Sharecare (Nasdaq: SHCR), the digital health company that helps

people manage all their health in one place, today announced

financial results for the quarter ended June 30, 2024.

“We began the second half of 2024 executing on our Enterprise

channel strategy to expand into additional verticals with the

successful launch of our new platform purpose-built for Medicaid to

750,000 members on July 1,” said Brent Layton, CEO of Sharecare. “I

am very enthusiastic about the opportunity to drive activation,

engagement, and positive impact in these verticals at scale,

leveraging our highly configurable digital capabilities, data, and

services while continuing to deepen our relationships with large

employers, health plans, and value-based companies, which remain

important cornerstones for the company’s continued growth.”

Second Quarter

2024 Financial Results All

comparisons, unless otherwise noted, are to the three months ended

June 30, 2023.

- Revenue of $94.3 million compared

to $110.4 million, a decrease of $16.1 million, or 14.6%.

- Net loss attributable to Sharecare

of $42.0 million compared to $35.1 million, an increase to net loss

attributable to Sharecare of $6.9 million. Net loss attributable to

Sharecare in the second quarter of 2024 included $15.8 million in

non-cash stock compensation; $1.8 million in non-operating,

non-recurring costs; $2.6 million of reorganizational and severance

costs; $4.7 million of acquisition related costs; and $3.0 million

of other non-cash or non-operational expense. Excluding these

amounts, the adjusted net loss was $14.1 million in the current

quarter.

- Adjusted EBITDA of near break-even

compared to $3.3 million, a decrease to adjusted EBITDA of $3.3

million.

- Net loss per share of $0.12

compared to $0.10, an increase to net loss per share of $0.02.

- Adjusted net loss per share, which

excludes the impact of non-cash and non-operational amounts, was

$0.04 compared to $0.03, an increase to adjusted net loss per share

of $0.01.

“In addition to the positive progress in the

Enterprise channel, we continued to drive top and bottom-line

growth across our Provider and Life Sciences channels which was

reflected in our Q2 earnings,” said Justin Ferrero, president and

chief financial officer of Sharecare. “Our focus for the second

half of the year is to accelerate growth and maximize profitability

by delivering our proven solutions at higher operating margins,

while continuing to invest in innovation to drive consumerism in

healthcare.”

Proposed Acquisition by

AltarisAs previously announced on June 21, 2024, Sharecare

entered into a definitive agreement to be acquired by an affiliate

of Altaris, LLC, an investment firm exclusively focused on the

healthcare industry. Under the terms of the definitive merger

agreement, Sharecare stockholders will receive $1.43 in cash per

common share upon closing. The expiration of the waiting period

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in

connection with the pending acquisition occurred at 11:59 p.m. ET

on August 8, 2024. The expiration of the waiting period satisfies

one of the conditions necessary for the consummation of the

transaction, which is expected to occur by the end of 2024, subject

to approval by Sharecare stockholders and satisfaction of the other

remaining closing conditions. The transaction is not subject to a

financing condition.

Conference Call and Financial

OutlookDue to the recently announced pending acquisition

of Sharecare by Altaris, Sharecare will not host an earnings

conference call or provide financial guidance in conjunction with

its second quarter 2024 earnings release.

Non-GAAP Financial MeasuresIn

addition to our financial results determined in accordance with

U.S. GAAP, we believe the non-GAAP measures adjusted EBITDA,

adjusted net loss, and adjusted loss per share are useful in

evaluating our operating performance. We use adjusted EBITDA,

adjusted net loss, and adjusted loss per share to evaluate our

ongoing operations and for internal planning and forecasting

purposes. We believe that these non-GAAP financial measures, when

taken together with the corresponding GAAP financial measures,

provide meaningful supplemental information regarding our

performance by excluding certain items that may not be indicative

of our business, results of operations, or outlook. In particular,

we believe that the use of these non-GAAP measures is helpful to

our investors as these metrics are used by management in assessing

the health of our business and our operating performance. However,

non-GAAP financial information is presented for supplemental

informational purposes only, has limitations as an analytical tool,

and should not be considered in isolation or as a substitute for

financial information presented in accordance with GAAP. In

addition, other companies, including companies in our industry, may

calculate similarly-titled non-GAAP measures differently or may use

other measures to evaluate their performance, all of which could

reduce the usefulness of our non-GAAP financial measures.

The calculations and reconciliations of historic

adjusted EBITDA, adjusted net loss, and adjusted loss per share to

net loss, the most directly comparable financial measure stated in

accordance with GAAP, are provided below and in the accompanying

financial tables. Investors are encouraged to review the

reconciliations and not to rely on any single financial measure to

evaluate our business.

Adjusted EBITDAWe calculate

adjusted EBITDA as net loss adjusted to exclude

(i) depreciation and amortization, (ii) interest income,

(iii) interest expense, (iv) income tax (benefit) expense, (v)

other (income) expense (non-operating), (vi)

share-based compensation, (vii) warrants issued with revenue

contracts, (viii) amortization of non-cash payment for research and

development, (ix) non-operating, non-recurring costs, (x)

reorganizational and severance costs, and (xi) acquisition-related

costs. We do not view the items excluded as representative of

normal, recurring, cash operating expenses necessary to operate the

Company’s lines of business and services.

Non-operating, non-recurring costs for the three

and six months ended June 30, 2024 include costs related to legal

matters involving prior acquisitions and in connection with the

contractual obligation with a financially distressed vendor and are

recorded in general and administrative operating expense.

Non-operating, non-recurring costs for the three

and six months ended June 30, 2023 include costs of our enterprise

resource planning (“ERP”) system implementation, costs of

contractual obligations associated with a financially distressed

vendor, and costs related to legal matters. The ERP and legal

matter costs are recorded in general and administrative operating

expense and the financially distressed vendor costs are recorded in

cost of revenue in the Consolidated Statement of Operations and

Comprehensive Loss for each respective period presented.

Legal matter costs include attorney fees

associated with a dispute that arose from a prior acquisition,

attorney fees associated with the submission of an unsolicited

acquisition offer as filed in the Schedule 13D with the SEC on

October 11, 2023, and attorney fees related to contractual

obligations associated with a financially distressed vendor. These

matters have unique facts and circumstance that are not directly

related to our operations. We do not consider these costs to be

normal, recurring, cash operating expenses necessary to operate our

business.

The ERP implementation is viewed as a

transformational undertaking due to the extensive scope and

inherent change management involved to transition to a new

single-solution ERP system from the disparate legacy systems. These

costs consist of internal and third-party costs of the ERP

implementation and do not include capitalized costs, depreciation

and/or amortization, or costs to support or maintain software

applications or systems once they are in productive use. The ERP

system was fully implemented as planned in 2023, and such costs are

not expected to recur in the foreseeable future. We do not consider

these costs to be normal, recurring, cash operating expenses

necessary to operate our business.

Financially distressed vendor costs include

financial support from us to a vendor in response to the vendor’s

financial difficulties, which absent such support would have

resulted in an interruption of our service to our customers.

Because we are committed to providing uninterrupted service to our

customers, and to minimizing the risk of such a disruption, we made

additional, advance payments to the vendor beyond those that were

due to the vendor in association with services procured from the

vendor. We ceased procuring services from the vendor in Q2 2023 and

subsequent to that period no further amounts were paid. Because the

costs of the additional payments made to the vendor were

incremental to the costs incurred by us to deliver service to our

customers, we do not consider them to be normal, recurring, cash

operating expenses necessary to operate our business.

Reorganizational and severance costs are a

component of our Globalization Efforts and Cost Savings as

described in Key Factors and Trends Affecting our Operating

Performance. These costs are due to efforts to globalize and

centralize our workforce through the creation of the global shared

service center. We have never had a global shared service center

and view this undertaking as outside the scope of normal

operations. Costs include salary, benefits, equity and bonus

compensation, and other employee costs for those who were

identified to be terminated. These costs were recorded in sales and

marketing, product and technology, and general and administrative

operating expenses in the Consolidated Statement of Operations and

Comprehensive Loss for the periods presented, based on the

employee’s respective job function. Because these costs are part of

a specific and unprecedented initiative, we do not consider these

expenses to be normal, recurring, cash operating expenses necessary

to operate our business.

Certain prior period adjusted EBITDA add-back

amounts have been reclassified to new add-back line items in order

to conform to the current period presentation and to more

accurately describe the nature of the amounts year-over-year.

In conformance with the SEC’s clarified guidance around – and

recent focus on – non-GAAP financial measures, our adjusted EBITDA

now includes costs related to an exited contract, abandoned leases,

and certain staff reorganization expenses, all of which were

previously disclosed but excluded from our historical adjusted

EBITDA calculations and guidance. Further details can be found

below in footnote (e) in the reconciliation table for adjusted

EBITDA.

Adjusted Net LossWe calculate

adjusted net loss as net loss attributable to Sharecare, Inc.

adjusted to exclude (i) amortization of acquired intangibles, (ii)

amortization of deferred financing fees, (iii) change in fair value

of warrant liability and contingent consideration, (iv) share-based

compensation, (v) warrants issued with revenue contracts, (vi)

amortization of non-cash payment for research and development,

(vii) non-operating, non-recurring costs, (viii) reorganizational

and severance costs, and (ix) acquisition related costs. We do not

view the items excluded as representative of normal, recurring,

cash operating expenses necessary to operate the Company’s lines of

business and services.

Adjusted Loss Per ShareWe

calculate adjusted lost per share as adjusted net loss, as defined

above, divided by the number of weighted average common shares

outstanding - basic and diluted.

About SharecareSharecare is the

leading digital health company that helps people – no matter where

they are in their health journey – unify and manage all their

health in one place. Our comprehensive and data-driven virtual

health platform is designed to help people, providers, employers,

health plans, government organizations, and communities optimize

individual and population-wide well-being by driving positive

behavior change. Driven by our philosophy that we are all together

better, at Sharecare, we are committed to supporting each

individual through the lens of their personal health and making

high-quality care more accessible and affordable for everyone. To

learn more, visit www.sharecare.com.

Important Notice Regarding

Forward-Looking StatementsThis press release contains

forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 that are based on beliefs

and assumptions and on information currently available. In some

cases, you can identify forward-looking statements by the following

words: “outlook,” “target,” “reflect,” “on track,” “foresees,”

“future,” “may,” “deliver,” “will,” “shall,” “could,” “would,”

“should,” “expect,” “intend,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “project,” “potential,” “continue,”

“ongoing” or the negative of these terms, other comparable

terminology (although not all forward-looking statements contain

these words), or by discussions of strategy, plans, or intentions.

These statements involve risks, uncertainties and other factors

that may cause actual results, levels of activity, performance or

achievements to be materially different from the information

expressed or implied by these forward-looking statements. Although

we believe that we have a reasonable basis for each forward-looking

statement contained in this press release, we caution you that

these statements are based on a combination of facts and factors

currently known by us and our projections of the future, about

which we cannot be certain.

Forward-looking statements in this press release

include, but are not limited to, statements regarding our pending

acquisition by Altaris, LLC (including timing of the closing

thereof), our long-term strategy and positioning, growth,

globalization and other strategic cost optimization initiatives and

the corresponding benefits, including long-term growth, margin

improvement and cash flow improvements, and partnerships or other

relationships with third parties or customers, in each case on our

future growth objectives and statements regarding our future

results and outlook, including those under the caption “Conference

Call and Financial Outlook.”

We cannot assure you that the forward-looking

statements in this press release will prove to be accurate. These

forward-looking statements are subject to a number of significant

risks and uncertainties that could cause actual results to differ

materially from expected results. For example, the Company’s

Financial Outlook assumes business currently under contract and

satisfaction by our customers of their contractual obligations

under those agreements, which is not within the Company’s

control. If a customer fails to satisfy its contractual

obligations, actual revenue and Adjusted EBITDA could be negatively

impacted. Descriptions of some of the other factors that could

cause actual results to differ materially from these

forward-looking statements are discussed in more detail in our

filings with the U.S. Securities and Exchange Commission (the

"SEC"), including the Risk Factors section of the Company's Annual

Report on Form 10-K for the year ended December 31, 2023, filed

with the SEC on March 29, 2024. Furthermore, if the forward-looking

statements prove to be inaccurate, the inaccuracy may be material.

In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a

representation or warranty by us or any other person that we will

achieve our objectives and plans in any specified time frame, or at

all. The forward-looking statements in this press release represent

our views as of the date of this press release. We anticipate that

subsequent events and developments will cause our views to change.

However, while we may elect to update these forward-looking

statements at some point in the future, we have no current

intention of doing so except to the extent required by applicable

law. You should, therefore, not rely on these forward-looking

statements as representing our views as of any date subsequent to

the date of this press release.

Additional Information and Where to Find ItIn

connection with the proposed transaction involving Sharecare,

Sharecare has filed and will file relevant materials with the SEC,

including Sharecare’s preliminary proxy statement on Schedule 14A

(the “Proxy Statement”), filed with the SEC on August 5, 2024, and

the transaction statement on Schedule 13E-3 jointly filed with the

SEC on August 5, 2024 by Sharecare, Altaris, LLC, Claritas Capital,

LLC, Jeff Arnold and certain affiliates of each of Altaris, LLC,

Claritas Capital, LLC and Jeff Arnold (the “Schedule 13E-3”). This

communication is not a substitute for the Proxy Statement, the

Schedule 13E-3 or any other document that Sharecare may file with

the SEC and send to its stockholders in connection with the

proposed transaction. The proposed transaction will be submitted to

Sharecare’s stockholders for their consideration. Before making any

voting decision, Sharecare’s stockholders are urged to read all

relevant documents filed or to be filed with the SEC, including the

Proxy Statement and the Schedule 13E-3, as well as any amendments

or supplements to those documents, when they become available

because they will contain important information about the proposed

transaction.

Sharecare’s stockholders will be able to obtain a free copy of

the Proxy Statement and the Schedule 13E-3, as well as other

filings containing information about Sharecare, without charge, at

the SEC’s website (www.sec.gov). Copies of the Proxy Statement, the

Schedule 13E-3 and the filings with the SEC that will be

incorporated by reference therein can also be obtained, without

charge, by directing a request to Sharecare, Inc., 255 East Paces

Ferry Road NE, Suite 700, Atlanta, Georgia 30305, Attention:

Investor Relations, investors@sharecare.com, or from Sharecare’s

website www.sharecare.com.

Participants in the

SolicitationSharecare and certain of its directors,

executive officers and employees may be deemed to be participants

in the solicitation of proxies in respect of the proposed

transaction. Information regarding Sharecare’s directors and

executive officers is available in Sharecare’s proxy statement for

the 2024 annual meeting of stockholders, which was filed with the

SEC on April 29, 2024 (the “Annual Meeting Proxy Statement”).

Please refer to the sections captioned “Executive Compensation,”

“Director Compensation” and “Stock Ownership” in the Annual Meeting

Proxy Statement. To the extent holdings of such participants in

Sharecare’s securities have changed since the amounts described in

the Annual Meeting Proxy Statement, such changes have been

reflected on Initial Statements of Beneficial Ownership on Form 3

or Statements of Change in Ownership on Form 4 filed with the SEC:

Form 4, filed by Jeffrey T. Arnold on May 17, 2024; Form 4, filed

by Dawn Whaley on May 17, 2024; Form 4, filed by Justin Ferrero on

May 17, 2024; Form 4, filed by Carrie Ratliff on May 17, 2024; Form

4, filed by Michael Blalock on May 17, 2024; Form 4, filed by Colin

Daniel on May 17, 2024; Form 4, filed by Jeffrey A. Allred on June

12, 2024; Form 4, filed by John Huston Chadwick on June 12, 2024;

Form 4, filed by Kenneth R. Goulet on June 12, 2024; Form 4, filed

by Brent D. Layton on June 12, 2024; Form 4, filed by Rajeev

Ronanki on June 12, 2024; Form 4, filed by Rajeev Ronanki on June

18, 2024; Form 4, filed by Kenneth R. Goulet on June 18, 2024; Form

4, filed by Colin Daniel on June 18, 2024; Form 4, filed by Carrie

Ratliff on June 18, 2024; Form 4, filed by Veronica Mallett on June

18, 2024; Form 4, filed by Jeffrey Sagansky on June 18, 2024; Form

4, filed by John Huston Chadwick on June 18, 2024; Form 4, filed by

Justin Ferrero on June 18, 2024; Form 4, filed by Nicole Torraco on

June 18, 2024; Form 4, filed by Alan G. Mnuchin on June 18, 2024;

Form 4, filed by Michael Blalock on June 18, 2024; Form 4, filed by

Sandro Galea on June 18, 2024; Form 4, filed by Dawn Whaley on June

18, 2024; Form 4, filed by Jeffrey A. Allred on June 18, 2024 Form

4, filed by Colin Daniel on July 15, 2024; Form 4, filed by Dawn

Whaley on July 15, 2024; Form 4, filed by Justin Ferrero on July

15, 2024; Form 4, filed by Michael Blalock on July 15, 2024; Form

4, filed by Carrie Ratliff on July 15, 2024; Form 4, filed by

Justin Ferrero on July 30, 2024; Form 4, filed by Brent D. Layton

on July 30, 2024; Form 4, filed by Jeffrey T. Arnold on July 30,

2024; Form 4, filed by Colin Daniel on July 30, 2024; Form 4, filed

by Michael Blalock on July 30, 2024; Form 4, filed by Carrie

Ratliff on July 30, 2024; and Form 4, filed by Dawn Whaley on July

30, 2024. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, are or will be

contained in the Proxy Statement, the Schedule 13E-3 and other

relevant materials to be filed with the SEC in connection with the

proposed transaction when they become available. Free copies of the

Proxy Statement, the Schedule 13E-3 and such other materials may be

obtained as described in the preceding paragraph.

Media Relations:PR@sharecare.com

Investor Relations:investors@sharecare.com

|

SHARECARE, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)(In

thousands, except share and per share amounts) |

| |

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

94,265 |

|

|

$ |

110,353 |

|

|

$ |

185,126 |

|

|

$ |

226,648 |

|

| Costs and operating

expenses: |

|

|

|

|

|

|

|

| Costs of revenue |

|

51,150 |

|

|

|

62,948 |

|

|

|

102,270 |

|

|

|

130,840 |

|

| Sales and marketing |

|

13,586 |

|

|

|

14,959 |

|

|

|

27,144 |

|

|

|

30,309 |

|

| Product and technology |

|

14,714 |

|

|

|

17,035 |

|

|

|

29,258 |

|

|

|

37,843 |

|

| General and

administrative |

|

39,688 |

|

|

|

35,371 |

|

|

|

74,595 |

|

|

|

69,490 |

|

| Depreciation and

amortization |

|

16,280 |

|

|

|

14,184 |

|

|

|

29,611 |

|

|

|

28,965 |

|

|

Total costs and operating expenses |

|

135,418 |

|

|

|

144,497 |

|

|

|

262,878 |

|

|

|

297,447 |

|

|

Loss from operations |

|

(41,153 |

) |

|

|

(34,144 |

) |

|

|

(77,752 |

) |

|

|

(70,799 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

1,023 |

|

|

|

1,646 |

|

|

|

2,297 |

|

|

|

3,326 |

|

|

Interest expense |

|

(312 |

) |

|

|

(453 |

) |

|

|

(528 |

) |

|

|

(882 |

) |

|

Other expense |

|

(1,542 |

) |

|

|

(2,631 |

) |

|

|

(1,176 |

) |

|

|

(2,201 |

) |

|

Total other (expense) income |

|

(831 |

) |

|

|

(1,438 |

) |

|

|

593 |

|

|

|

243 |

|

|

Loss before income tax expense |

|

(41,984 |

) |

|

|

(35,582 |

) |

|

|

(77,159 |

) |

|

|

(70,556 |

) |

| Income tax expense |

|

(37 |

) |

|

|

(65 |

) |

|

|

(6 |

) |

|

|

(96 |

) |

|

Net loss |

|

(42,021 |

) |

|

|

(35,647 |

) |

|

|

(77,165 |

) |

|

|

(70,652 |

) |

| Net income (loss) attributable

to noncontrolling interest in subsidiaries |

|

16 |

|

|

|

(504 |

) |

|

|

(41 |

) |

|

|

(850 |

) |

|

Net loss attributable to Sharecare, Inc. |

$ |

(42,037 |

) |

|

$ |

(35,143 |

) |

|

$ |

(77,124 |

) |

|

$ |

(69,802 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.12 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.20 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

360,401,283 |

|

|

|

354,049,808 |

|

|

|

357,315,727 |

|

|

|

353,490,234 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARECARE, INC.CONSOLIDATED BALANCE

SHEETS(Unaudited)(In thousands,

except share and per share amounts) |

| |

| |

As of June 30,2024 |

|

As of December 31,2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

85,151 |

|

|

$ |

128,187 |

|

|

Accounts receivable, net (net of allowance for doubtful accounts of

$8,091 and $8,544, respectively) |

|

130,519 |

|

|

|

128,173 |

|

|

Other receivables |

|

2,773 |

|

|

|

2,262 |

|

|

Prepaid expenses |

|

8,727 |

|

|

|

6,007 |

|

|

Other current assets |

|

2,644 |

|

|

|

3,178 |

|

|

Total current assets |

|

229,814 |

|

|

|

267,807 |

|

|

Property and equipment, net |

|

2,218 |

|

|

|

3,375 |

|

|

Other long-term assets |

|

13,043 |

|

|

|

13,863 |

|

|

Intangible assets, net |

|

123,308 |

|

|

|

136,552 |

|

|

Goodwill |

|

191,819 |

|

|

|

192,037 |

|

|

Total assets |

$ |

560,202 |

|

|

$ |

613,634 |

|

| Liabilities,

Redeemable Convertible Preferred Stock and Stockholders’

Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

48,102 |

|

|

$ |

45,388 |

|

|

Accrued expenses and other current liabilities |

|

60,461 |

|

|

|

65,706 |

|

|

Deferred revenue |

|

5,365 |

|

|

|

5,517 |

|

|

Total current liabilities |

|

113,928 |

|

|

|

116,611 |

|

|

Warrant liabilities |

|

1,398 |

|

|

|

403 |

|

|

Long-term debt |

|

— |

|

|

|

519 |

|

|

Other long-term liabilities |

|

7,069 |

|

|

|

8,032 |

|

|

Total liabilities |

|

122,395 |

|

|

|

125,565 |

|

|

Commitments and contingencies |

|

|

|

|

Series A convertible redeemable preferred shares, $0.0001 par

value; 5,000,000 shares authorized; 5,000,000 shares issued and

outstanding, aggregate liquidation preference of $50,000 as of June

30, 2024 and December 31, 2023 |

|

58,205 |

|

|

|

58,205 |

|

|

Stockholders’ equity: |

|

|

|

|

Common stock, $0.0001 par value; 600,000,000 and 600,000,000 shares

authorized; 367,662,956 and 353,430,357 shares issued and

outstanding as of June 30, 2024 and December 31, 2023,

respectively |

|

37 |

|

|

|

35 |

|

|

Additional paid-in capital |

|

1,185,003 |

|

|

|

1,157,737 |

|

|

Accumulated other comprehensive loss |

|

(2,645 |

) |

|

|

(2,263 |

) |

|

Accumulated deficit |

|

(802,497 |

) |

|

|

(725,373 |

) |

|

Total Sharecare stockholders’ equity |

|

379,898 |

|

|

|

430,136 |

|

|

Noncontrolling interest in subsidiaries |

|

(296 |

) |

|

|

(272 |

) |

|

Total stockholders’ equity |

|

379,602 |

|

|

|

429,864 |

|

|

Total liabilities, redeemable convertible preferred stock and

stockholders’ equity |

$ |

560,202 |

|

|

$ |

613,634 |

|

|

|

|

|

|

|

|

|

|

|

SHARECARE, INC.RECONCILIATION OF GAAP NET

LOSS TO ADJUSTED

EBITDA(Unaudited)(In

thousands) |

| |

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

2024 |

|

|

2023 |

|

2024 |

|

2023 |

|

Net loss |

$ |

(42,021 |

) |

|

$ |

(35,647 |

) |

|

$ |

(77,165 |

) |

|

$ |

(70,652 |

) |

| Add: |

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

16,280 |

|

|

|

14,184 |

|

|

|

29,611 |

|

|

|

28,965 |

|

| Interest income |

|

(1,023 |

) |

|

|

(1,646 |

) |

|

|

(2,297 |

) |

|

|

(3,326 |

) |

| Interest expense |

|

312 |

|

|

|

453 |

|

|

|

528 |

|

|

|

882 |

|

| Income tax expense |

|

37 |

|

|

|

65 |

|

|

|

6 |

|

|

|

96 |

|

| Other expense |

|

1,542 |

|

|

|

2,631 |

|

|

|

1,176 |

|

|

|

2,201 |

|

| Share-based compensation |

|

15,800 |

|

|

|

12,149 |

|

|

|

29,396 |

|

|

|

22,116 |

|

| Warrants issued with revenue

contracts |

|

9 |

|

|

|

14 |

|

|

|

36 |

|

|

|

28 |

|

| Amortization of non-cash

payment for research and development |

|

— |

|

|

|

1,190 |

|

|

|

— |

|

|

|

2,380 |

|

| Non-operating, non-recurring

costs(a) |

|

1,762 |

|

|

|

1,404 |

|

|

|

3,924 |

|

|

|

3,119 |

|

| Reorganizational and severance

costs(b) |

|

2,579 |

|

|

|

8,224 |

|

|

|

5,924 |

|

|

|

17,254 |

|

| Acquisition-related

costs(c) |

|

4,730 |

|

|

|

267 |

|

|

|

6,144 |

|

|

|

825 |

|

| Adjusted EBITDA(d)(e) |

$ |

7 |

|

|

$ |

3,288 |

|

|

$ |

(2,717 |

) |

|

$ |

3,888 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

For the three months ended June 30, 2024, primarily represents

costs related to legal matters involving prior acquisitions for

$1.5 million and in connection with the contractual obligation with

a financially distressed vendor of $0.2 million. For the three

months ended June 30, 2023, primarily represents costs related to

the ERP implementation of $0.5 million, contractual obligations

with a financially distressed vendor of $0.3 million, and legal

matters of $0.2 million.For the six months ended June 30, 2024,

primarily represents costs related to legal matters involving a

prior acquisitions for $3.2 million and in connection with the

contractual obligation with a financially distressed vendor of $0.7

million. For the six months ended June 30, 2023, primarily

represents costs related to the ERP implementation of $0.9 million,

contractual obligations with a financially distressed vendor of

$0.7 million, and legal matters of $0.3 million. |

| |

(b) |

For the three months ended June

30, 2024, represents costs related to globalizing the Company's

workforce of $1.8 million and severance of $0.8 million. For the

three months ended June 30, 2023, represents costs related to

globalizing the Company's workforce of $7.3 million and severance

of $0.9 million. For the six months ended June 30, 2024, represents

costs related to globalizing the Company's workforce of $4.7

million and severance of $1.2 million. For the six months ended

June 30, 2023, represents costs related to globalizing the

Company's workforce of $15.6 million and severance of $1.7

million. |

| |

(c) |

For the three and six month

periods ended June 30, 2024, primarily represents legal and other

transactional costs associated with the pending Merger. |

| |

(d) |

Includes non-cash amortization

associated with contract liabilities recorded in connection with

acquired businesses. |

| |

(e) |

Effective September 30, 2023, we

no longer exclude costs associated with exiting a contract and

lease terminations from our computation of adjusted EBITDA. For the

three months ended June 30, 2023 these costs totaled $0.5 million

and less than $0.1 million, respectively. For the six months ended

June 30, 2023 these costs totaled $1.2 million and $0.8 million,

respectively. |

|

SHARECARE, INC.RECONCILIATION OF GAAP NET

LOSS ATTRIBUTABLE TO SHARECARE TO ADJUSTED NET LOSS AND

ADJUSTEDLOSS PER

SHARE(Unaudited)(In thousands,

except share and per share data) |

| |

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net loss attributable to Sharecare, Inc. |

$ |

(42,037 |

) |

|

$ |

(35,143 |

) |

|

$ |

(77,124 |

) |

|

$ |

(69,802 |

) |

| Add: |

|

|

|

|

|

|

|

| Amortization of acquired

intangibles(a) |

|

1,534 |

|

|

|

1,633 |

|

|

|

3,133 |

|

|

|

3,265 |

|

| Amortization of deferred

financing fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

31 |

|

| Change in fair value of

warrant liability and contingent consideration |

|

1,508 |

|

|

|

96 |

|

|

|

1,129 |

|

|

|

(42 |

) |

| Share-based compensation |

|

15,800 |

|

|

|

12,149 |

|

|

|

29,396 |

|

|

|

22,116 |

|

| Warrants issued with revenue

contracts |

|

9 |

|

|

|

14 |

|

|

|

36 |

|

|

|

28 |

|

| Amortization of non-cash

payment for research and development |

|

— |

|

|

|

1,190 |

|

|

|

— |

|

|

|

2,380 |

|

| Non-operating, non-recurring

costs(b) |

|

1,762 |

|

|

|

1,404 |

|

|

|

3,924 |

|

|

|

3,119 |

|

| Reorganizational and severance

costs(c) |

|

2,579 |

|

|

|

8,224 |

|

|

|

5,924 |

|

|

|

17,254 |

|

| Acquisition-related

costs(d) |

|

4,730 |

|

|

|

267 |

|

|

|

6,144 |

|

|

|

825 |

|

| Adjusted net loss(e)(f) |

$ |

(14,115 |

) |

|

$ |

(10,166 |

) |

|

$ |

(27,438 |

) |

|

$ |

(20,826 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding, basic and diluted |

|

360,401,283 |

|

|

|

354,049,808 |

|

|

|

357,315,727 |

|

|

|

353,490,234 |

|

| |

|

|

|

|

|

|

|

| Loss per share |

$ |

(0.12 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.20 |

) |

| Adjusted loss per share |

$ |

(0.04 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Represents non-cash expenses related to the amortization of

intangibles in connection with acquired businesses. |

| |

(b) |

For the three months ended June

30, 2024, primarily represents costs related to legal matters

involving prior acquisitions for $1.5 million and in connection

with the contractual obligation with a financially distressed

vendor of $0.2 million. For the three months ended June 30, 2023,

primarily represents costs related to the ERP implementation of

$0.5 million, contractual obligations with a financially distressed

vendor of $0.3 million, and legal matters of $0.2 million.For the

six months ended June 30, 2024, primarily represents costs related

to legal matters involving a prior acquisitions for $3.2 million

and in connection with the contractual obligation with a

financially distressed vendor of $0.7 million. For the six months

ended June 30, 2023, primarily represents costs related to the ERP

implementation of $0.9 million, contractual obligations with a

financially distressed vendor of $0.7 million, and legal matters of

$0.3 million. |

| |

(c) |

For the three months ended June

30, 2024, represents costs related to globalizing the Company's

workforce of $1.8 million and severance of $0.8 million. For the

three months ended June 30, 2023, represents costs related to

globalizing the Company's workforce of $7.3 million and severance

of $0.9 million. For the six months ended June 30, 2024, represents

costs related to globalizing the Company's workforce of $4.7

million and severance of $1.2 million. For the six months ended

June 30, 2023, represents costs related to globalizing the

Company's workforce of $15.6 million and severance of $1.7

million. |

| |

(d) |

For the three and six month

periods ended June 30, 2024, primarily represents legal and other

transactional costs associated with the pending Merger. |

| |

(e) |

The income tax effect of the

Company’s non-GAAP reconciling items are offset by valuation

allowance adjustments of the same amount given the Company is in a

full valuation allowance position. |

| |

(f) |

Effective September 30, 2023, we

no longer exclude costs associated with exiting a contract and

lease terminations from our computation of adjusted EBITDA. For the

three months ended June 30, 2023 these costs totaled $0.5 million

and less than $0.1 million, respectively. For the six months ended

June 30, 2023 these costs totaled $1.2 million and $0.8 million,

respectively. |

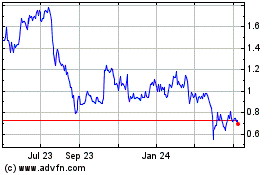

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Nov 2024 to Dec 2024

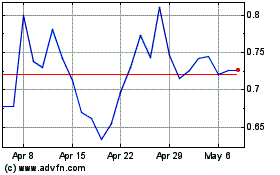

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Dec 2023 to Dec 2024