ShiftPixy, Inc. Reports Fiscal 2020 Results

November 30 2020 - 4:19PM

ShiftPixy, Inc. (NASDAQ: PIXY), a Florida-based staffing enterprise

that designs, manages, and sells access to a disruptive,

revolutionary platform that facilitates employment in the rapidly

growing Gig Economy, today announced operating results for the year

ended August 31, 2020 (“2020”).

2020 Financial

Highlights

- Improved balance

sheet compared to the fiscal year ended August 31, 2019 (“2019”):

- Eliminated debt

with full-ratchet anti-dilution price protection during 2020

- Raised over $25

million in equity from May 2020 to October 2020

- Sold 85% of

lower growth business which generated $9.5 million of cash

- Quarterly gross

billings improved to $18.7 million for Q4 2020, a sequential

increase of $4.3 million or 30% from Q3 2020, due to new customer

additions and COVID-19 recovery for existing customers. For the

entire fiscal year, gross billings from continuing operations were

$66 million, compared to $73 million for 2019, due primarily to

COVID-19 impacts in 2020, as well as client cancellations primarily

in the early part of 2020, during calendar 2019.

- Quarterly

revenues improved to $2.4 million for Q4 2020, a sequential

increase of 20% from Q3 2020. Revenues for the entire fiscal year

decreased 17% to $8.6 million, compared to $10.5 million for 2019,

primarily as a result of our strategic decision to shift our client

focus during 2019, as well as the negative impact of COVID-19

growth headwinds.

- Gross profit for

2020 was $1.0 million, decreasing 50% from 2019 gross profit of

$1.9 million, due to workers’ compensation cost increases.

- Loss from

Operations for 2020 increased $6.0 million to $21.6 million from

$15.6 million in 2019, of which $3.5 million was a non-cash asset

impairment charge related to previously capitalized software, along

with a $1.0 million increase in stock-based

compensation.

- EBITDAS Loss

(Operating Loss excluding asset impairment, interest expense,

depreciation, amortization and share-based compensation) increased

to $16.2 million for 2020 from $14.7 million for 2019 due to $1.0

million of reduced margins and increased spending on our mobile

application development, offset by decreased operations

costs.

- Investment in

our mobile application and technology solution deployment increased

to $4.2 million in 2020 from $3.1 million in 2019. Total Human

Resource Information System (“HRIS”) and mobile application

investment is $20.7 million to date.

2020

Operational

Highlights

- The number of

employees retained in our employee HRIS exceeded 35,000.

- Relocated

corporate headquarters to Miami, Florida to expand sales and

marketing reach to better serve Eastern United States and Latin

America (move substantially completed in September 2020).

- Experienced

billings and worksite employee growth during 2020 despite COVID-19

pandemic due to new client additions and Q4 COVID-19 recovery.

- New partnership

established in Q4 2020 that has the potential to bring over 200,000

new restaurant employees onto our HRIS platform, with the added

potential to generate gross wage billings of $20,000 per

employee.

- New nationwide

nurse staffing client signed in Q4 2020 with over 8,000 employees

that has the potential to generate gross billings of approximately

$50,000 per employee, which we expect to drive significant revenue

and gross profit growth.

- Full suite of

mobile application and HRIS platform functionality nearing

completion and full commercial launch, which we expect to add

additional revenue streams.

“2020 was a key transition year for ShiftPixy.

We completed the client refocus we began in 2019 away from light

industrial clients to quick service restaurants and other new

business opportunities that we believe are better served by our new

technology platform. We significantly improved our balance sheet by

selling assets and raising additional capital which allowed us to

eliminate our convertible debt and continue to invest in our growth

initiatives. Despite setbacks in our May 31, 2020 quarter due to

the COVID-19 pandemic, at year end the combined recovery of our

pre-COVID business combined with our new customer additions

resulted in sequential billing growth that continues into our first

fiscal quarter of 2021,” stated Chief Executive Officer Scott

Absher. “We are starting to see customer on-boarding from sales

wins by our new sales team in our new Miami headquarters and are

very excited about our new partnerships in the State of Washington

and our new nurse staffing client, both of which we believe will

drive revenue and gross profit growth in the first half of Fiscal

2021. We believe that we are well positioned to execute on these

recent wins and expect to see a significant increase in our

business activity levels. We hope to achieve profitability in the

second half of Fiscal 2021 as we continue our focus on creating

long-term shareholder value.”

About ShiftPixy

ShiftPixy is a disruptive human capital services

enterprise, revolutionizing employment in the Gig Economy by

delivering a next-gen platform for workforce management that helps

businesses with shift-based employees navigate regulatory mandates,

minimize administrative burdens and better connect with a

ready-for-hire workforce. With expertise rooted in management’s

nearly 25 years of workers’ compensation and compliance programs

experience, ShiftPixy adds a needed layer for addressing compliance

and continued demands for equitable employment practices in the

growing Gig Economy. ShiftPixy’s complete human capital management

ecosystem is designed to manage regulatory requirements and

compliance in such required areas as paid time off (PTO) laws,

insurance and workers’ compensation, minimum wage increases, and

Affordable Care Act (ACA) compliance.

ShiftPixy Cautionary

Statement

The information provided in this release

includes forward-looking statements, the achievement or success of

which involves risks, uncertainties, and assumptions. These

forward-looking statements are made pursuant to the safe harbor

provisions within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Although such forward-looking statements are based upon what our

management believes are reasonable assumptions, there can be no

assurance that forward-looking statements will prove to be

accurate. If any of the risks or uncertainties, including those set

forth below, materialize or if any of the assumptions proves

incorrect, our results could differ materially from the results

expressed or implied by the forward-looking statements we make. The

risks and uncertainties include, but are not limited to, risks

associated with the nature of our business model; our ability to

execute our vision and growth strategy; our ability to attract and

retain clients; our ability to assess and manage risks; changes in

the law that affect our business and our ability to respond to such

changes and incorporate them into our business model, as necessary;

our ability to insure against and otherwise effectively manage

risks that affect our business; risks arising from the COVID-19

pandemic or any other events that could cause wide-scale business

disruptions; competition; reliance on third-party systems and

software; our ability to protect and maintain our intellectual

property; and general developments in the economy and financial

markets. These and other risks are discussed in our filings with

the Securities and Exchange Commission (the “SEC”), including,

without limitation, our Annual Report on Form 10-K, filed

on November 30, 2020, our Quarterly Reports on Form 10-Q and

our Current Reports on Form 8-K. These documents, including the

sections therein entitled “Risk Factors,” identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements. All of our

forward-looking statements are expressly qualified by all such risk

factors and other cautionary statements. Statements made in

connection with any guidance may refer to financial statements that

have not been reviewed or audited. We undertake no obligation to

update forward-looking statements if circumstances or management's

estimates or opinions should change, except as required by

applicable securities laws. The information in this press release

shall not be deemed to be "filed" for the purpose of Section 18 of

the Exchange Act, or otherwise subject to the liabilities of that

section, and will not be deemed an admission as to the materiality

of any information that is required to be disclosed solely by

Regulation FD. Further information on these and other factors that

could affect our financial results is included in the filings we

make with the SEC from time to time. These documents are

available on the "SEC Filings" subsection of the "Investor

Information" section of our website

at https://ir.shiftpixy.com/financial-information/sec-filings,

or directly from the SEC’s website at https://www.sec.gov.

Consistent with the SEC’s April

2013 guidance on using social media outlets like Facebook and

Twitter to make corporate disclosures and announce key information

in compliance with Regulation FD, we are alerting investors and

other members of the general public that we will provide updates on

operations and progress required to be disclosed under Regulation

FD through the Company’s social media on Facebook, Twitter,

LinkedIn and YouTube. Investors, potential investors, shareholders

and individuals interested in us are encouraged to keep informed by

following us on Facebook, Twitter, LinkedIn and YouTube.

INVESTOR

CONTACT:InvestorRelations@shiftpixy.com800.475.3655

ShiftPixy,

Inc.Consolidated Balance Sheets

| |

|

August 31, 2020 |

|

|

August 31, 2019 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

4,303,000 |

|

|

$ |

1,561,000 |

|

|

Accounts receivable, net |

|

|

308,000 |

|

|

|

85,000 |

|

|

Unbilled accounts receivable |

|

|

2,303,000 |

|

|

|

1,418,000 |

|

|

Deposit – workers’ compensation |

|

|

293,000 |

|

|

|

235,000 |

|

|

Prepaid expenses |

|

|

723,000 |

|

|

|

349,000 |

|

|

Other current assets |

|

|

73,000 |

|

|

|

244,000 |

|

|

Current assets of discontinued operations |

|

|

1,030,000 |

|

|

|

10,139,000 |

|

|

Total current assets |

|

|

9,033,000 |

|

|

|

14,031,000 |

|

| |

|

|

|

|

|

|

|

|

|

Fixed assets, net |

|

|

575,000 |

|

|

|

4,155,000 |

|

|

Note receivable, net |

|

|

4,045,000 |

|

|

|

- |

|

|

Deposits – workers’ compensation |

|

|

736,000 |

|

|

|

754,000 |

|

|

Deposits and other assets |

|

|

449,000 |

|

|

|

124,000 |

|

|

Non-current assets of discontinued operations |

|

|

2,582,000 |

|

|

|

5,567,000 |

|

|

Total assets |

|

$ |

17,420,000 |

|

|

$ |

24,631,000 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and other accrued

liabilities |

|

$ |

3,831,000 |

|

|

$ |

4,454,000 |

|

|

Payroll related liabilities |

|

|

5,752,000 |

|

|

|

2,559,000 |

|

|

Convertible notes, net |

|

|

- |

|

|

|

3,351,000 |

|

|

Accrued workers’ compensation costs |

|

|

497,000 |

|

|

|

235,000 |

|

|

Default penalties accrual |

|

|

- |

|

|

|

1,800,000 |

|

|

Derivative liability |

|

|

- |

|

|

|

3,756,000 |

|

|

Current liabilities of discontinued

operations |

|

|

1,746,000 |

|

|

|

16,033,000 |

|

|

Total current liabilities |

|

|

11,826,000 |

|

|

|

32,188,000 |

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Accrued workers’ compensation costs |

|

|

1,247,000 |

|

|

|

525,000 |

|

|

Non-current liabilities of discontinued

operations |

|

|

4,377,000 |

|

|

|

3,853,000 |

|

|

Total liabilities |

|

|

17,450,000 |

|

|

|

36,566,000 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ deficit |

|

|

|

|

|

|

|

|

|

Preferred stock, 50,000,000 authorized shares; $0.0001 par

value |

|

|

- |

|

|

|

- |

|

|

Common stock, 750,000,000 authorized shares; $0.0001 par

value; 16,902,146 and 909,222 shares issued as of August 31, 2020

and 2019 |

|

|

1,000 |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

119,431,000 |

|

|

|

32,505,000 |

|

|

Treasury stock, at cost-0 and 13,953 shares as of August

31, 2020 and August 31, 2019 |

|

|

- |

|

|

|

(325,000 |

) |

|

Accumulated deficit |

|

|

(119,462,000 |

) |

|

|

(44,115,000 |

) |

|

Total stockholders’ deficit |

|

|

(30,000 |

) |

|

|

(11,935,000 |

) |

|

Total liabilities and stockholders’ deficit |

|

$ |

17,420,000 |

|

|

$ |

24,631,000 |

|

ShiftPixy

Inc.Consolidated Statements of

Operations

| |

|

For the year ended |

|

| |

|

August 31,2020 |

|

|

August 31,2019 |

|

| Revenues (gross billings of

$65.5 million and $73.4 million less worksite employee payroll cost

of $56.9 million and $62.9 million, respectively) |

|

$ |

8,642,000 |

|

|

$ |

10,451,000 |

|

| Cost of revenue |

|

|

7,685,000 |

|

|

|

8,538,000 |

|

| Gross profit |

|

|

957,000 |

|

|

|

1,913,000 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Salaries, wages, and payroll taxes |

|

|

7,227,000 |

|

|

|

6,283,000 |

|

|

Stock-based compensation – general and administrative |

|

|

1,526,000 |

|

|

|

632,000 |

|

|

Commissions |

|

|

181,000 |

|

|

|

201,000 |

|

|

Professional fees |

|

|

3,366,000 |

|

|

|

3,918,000 |

|

|

Software development - external |

|

|

2,240,000 |

|

|

|

1,209,000 |

|

|

Depreciation and amortization |

|

|

272,000 |

|

|

|

194,000 |

|

|

Impaired asset expense |

|

|

3,543,000 |

|

|

|

- |

|

|

General and administrative |

|

|

4,180,000 |

|

|

|

5,032,000 |

|

|

Total operating expenses |

|

|

22,535,000 |

|

|

|

17,469,000 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Loss |

|

|

(21,578,000 |

) |

|

|

(15,556,000 |

) |

| |

|

|

|

|

|

|

|

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(2,525,000 |

) |

|

|

(8,507,000 |

) |

|

Change in fair value of note receivable |

|

|

(1,074,000 |

) |

|

|

- |

|

|

Expense related to Preferred Options |

|

|

(62,091,000 |

) |

|

|

- |

|

|

Expense related to modification of warrants |

|

|

(21,000 |

) |

|

|

- |

|

|

Loss from debt conversion |

|

|

(3,500,000 |

) |

|

|

- |

|

|

Inducement loss |

|

|

(624,000 |

) |

|

|

(3,927,000 |

) |

|

Loss on debt extinguishment |

|

|

(1,592,000 |

) |

|

|

- |

|

|

Change in fair value derivative and warrant liability |

|

|

1,777,000 |

|

|

|

2,569,000 |

|

|

Loss on convertible note settlement |

|

|

- |

|

|

|

811,000 |

|

|

Gain on convertible note penalties accrual |

|

|

760,000 |

|

|

|

- |

|

|

Total other (expense) income |

|

|

(68,890,000 |

) |

|

|

(9,054,000 |

) |

| Loss from continuing

operations |

|

|

(90,468,000 |

) |

|

|

(24,610,000 |

) |

| (Loss) Income from

discontinued operations |

|

|

|

|

|

|

|

|

| (Loss) Income from

discontinued operations |

|

|

(561,000 |

) |

|

|

6,528,000 |

|

| Gain from asset sale |

|

|

15,682,000 |

|

|

|

- |

|

| Total Income (Loss) from

discontinued operations, net of tax |

|

|

15,121,000 |

|

|

|

6,528,000 |

|

| |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(75,347,000 |

) |

|

$ |

(18,082,000 |

) |

| |

|

|

|

|

|

|

|

|

| Net Loss per share, Basic and

diluted |

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(4.96 |

) |

|

$ |

(30.09 |

) |

| Discontinued operations |

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

|

(0.03 |

) |

|

|

7.98 |

|

|

Gain on sale of assets |

|

|

0.86 |

|

|

|

- |

|

|

Total discontinued operations |

|

|

0.83 |

|

|

|

7.98 |

|

| Net Loss per share of common

stock – Basic and diluted |

|

$ |

(4.13 |

) |

|

$ |

(22.11 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average common stock

outstanding – Basic and diluted |

|

|

18,222,661 |

|

|

|

817,720 |

|

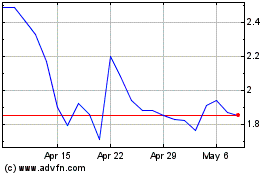

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

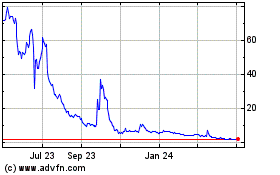

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Apr 2023 to Apr 2024