Sonos Investor Event Provides First Comprehensive Overview for Investors Since its IPO & Introduces Fiscal Year 2024 Financia...

March 09 2021 - 4:05PM

Business Wire

Company unveils Sonos Roam, an ultra-portable

smart speaker perfect for wherever life takes you

Sonos, Inc. (NASDAQ: SONO) announced that it is hosting a

virtual investor event today at 4:00 pm EST (1:00 pm PST) to

provide a comprehensive update on its business and financial

outlook for fiscal year 2024. The event is accessible at the Sonos

Investor Relations website.

The company is also introducing Sonos Roam™, the ultra-portable

smart speaker built to deliver great sound at home and on any

adventure. fully connected to your Sonos system on WiFi at home and

automatically switching to Bluetooth when you’re on the go, Roam’s

powerful, adaptable sound defies expectations for a speaker of its

size. Roam is available starting April 20 for $169 MSRP and

customers can pre-order today on sonos.com. For full product

details visit the Sonos Newsroom.

Highlights

- Sonos is just getting started. The company believes it’s

just scratching the surface of its long-term opportunity. Sonos was

in 11 million homes at the end of fiscal year 2020, representing

only approximately 9% of the 116 million affluent homes in its

existing markets1. On the revenue side, Sonos accounted for

approximately 7% of the total spend in the $18 billion premium home

audio market in 20202, and expects to expand into the broader $89

billion global audio opportunity over the long-term.

- Sonos has a unique model that serves customers and enables

it to continue building a sustainable, profitable business.

Sonos believes the power of its business model is that customers

can start with one product and expand to more over time, and its

customers have proven they do just that. The company has increased

its efficiency in attracting new customers, and existing and new

customers continue to add additional Sonos products over time as

they build out their system. Customers who purchased products in

2005, the year Sonos shipped its first product, have continued to

return through 2020 to add additional ones, illustrating the power

and longevity of the company’s model.

- Sonos plans to seize this opportunity by focusing on three

key strategic initiatives.

- Expanding its Brand

- Expanding its Offerings

- Driving Operational Excellence.

Fiscal 2024 Targets

Today, Sonos is sharing its financial targets for fiscal year

2024 which are ahead of long-term targets provided in 2018 in

conjunction with its initial public offering. Despite the

uncertainty that continues to exist in the broader macro

environment, Sonos believes it can deliver the following financial

targets in fiscal year 2024:

- Revenue of $2.25 billion, representing a 13% CAGR based on the

midpoint of its fiscal 2021 guidance and ahead of its prior

long-term target of 10% CAGR.

- Gross margin in the range of 45% to 47%, despite product and

channel mix shifts the company expects to achieve this range in

each fiscal year. This gross margin range is ahead of the company’s

prior long-term gross margin target of 42% to 44%.

- Adjusted EBITDA margin in the range of 15% to 18%, driven by

growth and leverage of existing operating expense, and ahead of the

company’s prior long-term adjusted EBITDA margin target of 13% to

15%.

Additional Event Details

In addition to CEO Patrick Spence, Sonos investor event speakers

will include:

- Brittany Bagley, Chief Financial Officer

- Eddie Lazarus, Chief Legal Officer

- Ted Dworkin, SVP, Product Management & Customer

Experience

- Pete Pedersen, VP, Marketing

The event will begin at 4:00 pm EST and the video webcast and

question and answer session will be available online at the Sonos

Investor Relations website. A replay and the slide presentation

will also be available at the Sonos Investor Relations website

following the conclusion of the event.

1 “Affluent homes” comprise households with disposable income as

defined by the OECD of $75,000+ USD. Existing markets Core Markets

include the United States, Canada, Australia, United Kingdom,

Germany, Netherlands, Sweden, France, Switzerland, Norway, Belgium,

Italy, Austria, Spain, Ireland, Finland and Poland. Source:

Euromonitor.

2 “Premium” defined as $100+ wireless speakers, $200+ soundbars,

$300+ Hi-Fi systems, $250+ in-wall/in-ceiling speakers, $250+

bookshelf speakers (pairs), and all AV receivers, Floor standing

speakers, home theater speakers and home theater in a box products

and Hi-Fi separates. Source: Futuresource.

Use of Non-GAAP Measures

We have provided in this press release financial information

that has not been prepared in accordance with generally accepted

accounting principles (“U.S. GAAP”), including adjusted EBITDA

margin. We define adjusted EBITDA as net income adjusted to exclude

the impact of depreciation, stock-based compensation expense,

interest income, interest expense, other income (expense), income

taxes and other items that we do not consider representative of our

underlying operating performance. We define adjusted EBITDA margin

as adjusted EBITDA divided by revenue. We use non-GAAP financial

measures to evaluate our operating performance and trends and make

planning decisions. We believe that non-GAAP financial measures

help identify underlying trends in our business that could

otherwise be masked by the effect of the expenses and other items

that we exclude in these non-GAAP financial measures. Accordingly,

we believe that non-GAAP financial measures provide useful

information to investors and others in understanding and evaluating

our operating results, enhancing the overall understanding of our

past performance and future prospects, and allowing for greater

transparency with respect to a key financial metric used by our

management in its financial and operational decision-making.

Non-GAAP financial measures should not be considered in isolation

of, or as an alternative to, measures prepared in accordance with

U.S. GAAP. This non-GAAP financial measure is not based on any

standardized methodology prescribed by U.S. GAAP and is not

necessarily comparable to similarly titled measures presented by

other companies. We do not provide a reconciliation of

forward-looking non-GAAP financial measures to their comparable

GAAP financial measures because we cannot do so without

unreasonable effort due to unavailability of information needed to

calculate reconciling items and due to the variability, complexity

and limited visibility of the adjusting items that would be

excluded from the non-GAAP financial measures in future periods.

When planning, forecasting and analyzing future periods, we do so

primarily on a non-GAAP basis without preparing a GAAP analysis as

that would require estimates for certain items such as stock-based

compensation, which is inherently difficult to predict with

reasonable accuracy. Stock-based compensation expense is difficult

to estimate because it depends on our future hiring and retention

needs, as well as the future fair market value of our common stock,

all of which are difficult to predict and subject to constant

change. In addition, for purposes of setting annual guidance, it

would be difficult to quantify stock-based compensation expense for

the year with reasonable accuracy in the current quarter. As a

result, we do not believe that a GAAP reconciliation would provide

meaningful supplemental information about our outlook.

Forward Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties. These forward-looking statements

include statements regarding our outlook for the fiscal year ended

September 28, 2024, our long-term focus, financial, growth and

business strategies and opportunities, growth metrics and targets,

our business model, new products and services, our expectations

about our potential and existing markets and customers and other

factors affecting variability in our financial results. These

forward-looking statements are only predictions and may differ

materially from actual results due to a variety of factors,

including, but not limited to the duration and impact of the

COVID-19 pandemic and related mitigation efforts on our industry

and our supply chain; changes in general economic or market

conditions that could affect consumer income and overall consumer

spending; our ability to successfully introduce new products and

services and maintain or expand the success of our existing

products; the success of our financial, growth and business

strategies;; and the other risk factors set forth under the caption

“Risk Factors” in our Annual Report on Form 10-Q for the quarter

ended January 2, 2021 and our other filings filed with the

Securities and Exchange Commission (the “SEC”), copies of which are

available free of charge at the SEC’s website at www.sec.gov or

upon request from our investor relations department. All

forward-looking statements herein reflect our opinions only as of

the date of this press release, and we undertake no obligation, and

expressly disclaim any obligation, to update forward-looking

statements herein in light of new information or future events.

Sonos and Sonos product names are trademarks or registered

trademarks of Sonos, Inc. All other product names and services may

be trademarks or service marks of their respective owners.

About Sonos

Sonos (Nasdaq: SONO) is one of the world’s leading sound

experience brands. As the inventor of multi-room wireless home

audio, Sonos innovation helps the world listen better by giving

people access to the content they love and allowing them to control

it however they choose. Known for delivering an unparalleled sound

experience, thoughtful home design aesthetic, simplicity of use and

an open platform, Sonos makes the breadth of audio content

available to anyone. Sonos is headquartered in Santa Barbara,

California. Learn more at www.sonos.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210309005674/en/

Investor Contact Cammeron McLaughlin IR@sonos.com

Press Contact Tom Lodge PR@sonos.com

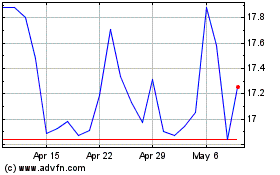

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Mar 2024 to Apr 2024

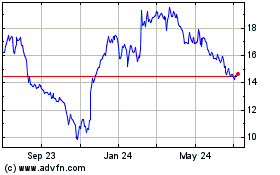

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Apr 2023 to Apr 2024