Fourth Quarter ICL Sales Rise 41%; Full Year

2018 ICL Sales Rise 48%

GAAP Net Income of $0.02 Per Share in Fourth

Quarter; $0.11 Per Share for Full Year 2018

STAAR Surgical Company (NASDAQ: STAA), a leading developer,

manufacturer and marketer of implantable lenses and companion

delivery systems for the eye, today reported financial results for

the fourth quarter and full year ended December 28, 2018.

Fourth Quarter 2018

Overview

- Net Sales of $31.2 Million Up 26% from

the Prior Year Quarter

- ICL Sales Up 41% and Units Up 54% from

the Prior Year Quarter

- Gross Margin at 73.7% of Sales from

69.9% of Sales in the Prior Year Quarter

- Fourth Quarter Net Income of $0.02 per

Share vs. Prior Year Net Loss of ($0.00) Per Share

- Cash, Cash Equivalents and Restricted

Cash Ended the Quarter at $104.0 Million

Full Year 2018 Overview

- Record Net Sales of $124.0 Million Up

37% from Prior Year

- Record ICL Sales Up 48% and Units Up

54% from the Prior Year

- Gross Margin Improved to 73.8% of Sales

from 70.9% of Sales in the Prior Year

- Full Year Net Income of $0.11 per Share

vs. Prior Year Net Loss of ($0.05) Per Share

“2018 was a breakout year for STAAR. The transformation of the

business over the past two years has created a strong trajectory

toward paradigm change in refractive vision correction delivering

visual freedom. Lens based correction of Myopia is becoming a

preferred surgical solution and EVO ICL only clinics are opening in

Asia and Europe. We expect our momentum to continue with strong

clinical evidence from refractive surgeons publishing ever more

data supporting the safety and effectiveness of the ICL,” said

Caren Mason, President and CEO. “Surgeons refer to the ICL patient

as their ‘happiest patients’ and 99.4% of patients in a Patient

Registry said they would have the procedure again. As such, we far

exceeded our projection of breaking the $100.0 million revenue mark

in 2018 by achieving $124.0 million in revenue. In fact, our ICL

sales alone recorded $101.1 million in sales. My appreciation to

the entire STAAR team and our surgeon partners around the globe for

such outstanding performance.”

Financial Overview – Q4

2018

Net sales were $31.2 million for the fourth quarter of 2018, up

26% compared to $24.9 million reported in the prior year quarter.

The sales increase was driven by ICL revenue and unit growth of 41%

and 54%, respectively. Other Product Sales decreased 20% compared

to the prior year quarter. ICL revenue was 84% of total Net sales

for the fourth quarter of 2018.

Gross profit margin for the fourth quarter of 2018, was 73.7%

compared to the prior year period of 69.9%. The increase in gross

profit margin for the quarter is due to favorable product mix

resulting from increased sales of ICLs, and lower freight and

inventory provisions, partially offset by the effect of lower

average selling prices (ASPs) for lower diopter ICLs and large

volume commitment strategic partners.

Operating expenses for the quarter were $21.8 million compared

to the prior year quarter of $18.6 million. General and

administrative expenses were $6.2 million compared to the prior

year quarter of $5.1 million. The increase in general and

administrative expenses was due to increased headcount and

salary-related expenses including stock-based compensation and

increased facility costs. Marketing and selling expenses were $9.9

million compared to the prior year quarter of $7.9 million. The

increase in marketing and selling expenses was due to increased

headcount and salary-related expenses including stock-based

compensation and investments in digital, strategic, and consumer

marketing. Research and development expenses were $5.7 million

compared to the prior year quarter of $5.6 million. The increase in

research and development expenses was due to an increase in

headcount and salary-related expenses including stock-based

compensation, and increased clinical expenses associated with our

clinical trial for the next generation ICL with EDOF optic.

Net income for the fourth quarter of 2018 was $1.1 million or

approximately $0.02 per share compared with a net loss of ($0.1)

million or ($0.00) per share for the prior year quarter. Non-GAAP

Adjusted Net Income for the fourth quarter of 2018 was $3.2 million

or $0.07 per share compared to $0.8 million or $0.02 per share for

the prior year quarter. The reconciliation between GAAP and

non-GAAP financial information is provided in the financial tables

included with this release.

Financial Overview – Full Year

2018

Net sales were $124.0 million for FY 2018, up 37% compared to

$90.6 million reported in the prior year. The sales increase was

driven by ICL revenue and unit growth of 48% and 54%, respectively.

Other Products Sales increased 3% compared to the prior year. ICL

revenue was 82% of total Net sales for FY 2018.

Gross profit margin for FY 2018 increased to 73.8% of revenue

compared to 70.9% of revenue for fiscal 2017. The increase in gross

profit margin for the year is due to favorable product mix

resulting from increased sales of ICLs, and lower unit costs,

freight costs, and inventory provisions, partially offset by

the effect of lower ASPs for lower diopter ICLs and large volume

commitment strategic partners.

Operating expenses for FY 2018 were $84.9 million compared to

prior year of $67.9 million. The increase in operating expense is

due to increased headcount and salary-related expenses including

stock-based compensation and increased investments in digital,

consumer, and strategic marketing.

Net income for full year 2018 was $5.0 million or approximately

$0.11 per share compared with a net loss of $2.1 million or $0.05

per share for the prior year. Non-GAAP Adjusted Net Income for full

year 2018 was $12.6 million or $0.28 per share, compared with a

Non-GAAP Adjusted Net Income of $0.4 million or $0.01 per share for

FY 2017. The reconciliation between GAAP and non-GAAP financial

information is provided in the financial tables included with this

release.

Cash, cash equivalents and restricted cash at December 28, 2018

totaled $104.0 million, compared to $18.6 million at the end of the

fourth quarter of 2017. The Company generated $12.8 million in cash

from operations in fiscal 2018 and raised $72.2 million in gross

proceeds from the sale of approximately 2 million shares of common

stock to increase its cash balances.

Outlook – Full Year 2019

The Company reaffirms its Outlook as follows:

- ICL Unit Growth Percentage Target

Increase of 30% over FY18

- Company Overall Revenue Growth

Percentage Target Increase of 20% over FY18; Overall Revenue Target

Expected to be Impacted by Other Products Segment Sales Decline of

Approximately $3.60M, including a $2.60M Reduction in Sales of Low

Margin Injector Parts

- GAAP Net Income Anticipated to Increase

over FY18

- Company Anticipates Achieving Positive

Full Year Cash Flow and Cash Balance Increase.

Conference Call

The Company will host a conference call and webcast on Thursday,

February 21, 2019 at 4:30 p.m. Eastern / 1:30 p.m. Pacific to

discuss its financial results and operational progress. To access

the conference call (Conference ID 2888737), please dial

855-765-5684 for domestic participants and 262-912-6252 for

international participants. The live webcast can be accessed from

the investor relations section of the STAAR website at

www.staar.com.

A taped replay of the conference call (Conference ID 2888737)

will be available beginning approximately one hour after the call’s

conclusion for seven days. This replay can be accessed by dialing

855-859-2056 for domestic callers and 404-537-3406 for

international callers. An archived webcast will also be available

at www.staar.com.

Use of Non-GAAP Financial

Measures

This press release includes supplemental non-GAAP financial

information, which STAAR believes investors will find helpful in

understanding its operating performance. “Adjusted Net Income” and

“Adjusted Net Income Per Share” exclude the following items that

are included in “Net Income (Loss)” as calculated in accordance

with U.S. generally accepted accounting principles (“GAAP”): gain

or loss on foreign currency transactions, stock-based compensation

expenses, and quality remediation expenses. Management believes

that “Adjusted Net Income” and “Adjusted Net Income Per Share” are

useful to investors in gauging the outcome of the key drivers of

the business performance: the ability to increase sales revenue and

our ability to increase profit margin by improving the mix of high

value products while reducing the costs over which management has

control. Management has excluded quality remediation expenses

because their inclusion may mask underlying trends in our business

performance.

Management has also excluded gains and losses on foreign

currency transactions because of the significant fluctuations that

can result from period to period as a result of market driven

factors. Stock-based compensation expenses consist of expenses for

stock options and restricted stock under the Financial Accounting

Standards Board’s Accounting Standards Codification (ASC) 718. In

calculating Adjusted Net Income and Adjusted Net Income Per Share,

STAAR excludes these expenses because they are non-cash expenses

and because of the complexity and considerable judgment involved in

calculating their values. In addition, these expenses tend to be

driven by fluctuations in the price of our stock and not by the

same factors that generally affect our other business expenses.

About STAAR Surgical

STAAR, which has been dedicated solely to ophthalmic surgery for

over 30 years, designs, develops, manufactures and markets

implantable lenses for the eye with companion delivery systems.

These lenses are intended to provide visual freedom for patients,

lessening or eliminating the reliance on glasses or contact lenses.

All of these lenses are foldable, which permits the surgeon to

insert them through a small incision. STAAR’s lens used in

refractive surgery is called an Implantable Collamer® Lens or

“ICL”, which includes the EVO Visian ICL™ product line. More than

900,000 Visian ICLs have been implanted to date. To learn more

about the ICL go to: www.discovericl.com. STAAR has approximately

400 full-time equivalent employees and markets lenses in over 75

countries. Headquartered in Monrovia, CA, the company operates

manufacturing facilities in Aliso Viejo, CA and Monrovia, CA. For

more information, please visit the Company’s website at

www.staar.com.

Safe Harbor

All statements in this press release that are not statements of

historical fact are forward-looking statements, including

statements about any of the following: any financial projections,

including those relating to the plans, strategies, and objectives

of management for 2019 or prospects for achieving such plans,

expectations for sales, revenue, or earnings, and any statements of

assumptions underlying any of the foregoing. Important factors that

could cause actual results to differ materially from those

indicated by such forward-looking statements are set forth in the

Company’s Annual Report on Form 10-K for the year ended December

29, 2017 and on the Company’s Current Report on Form 8-K on August

10, 2018, under the caption “Risk Factors,” respectively which are

on file with the Securities and Exchange Commission and available

in the “Investor Information” section of the company’s website

under the heading “SEC Filings.” We disclaim any intention or

obligation to update or revise any financial projections or

forward-looking statement due to new information or events.

These statements are based on expectations and assumptions as of

the date of this press release and are subject to numerous risks

and uncertainties, which could cause actual results to differ

materially from those described in the forward-looking statements.

The risks and uncertainties include the following: global economic

conditions; the discretion of regulatory agencies to approve or

reject existing, new or improved products, or to require additional

actions before approval, or to take enforcement action; potential

international trade disputes; and the willingness of surgeons and

patients to adopt a new or improved product and procedure. The

Visian ICL with CentraFLOW, now known as EVO Visian ICL, is not yet

approved for sale in the United States.

Consolidated Balance Sheets (in 000's)

Unaudited

December 28,

December 29,

ASSETS

2018

2017

Current assets: Cash and cash equivalents $ 103,877 $ 18,520

Accounts receivable trade, net 25,946 17,853 Inventories, net

16,704 13,310 Prepayments, deposits, and other current assets

5,045 4,207 Total current assets

151,572 53,890 Property, plant, and equipment,

net 11,451 9,776 Intangible assets, net 243 271 Goodwill 1,786

1,786 Deferred income taxes 1,278 1,242 Other assets 1,009

967 Total assets $ 167,339 $ 67,932

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Line of credit $ 3,780 $ 4,438 Accounts payable 6,524

6,033 Obligations under capital leases 1,098 1,278 Allowance for

sales returns 2,895 - Other current liabilities 13,431

7,339 Total current liabilities 27,728

19,088 Obligations under capital leases 459

531 Deferred income taxes 1,022 350 Asset retirement obligations

206 202 Deferred rent 188 172 Pension liability 5,310

4,653 Total liabilities 34,913

24,996 Stockholders' equity: Common

stock 442 414 Additional paid-in capital 289,584 204,920

Accumulated other comprehensive loss (1,320 ) (1,150 ) Accumulated

deficit (156,280 ) (161,248 ) Total stockholders'

equity 132,426 42,936 Total liabilities

and stockholders' equity $ 167,339 $ 67,932

Consolidated Statements of Operations (In 000's

except for per share data) Unaudited

Three Months Ended Twelve-Months Ended

% of

December 28,

% of

December 29,

Fav (Unfav) % of

December 28,

% of

December 29,

Fav (Unfav) Sales

2018

Sales

2017

Amount % Sales

2018

Sales

2017

Amount % Net sales 100.0 % $ 31,186 100.0 % $

24,852 $ 6,334 25.5 % 100.0 % $ 123,954 100.0 % $ 90,611 $ 33,343

36.8 % Cost of sales 26.3 % 8,194 30.1 %

7,472 (722 ) -9.7 % 26.2 % 32,444

29.1 % 26,331 (6,113 ) -23.2 %

Gross profit 73.7 % 22,992 69.9 % 17,380

5,612 32.3 % 73.8 % 91,510 70.9

% 64,280 27,230 42.4 % Selling,

general and administrative expenses: General and administrative

20.0 % 6,233 20.5 % 5,085 (1,148 ) -22.6 % 19.6 % 24,287 21.5 %

19,465 (4,822 ) -24.8 % Marketing and selling 31.6 % 9,867 31.9 %

7,929 (1,938 ) -24.4 % 31.1 % 38,600 31.3 % 28,402 (10,198 ) -35.9

% Research and development 18.3 % 5,705 22.6 %

5,626 (79 ) -1.4 % 17.8 % 22,028 22.1 %

20,044 (1,984 ) -9.9 % Total selling, general,

and administrative expenses 69.9 % 21,805 75.0 % 18,640 (3,165 )

-17.0 % 68.5 % 84,915 74.9 % 67,911 (17,004 ) -25.0 %

Operating income (loss) 3.8 % 1,187 -5.1 %

(1,260 ) 2,447 194.2 % 5.3 % 6,595 -4.0

% (3,631 ) 10,226 281.6 % Other income

(expense): Interest expense, net 0.7 % 230 -0.1 % (24 ) 254 1058.3

% 0.1 % 165 -0.1 % (112 ) 277 247.3 % Gain (loss) on foreign

currency transactions -0.9 % (291 ) 0.3 % 81 (372 ) -459.3 % -0.7 %

(836 ) 0.9 % 819 (1,655 ) -202.1 % Royalty income 0.5 % 168 0.7 %

181 (13 ) -7.2 % 0.5 % 633 0.6 % 581 52 9.0 % Other income

(expense), net 0.1 % 21 0.1 % 30

(9 ) -30.0 % 0.1 % 82 0.1 % 47

35 74.5 % Total other income (expense), net 0.4 % 128

1.0 % 268 (140 ) -52.2 % 0.0 %

44 1.5 % 1,335 (1,291 ) -96.7 %

Income (loss) before provision for income taxes 4.2 % 1,315 -4.1 %

(992 ) 2,307 232.6 % 5.3 % 6,639 -2.5 % (2,296 ) 8,935 389.2 %

Provision for income taxes 0.7 % 219 -3.4 %

(854 ) (1,073 ) -125.6 % 1.3 % 1,671

-0.2 % (157 ) (1,828 ) -1164.3 % Net income

(loss) 3.5 % $ 1,096 -0.7 % $ (138 ) $ 1,234 894.2 %

4.0 % $ 4,968 -2.3 % $ (2,139 ) $ 7,107 332.3 %

Net income (loss) per share - basic $ 0.02 $ -

$ 0.12 $ (0.05 ) Net income (loss) per share -

diluted $ 0.02 $ - $ 0.11 $ (0.05 )

Weighted average shares outstanding - basic 44,146

41,223 42,587 41,004

Weighted average shares outstanding - diluted 46,976

41,223 45,257 41,004

Consolidated Statements of Cash Flows (in

000's) Unaudited Three Months Ended

Twelve-Months Ended

December 28, 2018

December 29, 2017

December 28, 2018

December 29, 2017

Cash flows from operating activities: Net income (loss) $ 1,096 $

(138 ) $ 4,968 $ (2,139 ) Adjustments to reconcile net income

(loss) to net cash provided by (used in) operating activities:

Depreciation of property and equipment 638 789 2,430 3,133

Amortization of long-lived intangibles 8 55 34 221 Deferred income

taxes 78 (711 ) 441 (547 ) Change in net pension liability (2 ) 91

231 186 Stock-based compensation expense 1,836 976 6,762 3,161 Loss

on disposal of property and equipment 2 601 10 623 Provision for

sales returns and bad debts 13 277 905 463 Inventory provision 292

472 1,473 1,739 Changes in working capital: Accounts receivable

(2,051 ) (1,898 ) (6,040 ) (1,857 ) Inventories (569 ) (413 )

(4,194 ) 312 Prepayments, deposits and other current assets 423 700

(598 ) (64 ) Accounts payable (1,878 ) 250 243 (2,501 ) Other

current liabilities 2,459 61

6,102 123 Net cash provided by operating

activities 2,345 1,112 12,767

2,853 Cash flows from investing

activities: Acquisition of property and equipment (524 )

(77 ) (2,245 ) (1,046 ) Net cash used in

investing activities (524 ) (77 ) (2,245 )

(1,046 ) Cash flows from financing activities:

Repayment on line of credit (496 ) - (747 ) - Repayment of capital

lease obligations (511 ) (316 ) (1,907 ) (1,300 ) Net proceeds from

public offering of common stock - - 72,150 - Repurchase of employee

common stock for taxes withheld (54 ) - (54 ) (234 ) Proceeds from

vested restricted stock and exercise of stock options 615

1,695 5,197 3,971

Net cash provided by (used in) financing

activities

(446 ) 1,379 74,639 2,437

Effect of exchange rate changes on cash, cash

equivalents and restricted cash 308 (26 )

197 279 Increase in cash, cash

equivalents and restricted cash 1,683 2,388 85,358 4,523 Cash, cash

equivalents and restricted cash, at beginning of the period

102,316 16,253 18,641

14,118 Cash, cash equivalents and restricted cash, at end of

the period $ 103,999 $ 18,641 $ 103,999 $

18,641

Global Sales (in 000's)

Unaudited

Three Months Ended Twelve-Months

Ended

December 28,

December 29,

% Change

December 28,

December 29,

% Change Sales by Region

2018

2017

Fav (Unfav)

2018

2017

Fav (Unfav) North America 7.4 % $ 2,314 9.0 % $ 2,228 3.9 %

7.0 % $ 8,671 9.9 % $ 9,014 -3.8 % Europe 20.5 % 6,408 23.9 % 5,950

7.7 % 20.7 % 25,698 24.8 % 22,449 14.5 % Middle East, Africa, Latin

America 6.7 % 2,080 7.3 % 1,821 14.2 % 5.1 % 6,273 5.9 % 5,351 17.2

% Asia Pacific 65.4 % 20,384 59.8 % 14,853 37.2 %

67.2 % 83,312 59.4 % 53,797 54.9 % Total Sales 100.0

% $ 31,186 100.0 % $ 24,852 25.5 % 100.0 % $ 123,954 100.0 % $

90,611 36.8 %

Core Product Sales ICLs 84.1 % $

26,214 75.0 % $ 18,627 40.7 % 81.5 % $ 101,082

75.4

% $ 68,325 47.9 %

Other Product Sales IOLs 13.2 % 4,125 17.6

% 4,383 -5.9 % 13.1 % 16,193 19.0 % 17,258 -6.2 % Injector Parts

and Other 2.7 % 847 7.4 % 1,842 -54.0 % 5.4 %

6,679 5.6 % 5,028 32.8 % Total Other Sales 15.9 %

4,972 25.0 % 6,225 -20.1 % 18.5 % 22,872 24.6 %

22,286 2.6 % Total Sales 100.0 % $ 31,186 100.0 % $ 24,852

25.5 % 100.0 % $ 123,954 100.0 % $ 90,611 36.8 %

Reconciliation of Non-GAAP Financial Measure

(in 000's) Unaudited Three Months

Ended Twelve-Months Ended

December 28,

December 29,

December 28,

December 29,

2018

2017

2018

2017

Net income (loss) - (as reported) $ 1,096 $ (138 ) $ 4,968 $

(2,139 ) Less: Foreign currency impact 291 (81 ) 836 (819 )

Stock-based compensation expense 1,836 976 6,762 3,161 Quality

remediation expense - - -

210 Net income (loss) - (adjusted) $ 3,223 $

757 $ 12,566 $ 413 Net income (loss)

per share, basic - (as reported) $ 0.02 $ - $ 0.12 $ (0.05 )

Foreign currency impact 0.01 - 0.02 (0.02 ) Stock-based

compensation expense 0.04 0.02 0.16 0.08 Quality remediation

expense - - - 0.01

Net income (loss) per share, basic - (adjusted) $ 0.07

$ 0.02 $ 0.30 $ 0.01 Net income

(loss) per share, diluted - (as reported) $ 0.02 $ - $ 0.11 $ (0.05

) Foreign currency impact 0.01 - 0.02 (0.02 ) Stock-based

compensation expense 0.04 0.02 0.15 0.08 Quality remediation

expense - - - -

Net income (loss) per share, diluted - (adjusted) $ 0.07

$ 0.02 $ 0.28 $ 0.01 Weighted

average shares outstanding - Basic 44,146 41,223 42,587 41,004

Weighted average shares outstanding - Diluted 46,976 42,823 45,257

42,096 Note: Net income (loss) per share (adjusted), basic

and diluted, may not add due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190221005914/en/

Investors & MediaEVC GroupBrian Moore,

310-579-6199Doug Sherk, 415-652-9100

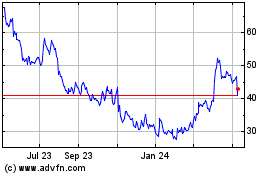

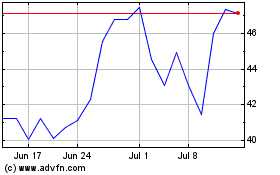

STAAR Surgical (NASDAQ:STAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

STAAR Surgical (NASDAQ:STAA)

Historical Stock Chart

From Apr 2023 to Apr 2024