Seanergy Announces New Refinancing Facility of $21.3 million with a Prominent Japanese Lender

March 02 2022 - 9:00AM

Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”)

(NASDAQ: SHIP) reported today that it has entered into a definitive

agreement with a reputable Japanese lender to refinance the loan

facilities secured by the 2012-built Capesize M/V Partnership (the

“Vessel”) through a sale and leaseback structure.

Pursuant to the terms of the new facility, the

Vessel will be sold and chartered back on a bareboat basis for an

eight-year period starting at the time of the closing, which is

anticipated promptly, within March 2022.

The financing amount is $21.3 million and the

applicable interest rate is SOFR + 2.90% per annum. The new

interest rate is approximately 210 bps lower as compared to the

blended rate of the existing senior and junior loan facilities

secured currently by the Vessel. Moreover, $4.3 million of

additional liquidity will be released to the Company through the

refinancing.

The facility will amortize through quarterly

instalments averaging at approximately $590,000. Following the

second anniversary of the bareboat charter, the Company has

continuous options to repurchase the Vessel. At the end of the

8-year bareboat period, Seanergy has an option to repurchase the

Vessel for $2.39 million, which the Company expects to

exercise.

Following the consummation of the refinancing,

the Company will have no further junior debt outstanding.

Fearnley Securities AS have acted as the

Company’s exclusive financial advisor for this financing offering

valuable support in the origination, structuring and execution of

the transaction.

Stamatis Tsantanis, the Company’s

Chairman & Chief Executive Officer, stated:

“I am pleased to announce another successful

refinancing for our Company, consistent with our commitment to

optimize the capital structure and further reduce our financing

expense. The transaction marks an important milestone for our

Company, since, following consummation, there will be no legacy

junior debt outstanding.

“The transaction has another strategic element

for Seanergy, as we have initiated a valuable relationship with a

prominent lender in the Japanese market. In the last 12 months, we

have strengthened our footing in the Asian ship-financing market

through similar transactions in China, Taiwan and Japan.”

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is the only

pure-play Capesize ship-owner publicly listed in the US. Seanergy

provides marine dry bulk transportation services through a modern

fleet of Capesize vessels. The Company's operating fleet consists

of 17 Capesize vessels with an average age of approximately 12

years and aggregate cargo carrying capacity of approximately

3,011,083 dwt.

The Company is incorporated in the Marshall

Islands and has executive offices in Glyfada, Greece. The Company's

common shares trade on the Nasdaq Capital Market under the symbol

“SHIP” and its Class B warrants under “SHIPZ”.

Please visit our company website at:

www.seanergymaritime.com.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events. Words such as "may",

"should", "expects", "intends", "plans", "believes", "anticipates",

"hopes", "estimates" and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks and are based upon

a number of assumptions and estimates, which are inherently subject

to significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the Company's operating

or financial results; the Company's liquidity, including its

ability to service its indebtedness; competitive factors in the

market in which the Company operates; shipping industry trends,

including charter rates, vessel values and factors affecting vessel

supply and demand; future, pending or recent acquisitions and

dispositions, business strategy, areas of possible expansion or

contraction, and expected capital spending or operating expenses;

risks associated with operations outside the United States; risks

associated with the length and severity of the ongoing novel

coronavirus (COVID-19) outbreak, including its effects on demand

for dry bulk products and the transportation thereof; and other

factors listed from time to time in the Company's filings with the

SEC, including its most recent annual report on Form 20-F. The

Company's filings can be obtained free of charge on the SEC's

website at www.sec.gov. Except to the extent required by law, the

Company expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor RelationsTel: +30 213 0181 522E-mail:

ir@seanergy.gr

Capital Link, Inc.Paul Lampoutis230 Park Avenue Suite 1536New

York, NY 10169Tel: (212) 661-7566E-mail:

seanergy@capitallink.com

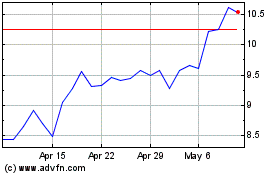

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

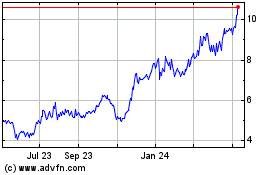

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Apr 2023 to Apr 2024