Current Report Filing (8-k)

August 07 2019 - 4:26PM

Edgar (US Regulatory)

0001038074

false

0001038074

2019-08-06

2019-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

August 7, 2019

SILICON LABORATORIES INC.

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

|

000-29823

|

|

74-2793174

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

400 West Cesar Chavez

,

Austin

,

TX

|

|

78701

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code:

(

512

)

416-8500

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value

|

|

SLAB

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth

company

¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Exchange Act of

1934.

¨

Item 1.01. Entry into a Material Definitive Agreement

On August 7, 2019, Silicon Laboratories Inc. (the “Company”)

and certain of its domestic subsidiaries (the “Guarantors”) entered into the Third Amendment to Credit Agreement (the

“Third Credit Agreement Amendment”) with Wells Fargo Bank, National Association (“Wells Fargo”), as administrative

agent, and a syndicate of lenders. The Third Credit Agreement Amendment amends the Company’s original credit agreement (as

amended prior to the Third Amendment, the “Original Credit Agreement” and, as amended by the Third Credit Agreement

Amendment, the “Amended Credit Agreement”) with Wells Fargo (as successor to Bank of America, N.A.), as administrative

agent, the Guarantors party thereto and syndicate of lenders party thereto, in order to, among other things, increase the revolving

credit facility (the “Revolving Credit Facility”) provided for therein to $400 million and extend the maturity

date of such facility to five years from the closing date.

Pursuant to the Amended Credit Agreement, the Company has an

option to incur term loans under one or more new term loan facilities (each, an “Incremental Term Loan”) and/or to

increase the Revolving Credit Facility (each increase, a “Revolving Facility Increase”), subject to certain conditions

and provided that the aggregate principal amount of Incremental Term Loans and Revolving Facility Increases available to be incurred

shall be limited to (i) the greater of $250 million and 100% of Consolidated EBITDA (as defined in the Amended Credit Agreement)

for the most recently completed four fiscal quarters for which financial statements have been delivered under the Amended Credit

Agreement plus (ii) the maximum amount of Incremental Term Loans/Revolving Facility Increases that could be incurred without causing

the Secured Leverage Ratio (as defined in the Amended Credit Agreement) to exceed 3.25 to 1.00 at the time of and after giving

effect to the incurrence thereof (assuming any Revolving Facility Increase is fully funded). The calculation of such cap with respect

to any Incremental Term Loan incurred in connection with a Limited Condition Acquisition (as defined in the Amended Credit Agreement)

shall be determined, at the option of the Company, on the date the definitive agreements for such Limited Condition Acquisition

are entered into.

The Revolving Credit Facility, other than swingline loans, will

bear interest at the Eurodollar rate plus an applicable margin or, at the option of the Company, the base rate (defined as the

highest of the Wells Fargo prime rate, the Federal Funds rate plus 0.50% and the Eurodollar Base Rate plus 1.00%) plus an applicable

margin. Swingline loans accrue interest at a per annum rate based on the base rate plus the applicable margin for base rate loans.

The applicable margins for the Eurodollar rate loans range from 1.00% to 1.75% and for base rate loans range from 0.00% to 0.75%,

depending in each case, on the consolidated leverage ratio as defined in the Amended Credit Agreement.

The Amended Credit Agreement contains various conditions, covenants

and representations with which the Company must be in compliance in order to borrow funds and to avoid an event of default, including

financial covenants that the Company must maintain a consolidated leverage ratio (defined as a ratio of Consolidated Funded Indebtedness

(as defined in the Amended Credit Agreement) to Consolidated EBITDA) of no more than 4.25 to 1.00 (which, at the election of the

Borrower following the consummation of a permitted acquisition with total consideration in an aggregate amount greater than or

equal to $100,000,000, shall be increased to 4.75 to 1.00 for the next four quarterly test dates); a Secured Leverage Ratio (as

defined in the Amended Credit Agreement) of no more than 3.50 to 1.00; and a minimum Consolidated Interest Coverage Ratio (as defined

in the Amended Credit Agreement) of no less than 2.5 to 1.00. The occurrence of an event of default could result in the acceleration

of all outstanding obligations under the Amended Credit Agreement as well as other remedies as defined therein. The Company’s

obligations under the Amended Credit Agreement are guaranteed by the Guarantors and are secured by a security interest in substantially

all assets of the Company and the Guarantors.

The foregoing descriptions are subject to, and qualified in

their entirety by, the Amended Credit Agreement. The Amended Credit Agreement is attached hereto as Exhibit 10.1 and

the terms thereof are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report

on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SILICON LABORATORIES INC.

|

|

|

|

|

|

|

|

|

|

August 7, 2019

|

|

/s/ John C. Hollister

|

|

Date

|

|

John C. Hollister

Senior Vice President and

Chief Financial Officer

(Principal Financial Officer)

|

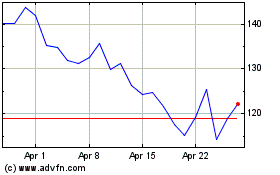

Silicon Labs (NASDAQ:SLAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Silicon Labs (NASDAQ:SLAB)

Historical Stock Chart

From Apr 2023 to Apr 2024