Sierra Bancorp (Nasdaq: BSRR), parent of Bank of the Sierra,

today announced its unaudited financial results for the quarter

ended March 31, 2020. Sierra Bancorp reported consolidated net

income of $7.8 million, or $0.51 per diluted share, for the first

quarter of 2020 compared to $8.9 million, or $0.58 per diluted

share, in the first quarter of 2019. The unfavorable variance in

net income came largely from a $1.5 million increase in the

provision for loan and lease losses in the first quarter of 2020 as

compared to the first quarter of 2019. The Company’s return on

average assets and return on average equity were 1.23% and 9.97%,

respectively, in the first quarter of 2020 as compared to 1.44% and

12.99%, respectively, in the first quarter of 2019.

Assets totaled $2.7 billion at March 31, 2020, representing an

increase of $131 million, or 5%, compared to March 31, 2019, and an

increase of $77 million, or 3%, compared to December 31, 2019. The

increase in assets compared to both March 31, 2019, and December

31, 2019, resulted primarily from a higher level of outstanding

balances on mortgage warehouse lines and growth in investment

securities. Total deposits at March 31, 2020, totaled $2.2 billion,

representing an increase of $19 million, or 1%, compared to March

31, 2019, and an increase of $11 million, or 1%, compared to

December 31, 2019. The growth in deposits came primarily from core

noninterest-bearing demand and interest-bearing transaction

deposits, as higher cost total time deposits declined from both

December 31, 2019, and March 31, 2019.

“The difference between a successful person and

others is not a lack of strength, not a lack of knowledge, but

rather a lack of will.”

– Vince Lombardi

“We are proud of our first quarter results, especially given the

challenges created by the worldwide coronavirus pandemic,” stated

Kevin McPhaill, President and CEO. “Our team is focused and working

diligently through these difficult circumstances, which is apparent

through an improved efficiency ratio and solid earnings,” he noted

further. “We remain optimistic and committed to providing excellent

service to our banking customers throughout the year and beyond!”

McPhaill concluded.

Financial Highlights

As noted above, the decline in net income in the first quarter

of 2020 as compared to the first quarter of 2019 was primarily due

to a $1.5 million increase in the provision for loan and lease

losses. Overall net interest income for the first quarter of 2020

was $23.8 million, as compared to $24.0 million in the first

quarter of 2019, a decrease of 1%, due mostly to lower rates on

earning assets. Noninterest income in the first quarter of 2020 was

$6.1 million as compared to $5.9 million in the same quarter in

2019, an increase of 3% as further detailed below. Noninterest

expense remained relatively unchanged at $17.8 million in the first

quarter of 2020 as compared to $17.9 million in the same quarter of

2019.

Other financial highlights are reflected in the following

table.

FINANCIAL HIGHLIGHTS

(Unaudited)

(Dollars in thousands, except per share

data)

At or For the

At or For the

Three Months

Three Months Ended

Increase

Ended

Increase

3/31/2020

12/31/2019

(Decrease)

3/31/2019

(Decrease)

Net Income

$

7,807

$

9,285

-16%

$

8,895

-12%

Diluted Earnings per share

$

0.51

$

0.60

-15%

$

0.58

-12%

Return on Average Assets

1.23%

1.41%

-13%

1.44%

-15%

Return on Average Equity

9.97%

11.97%

-17%

12.99%

-23%

Net Interest Margin (Tax-Equiv.)

4.13%

4.15%

0%

4.30%

-4%

Yield on Average Loans and Leases

5.21%

5.33%

-2%

5.62%

-7%

Cost of Average Total Deposits

0.34%

0.43%

-21%

0.56%

-39%

Efficiency Ratio (Tax-Equiv.)

58.88%

57.30%

+3%

58.74%

0%

Total Assets

$

2,670,469

$

2,593,819

+3%

$

2,539,087

+5%

Loans & Leases Net of Deferred

Fees

$

1,800,766

$

1,765,461

+2%

$

1,753,776

+3%

Noninterest Demand Deposits

$

704,700

$

690,950

+2%

$

658,524

+7%

Total Deposits

$

2,179,391

$

2,168,374

+1%

$

2,160,748

+1%

Noninterest-bearing Deposits over Total

Deposits

32.3%

31.9%

+1%

30.5%

+6%

Shareholders Equity / Total Assets

12.0%

11.9%

+1%

11.2%

+7%

Tangible Common Equity Ratio

10.9%

10.8%

+1%

10.0%

+1%

Book Value per Share

$

21.03

$

20.24

+4%

$

18.53

+13%

Tangible Book Value per Share

$

18.89

$

18.09

+4%

$

16.34

+16%

INCOME STATEMENT HIGHLIGHTS

Net Interest Income

Net interest income was $23.8 million for the first quarter of

2020, a decrease of $1.0 million, or 4%, as compared to the fourth

quarter of 2019 and a decrease of $0.2 million, or 1%, as compared

to the first quarter of 2019. As compared to the fourth quarter of

2019, overall loan interest income declined by $1.9 million, or 8%,

due primarily to a $77.8 million decline in average loan balances

and a 12 basis point decrease in loan yield. Although total

mortgage warehouse lines increased during the quarter, the average

balance of such loans declined by $59.0 million during the quarter

due to lower demand in January and February. The mortgage warehouse

line balances rebounded in March 2020. In addition, overall cash

and due from bank balances increased by $26.9 million, or 34%, at

March 31, 2020, as compared to December 31, 2019. The average

balance of interest earning due from bank balances increased by

$25.5 million, or 220%, during the first quarter of 2020 to

temporarily offset lower mortgage warehouse balances in the early

part of the quarter.

At March 31, 2020, our outstanding fixed rate loans represented

30% of our loan portfolio. However, 36% of our total portfolio

consists of adjustable rate loans that will not adjust for at least

another 3 years. Approximately 19% of our total portfolio, or $337

million, consists of variable rate loans. Of these variable rate

loans, approximately $118 million have floors that limited the

overall reduction in rates. As mentioned above, we have a

significant portion of our portfolio in adjustable rate loans with

adjustment periods ranging from 30 days to 10 years. Adjustable

rate loans comprise 51% of our portfolio at March 31, 2020.

Approximately $53 million of these adjustable rate loans are

scheduled to adjust in April 2020 and $46 million will reprice in

smaller amounts monthly over the remainder of 2020. Another $18

million of these adjustable rate loans will reprice in the first

quarter of 2021. The remaining $804 million of adjustable rate

loans will not reprice for at least another year with the vast

majority of approximately $650 million not repricing for at least

another 3 years.

In the later part of the quarter, overall cash balances were

increased as a precaution to reduce uncertainty of our cash

delivery providers being able to serve us during the stay-at-home

order. It is expected that these balances will return to more

normalized levels later in 2020. Overall investment securities

increased by $19.4 million during the first quarter of 2020, while

the tax-equivalent yield on investments increased by 16 basis

points to 2.77% during the first quarter of 2020. The overall

investment portfolio had a tax-equivalent yield of 2.81% at March

31, 2020, with an average life of 4.3 years.

Interest expense was $2.3 million in the first quarter of 2020,

a decline of $0.7 million, or 23%, compared to the fourth quarter

of 2019 and a decline of $1.2 million, or 35%, compared to the

first quarter of 2019. The significant decline in interest expense

is attributable to a favorable shift in deposit mix as total time

deposits declined by $34.3 million in the first quarter of 2020 and

the average cost of deposits declined by 9 basis points, or 21%, to

34 basis points.

Provision for Loan and Lease Losses

The Company recorded a loan and lease loss provision of $1.8

million in the first quarter of 2020, as compared to $0.5 million

in the fourth quarter of 2019, and $0.3 million in the first

quarter of 2019. The Company was subject to the adoption of the

Current Expected Credit Loss (“CECL”) accounting method under

Financial Accounting Standards Board (FASB) Accounting Standards

Update 2016-03 and related amendments, Financial Instruments –

Credit Losses (Topic 326). However, the Company elected under

Section 4014 of the Coronavirus Aid, Relief, and Economic Security

(CARES) Act to defer the implementation of CECL until the earlier

of when the national emergency related to the outbreak of COVID-19

ends or December 31, 2020. Although this deferral will still

require CECL to be implemented as of January 1, 2020, the Company

believes that the deferral will provide time to better assess the

impact of the COVID-19 pandemic on the expected lifetime credit

losses. There is increased uncertainty on the local, regional, and

national economy as a result of local and state stay-at-home

orders, as well as relief measures provided at a national, state,

and local level. Further, the Company has taken actions to mitigate

the impact on credit losses including permitting short-term payment

deferrals to current customers, as well as providing bridge loans

and SBA Paycheck Protection Program loans. More time is needed to

assess the impact of this uncertainty and related actions on the

Company’s allowance for loan and lease losses under the CECL

methodology.

The Company’s $1.3 million, or 260%, increase in provision for

loan and lease losses in the first quarter of 2020 as compared to

the fourth quarter of 2019 is due mostly to the estimated impact

that COVID-19 will have on the economy and our loan customers.

Management adjusted its qualitative risk factors under our incurred

loss model for economic conditions, changes in payment deferral

procedures, expected changes in collateral values due to reduced

cash flows, and external factors such as government actions. In

particular, the uncertainty regarding our customers’ ability to

repay loans could be adversely impacted by COVID-19 given higher

unemployment rates, requests for payment deferrals, temporary

business shut-downs, and reduced consumer and business

spending.

Noninterest Income

Noninterest income increased by $0.3 million, or 4%, to $6.1

million in the first quarter of 2020 as compared to $5.8 million in

the fourth quarter of 2019. Noninterest income increased by $0.2

million, or 3%, in the first quarter of 2020 as compared to the

same quarter in 2019. While the overall increase in noninterest

income was $0.3 million, there were some individually significant

offsetting variances in the first quarter of 2020 primarily related

to bank-owned life insurance income (BOLI) and valuation increases

under FASB ASU 2016-01. BOLI income decreased by $0.5 million

during the first quarter of 2020 as compared to the fourth quarter

of 2019 and by $0.9 million as compared to the first quarter of

2019. This decrease is due to unfavorable fluctuations in

underlying values of assets in the specific account BOLI policies

that are designed to have similar assets to those in the deferred

compensation plans. Thus, these lower values in BOLI policies are

offset by lower deferred compensation expense reflected primarily

in director fees expense. At March 31, 2020, there was $42.8

million in BOLI policies associated with the deferred compensation

plans and $8.0 million in separate account BOLI policies.

Offsetting this unfavorable change in BOLI income was a $0.5

million increase in the first quarter of 2020 as compared to the

fourth quarter of 2019 and first quarter of 2019 income associated

with valuations of restricted stock held by the Company. This stock

is related to an equity investment in Pacific Coast Bankers’ Bank

and is adjusted when financial information becomes available,

generally in the late first quarter of each year. In addition,

noninterest income includes a valuation adjustment related to

investments in low-income housing credit investments. This

valuation adjustment was a reduction of income of $0.2 million in

the first quarter of 2020, $0.5 million in the fourth quarter of

2019 and $0.5 million in the first quarter of 2019.

Service charges on customer deposit account income declined by

$0.2 million, or 5%, to $3.2 million in the first quarter of 2020

as compared to the fourth quarter of 2019. This same income was

$0.2 million higher in the first quarter of 2020 as compared to the

first quarter of 2019. These changes are primarily a result of

changes in overdraft income. Overdraft income is typically down in

the first quarter of each year. Waived overdraft fees were similar

to prior quarters.

Noninterest Expense

Noninterest expense was down by $0.2 million, or 1%, in the

first quarter of 2020 as compared to the fourth quarter of 2019 and

was relatively flat compared to the first quarter of 2019. Although

relatively unchanged in the first quarter of 2020, this was due to

offsetting differences. Salaries and benefits were $1.2 million

higher in the first quarter of 2020 as compared to the fourth

quarter of 2019 and $1.0 million higher than the first quarter of

2019. The reason for this increase is due to several factors

including merit increases for employees due to annual performance

evaluations during the first quarter of 2020. In addition, payroll

taxes were $0.3 million higher in the first quarter of 2020 as

compared to the prior linked quarter, and the impact of salaries

deferred as a loan cost was $0.3 million unfavorable in the first

quarter of 2020 as compared to the prior linked quarter. There have

not been any permanent or temporary reductions in employees as a

result of COVID-19. The $1.2 million decrease in Other Noninterest

Expense in the first quarter of 2020 as compared to the fourth

quarter of 2019 is primarily due to a $0.6 million decrease in

professional and other services due to lower loan review costs,

lower internal audit costs, and lower deferred compensation costs

associated for directors; a $0.2 million reduction in costs

associated with deposit services; and $0.1 million declines in each

of the following: marketing, telecommunications, and recruiting

costs.

Balance Sheet Summary

The $77 million, or 3%, increase in total assets during the

first quarter of 2020 is primarily a result of a $34 million

increase in net loans, a $20 million increase in investments, and a

$27 million increase in cash balances.

The increase in loan balances was primarily a result of a $40

million increase in mortgage warehouse lines with other loan

balances remaining relatively unchanged at March 31, 2020, as

compared to December 31, 2019. However, during the quarter, average

balances decreased for most loan categories with an increase late

in the quarter due to concentrated efforts to increase loan

balances in our Northern and Southern markets with new lending

teams. These lending teams started in early February 2020 and have

already had early success with booking new loans. Each team has a

strong pipeline of loans at March 31, 2020. Although banking is an

essential service under state and local safer-at-home orders, the

lending teams and the vast majority of both corporate and

back-office employees continue to work remotely. With respect to

mortgage warehouse lending, these balances also increased during

the quarter with most of the increase occurring in the last three

weeks of the quarter.

With regards to line utilization, unused commitments, excluding

mortgage warehouse and consumer overdraft lines were $283.9 million

at March 31, 2020 as compared to $303.4 million at December 31,

2019. Total utilization excluding mortgage warehouse and consumer

overdraft lines, was 60.0% at March 31, 2020, as compared to 59.1%

at December 31, 2019. Commercial line utilization was 62.0% at

March 31, 2020, as compared to 60.8% at December 31, 2019. Mortgage

warehouse utilization was 58.7% at December 31, 2019, as compared

to 66.6% at March 31, 2020.

The Company has elected to participate in the Small Business

Administration’s Paycheck Protection Program (PPP) as authorized by

the CARES Act and began accepting and funding loans under this

program in April 2020.

Deposit balances grew by $11 million, or 1%, during the first

quarter of 2020 to $2.2 billion at March 31, 2020. Total time

deposits declined by $34 million, including a $20 million decline

in brokered deposits during the quarter. The $30 million in

brokered deposits at March 31, 2020, are very short in duration

with an average life of less than 2 months. Overall

noninterest-bearing deposits as a percent of total deposits

increased to 32.3% at March 31, 2020, as compared to 31.9% at

December 31, 2019, and 30.5% at March 31, 2019. Other

interest-bearing liabilities of $103.5 million at March 31, 2020,

includes $29.4 million of customer repurchase agreements and $74.1

million of FHLB overnight borrowings.

The Company continues to have strong liquidity. At March 31,

2020 and December 31, 2019, the Company had the following sources

of primary and secondary liquidity ($ in thousands):

Primary and Secondary Liquidity

Sources

March

31, 2020

December

31, 2019

Cash and Due From Banks

$

106,992

$

80,076

Unpledged Investment Securities

379,410

366,012

Excess Pledged Securities

72,912

70,955

FHLB Borrowing Availability

347,348

443,200

Unsecured Lines of Credit

80,000

80,000

Funds Available through Fed Discount

Window

69,518

59,198

Totals

$

1,056,180

$

1,099,441

Total capital of $319 million at March 31, 2020, reflects an

increase of $10 million, or 3%, as compared to December 31, 2019.

The increase in equity during the first quarter of 2020 is due to

net income of $7.8 million and a $7.7 million increase in other

comprehensive income/loss due mostly to changes in fair value of

investment securities. These increases were offset by $3.1 million

in dividends and $2.6 million in stock repurchases. The remaining

difference is related to stock options exercised during the

quarter. There were share repurchases totaling 112,050 shares at a

weighted average cost of $22.86 per share executed by the Company

during the first quarter of 2020.

Asset Quality

Total nonperforming assets, comprised of non-accrual loans and

foreclosed assets, increased by $1.6 million, or 24%, during the

first quarter of 2020. The increase resulted from $2.0 million in

new nonaccrual loans and paydowns of approximately $0.4 million.

The increases consisted of a few smaller real-estate loans of

approximately $1.5 million being downgraded to nonaccrual status in

the early part of the quarter, as well as a single commercial loan

for $0.5 million moving to nonaccrual status in early March 2020.

The Company’s ratio of nonperforming assets to loans increased to

0.41% at March 31, 2020, from 0.33% at December 31, 2019. All of

the Company’s impaired assets are periodically reviewed, and are

either well-reserved based on current loss expectations, or are

carried at the fair value of the underlying collateral net of

expected disposition costs.

The Company’s allowance for loan and lease losses was $11.5

million at March 31, 2020, as compared to $9.9 million at December

31, 2019, and $9.4 million at March 31, 2019. The increase during

the first quarter of 2020 is due to a $0.3 million increase in

specific reserve associated primarily with an unsecured commercial

loan being added to nonaccrual status in early March 2020, as well

as a $1.8 million increase in other factors, primarily qualitative

factors associated with economic uncertainty, and net charge-offs

of $0.3 million. For further information regarding the Company’s

decision to defer CECL under Section 4014 of the CARES Act, as well

as further detail on the increase in provision during the first

quarter of 2020, please see the discussion above under Provision

for Loan and Lease Losses. The allowance was 0.64% of total loans

at March 31, 2020, 0.56% of total loans at December 31, 2019, and

0.54% of total loans at March 31, 2019. Management’s detailed

analysis indicates that the Company’s allowance for loan and lease

losses should be sufficient to cover credit losses inherent in loan

and lease balances outstanding as of March 31, 2020, but no

assurance can be given that the Company will not experience

substantial future losses relative to the size of the

allowance.

As discussed above under the provision for loan losses, the

Company provided $1.8 million in provision for loan loss in the

first quarter of 2020 as compared to $0.5 million in the fourth

quarter of 2019. This increase is primarily due to increased

uncertainty of economic risks associated with the COVID-19

pandemic. With respect to exposures related to the COVID-19

pandemic, the Company had less than 70 relationships in the

hospitality industry totaling $216.0 million at March 31, 2020. In

addition to loans in the hospitality sector, we have approximately

$82.7 million of loans in the oil and gas industry (including $69.7

million to convenience stores that offer petroleum products), $86.2

million of loans in retail, and $7 million in consumer loans.

The Company is providing deferrals to customers under Section

4013 of the CARES Act. These deferrals typically provide deferrals

of both principal and interest for 180 days. At the end of the

deferral period, for term loans, payments will be applied to

accrued interest first and after the accrued interest is paid in

full, the loan will be re-amortized with the maturity extended. For

lines of credit, the borrower must repay the accrued interest at

the end of the deferral period or take out a second credit facility

to repay the accrued interest. As of April 15, 2020, we have had

104 commercial customers for a total of $149.1 million who have

either executed a loan modification under Section 4013 of the CARES

Act or we have approved a modification that is expected to be

executed in April 2020. Approximately $50.8 million of these

modifications were in the hospitality industry representing 15

different customers.

About Sierra Bancorp

Sierra Bancorp is the holding company for Bank of the Sierra

(www.bankofthesierra.com), which is in its 43rd year of operations

and is the largest independent bank headquartered in the South San

Joaquin Valley. Bank of the Sierra is a community-centric regional

bank, which offers a broad range of retail and commercial banking

services through full-service branches located within the counties

of Tulare, Kern, Kings, Fresno, Los Angeles, Ventura, San Luis

Obispo and Santa Barbara. The Bank also maintains an online branch,

and provides specialized lending services through an agricultural

credit center, an SBA center, and a dedicated loan production

office in Rocklin, California. In 2019, Bank of the Sierra was

recognized as one of the strongest and top-performing community

banks in the country with a 5‑star rating from Bauer Financial.

Forward-Looking Statements

The statements contained in this release that are not historical

facts are forward-looking statements based on management’s current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties including but not limited to the

health of the national and local economies, the Company’s ability

to attract and retain skilled employees, customers’ service

expectations, the Company’s ability to successfully deploy new

technology, the success of acquisitions and branch expansion,

changes in interest rates, loan portfolio performance, and other

factors detailed in the Company’s SEC filings, including the “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of the Company’s most

recent Form 10‑K and Form 10‑Q.

STATEMENT OF CONDITION

(Dollars in thousands,

unaudited)

Mar '20 vs

Mar '20 vs

ASSETS

3/31/2020

12/31/2019

Dec '19

3/31/2019

Mar '19

Cash and Due from Banks

$106,992

$80,077

+34%

$68,063

+57%

Investment Securities

620,154

600,799

+3%

563,628

+10%

Real Estate Loans (non-Agricultural)

1,259,448

1,258,081

0%

1,318,740

-4%

Agricultural Real Estate Loans

141,740

144,033

-2%

155,110

-9%

Agricultural Production Loans

49,199

48,036

+2%

52,086

-6%

Comm'l & Industrial Loans &

Leases

111,990

115,532

-3%

125,679

-11%

Mortgage Warehouse Lines

228,608

189,103

+21%

91,118

+151%

Consumer Loans

7,040

7,780

-10%

8,256

-15%

Gross Loans & Leases

1,798,025

1,762,565

+2%

1,750,989

+3%

Deferred Loan & Lease Fees

2,741

2,896

-5%

2,787

-2%

Loans & Leases Net of Deferred

Fees

1,800,766

1,765,461

+2%

1,753,776

+3%

Allowance for Loan & Lease Losses

(11,453)

(9,923)

+15%

(9,438)

+21%

Net Loans & Leases

1,789,313

1,755,538

+2%

1,744,338

+3%

Bank Premises & Equipment

28,425

27,435

+4%

28,855

-1%

Other Assets

125,585

129,970

-3%

134,203

-6%

Total Assets

$2,670,469

$2,593,819

+3%

$2,539,087

+5%

LIABILITIES & CAPITAL

Noninterest Demand Deposits

$704,700

$690,950

+2%

$658,524

+7%

Int-Bearing Transaction Accounts

576,014

549,812

+5%

556,628

+3%

Savings Deposits

304,894

294,317

+4%

291,875

+4%

Money Market Deposits

113,766

118,933

-4%

120,697

-6%

Customer Time Deposits

450,017

464,362

-3%

483,024

-7%

Wholesale Brokered Deposits

30,000

50,000

-40%

50,000

-40%

Total Deposits

2,179,391

2,168,374

+1%

2,160,748

+1%

Junior Subordinated Debentures

34,990

34,945

0%

34,811

+1%

Other Interest-Bearing Liabilities

103,461

45,711

+126%

19,360

+434%

Total Deposits & Int.-Bearing

Liab.

2,317,842

2,249,030

+3%

2,214,919

+5%

Other Liabilities

33,168

35,504

-7%

40,100

-17%

Total Capital

319,459

309,285

+3%

284,068

+12%

Total Liabilities & Capital

$2,670,469

$2,593,819

+3%

$2,539,087

+5%

GOODWILL & INTANGIBLE

ASSETS

(Dollars in thousands,

unaudited)

Mar '20 vs

Mar '20 vs

3/31/2020

12/31/2019

Dec '19

3/31/2019

Mar '19

Goodwill

$ 27,357

$ 27,357

0%

$ 27,357

0%

Core Deposit Intangible

5,112

5,381

-5%

6,187

-17%

Total Intangible Assets

$ 32,469

$ 32,738

-1%

$ 33,544

-3%

CREDIT QUALITY

(Dollars in thousands,

unaudited)

Mar '20 vs

Mar '20 vs

3/31/2020

12/31/2019

Dec '19

3/31/2019

Mar '19

Non-Accruing Loans

$ 7,351

$ 5,737

+28%

$ 4,568

+61%

Foreclosed Assets

766

800

-4%

806

-5%

Total Nonperforming Assets

$ 8,117

$ 6,537

+24%

$ 5,374

+51%

Performing TDR's (not incl. in NPA's)

$ 8,188

$ 8,415

-3%

$ 10,750

-24%

Net charge-offs

$ 270

$ 1,777

-85%

$ 612

-56%

Non-Perf Loans to Gross Loans

0.41%

0.33%

0.26%

NPA's to Loans plus Foreclosed Assets

0.45%

0.37%

0.31%

Allowance for Ln Losses to Loans

0.64%

0.56%

0.54%

SELECT PERIOD-END STATISTICS

(unaudited)

3/31/2020

12/31/2019

3/31/2019

Shareholders Equity / Total Assets

12.0%

11.9%

11.2%

Gross Loans / Deposits

82.5%

81.3%

81.0%

Non-Int. Bearing Dep. / Total Dep.

32.3%

31.9%

30.5%

CONSOLIDATED INCOME STATEMENT

(Dollars in thousands,

unaudited)

Qtr Ended:

1Q20 vs

Qtr Ended:

1Q20 vs

3/31/2020

12/31/2019

4Q19

3/31/2019

1Q19

Interest Income

$ 26,051

$ 27,775

-6%

$ 27,483

-5%

Interest Expense

2,264

2,953

-23%

3,510

-35%

Net Interest Income

23,787

24,822

-4%

23,973

-1%

Provision for Loan & Lease Losses

1,800

500

+260%

300

+500%

Net Int after Provision

21,987

24,322

-10%

23,673

-7%

Service Charges

3,183

3,356

-5%

2,943

+8%

BOLI Income

38

567

-93%

900

-96%

Gain (Loss) on Investments

-

(227)

100%

6

-100%

Other Noninterest Income

2,885

2,150

+34%

2,057

+40%

Total Noninterest Income

6,106

5,846

+4%

5,906

+3%

Salaries & Benefits

10,172

8,957

+14%

9,243

+10%

Occupancy Expense

2,327

2,550

-9%

2,361

-1%

Other Noninterest Expenses

5,319

6,475

-18%

6,248

-15%

Total Noninterest Expense

17,818

17,982

-1%

17,852

0%

Income Before Taxes

10,275

12,186

-16%

11,727

-12%

Provision for Income Taxes

2,468

2,901

-15%

2,832

-13%

Net Income

$ 7,807

$ 9,285

-16%

$ 8,895

-12%

TAX DATA

Tax-Exempt Muni Income

$ 1,339

$ 1,257

+7%

$ 1,045

+28%

Interest Income - Fully Tax Equivalent

$ 26,407

$ 28,109

-6%

$ 27,761

-5%

PER SHARE DATA

(unaudited)

Qtr Ended:

1Q20 vs

Qtr Ended:

1Q20 vs

3/31/2020

12/31/2019

4Q19

3/31/2019

1Q19

Basic Earnings per Share

$0.51

$0.61

+12%

$0.58

+32%

Diluted Earnings per Share

$0.51

$0.60

+14%

$0.58

+32%

Common Dividends

$0.20

$0.19

+13%

$0.18

+13%

Wtd. Avg. Shares Outstanding

15,262,252

15,285,413

0%

15,311,154

+1%

Wtd. Avg. Diluted Shares

15,340,017

15,393,381

0%

15,447,747

0%

Book Value per Basic Share (EOP)

$21.03

$20.24

+4%

$18.53

+11%

Tangible Book Value per Share (EOP)

$18.89

$18.09

+5%

$16.34

+12%

Common Shares Outstanding (EOP)

15,190,038

15,284,538

0%

15,328,030

+1%

KEY FINANCIAL RATIOS

(unaudited)

Qtr Ended:

Qtr Ended:

3/31/2020

12/31/2019

3/31/2019

Return on Average Equity

9.97%

11.97%

12.99%

Return on Average Assets

1.23%

1.41%

1.44%

Net Interest Margin (Tax-Equiv.)

4.13%

4.15%

4.30%

Efficiency Ratio (Tax-Equiv.)

58.88%

57.30%

58.74%

Net C/O's to Avg Loans (not

annualized)

0.02%

0.10%

0.04%

AVERAGE BALANCE SHEET, INTEREST

INCOME/EXPENSE, & YIELD/RATE

(Dollars in thousands,

unaudited)

For the quarter ended

For the quarter ended

For the quarter ended

March 31, 2020

December 31, 2019

March 31, 2019

Average Balance

Income/ Expense

Yield/ Rate

Average Balance

Income/ Expense

Yield/ Rate

Average Balance

Income/ Expense

Yield/ Rate

Assets

Investments:

Federal funds sold/due from's

$

37,124

$

140

1.52%

$

11,592

$

49

1.68%

$

11,469

$

73

2.58%

Taxable

408,591

2,460

2.42%

422,813

2,448

2.30%

418,901

2,617

2.53%

Non-taxable

195,690

1,339

3.48%

181,633

1,257

3.48%

142,329

1,045

3.77%

Total investments

641,405

3,939

2.69%

616,038

3,754

2.63%

572,699

3,735

2.84%

Loans and Leases:

Real estate

1,394,911

18,722

5.40%

1,413,347

19,719

5.54%

1,464,275

20,100

5.57%

Agricultural Production

48,532

583

4.83%

47,964

647

5.35%

50,550

780

6.26%

Commercial

107,696

1,097

4.10%

110,760

1,344

4.81%

122,597

1,577

5.22%

Consumer

7,583

368

19.52%

8,148

379

18.45%

8,718

315

14.65%

Mortgage warehouse lines

144,621

1,264

3.52%

203,593

1,883

3.67%

63,120

927

5.96%

Other

5,242

78

5.98%

2,596

49

7.49%

3,107

49

6.40%

Total loans and leases

1,708,585

22,112

5.21%

1,786,408

24,021

5.33%

1,712,367

23,748

5.62%

Total interest earning assets

2,349,990

$

26,051

4.52%

2,402,446

$

27,775

4.64%

2,285,066

$

27,483

4.93%

Other earning assets

12,841

12,743

11,678

Non-earning assets

196,906

197,857

209,613

Total assets

$

2,559,737

$

2,613,046

$

2,506,357

Liabilities and shareholders'

equity

Interest bearing deposits:

Demand deposits

$

88,731

$

62

0.28%

$

92,132

$

69

0.30%

$

99,252

$

72

0.29%

NOW

456,586

122

0.11%

457,008

131

0.11%

437,209

126

0.12%

Savings accounts

297,721

73

0.10%

291,107

78

0.11%

287,773

75

0.11%

Money market

117,249

43

0.15%

126,211

45

0.14%

128,686

41

0.13%

Time Deposits

460,551

1,367

1.19%

479,441

1,779

1.47%

472,296

2,316

1.99%

Wholesale Brokered Deposits

40,824

167

1.65%

50,761

247

1.93%

50,000

325

2.64%

Total interest-bearing deposits

1,461,662

1,834

0.50%

1,496,660

2,349

0.62%

1,475,216

2,955

0.81%

Borrowed funds:

Junior Subordinated Debentures

34,962

394

4.53%

34,919

430

4.89%

34,784

483

5.63%

Other Interest-bearing Liabilities

33,432

36

0.43%

56,029

174

1.23%

26,521

72

1.10%

Total borrowed funds

68,394

430

2.53%

90,948

604

2.63%

61,305

555

3.67%

Total interest-bearing liabilities

1,530,056

$

2,264

0.60%

1,587,608

$

2,953

0.74%

1,536,521

$

3,510

0.93%

Noninterest-bearing deposits

678,592

679,718

652,910

Other liabilities

36,220

38,038

39,150

Shareholders' equity

314,869

307,682

277,776

Total liabilities and shareholders'

equity

$

2,559,737

$

2,613,046

$

2,506,357

Yield on earning assets

4.52%

4.64%

4.93%

Interest expense/interest earning

assets

0.39%

0.49%

0.63%

Net interest income and margin

$

23,787

4.13%

$

24,822

4.15%

$

23,973

4.30%

Note: Where impacted by non-taxable

income, yields and net interest margins have been computed on a tax

equivalent basis utilizing a 21% tax rate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200420005109/en/

Kevin McPhaill, President/CEO (559) 782‑4900 or (888) 454‑BANK

www.sierrabancorp.com

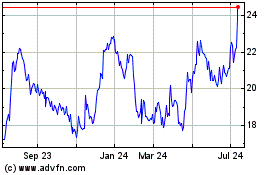

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

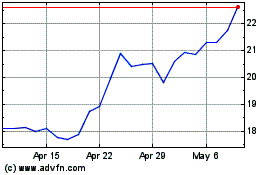

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Apr 2023 to Apr 2024