- Operating income increased 8% from the

fourth quarter of 2018, with operating margin increasing 2%

- Good results from Park Wilshire in the

first quarter of 2019

- New office openings in Jersey City and

Miami, reflecting business expansion and upgrading of technology

across the organization

Siebert Financial Corp. (NASDAQ:SIEB) (“Siebert”), a provider of

financial services, today announced results for the first quarter

of 2019, reporting net income of $1.0 million, basic and diluted

earnings per share (EPS) of $0.04, and revenue of $6.4 million.

“We entered 2019 on the heels of a record setting 2018 that saw

strong results across nearly every financial metric. The first

quarter of 2019 was weaker on a year over year basis due mostly to

market volatility, lower trading volume, and investment in

infrastructure and technology. Despite revenues being down year

over year, in comparison to the fourth quarter of 2018, operating

income was up 8% and revenue stayed relatively flat,” said Gloria

E. Gebbia, controlling shareholder and board member of Siebert.

“Additionally, we saw good results from Park Wilshire in the

first quarter of 2019. We are also exploring ways to invigorate our

customer channels, including the implementation of a program to

contact a targeted number of our clients – nearly $3 billion in AUM

– to proactively market new Siebert products and offerings. We see

this as an opportunity to generate new business from existing

clients.

“As we continue to expand our corporate footprint, we increased

our office space in Jersey City to nearly 11,000 square feet and

are in the process of establishing a large Miami office. Investing

in our office infrastructure, technology and internal processes is

key towards the long-term success of our business. Going forward,

we are excited to further energize our customer networks,

delivering value for our clients, partners and shareholders,” added

Mrs. Gebbia.

Selected Financial Highlights

The following table summarizes the results for the below periods

(unaudited):

Three Months Ended

March 31,

2019 2018

2017 Revenue $ 6,429,000

$ 8,177,000 $ 2,379,000

Operating income

$ 1,336,000 $ 2,106,000 $ 61,000 Net income $ 1,006,000 $ 1,693,000

$ 58,000 Basic and diluted EPS $ 0.04 $ 0.06 $ 0.00

SIEBERT FINANCIAL CORP. &

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

Three Months Ended

March 31,

2019 2018 Revenue: Margin

interest, marketing and distribution fees $ 2,772,000 $ 2,535,000

Commissions and fees 1,864,000 2,674,000 Principal transactions

1,610,000 2,941,000 Advisory fees 168,000 16,000 Interest

15,000 11,000 Total Revenue 6,429,000 8,177,000

Expenses: Employee compensation and benefits 2,835,000

3,662,000 Clearing fees, including execution costs 654,000 902,000

Professional fees 502,000 608,000 Other general and administrative

385,000 386,000 Technology and communications 247,000 234,000 Rent

and occupancy 295,000 242,000 Depreciation and amortization 175,000

24,000 Advertising and promotion — 13,000

Total Expenses 5,093,000 6,071,000

Income before provision for income tax and

before earnings of equity method investment

1,336,000 2,106,000

Provision for income tax

369,000 413,000

Income before earnings of equity method

investment

967,000 1,693,000

Earnings of equity method investment

39,000 — Net income $ 1,006,000 $

1,693,000 Net income per share of common stock Basic and

diluted $ 0.04 $ 0.06 Weighted average shares

outstanding Basic and diluted 27,157,188

27,157,188

SIEBERT FINANCIAL CORP. &

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION

March 31, 2019 December 31, 2018

(unaudited) ASSETS Cash and cash equivalents $

3,767,000 $ 7,229,000 Receivables from clearing and other brokers

2,275,000 2,030,000 Receivable from related party 1,000,000

1,000,000 Receivable from lessors — 171,000 Other receivables

96,000 96,000 Prepaid expenses and other assets 568,000 470,000

Furniture, equipment and leasehold improvements, net 992,000

468,000 Software, net 1,404,000 1,137,000 Lease right-of-use assets

2,257,000 — Investment in related party 3,704,000 — Deferred tax

assets 5,486,000 5,576,000 $ 21,549,000

$ 18,177,000 LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities: Accounts payable and accrued liabilities $ 579,000 $

699,000 Due to clearing brokers and related parties 64,000 133,000

Income tax payable

196,000 — Lease incentive obligation — 171,000 Lease liabilities

2,530,000 — 3,369,000 1,003,000

Commitments and Contingencies Stockholders’ equity:

Common stock, $.01 par value; 49,000,000

shares authorized, 27,157,188 shares issued and outstanding as of

March 31, 2019 and December 31, 2018

271,000 271,000 Additional paid-in capital 7,641,000 7,641,000

Retained earnings 10,268,000 9,262,000

18,180,000 17,174,000 $ 21,549,000 $

18,177,000

Notice to Investors

This communication is provided for informational purposes only

and is neither an offer to sell nor a solicitation of an offer to

buy any securities in the United States or elsewhere.

About Siebert Financial Corp.

Siebert Financial Corp. is a holding company that conducts its

retail discount brokerage business through its wholly-owned

subsidiary, Muriel Siebert & Co., Inc. (“MSCO”), which became a

member of the New York Stock Exchange (“NYSE”) in 1967 when Ms.

Siebert became the first woman to own a seat on the NYSE and the

first to head one of its member firms. The company conducts its

investment advisory business through its wholly-owned subsidiary,

Siebert AdvisorNXT, Inc. (“AdvisorNXT”), a registered investment

advisor, and its insurance business through its wholly-owned

subsidiary, Park Wilshire Companies Inc. (“PWC”), a licensed

insurance agency. Siebert’s fourth wholly-owned subsidiary, KCA

Technologies, LLC (“KCAT”), is a developer of robo-advisory

technology. Siebert is headquartered in New York City with 13

retail branches throughout the continental United States. Siebert

is under common control with StockCross Financial Services, Inc.

(“StockCross”). More information is available at

www.siebertnet.com.

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such “forward-looking statements” involve risks and

uncertainties and known and unknown factors that could cause the

actual results of Siebert Financial Corp. (the “Company”) to be

materially different from historical results or from any future

results expressed or implied by such “forward-looking statements”,

including without limitation: changes in general economic and

market conditions; changes and prospects for change in interest

rates; fluctuations in volume and price of securities; changes in

demand for brokerage services; competition within and without the

brokerage business, including the offer of broader services;

competition from electronic discount brokerage firms offering

greater discounts on commissions than the Company; the prevalence

of a flat fee environment; limited trading opportunities; the

method of placing trades by the Company’s customers; computer and

telephone system failures; the level of spending by the Company on

advertising and promotion; trading errors and the possibility of

losses from customer non-payment amounts due; other increases in

expenses and changes in net capital or other regulatory

requirements. As a result of these and other factors, the Company

may experience material fluctuations in its operating results on a

quarterly or annual basis, which could materially and adversely

affect its business, financial condition, operating results, and

stock price, as well as other risks detailed in the Company’s

filings with the Securities and Exchange Commission (“SEC”).

Accordingly, investors are cautioned not to place undue reliance on

any such “forward-looking statements.” The Company undertakes no

obligation to update the information contained herein or to

publicly announce the result of any revisions to such

“forward-looking statements” to reflect future events or

developments. An investment in the Company involves various risks,

including those mentioned above and those which are detailed from

time to time in the Company’s SEC filings, copies of which may be

obtained from the Company or through the SEC’s website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190515005956/en/

Siebert Financial Corp.120 Wall StreetNew York, NY 10005

Investor Relations:Melissa SheerKent Place

Communicationsmelissa@kentplacellc.com

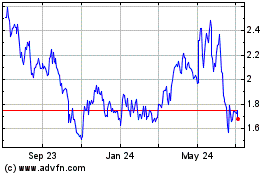

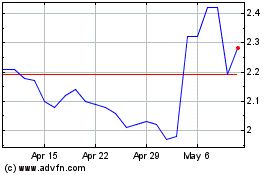

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024