Current Report Filing (8-k)

August 28 2020 - 4:38PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): August 28, 2020

Commission

File No. 000-16929

Soligenix,

Inc.

(Exact

name of small business issuer as specified in its charter)

|

DELAWARE

|

|

41-1505029

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification Number)

|

|

|

|

|

29

Emmons Drive,

Suite B-10

Princeton, NJ

|

|

08540

|

(Address

of principal

executive offices)

|

|

(Zip

Code)

|

|

(609)

538-8200

|

|

(Issuer’s

telephone number, including area code)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $.001 per share

|

|

SNGX

|

|

The

Nasdaq Capital Market

|

|

Common

Stock Purchase Warrants

|

|

SNGXW

|

|

The

Nasdaq Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item

1.01.

|

Entry

into a Material Definitive Agreement.

|

To

the extent applicable, the information in Item 8.01 of this Current Report on Form 8-K is incorporated by reference into this

Item 1.01.

As

previously disclosed, on August 11, 2017, Soligenix, Inc. (the “Company”) and FBR Capital Markets & Co. (now known

as B. Riley FBR, Inc.) (“FBR”) entered into an At Market Issuance Sales Agreement (the “Original Sales Agreement”),

pursuant to which the Company may sell from time to time, at its option, shares of its common stock through FBR, as sales agent.

On August 28, 2020, the Company and FBR entered into Amendment No. 1 to At Market Issuance Sales Agreement (the “Amendment”)

to amend the Original Sales Agreement (as amended, the “Sales Agreement”) (a) to update the reference to the registration

statement pursuant to which the shares of common stock may be sold and (b) to extend the expiration date of the Original Sales

Agreement to December 31, 2023.

Sales

of common stock made pursuant to the Sales Agreement, if any, will be made in “at the market offerings” as defined

in Rule 415 under the Securities Act of 1933, as amended, on or through The NASDAQ Capital Market (“Nasdaq”), pursuant

to the Company’s effective shelf registration statement on Form S-3 (File No. 333-239928) filed on August 14, 2020 with

the U.S. Securities and Exchange Commission (the “SEC”), the base prospectus filed as part of such registration statement,

and the prospectus supplement dated August 28, 2020 filed by the Company with the SEC. In accordance with the terms of the Sales

Agreement, under the prospectus supplement dated August 28, 2020, the Company may offer and sell shares of the Company’s

common stock having an aggregate offering price of up to $20 million, from time to time.

On April 10, 2020, the Company filed a prospectus

supplement for sale of up to $10.2 million of shares of common stock pursuant to the Original Sales Agreement. No additional shares

will be offered or sold pursuant to the prospectus supplement dated April 10, 2020.

This

Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any security nor shall

there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state.

Additional

information with respect to the Sales Agreement is available under “Item 5 – Other Information” in the Company’s

Quarterly Report on Form 10-Q filed on August 11, 2017 and is incorporated herein by reference. The description of the Sales Agreement

presented here does not purport to be complete and is qualified in its entirety by reference to the Original Sales Agreement which

is filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on August 11, 2017 and the Amendment which

is filed herewith as Exhibit 10.2. The opinion of the Company’s counsel regarding the validity of the shares that will be

issued pursuant to the Sales Agreement under the prospectus supplement filed on August 28, 2020 is filed herewith as Exhibit 5.1.

This

report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve

risks and uncertainties and reflect the Company’s judgment as of the date of this report. Such forward-looking statements

include statements regarding the ability to sell shares and raise additional funds pursuant to the Sales Agreement. Such forward-looking

statements involve risks and uncertainties that could cause actual results to differ materially from predicted or expected results.

The inclusion of forward-looking statements should not be regarded as a representation by the Company that any of these results

will be achieved. Actual results may differ from those set forth in this report due to the risks and uncertainties associated

with market conditions and the satisfaction of pre-sale conditions under the Sales Agreement, as well as risks and uncertainties

inherent in the Company’s business, including those described in the Company’s periodic filings with the SEC. These

forward-looking statements are made only as the date hereof, and, except as required by law, the Company undertakes no obligation

to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking

statements are qualified in their entirety by this cautionary statement.

Item 9.01. Financial

Statements and Exhibits.

(d)

Exhibits.

|

|

(1)

|

Incorporated

by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on August 11, 2017.

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Soligenix,

Inc.

|

|

August

28, 2020

|

By:

|

/s/

Christopher J. Schaber

|

|

|

|

Christopher

J. Schaber, Ph.D.

President

and Chief Executive Officer

(Principal

Executive Officer)

|

3

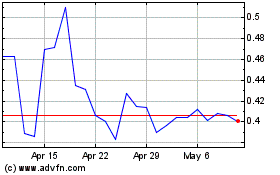

Soligenix (NASDAQ:SNGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Soligenix (NASDAQ:SNGX)

Historical Stock Chart

From Apr 2023 to Apr 2024