Current Report Filing (8-k)

November 07 2019 - 4:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 7, 2019

SIENTRA, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36709

|

|

20-5551000

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

420 South Fairview Avenue, Suite 200

Santa Barbara, CA 93117

(Address of Principal Executive Offices and Zip Code)

Registrant’s Telephone Number, Including Area Code: (805) 562-3500

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

SIEN

|

|

The Nasdaq Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 7, 2019 (the “Closing Date”), Sientra, Inc. (the “Company”) entered into

an Asset Purchase Agreement (the “Purchase Agreement”) with Vesta Intermediate Funding, Inc. (“Vesta”), pursuant to which the Company purchased certain assets, assumed certain liabilities and obtained

a non-exclusive, royalty-free, perpetual, irrevocable, assignable, sublicensable, and worldwide license to certain intellectual property owned by Vesta (the “Vesta Acquisition”). In

consideration of the Vesta Acquisition, the Company paid $14.0 million in cash on the Closing Date and will pay an additional $3.2 million and $3.0 million in cash (the “Post-Closing Amounts”) on

November 7, 2021 and November 7, 2023, respectively. In addition, in the event the closing price of the Company’s common stock equals or exceeds a certain agreed upon price target (the “First Milestone Price

Target”) on any date through November 7, 2023, the Company will issue Vesta 303,721 shares of common stock (the “First Milestone Shares”) within five business days of such date, and in the event the closing

price of the Company’s common stock equals or exceeds a certain agreed upon price target (the “Second Milestone Price Target”) on any date through November 7, 2023, the Company will issue Vesta 303,721 shares of

common stock (the “Second Milestone Shares”) within five business days of such date. The Company will use its commercially reasonable efforts to file and maintain a resale registrations statement registering the resale of the

First Milestone Shares and the Second Milestone Shares. The Purchase Agreement contains customary representations and warranties and indemnification provisions. The Purchase Agreement also includes a mutual

non-solicitation agreement.

In connection with, and as a condition to the closing of, the

Purchase Agreement, on November 7, 2019, the Company entered into a Lease with Vesta (the “Lease”) whereby the Company will lease approximately 24,000 square feet in the building where the manufacturing operations

acquired in the Vesta Acquisition are located (the “Facility”). The Lease has an initial term of four years (the “Initial Term”). The Company will pay annual rent of $200,000 for each of the first two

years and $320,000 for each of the third and fourth years of the Lease payable in equal monthly installments. The Lease includes an option for the Company to extend the term of the Lease one time for an additional four years (the

“Extended Term”). The Lease contains customary events of default and, additionally, any failure by the Company to pay the Post-Closing Amounts when due or issue the First Milestone Shares or Second Milestone Shares when

required shall be considered an event of default. The Lease also provides that, in the event of a sale of the Facility, the Company will have a right of first offer to purchase the Facility from Vesta.

The foregoing summaries of the Purchase Agreement and the Lease do not purport to be complete and are qualified in their entirety by reference

to the text of the Purchase Agreement and Lease filed as Exhibit 10.1 ad Exhibit 10.2, respectively, to this Current Report on Form 8-K.

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated herein by

reference.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated herein by

reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1†

|

|

Asset Purchase Agreement, dated November 7, 2019, by and between Sientra, Inc. and Vesta Intermediate Funding, Inc.

|

|

|

|

|

10.2†

|

|

Lease, dated November 7, 2019, by and between Sientra, Inc. and Vesta Intermediate Funding, Inc.

|

|

†

|

Portions of this exhibit have been redacted in compliance with

Regulation S-K Item 601(b)(10).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SIENTRA, INC.

|

|

|

|

|

|

|

Dated: November 7, 2019

|

|

|

|

By:

|

|

/s/ Jeffrey Nugent

|

|

|

|

|

|

|

|

Jeffrey Nugent

|

|

|

|

|

|

|

|

Chairman and Chief Executive Officer

|

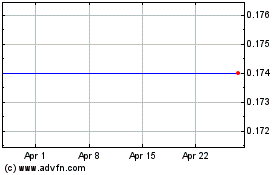

Sientra (NASDAQ:SIEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

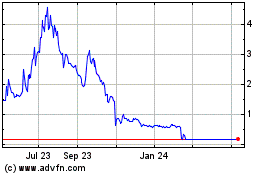

Sientra (NASDAQ:SIEN)

Historical Stock Chart

From Apr 2023 to Apr 2024