Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 27 2021 - 5:14PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of: October 2021 (Report No. 5)

Commission

file number: 001-39557

SIYATA

MOBILE INC.

(Translation

of registrant’s name into English)

2200

- 885 West Georgia Street

Vancouver,

BC V6C 3E8

514-500-1181

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(1):_____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(7):_____

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

On October 27, 2021, Siyata Mobile Inc. (the “Company”)

entered into a securities purchase agreement relating to the purchase and sale of a senior secured convertible note (the “Note”)

for gross proceeds of US$6,000,000 (the “Purchase Agreement”) with Lind Global Partners II, LP, an investment fund managed

by The Lind Partners, a New York based institutional fund manager (together “Lind”). Proceeds are expected within ten (10)

days of the execution of the Purchase Agreement, subject to customary closing conditions, and such proceeds are intended to be used to

repay and terminate existing convertible notes, as well as to pay certain fees and costs associated with the transaction.

The Purchase Agreement provides for, among other things,

the issuance of a US$7,200,000 Note with a 24-month maturity, 0% annual interest rate, and a fixed conversion price of US$10.00 per share

(“Conversion Price”) of the Company’s common shares (“Common Shares”). The Company is required to make principal

payments in 18 equal monthly installments commencing 180 days after funding (“Repayment”). At the discretion of the Company,

the Repayments can be made in: (i) cash; (ii) Common Shares (after Common Shares are registered) (the “Repayment Shares”);

or a combination of both. Repayment Shares will be priced at 90% of the average of the five lowest daily VWAPs during the 20 trading days

before the issuance of the Common Shares (the “Repayment Price”). The Company will have the right to buy-back the outstanding

face value of the Note at any time with no penalty (“Buy-Back Right”). Should the Company exercise its Buy-Back Right, Lind

will have the option to convert up to 25% of the face value of the Note at the lesser of the Conversion Price or Repayment Price. Additionally,

the Note ranks senior to other Company debt, excluding certain debt facilities, and is secured over Company assets, as more fully detailed

in the Purchase Agreement and Note. Further, the Purchase Agreement provides that Lind will also receive a common shares purchase warrant

to purchase up to 2,142,857 shares of the Company’s Common Shares (“Warrant”). The Warrant may be exercisable with cash

payment for 60 months with an exercise price of US$4.00 per Common Share and may be exercised on a cashless basis in the event that a

registration statement covering the underlying Common Shares is not deemed effective. Both the Note and the Warrant contain certain anti-dilution

protection in certain circumstances. The Company is obligated to file a registration statement covering the Common Shares underlying the

Note and Warrant within forty five (45) days of Closing.

Concurrently

with the execution of the Purchase Agreement, the Company, its subsidiaries and Lind entered into certain security agreements and guarantees

as more fully detailed in the Purchase Agreement.

The

Purchase Agreement contains customary representations and warranties of the Company and Lind. In addition, the Note contains restrictive

covenants and event of default provisions that are customary for transactions of this type.

The

representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of such agreement and as of

specific dates, were solely for the benefit of the parties to the Purchase Agreement, and may be subject to limitations agreed upon by

the contracting parties. Accordingly, the Purchase Agreement is incorporated herein by reference only to provide information regarding

the terms of the Purchase Agreement, and not to provide any other factual information regarding the Company or its business, and should

be read in conjunction with the disclosures in the Company's periodic reports and other filings with the Securities and Exchange Commission

(the "SEC"). The foregoing summaries of the Purchase Agreement, the Note and Warrant do not purport to be complete and are

qualified in their entirety by reference to the copies of the Warrant, Purchase Agreement and Note filed herewith as Exhibits 4.1, 10.1

and 10.2, respectively.

Additionally,

the Company issued a press release on October 27, 2021, titled “Siyata Mobile Enters into an Agreement for a US$6,000,000 Investment

from The Lind Partners.” The press release is filed herewith as Exhibit 99.1

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

SIYATA

MOBILE INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/

Marc Seelenfreund

|

|

|

Name:

|

Marc

Seelenfreund

|

|

|

Title:

|

Chief

Executive Officer

|

Date:

October 27, 2021

2

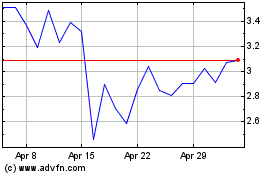

Siyata Mobile (NASDAQ:SYTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

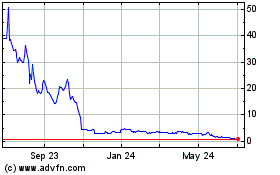

Siyata Mobile (NASDAQ:SYTA)

Historical Stock Chart

From Apr 2023 to Apr 2024