Starbucks Places Bet On Tech Services -- WSJ

July 23 2019 - 3:02AM

Dow Jones News

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 23, 2019).

Starbucks Corp. said it is taking a stake in a digital

technology company to speed up its offering of mobile ordering and

payment options at its global stores to improve customer

convenience.

The Seattle-based coffee giant is making an investment and

securing a board seat in Brightloom, a company founded in 2015

under the earlier name eatsa, as it seeks to accelerate the

adoption of technology by its stores around the world.

In return, Brightloom will make available to Starbucks licensees

the coffee chain's system for mobile ordering and payment, loyalty

perks and delivery-order management. Brightloom and Starbucks will

also sell access to the platform to other restaurants trying to

quickly adopt their own digital programs, the companies said.

Both companies said Starbucks's stake was significant but

wouldn't disclose the specific financial terms. Franchisees abroad

were expected to be the first to sign up.

Starbucks -- the world's largest coffee chain by stores and

revenue, with more than 30,000 locations -- was one of the first

big restaurant chains to invest in a sophisticated loyalty program,

with nearly 17 million members currently. But adoption of its

digital offerings among store licensees has been less widespread.

Less than half of Starbucks markets around the world now have the

company's mobile app, and only eight have digital payments,

according to the company.

Digital ordering and delivery programs are becoming increasingly

vital to restaurants trying to draw more customers amid

intensifying competition.

"It went from something that was nice to have to being table

stakes," said Adam Brotman, Brightloom's chief executive and a

former Starbucks global retail and digital head, on Monday.

In addition to delivery, restaurants are also expanding mobile

payment to make purchasing easier and more appealing to younger

consumers. Mobile payment is still small in the U.S., but is firmly

established in Asia. Thirty-one percent of restaurants offer mobile

payment, according to a survey of U.S. restaurant operators by the

Toast Inc. food-service tech provider this year.

Big restaurant chains in particular are ramping up their tech

investments. McDonald's Corp. bought an Israeli digital startup

earlier this year to improve its drive-through ordering and

promotions. The burger chain is also experimenting with

voice-activated ordering at its drive-throughs.

Starbucks is facing increasing competition abroad from Luckin

Coffee Inc., a newly public Chinese company that specializes in

delivery and mobile ordering. Luckin said Monday that it had signed

a joint partnership to launch coffee shops in the Middle East and

India that will also employ its technology, which includes mobile

ordering, payment and delivery.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

July 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

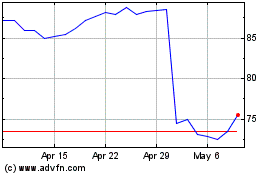

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

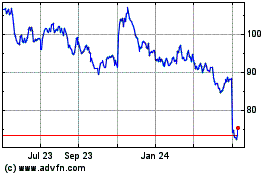

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024