Current Report Filing (8-k)

June 04 2020 - 4:55PM

Edgar (US Regulatory)

Seagate Technology plc false 0001137789 0001137789 2020-06-03 2020-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 3, 2020

SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Ireland

|

|

001-31560

|

|

98-0648577

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

38/39 Fitzwilliam Square

Dublin 2, Ireland

|

|

D02 NX53

|

|

(Address of Principal Executive Office)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (353) (1) 234-3136

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Ordinary Shares, par value $0.00001 per share

|

|

STX

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 — Entry into a Material Definitive Agreement

On June 3, Seagate Technology plc (the “Company”) and Seagate HDD Cayman (“HDD”), an indirect wholly owned subsidiary of the Company, entered into a purchase agreement (the “Purchase Agreement”), by and among HDD, the Company, and Morgan Stanley & Co. LLC and BofA Securities, Inc., as representatives of the initial purchasers named therein (the “Initial Purchasers”), pursuant to which HDD has agreed to issue and sell, and the Initial Purchasers have agreed to purchase, $500 million aggregate principal amount of 4.125% Senior Notes due 2031 (the “Notes”) in a private placement to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States to non-U.S. persons in reliance on Regulation S under the Securities Act. The offering of the Notes is expected to close on June 10, 2020, subject to satisfaction of customary closing conditions.

The Notes will be senior unsecured debt obligations of HDD and will initially be guaranteed on a senior unsecured basis by the Company. HDD intends to use the net proceeds from this offering, together with cash on hand, to finance the cash consideration HDD will deliver in connection with an offer to purchase for cash up to $275 million in aggregate principal amount of HDD’s 4.250% Senior Notes due 2022 and up to $225 million in aggregate principal amount of HDD’s 4.750% Senior Notes due 2023. Any remaining net proceeds will be used for general corporate purposes, which may include repayment of other outstanding indebtedness, capital expenditures and other investments in the business.

The Purchase Agreement contains customary representations and warranties of the parties and indemnification and contribution provisions whereby HDD and the Company, on the one hand, and the Initial Purchasers, on the other, have agreed to indemnify each other against certain liabilities.

Certain of the Initial Purchasers or their affiliates are lenders and/or agents under HDD’s existing credit agreement.

The foregoing description of the Purchase Agreement is only a summary and is qualified in its entirety by reference to the full text of the Purchase Agreement which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 8.01 — Other Events.

On June 3, the Company issued a press release announcing that HDD commenced exchange offers to certain eligible holders of HDD’s outstanding 4.750% Senior Notes due 2025 and 4.875% Senior Notes due 2027 (together, the “Existing Notes”) to exchange the Existing Notes for up to $500 million in aggregate principal amount of HDD’s new senior notes due 2029. A copy of this press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

On June 3, the Company issued a press release announcing the pricing of HDD’s offering of the Notes to qualified institutional buyers pursuant to Rule 144A and in offshore transactions pursuant to Regulation S under the Securities Act. A copy of this press release is attached to this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY

|

|

|

|

|

|

By:

|

|

/s/ Gianluca Romano

|

|

Name:

|

|

Gianluca Romano

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: June 4, 2020

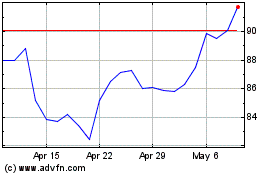

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

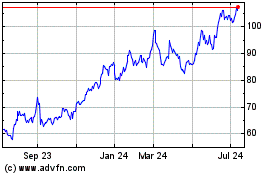

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024