SIGMATRON INTERNATIONAL, INC. REPORTS THIRD QUARTER FINANCIAL RESULTS FOR FISCAL 2020

March 11 2020 - 9:00AM

SigmaTron International, Inc. (NASDAQ: SGMA), an electronic

manufacturing services company, today reported revenues and

earnings for the third quarter ended January 31, 2020.

Revenues decreased to $67.4 million for the third quarter of

fiscal 2020 from $68.9 million for the same quarter in the prior

year. Net loss for the quarter was $217,039 compared to a net

loss of $595,526 for the same period in the prior year. Basic

and diluted loss per share were each $0.05 for the quarter ended

January 31, 2020, compared to basic and diluted loss per share each

of $0.14 for the same quarter in fiscal 2019.

For the nine months ended January 31, 2020, revenues decreased

to $216.3 million compared to $217.3 million for the same period in

the prior year. Net income for the nine month period ended

January 31, 2020 was $805,169 compared to net loss of $1,846,074

for the same period in the prior year. Basic and diluted

earnings per share for the nine months ended January 31, 2020, were

each $0.19, compared to basic and diluted loss per share each of

$0.44 for the nine months ended January 31, 2019.

Commenting on SigmaTron’s third quarter, fiscal 2020 results,

Gary R. Fairhead, President, Chief Executive Officer and Chairman

of the Board, said “Unfortunately, I am reporting disappointing

results for the third quarter of fiscal 2020. We had a modest

pre-tax loss for the quarter, directly tied to lower sales than

projected. The third quarter of our fiscal year is

historically our weakest quarter due to the holiday period, and

this year the Lunar New Year in Asia fell in the third quarter as

well. While sales were lower than last year’s third quarter,

we were able to reduce the loss for the period and still remain

profitable for the first three quarters of fiscal 2020. Gross

profit increased by almost 1% for the nine months ended January 31,

2020 compared to the previous year.

“As mentioned in our second quarter press release, we were not

optimistic regarding the third quarter results. Exactly as we

expected we had weak sales in November and December which started

to rebound in January. In addition to the holiday period

impacting revenue and results, customers were managing year-end

inventory levels which led to the lower revenue than expected.

“Heading into the fourth quarter, our backlog was strong and

revenue was ramping and all of a sudden the world was introduced to

the Novel Coronavirus. There is no doubt that this will

negatively affect our fourth quarter but to what extent remains to

be seen. On the manufacturing level, our China plant was

delayed by the government in terms of reopening after the Lunar New

Year holiday. As of the end of February, we are up to 60% of

our direct labor headcount before the holiday and it has steadily

increased. If that wasn’t bad enough, we will now be facing

disruptions in the supply chain, as our supply base returns to work

with smaller workforces due to the Coronavirus outbreak.

Through the end of February, the disruptions were manageable, but

we are being told de-commits from suppliers may increase in the

weeks ahead. We have little doubt that is accurate.

With that said, the customer backlog remains strong and we believe

that once the Coronavirus situation is under control business will

be strong.

“We have continued to successfully reduce inventory and increase

our availability under our line of credit. That will help us

going forward. We also have several new customers ramping

their business with us. The primary negative at this time is

the uncertainty surrounding our China operation and supply

chain. Hopefully, it will be under control soon and will

allow us to continue in a positive direction.”

Headquartered in Elk Grove Village, IL, SigmaTron International,

Inc. is an electronic manufacturing services company that provides

printed circuit board assemblies and completely assembled

electronic products. SigmaTron International, Inc. operates

manufacturing facilities in Elk Grove Village, Illinois; Acuna,

Chihuahua, and Tijuana Mexico; Union City, California; Suzhou,

China, and Ho Chi Minh City, Vietnam. SigmaTron

International, Inc. maintains engineering and materials sourcing

offices in Elgin, Illinois and Taipei, Taiwan.

Note: This press release contains

forward-looking statements. Words such as “continue,”

“anticipate,” “will,” “expect,” “believe,” “plan,” and similar

expressions identify forward-looking statements. These

forward-looking statements are based on the current expectations of

the Company. Because these forward-looking statements involve

risks and uncertainties, the Company’s plans, actions and actual

results could differ materially. Such statements should be

evaluated in the context of the direct and indirect risks and

uncertainties inherent in the Company’s business including, but not

necessarily limited to, the Company’s continued dependence on

certain significant customers; the continued market acceptance of

products and services offered by the Company and its customers;

pricing pressures from the Company’s customers, suppliers and the

market; the activities of competitors, some of which may have

greater financial or other resources than the Company; the

variability of the Company’s operating results; the results of

long-lived assets impairment testing; the collection of aged

account receivables; the variability of the Company’s customers’

requirements; the availability and cost of necessary components and

materials; the ability of the Company and its customers to keep

current with technological changes within its industries;

regulatory compliance, including conflict minerals; the continued

availability and sufficiency of the Company’s credit arrangements;

the ability to meet the Company’s financial covenant; changes in

U.S., Mexican, Chinese, Vietnamese or Taiwanese regulations

affecting the Company’s business; the turmoil in the global economy

and financial markets; the spread of COVID-19 (commonly known as

“Coronavirus”) which has threatened the Company’s financial

stability by causing a decrease in consumer spending, caused a

disruption to the Company’s global supply chain, and caused the

Company to temporarily operate its Suzhou facility with a reduced

workforce thus reducing output at that facility; the stability of

the U.S., Mexican, Chinese, Vietnamese and Taiwanese economic,

labor and political systems and conditions; currency exchange

fluctuations; and the ability of the Company to manage its

growth. These and other factors which may affect the

Company’s future business and results of operations are identified

throughout the Company’s Annual Report on Form 10-K, and as risk

factors, may be detailed from time to time in the Company’s filings

with the Securities and Exchange Commission. These statements

speak as of the date of such filings, and the Company undertakes no

obligation to update such statements in light of future events or

otherwise unless otherwise required by law.

Financial tables to follow…

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

Three Months |

|

|

Nine Months |

|

Nine Months |

|

|

|

Ended |

|

Ended |

|

|

Ended |

|

Ended |

|

|

|

January 31, |

|

January 31, |

|

|

January 31, |

|

January 31, |

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

67,407,268 |

|

|

$ |

68,852,050 |

|

|

|

$ |

216,272,561 |

|

$ |

217,267,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold |

|

|

61,885,491 |

|

|

|

63,322,930 |

|

|

|

|

196,660,966 |

|

|

199,254,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

5,521,777 |

|

|

|

5,529,120 |

|

|

|

|

19,611,595 |

|

|

18,012,261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

|

5,469,654 |

|

|

|

5,539,831 |

|

|

|

|

16,997,268 |

|

|

17,291,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

52,123 |

|

|

|

(10,711 |

) |

|

|

|

2,614,327 |

|

|

721,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense |

|

|

371,893 |

|

|

|

590,422 |

|

|

|

|

1,348,668 |

|

|

1,643,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before income tax |

|

|

(319,770 |

) |

|

|

(601,133 |

) |

|

|

|

1,265,659 |

|

|

(922,695 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

|

(102,731 |

) |

|

|

(5,607 |

) |

|

|

|

460,490 |

|

|

923,379 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

($ |

217,039 |

) |

|

($ |

595,526 |

) |

|

|

$ |

805,169 |

|

($ |

1,846,074 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share - basic |

|

($ |

0.05 |

) |

|

($ |

0.14 |

) |

|

|

$ |

0.19 |

|

($ |

0.44 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share - assuming dilution |

($ |

0.05 |

) |

|

($ |

0.14 |

) |

|

|

$ |

0.19 |

|

($ |

0.44 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common equivalent |

|

|

|

|

|

|

|

|

|

|

shares outstanding - assuming dilution |

|

|

4,242,508 |

|

|

|

4,230,008 |

|

|

|

|

4,260,022 |

|

|

4,227,891 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 31, |

|

April 30, |

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

$ |

104,962,606 |

|

|

$ |

123,545,289 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery and equipment-net |

|

|

32,333,369 |

|

|

|

33,232,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

|

384,022 |

|

|

|

384,022 |

|

|

|

|

|

|

|

Intangibles |

|

|

2,441,279 |

|

|

|

2,713,360 |

|

|

|

|

|

|

|

Other assets |

|

|

8,335,425 |

|

|

|

1,589,325 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

148,456,701 |

|

|

$ |

161,464,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

49,232,137 |

|

|

$ |

55,606,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term obligations |

|

|

40,020,961 |

|

|

|

47,570,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

59,203,603 |

|

|

|

58,287,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

148,456,701 |

|

|

$ |

161,464,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Further Information Contact:SigmaTron International,

Inc.Linda K. Frauendorfer1-800-700-9095

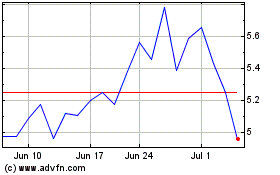

Sigmatron (NASDAQ:SGMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sigmatron (NASDAQ:SGMA)

Historical Stock Chart

From Apr 2023 to Apr 2024