Staffing 360 Solutions Improves Balance Sheet, Reduces Debt by 55%, Anticipates Reporting Increased Fourth Quarter Revenue

February 16 2021 - 8:36AM

Staffing 360 Solutions, Inc. (NASDAQ: STAF), a staffing company

executing an international buy-integrate-build strategy through the

acquisition of staffing organizations in the United States and the

United Kingdom, today discussed its improved balance sheet and

previewed fourth quarter revenue for the year ended December 31,

2020.

Improved Balance SheetAs

previously announced on February 12, 2021, the Company raised

approx. $19.7 million (approx. $18 million net) in a public

offering of 21,855,280 shares of its common stock at a price of

$0.90 per share.

Staffing 360 Solutions used 75% of the net

proceeds (approx. $13.5 million) to pay down a portion of its

outstanding note due September 30, 2022, and 25% of the net

proceeds (approx. $4.5 million) to redeem a portion of its Series E

Preferred Stock. 55% Debt

ReductionSince June 2020, the Company has reduced $55

million of debt to $26.8 million, a reduction of $28.3 million, or

55%.

The Company has paid down $16.6 million of the

note (leaving a balance of $19.1 million) and redeemed $8.6 million

in stated value of Series E Preferred Stock (leaving a balance of

$6.1 million). It carries a remaining balance of $1.4 million of

stated value of the Series E-1 Preferred.

Brendan Flood, CEO and President, said,

“Completing this raise of $19.7 million gross proceeds is the

latest step forward toward improving our balance sheet, setting the

stage for further growth and progress in 2021, and enhancing our

ability to achieve our long-term goals. Since June, we’ve not only

significantly reduced debt, but eliminated approx. $5 million per

year in interest and dividends.

“We are now in a much better position to

refinance our total debt prior to maturity next year. A more

attractive refinancing in 2021 should allow us improved flexibility

to both build organic growth and seek future M&A-driven

expansion. We’ve taken $6.2 million of annualized overhead out of

the business in 2020 which allowed us to manage through the worst

of the pandemic and emerge into what we see as a recovery

phase.”

Flood continued, “Staffing 360 Solutions is in a

significantly healthier position now than before the pandemic. Our

Company exited 2020 with 10% higher number of temp workers than the

previous December. The Company expects unaudited Q4 Revenue to be

$53.8 million, an increase of 11 percent, over Q3. Gross profits

are up and demand is growing.

“While we are experiencing increasing recovery

in both the US and UK, the overall staffing industry is poised to

have what could be one of its best years as the recovery continues

in 2021. The journey ahead is exciting and we are ready for

it.”

Actual results may differ materially from the

foregoing estimates due to developments or other information that

may arise between now and the time the financial results for the

fourth quarter of 2020 are finalized. These preliminary results

should not be viewed as a substitute for the company’s fourth

quarter reviewed consolidated financial statements prepared in

accordance with GAAP.

About Staffing 360 Solutions,

Inc. Staffing 360 Solutions, Inc. is engaged in the

execution of an international buy-integrate-build strategy through

the acquisition of domestic and international staffing

organizations in the United States and United Kingdom. The Company

believes that the staffing industry offers opportunities for

accretive acquisitions and as part of its targeted consolidation

model, is pursuing acquisition targets in the finance and

accounting, administrative, engineering, IT, and Light Industrial

staffing space. For more information, visit

http://www.staffing360solutions.com. Follow Staffing 360 Solutions

on Facebook, LinkedIn and Twitter.

Forward-Looking Statements This

press release contains forward-looking statements, which may be

identified by words such as "expect," "look forward to,"

"anticipate," "intend," "plan," "believe," "seek," "estimate,"

"will," "project" or words of similar meaning. Forward-looking

statements are not guarantees of future performance, are based on

certain assumptions and are subject to various known and unknown

risks and uncertainties, many of which are beyond the Company's

control, and cannot be predicted or quantified; consequently,

actual results may differ materially from those expressed or

implied by such forward-looking statements. Such risks and

uncertainties include, without limitation, market and other

conditions; the geographic, social and economic impact of COVID-19

on the Company’s ability to conduct its business and raise capital

in the future when needed; weakness in general economic conditions

and levels of capital spending by customers in the industries the

Company serves; weakness or volatility in the financial and capital

markets, which may result in the postponement or cancellation of

customer capital projects or the inability of the Company’s

customers to pay the Company’s fees; the termination of a major

customer contract or project; delays or reductions in U.S.

government spending; credit risks associated with the Company’s

customers; competitive market pressures; the availability and cost

of qualified labor; the Company’s level of success in attracting,

training and retaining qualified management personnel and other

staff employees; changes in tax laws and other government

regulations, including the impact of health care reform laws and

regulations; the possibility of incurring liability for the

Company’s business activities, including, but not limited to, the

activities of the Company’s temporary employees; the Company’s

performance on customer contracts; negative outcome of pending and

future claims and litigation; government policies, legislation or

judicial decisions adverse to the Company’s businesses; the

Company’s ability to access the capital markets by pursuing

additional debt and equity financing to fund its business plan and

expenses on terms acceptable to the Company or at all; the

Company’s ability to achieve loan forgiveness under Paycheck

Protection Program; and the Company’s ability to comply with its

contractual covenants, including in respect of its debt agreements,

as well as various additional risks, many of which are now unknown

and generally out of the Company’s control, and which are detailed

from time to time in reports filed by the Company with the SEC,

including quarterly reports on Form 10-Q, reports on Form 8-K and

annual reports on Form 10-K. Staffing 360 Solutions does not

undertake any duty to update any statements contained herein

(including any forward-looking statements), except as required by

law.

Investor Relations

Contact:Terri MacInnis, VP of IRBibicoff + MacInnis,

Inc.(818) 379-8500 x2terri@bibimac.com

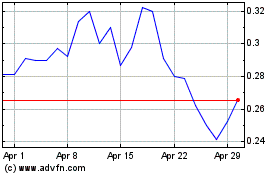

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024