Summit Therapeutics Inc Reports Financial Results and Operational Progress for the Second Quarter Ended June 30, 2022

August 11 2022 - 8:00AM

Summit Therapeutics Inc. (NASDAQ: SMMT) ("Summit," "we," or the

"Company") today reports its financial results and provides an

update on operational progress for the second quarter ended June

30, 2022.

Financial Highlights

- Aggregate cash, accounts

receivable, and tax credits receivable on June 30, 2022 totaled

$74.0 million as compared to $89.0 million on December

31, 2021. Our cash balance on June 30, 2022 was $57.3 million

as compared to $71.8 million on December 31, 2021. Accounts

receivable and research and development tax credits receivable on

June 30, 2022 were $16.7 million as compared to

$17.2 million on December 31, 2021.

- Net loss for the three months ended

June 30, 2022 and 2021 was $16.8 million and

$24.4 million, respectively. Net loss for the six months ended

June 30, 2022 and 2021 was $38.2 million and $41.9 million,

respectively.

- Operating cash outflow for the six

months ended June 30, 2022 and 2021 was $38.2 million and

$39.8 million, respectively.

- On June 22, 2022, the Company

announced a Rights Offering for its existing shareholders to

participate in the purchase of additional shares of its common

stock. The Rights Offering commenced on July 18, 2022, and the

associated subscription rights expired on August 8, 2022. Through

the fully subscribed Rights Offering, the Company raised $100.0

million in gross proceeds through the issuance and sale of

approximately 103 million shares of its common stock at a price per

share of $0.97. Issuance costs associated with the Rights Offering

were approximately $0.1 million, resulting in net proceeds of

approximately $99.9 million.

- In connection with the closing of the rights offering, a $25.0

million note payable with our Chairman and CEO, Robert W. Duggan,

matured and became due, and the Company repaid all principal and

accrued interest via a portion of the proceeds from this Rights

Offering.

- During the three months ended June

30, 2022, the Company received non-dilutive funding of

$0.1 million from the Biomedical Advanced Research and

Development Authority ("BARDA"), part of the Office of the

Assistant Secretary for Preparedness and Response at the U.S.

Department of Health and Human Services, in support of the

Company's Ri-CoDIFy clinical trials and clinical development of

ridinilazole. As of June 30, 2022, an aggregate of

$58.0 million out of a potential award of $72.5 million has

been received from BARDA under contract number HHSO100201700014C.

The contract with BARDA was set to expire on April 30, 2022. The

contract was extended through December 2022 as a no cost contract,

solely to close out open activities. Remaining potential funding

from BARDA has not been included in aggregate cash and receivables

balances, above.

- During the three months ended June

30, 2022, the Company received non-dilutive funding of

$0.3 million from the Trustees of Boston University under the

Combating Antibiotic Resistant Bacteria Biopharmaceutical

Accelerator ("CARB-X") program, in support of IND-enabling

activities for SMT-738. As of June 30, 2022, an aggregate of

$1.2 million out of a potential of up to $7.8 million of

funding has been received from CARB-X. Remaining potential funding

from CARB-X has not been included in aggregate cash and receivables

balances, above.

Operational & Corporate Updates

- Our intention is to expand our

pipeline product portfolio in the therapeutic area of oncology

and/or product offerings that are designed to work in harmony with

the human gut microbiome. We intend to enact this through business

development activities, including possible acquisitions and/or

collaborations in addition to internal research and discovery

efforts.

- In July 2022, we held a Type C

meeting with the US Food & Drug Administration (the “FDA”)

during which we discussed certain data from the Ri-CoDIFy Phase III

clinical trial with the agency. The FDA and Summit discussed a

possible pathway in which to advance ridinilazole forward with the

goal of achieving marketing authorization. This pathway would

involve at least one additional clinical trial. We plan to explore

this possibility.

- During the second quarter of 2022,

we continued to expand and bolster our leadership team to fit the

expansive vision of our Company going forward. In doing so, we have

appointed two individuals to positions of senior leadership,

continuing to enhance the strong existing core leadership team and

positioning the Company well for our strategic goals in the coming

years.

- In May, Ankur Dhingra joined Summit as our Chief Financial

Officer. Mr. Dhingra was most recently the CFO of CareDx;

previously, he spent over 15 years at Agilent Technologies, holding

positions of increasing responsibility across its finance

organization, including serving in multiple business unit CFO

roles. Mr. Dhingra has over 20 years of progressive financial

leadership experience in the fields of healthcare, medical devices,

and technology and has assumed responsibility for Summit's human

resources and information technology functions in addition to his

finance responsibilities.

- In April, Urte Gayko, PhD, was appointed as our Head of

Regulatory, Safety, and Quality. Dr. Gayko, who is also a member of

our Board of Directors, was most recently the Senior Vice President

of Drug Development & Regulatory Affairs at Nektar

Therapeutics; she was previously the Global Head of Regulatory

Affairs and Pharmacovigilance at Pharmacyclics, Inc. Dr. Gayko has

over 20 years of experience in regulatory affairs and clinical

development ranging from pre-commercial entities to large

biopharmaceutical companies, including Amgen and AbbVie.

- We are continuing to perform

IND-enabling activities for our second drug candidate,

SMT-738.

Summit Therapeutics’ Mission Statement

To build a viable, long-lasting health care

organization that assumes full responsibility for designing,

developing, trial execution and enrollment, regulatory submission

and approval, and successful commercialization of patient,

physician, caregiver, and societal-friendly medicinal therapy

intended to: improve quality of life, increase potential duration

of life, and resolve serious medical healthcare needs. To identify

and control promising product candidates based on exceptional

scientific development and administrational expertise, develop our

products in a rapid, cost-efficient manner, and to engage

commercialization and/or development partners when appropriate.

We accomplish this by building a team of world

class professional scientists and business administrators that

apply their experience and knowledge to this mission. Team Summit

exists to pose, strategize, and execute a path forward in medicinal

therapeutic health care that places Summit in a well-deserved, top

market share, leadership position. Team Summit assumes full

responsibility for stimulating continuous expansion of knowledge,

ability, capability, and well-being for all involved stakeholders

and highly-valued shareholders.

About Summit Therapeutics

Summit was founded in 2003 and our shares are

listed on the Nasdaq Global Market (symbol ‘SMMT’). We are

headquartered in Menlo Park, California, and we have additional

offices in Oxford, UK and Cambridge, UK.

For more information, please visit

https://www.summittxinc.com and follow us on Twitter

@summitplc.

Contact Summit Investor Relations:

Dave GancarzHead of Stakeholder Relations &

Corporate Strategydavid.gancarz@summitplc.com

General Inquiries:

investors@summitplc.com

Summit Forward-looking StatementsAny

statements in this press release about the Company’s future

expectations, plans and prospects, including but not limited to,

statements about the clinical and preclinical development of the

Company’s product candidates, the therapeutic potential of the

Company’s product candidates, the potential commercialization of

the Company’s product candidates, the timing of initiation,

completion and availability of data from clinical trials, the

potential submission of applications for marketing approvals, the

impact of the COVID-19 pandemic on the Company’s operations and

clinical trials, potential acquisitions and other statements

containing the words "anticipate," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "plan," "potential,"

"predict," "project," "should," "target," "would," and similar

expressions, constitute forward-looking statements within the

meaning of The Private Securities Litigation Reform Act of 1995.

Actual results may differ materially from those indicated by such

forward-looking statements as a result of various important

factors, including the results of our evaluation of the underlying

data in connection with the topline results of our Phase III

Ri-CoDIFy study evaluating ridinilazole, the outcome of discussions

with regulatory authorities, including the Food and Drug

Administration, the uncertainties inherent in the initiation of

future clinical trials, availability and timing of data from

ongoing and future clinical trials, the results of such trials, and

their success, and global public health crises, including the

coronavirus COVID-19 outbreak, that may affect timing and status of

our clinical trials and operations, whether preliminary results

from a clinical trial will be predictive of the final results of

that trial or whether results of early clinical trials or

preclinical studies will be indicative of the results of later

clinical trials, whether business development opportunities to

expand the Company’s pipeline of drug candidates, including without

limitation, through potential acquisitions of, and/or

collaborations with, other entities occur, expectations for

regulatory approvals, laws and regulations affecting government

contracts and funding awards, availability of funding sufficient

for the Company’s foreseeable and unforeseeable operating expenses

and capital expenditure requirements and other factors discussed in

the "Risk Factors" section of filings that the Company makes with

the Securities and Exchange Commission. Any change to our ongoing

trials could cause delays, affect our future expenses, and add

uncertainty to our commercialization efforts, as well as to affect

the likelihood of the successful completion of clinical development

of ridinilazole. Accordingly, readers should not place undue

reliance on forward-looking statements or information. In addition,

any forward-looking statements included in this press release

represent the Company’s views only as of the date of this release

and should not be relied upon as representing the Company’s views

as of any subsequent date. The Company specifically disclaims any

obligation to update any forward-looking statements included in

this press release.

SUMMIT THERAPEUTICS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(Unaudited)In thousands, except per share

data

| |

Three Months Ended June 30, |

Six Months Ended June 30, |

| |

2022 |

|

2021 |

2022 |

|

2021 |

|

Revenue |

$235 |

|

$57 |

$485 |

|

$249 |

| |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

Research and development |

9,008 |

|

23,923 |

29,564 |

|

42,302 |

|

General and administrative |

6,933 |

|

5,984 |

13,592 |

|

10,169 |

| Total

operating expenses |

15,941 |

|

29,907 |

43,156 |

|

52,471 |

| Other

operating income |

3,014 |

|

6,120 |

7,821 |

|

11,569 |

| Operating

loss |

(12,692) |

|

(23,730) |

(34,850) |

|

(40,653) |

| Other

expense, net |

(4,079) |

|

(686) |

(3,318) |

|

(1,251) |

| Net

loss |

$(16,771) |

|

$(24,416) |

$(38,168) |

|

$(41,904) |

| |

|

|

|

|

|

|

| Basic and

diluted loss per share |

$(0.17) |

|

$(0.27) |

$(0.38) |

|

$(0.48) |

| |

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

| Net

loss |

$(16,771) |

|

$(24,416) |

$(38,168) |

|

$(41,904) |

| Other

comprehensive (loss) income: |

|

|

|

|

|

|

| Foreign

currency translation adjustments |

789 |

|

540 |

(971) |

|

1,215 |

|

Comprehensive loss |

$(15,982) |

|

$(23,876) |

$(39,139) |

|

$(40,689) |

CONDENSED CONSOLIDATED BALANCE SHEET

INFORMATION(Unaudited)In thousands

| |

|

June 30, 2022 |

|

December 31, 2021 |

| |

|

|

|

|

|

Cash |

|

$57,335 |

|

$71,791 |

| Total

assets |

|

$95,718 |

|

$113,374 |

| Total

liabilities |

|

$44,401 |

|

$30,090 |

| Total

stockholders' equity |

|

$51,317 |

|

$83,284 |

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS INFORMATION(Unaudited)In

thousands

| |

|

Six Months Ended June 30, |

| |

|

2022 |

|

2021 |

| |

|

|

|

|

| Net cash

used in operating activities |

|

$(38,218) |

|

$(39,843) |

| Net cash

used in investing activities |

|

(654) |

|

(190) |

| Net cash

provided by financing activities |

|

25,187 |

|

75,979 |

| Effect of

exchange rate changes on cash |

|

(771) |

|

1,023 |

| |

|

|

|

|

|

(Decrease) Increase in cash |

|

$(14,456) |

|

$36,969 |

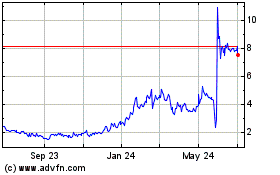

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

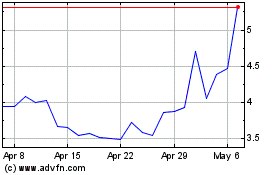

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Apr 2023 to Apr 2024