By Jaewon Kang

Supermarkets are using pandemic-driven changes in shopping

behavior to accelerate the shift to e-commerce they have been

seeking but have been slow to realize in recent years.

Grocers are now devoting more of their floor space to fulfill

digital orders in response to customers' increased food consumption

at home and their growing reliance on online shopping.

Albertsons Cos., the country's second-largest grocer, is testing

the use of dozens of 9-by-12 foot temperature-controlled lockers in

select stores in Chicago and California for customers to collect

what they buy online. It is also introducing contactless payment in

all of its more than 2,200 stores.

"The principle of that is to make things easier for the

shopper," said Vivek Sankaran, chief executive of the Boise,

Idaho-based chain. He also said the pandemic has prompted the

company to make a fundamental change by prioritizing digital

investments.

While many such technology investments were under way in the

industry before the health crisis, food retailers are now making

bigger and faster bets in hopes of appealing to consumers who want

to avoid shopping in person or at least reduce the number of

visits. Online grocery sales in August were up about 74% from a

year earlier, according to data provider Nielsen.

The jump in digital sales is also creating new challenges,

however.

Industry executives say online purchases are less profitable

than those made in-store because of the extra costs associated with

fulfilling orders for customers. Grocers have to pay their own

staff to pick and package items on shoppers' behalf.

Delivering groceries to consumers is more expensive than having

people pick them up because of the labor and transportation

required, said Bill Bishop, co-founder of the consulting firm Brick

Meets Click. Compared to pickup, delivery typically adds $8 per

order to retailers' costs, he said. Lowering costs "is viewed as

the only way to move the online business to profitability," he

said.

For grocers, expanding pickup can help make that happen.

Midwest chain Hy-Vee Inc., for instance, is redesigning its

stores to handle more pickup orders, converting parts of the

customer-service area and building lanes of canopies outside its

stores. The company is also fast-tracking plans to add

self-checkout kiosks because customers are increasingly recognizing

their convenience, Chief Executive Randy Edeker said. It has added

more than 1,200 kiosks in total to about half of its stores.

Cub Foods, part of United Natural Foods Inc., hadn't previously

provided a place for collecting online purchases in parking lots

but now have four to eight slots at many locations. The Minnesota

chain is also devoting 7% to 10% of its square footage for staging

online orders, doubling the previous allocation.

Such investments allow Cub Foods to better satisfy shoppers, CEO

Mike Stigers said. "Customers want to come in and out. They know

exactly what they want," he said.

Alissa Grosso, who lives in Upper Black Eddy, Pa., has been

picking up her online orders at a nearby ShopRite since March. The

process has become smoother thanks to more parking space and a new

option to text store employees upon arrival.

"We've noticed they have improved since this started," said Ms.

Grosso, 44, referring to the coming of the pandemic.

In addition to building up their online services, grocers are

making other adjustments throughout the stores. Many are

reassessing inventory and expanding sections that have drawn more

purchases in recent months, including the frozen and meat

sections.

Anthony Hucker, chief executive of Southeastern Grocers Inc.,

said the retailer plans to increase the amount of square footage

for seafood, meat and produce in the new stores slated to open

later this year and early next year. The size of the sections will

vary depending on the location. He said there is more demand for

fresh items as consumers cook more at home.

Phoenix-based Sprouts Farmers Market Inc., which operates more

than 340 stores, said last month that it plans to give more space

to frozen, baking, cooking and meat products that have been popular

in recent months.

Others are allocating more shelf space for nonfood items and

larger sizes of groceries in high demand. Associated Food Stores

recently directed all of its stores to display personal protective

equipment at the end of aisles, said Darin Peirce, vice president

of retail operations for the cooperative.

SpartanNash Co. plans to double space for quart-sized yogurt

because it has been selling well among shoppers seeking larger

packages, said Thomas Swanson, executive vice president at the

company. The owner of Family Fares and Martin's chains is also

offering more space for larger-sized spirits.

"We're repurposing all the space we can," Mr. Swanson said.

Write to Jaewon Kang at jaewon.kang@wsj.com

(END) Dow Jones Newswires

November 04, 2020 15:08 ET (20:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

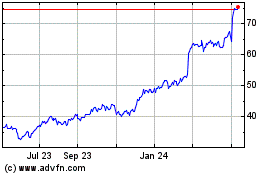

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

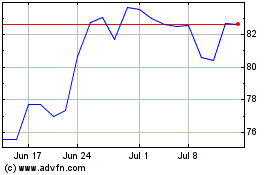

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Apr 2023 to Apr 2024