Some Fund Managers See Opportunities for Investors From Trade Dispute -- Journal Report

June 09 2019 - 10:31PM

Dow Jones News

By Tanzeel Akhtar

The U.S.-China trade dispute and American sanctions on Huawei

Technologies Co. are affecting share prices around the world. So,

should fund investors look for opportunities to profit from the

situation?

Some fund managers think they can provide those opportunities by

picking up shares that have been beaten down to more enticing

prices. Ben Phillips, chief investment officer of EventShares, a

New York-based ETF sponsor and investment manager, says the firm

has bought shares of four semiconductor makers whose stocks have

been hit by U.S.-China tensions: Xilinx Inc., Skyworks Solutions

Inc., NXP Semiconductors NV and Broadcom Inc. All four stocks were

"previously at what we viewed as expensive valuations," he

says.

Kip Meadows, chief executive of Nottingham, a

fund-administration firm based in Rocky Mount, N.C., says the trade

tensions have created opportunities for companies around the world

-- and for investors to benefit if those companies can expand their

businesses.

"The largest potential impact may be manufacturing shifts back

to the U.S., or more probably to other Asian economies like

Vietnam," Mr. Meadows says. "The U.S. demand for electronics,

various forms of industrial machinery, furniture and the low end of

our economy -- toys, plastics, games -- has been served by China.

Those supplies will move elsewhere. The savvy investor can

determine where."

Others are more skeptical of investors' chances to profit from

trade tensions. "I think that all the brouhaha around so-called

trade wars presents investors with an opportunity to remind

themselves just how counterproductive tinkering with their

portfolios in response to the headline risk du jour can be," says

Ben Johnson, director of fund research at Morningstar Inc.

The idea that investors can exploit any opportunities that might

arise assumes that they know how the markets will respond and how

current tensions will be resolved, and that market prices don't

already reflect any of what will happen.

"Finding an ETF that might benefit is more difficult still, and

the ones that could fit the bill -- those offering exposure to

semiconductor, industrial and rare-earths equities -- are very

narrow and volatile," Mr. Johnson says.

Staying out of the dispute might be a better bet, says Todd

Rosenbluth, senior director of ETF and mutual-fund research at

CFRA: "U.S.-centric sectors like real estate and utilities are good

places to invest to avoid the trade-dispute-related volatility and

earn appealing dividend income as well." He says Vanguard Real

Estate ETF (VNQ) and Utilities Select Sector SPDR ETF (XLU) "offer

diversified, low-cost exposure to these sectors."

Ms. Akhtar is a writer in London. She can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

June 09, 2019 22:16 ET (02:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

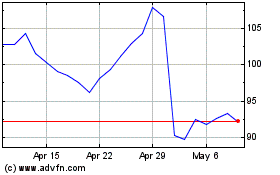

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

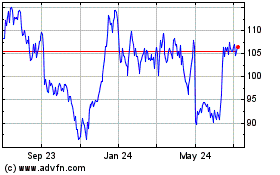

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Apr 2023 to Apr 2024