StepStone Group Launching ELTIF in Europe

February 13 2025 - 1:15PM

StepStone Group Inc. (Nasdaq: STEP), a leading global private

markets investment firm responsible for approximately $698 billion

in total capital, including $65 billion in private debt, announced

it received approval to launch a Private Debt-based European

Long-Term Investment Fund (“ELTIF”).

“As part of our continued expansion into the European private

wealth market, this milestone marks yet another chapter in our

story of delivering private markets strategies to more investors

with the mission of convenience, efficiency, and transparency,”

said Neil Menard, Partner and President of Distribution, StepStone

Private Wealth. “With these approvals in place, we will now be able

to deliver institutional-grade investments better tailored to the

dynamics of European wealth platforms.”

ELTIFs are designed to channel investments in Europe that

support economic growth and job creation. StepStone plans to

initially market ELTIFs in Italy, Spain, Germany, France, and the

Nordic and Benelux regions, focusing on investing in private credit

assets in the European Union.

“We believe that this offering provides unique advantages and is

very differentiated to all other solutions in the market. The

Firm’s sourcing network can provide significant selectivity and

diversification to investors in a market that is otherwise highly

fragmented,” said Marcel Schindler, Head of StepStone Private Debt.

“Both institutional and individual investors alike are seeking

efficient solutions such as this one. StepStone is well positioned

to meet these expectations.”

StepStone also received approval to convert their current RAIF

funds into UCI Part II vehicles, allowing professional investors

and semi-professional investors greater access to the private

markets, including private equity, infrastructure, and real estate.

Funds set to be converted include StepStone Private Markets Fund

Lux (SPRIM Lux), StepStone Private Venture and Growth Fund Lux

(SPRING Lux) and StepStone Private Infrastructure Fund Lux

(STRUCTURE Lux). These funds are currently available on a variety

of platforms, including Allfunds, FundsPlace, and offer a digital

subscription through Goji.

About StepStone

StepStone Group Inc. (Nasdaq: STEP) is a global private markets

investment firm focused on providing customized investment

solutions and advisory and data services to its clients. As of

December 31, 2024, StepStone was responsible for approximately $698

billion of total capital, including $179 billion of assets under

management. StepStone’s clients include some of the world’s largest

public and private defined benefit and defined contribution pension

funds, sovereign wealth funds and insurance companies, as well as

prominent endowments, foundations, family offices and private

wealth clients, which include high-net-worth and mass affluent

individuals. StepStone partners with its clients to develop and

build private markets portfolios designed to meet their specific

objectives across the private equity, infrastructure, private debt

and real estate asset classes.

Contacts

Shareholder Relations:Seth

Weissshareholders@stepstonegroup.com+1 (212) 351-6106

Media:Brian Ruby / Chris

Gillick / Matt Lettiero, ICRStepStonePR@icrinc.com+1 (203)

682-8268

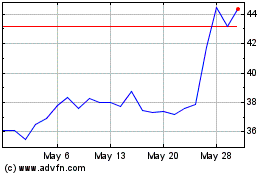

StepStone (NASDAQ:STEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

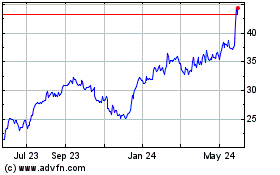

StepStone (NASDAQ:STEP)

Historical Stock Chart

From Feb 2024 to Feb 2025