Semtech Corporation (Nasdaq: SMTC), a leading supplier of high

performance analog and mixed-signal semiconductors and advanced

algorithms, today reported unaudited financial results for its

third quarter of fiscal year 2021, which ended October 25,

2020.

Highlights for the Third Fiscal Quarter 2021

- Q3 FY2021 net sales of $154.1 million increased 7% sequentially

and 9% year-over-year

- Q3 FY2021 diluted GAAP EPS of $0.28 and diluted non-GAAP EPS of

$0.47

- Distributor Point of Sale (POS) increased 8% sequentially and

represented a new quarterly record

- Wireless and Sensing products group net sales increased 32%

sequentially and represented a new record that included record net

sales of our LoRa® platform products

- Announced collaboration with Amazon's Sidewalk platform to

extend home network connectivity for indoor and outdoor smart home

products

- Repurchased 439,921 shares for $24.0 million during Q3

FY2021

Results on a GAAP basis for the Third Fiscal Quarter

2021

- Net sales were $154.1 million

- GAAP Gross margin was 61.0%

- GAAP SG&A expense was $42.9 million

- GAAP R&D expense was $27.9 million

- GAAP Operating margin was 13.9%

- GAAP Net income attributable to common stockholders was $18.5

million or $0.28 per diluted share

To facilitate a complete understanding of comparable financial

performance between periods, the Company also presents performance

results that exclude certain non-cash items and items that are not

considered reflective of the Company’s core results over time.

These non-GAAP financial measures exclude certain items and are

described below under “Non-GAAP Financial Measures.”

Results on a Non-GAAP basis for the Third Fiscal Quarter

2021 (see the list of non-GAAP items and the reconciliation of

these to the most comparable GAAP items set forth in the tables

below):

- Non-GAAP Gross margin was 61.5%

- Non-GAAP SG&A expense was $32.6 million

- Non-GAAP R&D expense was $24.4 million

- Non-GAAP Operating margin was 24.4%

- Non-GAAP Net income attributable to common stockholders was

$30.8 million or $0.47 per diluted share

Mohan Maheswaran, Semtech’s President and Chief Executive

Officer, stated, “We delivered Fiscal Q3 net sales that were at the

upper-end of our guidance led by another quarterly record from our

LoRa technology platforms and increasing smartphone demand. During

the quarter we announced a collaboration with Amazon for its new

Sidewalk network, further demonstrating the value that LoRa

delivers to the emerging smart-home and consumer use cases.”

Maheswaran continued, "We believe the underlying fundamentals

driving our growth engines in the Infrastructure, IoT and mobile

platform markets remain strong and the Company remains well

positioned for growth."

Fourth Fiscal Quarter 2021 Outlook

Both the GAAP and non-GAAP fourth fiscal quarter 2021 outlook

below take into account, based on the Company's current estimates,

the anticipated, but uncertain, negative impact to the Company of

the COVID-19 pandemic on global economic conditions and on the

Company's business operations, sales and operating results, as well

as export restrictions pertaining to Huawei and certain of its

affiliates imposed by the U.S. government. The Company is unable to

predict the full impact such challenges may have on its future

results of operations.

GAAP Fourth Fiscal Quarter 2021 Outlook

- Net sales are expected to be in the range of $153.0 million to

$163.0 million

- GAAP Gross margin is expected to be in the range of 60.5% to

61.6%

- GAAP SG&A expense is expected to be in the range of $43.1

million to $44.1 million

- GAAP R&D expense is expected to be in the range of $30.5

million to $31.5 million

- GAAP Intangible amortization expense is expected to be

approximately $1.6 million

- GAAP Interest and other expense, net is expected to be

approximately $1.5 million

- GAAP Effective tax rate is expected to be in the range of 10%

to 13%

- GAAP Earnings per diluted share are expected to be in the range

of $0.22 to $0.29

- Fully-diluted share count is expected to be approximately 65.8

million shares

- Share-based compensation is expected to be approximately $16.3

million, categorized as follows: $0.7 million cost of sales, $11.6

million SG&A, and $4.0 million R&D

- Capital expenditures are expected to be approximately $9.3

million

- Depreciation expense is expected to be approximately $6.1

million

Non-GAAP Fourth Fiscal Quarter 2021 Outlook (see the list

of non-GAAP items and the reconciliation of these to the most

comparable GAAP items set forth in the tables below)

- Non-GAAP Gross margin is expected to be in the range of 61.0%

to 62.0%

- Non-GAAP SG&A expense is expected to be in the range of

$31.0 million to $32.0 million

- Non-GAAP R&D expense is expected to be in the range of

$26.5 million to $27.5 million

- Non-GAAP Interest and other expense, net is expected to be

approximately $1.5 million

- Non-GAAP Effective tax rate is expected to be in the range of

15% to 17%

- Non-GAAP Earnings per diluted share are expected to be in the

range of $0.45 to $0.51

Correction of Immaterial Errors

During the fourth quarter of fiscal year 2020, management

identified certain immaterial errors related to share-based

compensation expense of market-based awards granted during fiscal

years 2018, 2019 and 2020. The errors resulted from adjustments to

the grant date fair value of the market-based awards that were

incorrectly accounted for as performance-based awards. The Company

concluded that the impact of these errors was immaterial and has

corrected its consolidated financial statements for these errors

for all prior periods presented in this press release.

Webcast and Conference Call

Semtech will be hosting a conference call today to discuss its

third fiscal quarter 2021 results at 2:00 p.m. Pacific time. An

audio webcast will be available on Semtech’s website at

www.semtech.com in the “Investor Relations” section under “Investor

News.” A replay of the call will be available through December 30,

2020 at the same website or by calling (877) 660-6853 and entering

conference ID 13704538.

Non-GAAP Financial Measures

To supplement the Company's consolidated financial statements

prepared in accordance with GAAP, this release includes a

presentation of select non-GAAP metrics. The Company’s non-GAAP

measures of gross margin, SG&A expenses, R&D expenses,

operating margin, effective tax rate, net income attributable to

common stockholders and earnings per diluted share exclude the

following items, if any:

- Share-based compensation

- Amortization of purchased intangibles, impairments and credit

loss reserves

- Restructuring, transaction and other acquisition or

disposition-related gains or losses

- Litigation expenses or dispute settlement charges or gains

- Cumulative other reserves associated with historical activity

including environmental and pension

- Equity in net gains or losses of equity method investments

- Loss on early extinguishment of debt

- Non-cash interest income from debt investments

To provide additional insight into the Company's fourth quarter

outlook, this release also includes a presentation of

forward-looking non-GAAP measures. Management believes that the

presentation of these non-GAAP financial measures provide useful

information to investors regarding the Company’s financial

condition and results of operations because these non-GAAP

financial measures are adjusted to exclude the items identified

above because such items are either operating expenses which would

not otherwise have been incurred by the Company in the normal

course of the Company’s business operations, or are not reflective

of the Company’s core results over time. These excluded items may

include recurring as well as non-recurring items, and no inference

should be made that all of these adjustments, charges, costs or

expenses are unusual, infrequent or non-recurring. For example:

certain restructuring and integration-related expenses (which

consist of employee termination costs, facility closure or lease

termination costs, and contract termination costs) may be

considered recurring given the Company’s ongoing efforts to be more

cost effective and efficient; certain acquisition and

disposition-related adjustments or expenses may be deemed recurring

given the Company's regular evaluation of potential transactions

and investments; and certain litigation expenses or dispute

settlement charges or gains (which may include estimated losses for

which we may have established a reserve, as well as any actual

settlements, judgments, or other resolutions against, or in favor

of, the Company related to litigation, arbitration, disputes or

similar matters, and insurance recoveries received by the Company

related to such matters) may be viewed as recurring given that the

Company may from time to time be involved in, and may resolve,

litigation, arbitration, disputes, and similar matters.

Notwithstanding that certain adjustments, charges, costs or

expenses may be considered recurring, in order to provide

meaningful comparisons, the Company believes that it is appropriate

to exclude such items because they are not reflective of the

Company's core results and tend to vary based on timing, frequency

and magnitude.

These non-GAAP financial measures are provided to enhance the

user's overall understanding of the Company's comparable financial

performance between periods. In addition, the Company’s management

generally excludes the items noted above when managing and

evaluating the performance of the business. The financial

statements provided with this release include reconciliations of

these non-GAAP measures to their most comparable GAAP measures for

the third quarter of fiscal year 2020 and the second and third

quarters of fiscal year 2021, along with a reconciliation of

forward-looking non-GAAP measures (other than the non-GAAP

effective tax rate) to their most comparable GAAP measures for the

fourth quarter of fiscal year 2021. The Company is unable to

include a reconciliation of the forward-looking non-GAAP measure of

the non-GAAP effective tax rate to the corresponding GAAP measure

as this is not available without unreasonable efforts due to the

high variability and low visibility with respect to the charges

that are excluded from this non-GAAP measure. We expect the

variability of the above charges to have a potentially significant

impact on our GAAP financial results. These additional non-GAAP

financial measures should not be considered substitutes for any

measures derived in accordance with GAAP and may be inconsistent

with similar measures presented by other companies.

Forward-Looking and Cautionary Statements

This press release contains "forward-looking statements" within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, as amended, based on the

Company’s current expectations, estimates and projections about its

operations, industry, financial condition, performance, results of

operations, and liquidity. Forward-looking statements are

statements other than historical information or statements of

current condition and relate to matters such as future financial

performance including the fourth quarter of fiscal year 2021

outlook; the negative impact of the COVID-19 pandemic on global

economic conditions and on the Company's business operations, sales

and operating results; the Company’s expectations concerning the

negative impact on the Company’s results of operations from its

inability to ship certain products and provide certain support

services due to the export restrictions including export

restrictions with respect to Huawei and certain of its affiliates;

future operational performance; the anticipated impact of specific

items on future earnings; and the Company’s plans, objectives and

expectations. Statements containing words such as “may,”

“believes,” “anticipates,” “expects,” “intends,” “plans,”

“projects,” “estimates,” “should,” “will,” “designed to,”

“projections,” or “business outlook,” or other similar expressions

constitute forward-looking statements.

Forward-looking statements involve known and unknown risks and

uncertainties that could cause actual results and events to differ

materially from those projected. Potential factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to: the

uncertainty surrounding the impact and duration of the COVID-19

pandemic on global economic conditions and on the Company's

business and results of operations; export restrictions and laws

affecting the Company's trade and investments including with

respect to Huawei and certain of its affiliates, and tariffs or the

occurrence of trade wars; competitive changes in the marketplace

including, but not limited to, the pace of growth or adoption rates

of applicable products or technologies; downturns in the business

cycle; decreased average selling prices of the Company’s products;

the Company’s reliance on a limited number of suppliers and

subcontractors for components and materials; changes in projected

or anticipated end-user markets; the Company’s ability to forecast

its effective tax rates due to changing income in higher or lower

tax jurisdictions and other factors that contribute to the

volatility of the Company’s effective tax rates and impact

anticipated tax benefits; and the Company's ability to forecast and

achieve anticipated net sales and earnings estimates in light of

periodic economic uncertainty, to include impacts arising from

Asian, European and global economic dynamics. Additionally,

forward-looking statements should be considered in conjunction with

the cautionary statements contained in the risk factors disclosed

in the Company's Annual Report on Form 10-K for the fiscal year

ended January 26, 2020, subsequent Quarterly Reports on Form 10-Q,

and other filings with the Securities and Exchange Commission, and

in material incorporated therein, including, without limitation,

information under the captions “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and

“Risk Factors.” In light of the significant risks and uncertainties

inherent in the forward-looking information included herein that

may cause actual performance and results to differ materially from

those predicted, any such forward-looking information should not be

regarded as representations or guarantees by the Company of future

performance or results, or that its objectives or plans will be

achieved or that any of its operating expectations or financial

forecasts will be realized. Reported results should not be

considered an indication of future performance. Investors are

cautioned not to place undue reliance on any forward-looking

information contained herein, which reflect management’s analysis

only as of the date hereof. Except as required by law, the Company

assumes no obligation to publicly release the results of any update

or revision to any forward-looking statements that may be made to

reflect new information, events or circumstances after the date

hereof or to reflect the occurrence of unanticipated or future

events, or otherwise.

About Semtech

Semtech Corporation is a leading supplier of high performance

analog, mixed-signal semiconductors and advanced algorithms for

infrastructure, high-end consumer, and industrial end markets.

Products are designed to benefit the engineering community as well

as the global community. The Company is dedicated to reducing the

impact it, and its products, have on the environment. Internal

green programs seek to reduce waste through material and

manufacturing control, use of green technology and designing for

resource reduction. Publicly traded since 1967, Semtech is listed

on the NASDAQ Global Select Market under the symbol SMTC. For more

information, visit http://www.semtech.com.

Semtech, the Semtech logo and LoRa are registered trademarks or

service marks of Semtech Corporation or its subsidiaries.

SMTC-F

SEMTECH CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

October 25,

2020

October 27,

2019

Q321

Q221

Q320

Q321

Q320

Net sales

$

154,082

$

143,660

$

141,011

$

430,444

$

409,511

Cost of sales

60,021

55,409

54,763

167,371

157,104

Gross profit

94,061

88,251

86,248

263,073

252,407

Operating costs and expenses:

Selling, general and administrative

42,891

38,255

37,777

115,746

120,074

Product development and engineering

27,890

29,220

26,976

84,696

80,012

Intangible amortization

1,798

2,020

3,770

6,658

12,821

Changes in the fair value of contingent

earn-out obligations

—

—

(152

)

(33

)

(2,313

)

Total operating costs and expenses

72,579

69,495

68,371

207,067

210,594

Operating income

21,482

18,756

17,877

56,006

41,813

Interest expense

(1,008

)

(1,252

)

(2,183

)

(3,819

)

(7,247

)

Non-operating (expense) income, net

(236

)

(176

)

644

11

2,900

Investment impairments and credit loss

reserves

(335

)

(1,485

)

—

(5,450

)

—

Income before taxes and equity in net

(losses) gains of equity method investments

19,903

15,843

16,338

46,748

37,466

(Benefit) provision for taxes

1,580

(416

)

2,693

2,523

8,638

Net income before equity in net

(losses) gains of equity method investments

18,323

16,259

13,645

44,225

28,828

Equity in net (losses) gains of equity

method investments

159

(137

)

352

11

109

Net income

18,482

16,122

13,997

44,236

28,937

Net loss attributable to noncontrolling

interest

(5

)

(3

)

—

(11

)

—

Net income attributable to common

stockholders

$

18,487

$

16,125

$

13,997

$

44,247

$

28,937

Earnings per share:

Basic

$

0.28

$

0.25

$

0.21

$

0.68

$

0.44

Diluted

$

0.28

$

0.24

$

0.21

$

0.67

$

0.43

Weighted average number of shares used in

computing earnings per share:

Basic

65,136

65,084

66,387

65,270

66,337

Diluted

65,967

66,004

67,318

66,050

67,630

SEMTECH CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

October 25, 2020

January 26, 2020

ASSETS

Current assets:

Cash and cash equivalents

$

262,271

$

293,324

Accounts receivable, net

58,700

61,927

Inventories

78,367

73,010

Prepaid taxes

22,677

10,718

Other current assets

25,731

21,757

Total current assets

447,746

460,736

Non-current assets:

Property, plant and equipment, net

127,472

124,418

Deferred tax assets

24,983

20,094

Goodwill

351,141

351,141

Other intangible assets, net

13,354

20,012

Other assets

83,276

76,032

Total assets

$

1,047,972

$

1,052,433

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

47,338

$

48,009

Accrued liabilities

58,535

50,632

Total current liabilities

105,873

98,641

Non-current liabilities:

Deferred tax liabilities

877

3,600

Long term debt

183,075

194,743

Other long-term liabilities

81,521

78,249

Stockholders’ equity

676,391

676,954

Noncontrolling interest

235

246

Total liabilities & equity

$

1,047,972

$

1,052,433

SEMTECH CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS AND SUPPLEMENTAL INFORMATION

(in thousands)

(unaudited)

Nine Months Ended

October 25,

2020

October 27,

2019

Net income

$

44,236

$

28,937

Net cash provided by operations

91,676

73,361

Net cash used in investing activities

(32,399

)

(29,672

)

Net cash used in financing activities

(90,330

)

(72,752

)

Net decrease in cash and cash

equivalents

(31,053

)

(29,063

)

Cash and cash equivalents at beginning of

period

293,324

312,120

Cash and cash equivalents at end of

period

$

262,271

$

283,057

Three Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

Q321

Q221

Q320

Free Cash Flow:

Cash Flow from Operations

$

28,377

$

37,216

$

33,268

Net Capital Expenditures

(7,168

)

(6,968

)

(3,516

)

Free Cash Flow

$

21,209

$

30,248

$

29,752

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION:

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(in thousands, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

October 25,

2020

October 27,

2019

Q321

Q221

Q320

Q321

Q320

Gross Margin–GAAP

61.0

%

61.4

%

61.2

%

61.1

%

61.6

%

Share-based compensation

0.5

%

0.4

%

0.4

%

0.4

%

0.4

%

Adjusted Gross Margin

(Non-GAAP)

61.5

%

61.8

%

61.6

%

61.5

%

62.0

%

Three Months Ended

Nine Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

October 25,

2020

October 27,

2019

Q321

Q221

Q320

Q321

Q320

Selling, general and

administrative–GAAP

$

42,891

$

38,255

$

37,777

$

115,746

$

120,074

Share-based compensation

(9,404

)

(9,501

)

(9,323

)

(24,864

)

(27,794

)

Transaction and integration related

(292

)

(249

)

258

(626

)

(977

)

Restructuring and other reserves

—

(502

)

—

(502

)

(2,711

)

Litigation cost, net of recoveries

(558

)

(105

)

(205

)

(809

)

(930

)

Adjusted selling, general and

administrative (Non-GAAP)

$

32,637

$

27,898

$

28,507

$

88,945

$

87,662

Three Months Ended

Nine Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

October 25,

2020

October 27,

2019

Q321

Q221

Q320

Q321

Q320

Product development and

engineering–GAAP

$

27,890

$

29,220

$

26,976

$

84,696

$

80,012

Share-based compensation

(3,480

)

(3,135

)

(3,180

)

(9,505

)

(8,283

)

Transaction and integration related

—

—

593

87

360

Adjusted product development and

engineering (Non-GAAP)

$

24,410

$

26,085

$

24,389

$

75,278

$

72,089

Three Months Ended

Nine Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

October 25,

2020

October 27,

2019

Q321

Q221

Q320

Q321

Q320

Operating Margin–GAAP

13.9

%

13.1

%

12.7

%

13.0

%

10.2

%

Share-based compensation

8.8

%

9.2

%

9.2

%

8.4

%

9.1

%

Intangible amortization

1.2

%

1.4

%

2.7

%

1.5

%

3.1

%

Transaction and integration related

0.1

%

0.1

%

(0.6

)%

0.2

%

0.2

%

Restructuring and other reserves

—

%

0.3

%

—

%

0.1

%

0.7

%

Litigation cost, net of recoveries

0.4

%

0.1

%

0.1

%

0.2

%

0.2

%

Changes in the fair value of contingent

earn-out obligations

—

%

—

%

(0.1

)%

—

%

(0.6

)%

Adjusted Operating Margin

(Non-GAAP)

24.4

%

24.2

%

24.0

%

23.4

%

22.9

%

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION:

RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in thousands, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

October 25,

2020

July 26,

2020

October 27,

2019

October 25,

2020

October 27,

2019

Q321

Q221

Q320

Q321

Q320

GAAP net income attributable to common

stockholders

$

18,487

$

16,125

$

13,997

$

44,247

$

28,937

Adjustments to GAAP net income

attributable to common stockholders:

Share-based compensation

13,538

13,186

13,055

36,103

37,458

Intangible amortization

1,798

2,020

3,770

6,658

12,821

Transaction and integration related

292

249

(851

)

539

617

Restructuring and other reserves

—

502

—

502

2,711

Litigation cost, net of recoveries

558

105

205

809

930

Changes in the fair value of contingent

earn-out obligations

—

—

(152

)

(33

)

(2,313

)

Investment gains, losses, reserves and

impairments

61

729

—

4,420

—

Total Non-GAAP adjustments before

taxes

16,247

16,791

16,027

48,998

52,224

Associated tax effect

(3,763

)

(4,848

)

(2,276

)

(11,183

)

(5,175

)

Equity in net losses (gains) of equity

method investments

(159

)

137

(352

)

(11

)

(109

)

Total of supplemental information, net of

taxes

12,325

12,080

13,399

37,804

46,940

Non-GAAP net income attributable to

common stockholders

$

30,812

$

28,205

$

27,396

$

82,051

$

75,877

Diluted GAAP earnings per share

$

0.28

$

0.24

$

0.21

$

0.67

$

0.43

Adjustments per above

0.19

0.19

0.20

0.57

0.69

Diluted non-GAAP earnings per

share

$

0.47

$

0.43

$

0.41

$

1.24

$

1.12

SEMTECH CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP OUTLOOK

Fourth Quarter of Fiscal Year

2021 Outlook

(in millions, except per share

data)

Q4 FY21 Outlook

January 31, 2021

Low

High

Gross Margin–GAAP

60.5

%

61.6

%

Share-based compensation

0.5

%

0.4

%

Adjusted Gross Margin

(Non-GAAP)

61.0

%

62.0

%

Low

High

Selling, general and

administrative–GAAP

$

43.1

$

44.1

Share-based compensation

(11.6

)

(11.6

)

Transaction and integration related

(0.5

)

(0.5

)

Adjusted selling, general and

administrative (Non-GAAP)

$

31.0

$

32.0

Low

High

Product development and

engineering–GAAP

$

30.5

$

31.5

Share-based compensation

(4.0

)

(4.0

)

Adjusted product development and

engineering (Non-GAAP)

$

26.5

$

27.5

Low

High

Diluted GAAP earnings per share

$

0.22

$

0.29

Share-based compensation

0.25

0.25

Transaction, restructuring, and

acquisition related expenses

0.01

0.01

Amortization of acquired intangibles

0.02

0.02

Associated tax effect

(0.05

)

(0.06

)

Diluted adjusted earnings per share

(Non-GAAP)

$

0.45

$

0.51

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201202005903/en/

Sandy Harrison Semtech Corporation (805) 480-2004

webir@semtech.com

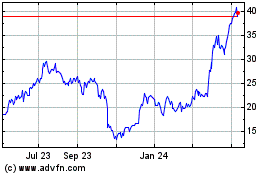

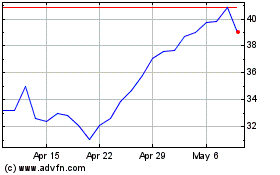

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Apr 2023 to Apr 2024