split

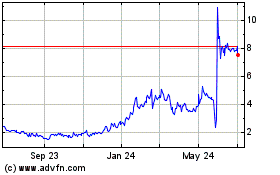

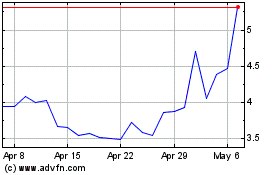

With a high number of issued and outstanding shares of common stock, the price per each share of our common stock may be too low for the Company to attract investment capital on reasonable terms for the Company. We believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. We believe that the Reverse Stock Split may make our common stock a more attractive and cost-effective investment for many investors, which may enhance the liquidity of the holders of our common stock.

In addition, we believe that the Reverse Stock Split will help us achieve a number of important goals, including enhancing our ability to continue to satisfy the continued listing requirements of Nasdaq Capital Market. One of the listing requirements common to national securities exchanges is that the bid price of our common stock be at a specified minimum per share. Reducing the number of outstanding shares of our common stock should, absent other factors, result in an increase in the per share market price of our common stock, although we cannot provide any assurance that our minimum bid price would, following the Reverse Stock Split, remain over any applicable minimum bid price requirements. The Reverse Stock Split will also effectively increase the number of authorized and unissued shares of our common stock available for future issuance by the amount of the reduction in outstanding shares effected by the Reverse Stock Split.

Although reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, or that the market price of our common stock will increase (proportionately to the reduction in the number of shares of our common stock after the Reverse Stock Split or

otherwise) following the Reverse Stock Split or that the market price of our common stock will not decrease in the future.

If the Reverse Stock Split Charter Amendment is effected, it would cause a decrease in the total number of shares of our common stock outstanding and increase the market price of our common stock, as well as effectively increase the number of authorized and unissued shares of our common stock available for future issuance. The Board intends to effect the Reverse Stock Split only if it believes that a decrease in the number of shares outstanding is in the best interests of the Company and our stockholders and is likely to improve the trading price of our common stock and improve the likelihood that we will be able to satisfy the continued listing requirements of Nasdaq Capital Market. Accordingly, our Board approved the Reverse Stock Split Charter Amendment and recommended it be submitted to stockholders for approval.

Consequences of Not Obtaining Stockholder Approval of the Reverse Stock Split

If we do not obtain stockholder approval of the Reverse Stock Split and if we need additional capital to fund operations and at such time do not have a sufficient number of authorized and unissued shares of common stock to raise such additional capital, our business would be materially and adversely affected. In addition, if we are unable to satisfy the continued listing requirements for the Nasdaq Capital Market, we may be delisted from the exchange.

If stockholder approval for the Reverse Stock Split is not obtained, the number of shares of our common stock that are issued and outstanding will not change and the anticipated benefits of the Reverse Stock Split described above under “Reasons for the Reverse Stock Split” will not be achieved.

Principal Effects of the Reverse Stock Split

A reverse stock split refers to a reduction in the number of outstanding shares of a class of a corporation’s capital stock, which may be accomplished, as in this case, by reclassifying and combining all of our outstanding shares of common stock into a proportionately smaller number of shares. For example, a stockholder holding 100,000 shares of common stock before the reverse stock split would instead hold 10,000 shares of common stock immediately after the reverse stock split if the ratio at which the board of directors determines the ratio to be 1-for-10. Each stockholder’s proportionate ownership of outstanding shares of common stock would remain the same, subject to immaterial adjustments due to the issuance of an additional share in lieu of a fractional share. All shares of common stock will remain validly issued, fully paid and non-assessable.

After the Effective Time, as defined below, of the Reverse Stock Split, our common stock will have a new committee on uniform securities identification procedures number, also known as a CUSIP number, which is a number used to identify our common stock. Our common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The proposed Reverse Stock Split will not affect the registration of our common stock under the Exchange Act.

Effect on Authorized but Unissued Shares

Pursuant to the Reverse Stock Split Charter Amendment, each holder of our common stock outstanding immediately prior to the effectiveness of the Reverse Stock Split (“Old Common Stock”) will become the holder of fewer shares of our common stock (“New Common Stock”) after consummation of the Reverse Stock Split.

The table below provides examples of reverse stock splits at various ratios between 1-for-5 and 1-for-10, without giving effect to the treatment of fractional shares. The actual number of shares outstanding after giving effect to the Reverse Stock Split, if effected, will depend on the actual ratio that is determined by our board of directors.

| | | | | | | | | | | | | | | | | | | | |

| Shares outstanding at December 5, 2022 | | Reverse Stock Split Ratio | | Shares outstanding after Reverse Stock Split | | Reduction in Shares Outstanding |

| 201,321,175 | | 1-for-5 | | 40,264,235 | | 80% |

| 201,321,175 | | 1-for-10 | | 20,132,118 | | 90% |

The Reverse Stock Split will affect all stockholders equally and will not affect any stockholder’s proportionate equity interest in the Company, except for those stockholders who receive an additional share of our common stock in lieu of a fractional share. None of the rights currently accruing to holders of our common stock will be affected by the Reverse Stock Split. Following the Reverse Stock Split, each share of New Common Stock will entitle the holder thereof to one vote per share and will otherwise be identical to Old Common Stock. The Reverse Stock Split also will have no effect on the number of authorized shares of our Common Stock. The shares of New Common Stock will be fully paid and non-assessable.

The par value per share of the Common Stock will remain unchanged at $0.01 per share after the Reverse Stock Split. As a result, on the Effective Time of the Reverse Stock Split, if any, the stated capital on our balance sheet attributable to the common stock will be reduced proportionately based on the Reverse Stock Split ratio, from its present amount, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. After the Reverse Stock Split, net income or loss per share and other per share amounts will be increased because there will be fewer shares of our common stock outstanding. In future financial statements, net income or loss per share and other per share amounts for periods ending before the Reverse Stock Split would be recast to give retroactive effect to the Reverse Stock Split. The Company does not anticipate that any other accounting consequences would arise as a result of the Reverse Stock Split.

Risks Associated with the Reverse Stock Split

The Reverse Stock Split may not increase the price of our common stock over the long-term. As noted above, a principal purpose of the Reverse Stock Split is to increase the trading price of our common stock to enhance our ability to satisfy Nasdaq Capital Market’s continued listing requirements. However, the effect of the Reverse Stock Split on the market price of our common stock cannot be predicted with any certainty, and we cannot assure you that the Reverse Stock Split will accomplish this objective for any meaningful period of time, or at all. While we expect that the reduction in the number of outstanding shares of common stock will proportionally increase the market price of our common stock, we cannot assure you that the Reverse Stock Split will increase the market price of our common stock by a multiple of the Reverse Stock Split ratio, or result in any permanent or sustained increase in the market price of our common stock. The market price of our common stock may be affected by other factors which may be unrelated to the number of shares outstanding, including the Company’s business and financial performance, general market conditions, and prospects for future success.

The Reverse Stock Split may decrease the liquidity of our common stock. The Board believes that the Reverse Stock Split may result in an increase in the market price of our common stock, which could lead to increased interest in our common stock and possibly promote greater liquidity for our stockholders. However, the Reverse Stock Split will also reduce the total number of outstanding shares of common stock, which may lead to reduced trading and a smaller number of market makers for our common stock, particularly if the price per share of our common stock does not increase as a result of the Reverse Stock Split.

The Reverse Stock Split may result in some stockholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell. If the Reverse Stock Split is implemented, it will increase the number of stockholders who own “odd lots” of less than 100 shares of common stock. A purchase or sale of less than 100 shares of common stock (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares of common stock following the Reverse Stock Split may be required to pay higher transaction costs if they sell their common stock.

The Reverse Stock Split may lead to a decrease in our overall market capitalization. The Reverse Stock Split may be viewed negatively by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of our common stock does not increase in proportion to the Reverse Stock Split ratio, or following such increase does not maintain or exceed such price, then the value of our Company, as measured by our market capitalization, will be reduced. Additionally, any reduction in our market capitalization may be magnified as a result of the smaller number of total shares of common stock outstanding following the Reverse Stock Split.

Anti-Takeover and Dilutive Effects

In addition, we have not proposed the Reverse Stock Split, with its corresponding increase in the authorized and unissued number of shares of common stock, with the intention of using the additional shares for anti-takeover purposes, although we could theoretically use the additional shares to make it more difficult or to discourage an attempt to acquire control of the Company.

We do not believe that our officers or directors have interests in this proposal that are different from or greater than those of any other of our stockholders.

Effect on Registered and Beneficial Stockholders

If you hold shares of common stock in “street name” through an intermediary, we will treat your common stock in the same manner as stockholders whose shares are registered in their own names. Intermediaries will be instructed to effect the Reverse Stock Split for their customers holding common stock in street name. However, these intermediaries may have different procedures for processing a reverse stock split. If you hold shares of common stock in street name, we encourage you to contact your intermediaries.

Registered “Book-Entry” Holders of Common Stock

If you hold shares of common stock electronically in book-entry form with our transfer agent, Computershare Trust Company, N.A., you do not currently have and will not be issued stock certificates evidencing your ownership after the reverse stock split, and you do not need to take action to receive post-reverse stock split shares. If you are entitled to post-reverse stock split shares, a transaction statement will automatically be sent to you indicating the number of shares of common stock held following the reverse stock split.

Effect on Registered Stockholders Holding Certificates

Some stockholders of record hold their shares of our common stock in certificate form or a combination of certificate and book-entry form. If any of your shares of our common stock are held in certificate form, you will receive a letter of transmittal from the Company’s transfer agent, Computershare Trust Company, N.A., containing instructions on how a stockholder should surrender its, his or her certificate(s) representing shares of Old Common Stock to the transfer agent in exchange for certificate(s) representing shares of New Common Stock. No certificate(s) representing shares of New Common Stock will be issued to a stockholder until such stockholder has surrendered all certificate(s) representing shares of Old Common Stock, together with a properly completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange its, his or her certificate(s) shares of Old Common Stock for certificate(s) representing shares of New Common Stock registered in the same name.

Effect on Outstanding Options and Warrants

Upon a reverse stock split, all outstanding options, warrants and future or contingent rights to acquire common stock will be adjusted to reflect the Reverse Stock Split. With respect to all outstanding options and warrants to purchase common stock, the number of shares of common stock that such holders may purchase upon exercise of such options or warrants will decrease, and the exercise prices of such options or warrants will increase, in proportion to the fraction by which the number of shares of common stock underlying such options and warrants are reduced as a result of the Reverse Stock Split. Also, the number of shares reserved for issuance under our existing stock incentive and employee stock purchase plans would be equitably adjusted by the Company in the manner determined by the Board.

Fractional Shares

Fractional shares will not be issued in connection with the Reverse Stock Split. Each stockholder who would otherwise hold a fractional share of common stock as a result of the Reverse Stock Split will receive one share of common stock in lieu of such fractional share. If such shares are subject to an award granted under an

Incentive Plan, each fractional share of common stock will be rounded down to the nearest whole share of common stock in order to comply with the requirements of Sections 409A and 424 of the Code.

Appraisal Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal or dissenter’s rights with respect to the Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Regulatory Approvals

The Reverse Stock Split will not be consummated, if at all, until after approval of the Company’s stockholders is obtained. The Company is not obligated to obtain any governmental approvals or comply with any state or federal regulations prior to consummating the Reverse Stock Split other than the filing of the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware.

Procedure for Effecting the Reverse Stock Split

If our stockholders approve this proposal, and the board of directors elects to effect the Reverse Stock Split, we will effect the Reverse Stock Split by filing the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Delaware. The Reverse Stock Split will become effective, and the combination of, and reduction in, the number of our outstanding shares as a result of the Reverse Stock Split will occur automatically, at the time of the filing of the Reverse Stock Split Charter Amendment (referred to as the “Effective Time”), without any action on the part of our stockholders and without regard to the date that stock certificates representing any certificated shares prior to the Reverse Stock Split are physically surrendered for new stock certificates. Beginning at the Effective Time, each certificate representing pre-Reverse Stock Split shares will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares. The text of the Reverse Stock Split Charter Amendment is subject to modification to include such changes as may be required by the office of the Secretary of State of the State of Delaware and as the Board deems necessary and advisable to effect the Reverse Stock Split.

The board of directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the Reverse Stock Spit Charter Amendment, the Board, in its sole discretion, determines that it is no longer in the best interests of the Company and its stockholders to proceed with the Reverse Stock Split. By voting in favor of the Reverse Stock Split, you are also expressly authorizing the Board to delay or abandon the Reverse Stock split. Stockholders should not destroy any stock certificate(s) and should not submit any certificate(s) until they receive a letter of transmittal from our transfer agent.

Certain Material U.S Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of certain material United States federal income tax consequences of the Reverse Stock Split to our stockholders. This summary does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse Stock Split and is included for general information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to stockholders that are subject to special tax rules, including but not limited to banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers, traders, and tax-exempt entities. Other stockholders also may be subject to special tax rules, including but not limited to: stockholders who received common stock as compensation for services or pursuant to the exercise of an employee stock option, or stockholders who have held, or will hold, stock as part of a straddle, hedging or conversion transaction for federal income tax purposes. This summary also assumes that you are a United States holder (defined below) who has held, and will hold, shares of common stock as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (the “Code”), generally, property held for investment. Finally, the following discussion does not address the tax consequences of transactions occurring prior to or after the Reverse Stock Split (whether or not such transactions are in connection with the Reverse Stock Split), including, without limitation, the exercise of options or rights to purchase common stock in anticipation of the Reverse Stock Split or otherwise.

The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. You should consult with your own tax advisor with respect to your tax consequences of the Reverse Stock Split. As used herein, the term “United States holder” means a stockholder that is, for federal income tax purposes: a citizen or resident of the United States; a corporation or other entity taxed as a corporation created or organized in or under the laws of the United States or any state, including the District of Columbia; an estate the income of which is subject to federal income tax regardless of its source; or a trust that (i) is subject to the primary supervision of a U.S. court and the control of one of more U.S. persons or (ii) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

The following discussion is based on the Code, applicable Treasury Regulations, judicial authority and administrative rulings and practice, all as of the date hereof. The Internal Revenue Service could adopt a contrary position. In addition, future legislative, judicial or administrative changes or interpretations could adversely affect the accuracy of the statements and conclusions set forth herein. Any such changes or interpretations could be applied retroactively and could affect the tax consequences described herein. No ruling from the Internal Revenue Service or opinion of counsel has been obtained in connection with the Reverse Stock Split.

No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Reverse Stock Split shares of common stock for post-Reverse Stock Split shares of common stock pursuant to the Reverse Stock Split. The aggregate tax basis of the post-Reverse Stock Split shares received in the Reverse Stock Split (including any whole share received in exchange for a fractional share) will be the same as the stockholder’s aggregate tax basis in the pre-Reverse Stock Split shares exchanged therefore. The stockholder’s holding period for the post-Reverse Stock Split shares will include the period during which the stockholder held the pre-Reverse Stock Split shares surrendered in the Reverse Stock Split.

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT AND DOES NOT PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU ARE STRONGLY ADVISED TO CONSULT YOUR OWN TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

Accounting Matters

The par value of the common stock will remain unchanged at $0.01 per share after the Reverse Stock Split. As a result, our stated capital, which consists of the par value per share of the common stock multiplied by the aggregate number of shares of the common stock issued and outstanding, will be reduced proportionately at the Effective Time of the Reverse Stock Split. Correspondingly, our additional paid-in capital, which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares of common stock, will be increased by a number equal to the decrease in stated capital. Further, net loss per share, book value per share and other per share amounts will be increased as a result of the Reverse Stock Split because there will be fewer shares of common stock outstanding.

Vote Required

In accordance with Delaware law, approval and adoption of this proposal requires the affirmative vote of at least a majority of our issued and outstanding shares entitled to vote either in person or by proxy at the meeting. Accordingly, abstentions and broker non-votes will have the same effect as a vote against the proposal. Shares represented by valid proxies and not revoked will be voted at the meeting in accordance with the instructions given. If no voting instructions are given, such shares will be voted “FOR” this proposal.

The Board of Directors unanimously recommends a vote “FOR” the Approval of the Charter Amendment to Effect The Reverse Stock Split.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of December 5, 2022 with respect to the beneficial ownership of our common stock by (i) each person we believe beneficially holds more than 5% of the outstanding shares of our common stock based solely on our review of SEC filings or information provided to us by such person; (ii) each director and nominee; and (iii) all directors and executive officers as a group. As of December 5, 2022, 201,321,175 shares of our common stock were issued and outstanding. Unless otherwise indicated, all persons named as beneficial owners of our common stock have sole voting power and sole investment power with respect to the shares indicated as beneficially owned. Unless otherwise noted below, the address of each stockholder listed on the table is c/o Summit Therapeutics Inc., 2882 Sand Hill Road, Suite 106, Menlo Park, California 94025.

| | | | | | | | | | | | | | |

| Name and address of beneficial owner | Number of Shares Owned (1) | Right to Acquire Shares (2) | Total Beneficial Ownership | Percent of Class (3) |

| 5% Stockholders: | | | | |

Robert W. Duggan (4) | 162,532,792 | 3,985,055 | 166,517,847 | 81.1% |

Mahkam Zanganeh (5) | 10,556,992 | 2,424,500 | 12,981,492 | 6.4% |

Named executive officers and directors: | | | | |

Robert W. Duggan(4) | 162,532,792 | 3,985,055 | 166,517,847 | 81.1% |

Mahkam Zanganeh(5) | 10,556,992 | 2,424,500 | 12,981,492 | 6.4% |

| Kenneth Clark | – | 139,760 | 139,760 | * |

| Ankur Dhingra | 76,253 | – | 76.253 | * |

| Ujwala Mahatme | – | 211,212 | 211,212 | * |

| Manmeet S. Soni | – | 309,719 | 309,719 | * |

| Robert F. Booth | – | 6,250 | 6,250 | * |

| Alessandra Cesano | – | 4,166 | 4,166 | * |

| | | | |

| All executive officers and directors as a group (8 people) | 173,166,037 | 7,080,662 | 180,246,699 | 87.5% |

_______________

(*) Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

(1) Excludes shares that may be acquired through the exercise of outstanding stock options or other equity awards.

(2) Represents shares issuable within 60 days after December 5, 2022 upon exercise of exercisable options and warrants; however, unless otherwise indicated, these shares do not include any equity awards awarded after December 5, 2022.

(3) For purposes of calculating the Percent of Class, shares that the person or entity had a right to acquire within 60 days after December 5, 2022 are deemed to be outstanding when calculating the Percent of Class of such person or entity.

(4) This information is based upon a Schedule 13D/A filed by Mr. Duggan with the Securities and Exchange Commission on August 18, 2022 and a Form 4 filed on August 18, 2022. The 166,517,847 shares of common stock beneficially owned by Mr. Duggan includes (i) 162,532,792 shares of common stock and (ii) warrants to purchase 3,985,055 shares of common stock, which are exercisable until December 24, 2029. This does not include the 9,346,434 shares issued to Mr. Duggan in connection with the Note Purchase Agreement, dated December 6, 2022, between the Company, Mr. Duggan and Dr. Zanganeh.

(5) This information is based upon a Schedule 13D/A filed by Dr. Zanganeh with the Securities and Exchange Commission on November 25, 2020 and information known to the Company. The 12,981,492 shares of common stock beneficially owned by Dr. Zanganeh includes (i) 10,556,992 shares of common stock, (ii) the exercise of warrants to purchase 1,121,177 shares of common stock, and (iii) options to purchase 1,303,323 shares of common stock. The warrants to purchase 631,362 shares of common stock (exercisable until December 24, 2029) are held by the Mahkam Zanganeh Revocable Trust and the Shaun Zanganeh Irrevocable Trust. The remaining warrants to purchase 489,815 shares of common stock (exercisable until June 30, 2025) are held individually by Mahkam Zanganeh. The options to purchase 1,303,323 shares of common stock are held individually by Dr. Zanganeh. This does not include the 373,857 shares issued to Dr. Zanganeh in connection with the Note Purchase Agreement, dated December 6, 2022, between the Company, Mr. Duggan and Dr. Zanganeh.

STOCKHOLDER PROPOSALS

You may submit proper proposals, including recommendations of director candidates, for inclusion in the proxy materials or meeting agenda for future stockholder meetings by following certain procedures outlined in this proxy statement.

PROXY SOLICITATION

We are making this solicitation of proxies on behalf of the Board, and we will bear the cost of soliciting proxies. Proxies may be solicited through the mail and through telephonic or telegraphic communications to, or by meetings with, stockholders or their representatives by directors, officers and other of our employees who will receive no additional compensation therefore. We request persons such as brokers, nominees and fiduciaries holding stock in their names for others, or holding stock for others who have the right to give voting instructions, to forward proxy material to their principals and to request authority for the execution of the proxy. We will reimburse such persons for their reasonable expenses.

STOCKHOLDERS SHARING THE SAME ADDRESS

The SEC has adopted rules that allow a company to deliver a single proxy statement to an address shared by two or more of its stockholders. This method of delivery, known as “householding,” permits us to realize significant cost savings, reduces the amount of duplicate information stockholders receive, and reduces the environmental impact of printing and mailing documents to our stockholders. Under this process, certain stockholders will receive only one copy of our proxy materials and any additional proxy materials that are delivered until such time as one or more of these stockholders notifies us that they want to receive separate copies. Any stockholders who object to or wish to begin householding may notify our Investor Relations Department at investors@summitplc.com or Investor Relations, 2882 Sand Hill Road, Suite 106, Menlo Park, California 94025.

OTHER MATTERS

This Proxy Statement is posted on our website at https://www.summittxinc.com/ and is also available from the SEC at its website at www.sec.gov.

The board of directors does not know of any other matters to be presented at the Special Meeting. If any additional matters are properly presented at the Special Meeting, the persons named in the enclosed proxy card will have discretion to vote the shares of our common stock they represent in accordance with their own judgment on such matters.

It is important that your shares of our common stock be represented at the Special Meeting, regardless of the number of shares that you hold. You are, therefore, requested to vote by telephone or by using the Internet as instructed on the enclosed proxy card or execute and return, at your earliest convenience, the enclosed proxy card in the envelope that has also been provided.

THE BOARD OF DIRECTORS

Menlo Park, California

December 13, 2022

Annex A

AMENDMENT NO. 2

TO

RESTATED

CERTIFICATE OF INCORPORATION

OF

SUMMIT THERAPEUTICS INC.

Pursuant to Section 242 of the

General Corporation Law of the State of Delaware

Summit Therapeutics Inc. (the “Company”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify as follows:

A resolution was duly adopted by the Board of Directors (the “Board”) of the Company pursuant to Section 242 of the General Corporation Law of the State of Delaware setting forth an amendment to the Restated Certificate of Incorporation of the Company (the “Charter Amendment”) and declaring said amendment to be advisable. The stockholders of the Company duly approved said proposed amendment at a special meeting of the stockholders called and held on January 6, 2023, upon notice in accordance with Section 222 of the General Corporation Law of the State of Delaware, by voting the necessary number of shares as required by statute in favor of the Charter Amendment. The resolution setting forth the amendment is as follows:

RESOLVED, that the Board hereby approves and recommends that the Company’s stockholders approve that the first paragraph of the FOURTH Article of the Restated Certificate of Incorporation, dated September 18, 2020, as amended by that Amendment to the Restated Certificate of Incorporation, dated July 27, 2022 be deleted in its entirety and replaced with the following language:

“The total number of shares of all classes of capital stock that the Corporation shall have authority to issue is 1,020,000,000 shares, consisting of (i) 1,000,000,000 shares of Common stock, $0.01 par value per share (the “Common Stock”), and (ii) 20,000,000 shares of Preferred stock, $0.01 par value per share (the “Preferred Stock”).”

IN WITNESS WHEREOF, the Company has caused its corporate seal to be affixed hereto and this Charter Amendment to be signed by its [TITLE OF EMPLOYEE] this [ ] day of ____, 202_.

SUMMIT THERAPEUTICS INC.

By:

Annex B

AMENDMENT NO. 2

TO

RESTATED

CERTIFICATE OF INCORPORATION

OF

SUMMIT THERAPEUTICS INC.

Pursuant to Section 242 of the

General Corporation Law of the State of Delaware

Summit Therapeutics Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify as follows: