Current Report Filing (8-k)

April 28 2021 - 4:38PM

Edgar (US Regulatory)

0000764038false00007640382020-10-062020-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2021

SOUTH STATE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

South Carolina

(State or Other Jurisdiction of

Incorporation)

|

001-12669

(Commission File Number)

|

57-0799315

(IRS Employer

Identification No.)

|

|

|

|

|

|

1101 First Street South, Suite 202

Winter Haven, FL

(Address of principal executive offices)

|

|

33880

(Zip Code)

|

(863) 293-4710

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐- Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐- Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐- Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐- Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class: Common Stock

|

Trading Symbol

|

Name of each exchange on which registered

|

|

$2.50 par value

|

SSB

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 Compensatory Arrangements of Certain Officers.

On April 28, 2021, the Board of Directors (the “Board”) of SouthState Corporation (the “Company”) approved a new Annual Incentive Plan (the “Incentive Plan”). Under the Incentive Plan, each year, the Compensation Committee of the Board (the “Committee”) expects to select eligible senior executive officers who will participate in the Incentive Plan and will establish a dollar amount or a percentage of Base Salary for each such Participant representing the amount of the Incentive Payment the participant will receive if the threshold, target or maximum levels of the Performance Measures are achieved. The Committee also expects to establish one or more Performance Measures and a formula to determine the amount of the award that will be earned at different levels of achievement of the Performance Measures.

The Incentive Plan is administered by the Committee, which has full authority, among other things, to designate participants; construe and interpret the plan; waive, prospectively or retroactively, any conditions of or rights of the Company under any award; increase or decrease the payout due under any award; adjust any Performance Measure to prevent dilution or enlargement of an award as a result of extraordinary events or circumstances or to exclude the effects of extraordinary, unusual, or non-recurring items; and make all other determinations and take all other actions necessary under the Incentive Plan. Under the Incentive Plan, except as may otherwise be approved by the Committee or as specifically set forth in a written employment agreement between a participant and the Company, no incentive payment will be awarded under the Incentive Plan if the participant is not employed in good standing on the date payment is made for a particular performance period.

The foregoing description of the Incentive Plan does not purport to be complete and is qualified in its entirety by reference to the Incentive Plan, which is incorporated herein by reference into this Item 5.02 as Exhibit 10.1.

ITEM 5.07 Submission of Matters to a Vote of Security Holders.

The Annual Meeting of Shareholders of the Company was held on April 28, 2021. Proxies for the meeting were solicited pursuant to Regulation 14A of the Securities Exchange Act of 1934, and there was no solicitation in opposition to management’s solicitations. A total of 71,032,735 shares of the Company’s common stock were entitled to vote as of February 26, 2021, the record date for the Annual Meeting. There were 63,291,177 shares present in person or by proxy at the Annual Meeting, at which the shareholders were asked to vote on three proposals. Set forth below are the matters acted upon by the shareholders at the Annual Meeting, and the final voting results of each such proposal.

Proposal No. 1: Election of Directors. The following directors were elected to serve until the annual meeting of shareholders in 2022 or until their successors are duly designated and qualified. Each nominee was an incumbent director, no other person was nominated, and each nominee was elected. The number of votes cast was approximately as follows:

|

|

|

|

|

|

Nominees for Director

|

Votes For

|

Abstentions

|

Broker Non-Votes

|

|

John C. Corbett

|

54,616,171

|

1,126,629

|

7,548,377

|

|

Jean E. Davis

|

53,621,707

|

2,121,093

|

7,548,377

|

|

Martin B. Davis

|

55,038,912

|

703,888

|

7,548,377

|

|

Robert H. Demere, Jr.

|

55,110,231

|

632,569

|

7,548,377

|

|

Cynthia A. Hartley

|

53,546,506

|

2,196,294

|

7,548,377

|

|

Robert R. Hill, Jr.

|

54,225,241

|

1,517,559

|

7,548,377

|

|

John H. Holcomb III

|

53,190,009

|

2,552,791

|

7,548,377

|

|

Robert R. Horger

|

53,865,013

|

1,877,787

|

7,548,377

|

|

Charles W. McPherson

|

54,849,080

|

893,720

|

7,548,377

|

|

G. Ruffner Page, Jr.

|

55,194,410

|

548,390

|

7,548,377

|

|

Ernest S. Pinner

|

54,406,150

|

1,336,650

|

7,548,377

|

|

John C. Pollok

|

54,207,619

|

1,535,181

|

7,548,377

|

|

William Knox Pou, Jr.

|

54,826,929

|

915,871

|

7,548,377

|

|

David G. Salyers

|

54,863,386

|

879,414

|

7,548,377

|

|

Joshua A. Snively

|

54,881,887

|

860,913

|

7,548,377

|

|

Kevin P. Walker

|

55,029,643

|

713,157

|

7,548,377

|

Proposal 2: Compensation of Named Executive Officers. The shareholders voted to approve the non-binding advisory proposal on the compensation of the Company’s Named Executive Officers, as disclosed in the proxy statement. The results of the vote were as follows:

|

|

|

|

Voting For

|

45,433,467

|

|

Voting Against

|

10,070,258

|

|

Abstain from Voting

|

239,075

|

|

Non-Votes

|

7,548,377

|

|

|

63,291,177

|

Proposal 3: Appointment of Independent Registered Public Accounting Firm. The shareholders voted to ratify, as an advisory, non-binding vote, the appointment of Dixon Hughes Goodman LLP, Certified Public Accountants, as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021. The results of the vote were as follows:

|

|

|

|

Voting For

|

62,376,837

|

|

Voting Against

|

798,149

|

|

Abstain from Voting

|

116,191

|

|

Non-Votes

|

-

|

|

|

63,291,177

|

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

SOUTH STATE CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ JOHN C. CORBETT

|

|

|

|

JOHN C. CORBETT

|

|

|

|

Chief Executive Officer

|

Dated: April 28, 2021

SouthState (NASDAQ:SSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

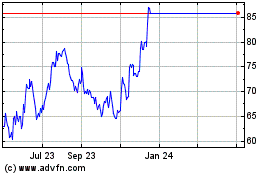

SouthState (NASDAQ:SSB)

Historical Stock Chart

From Apr 2023 to Apr 2024