UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of September 2024 (Report No. 2)

Commission

file number: 001-38041

SCISPARC

LTD.

(Translation

of registrant’s name into English)

20

Raul Wallenberg Street, Tower A,

Tel

Aviv 6971916 Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

On

September 5, 2024, SciSparc Ltd. (the “Company”) entered into a second amendment (the “Second Amendment”) to

the bridge loan agreement, dated January 14, 2024, and as amended on June 9, 2024 (the “Bridge Loan Agreement”) with AutoMax

Motors Ltd. (“AutoMax”). Pursuant to the Second Amendment, the Company extended an additional loan in the amount of $1.85

million to AutoMax under terms similar to the Bridge Loan Agreement, bringing the total bridge loan amount to $4.25 million (the “Loan

Amount”). In consideration for the Loan Amount, AutoMax established a first ranking fixed charge security interest on AutoMax’s

shares of its wholly-owned subsidiary AutoMax Leasing Ltd. in favor of the Company.

The

Company, AutoMax and SciSparc Merger Sub Ltd., an Israeli limited company and wholly-owned subsidiary of the Company, previously entered

into an Agreement and Plan of Merger, dated April 10, 2024, according to which, among other things, the Company agreed to deliver to

AutoMax an amount of $4.25 million, less any amount owed by AutoMax to the Company under any loan agreement between the parties (the

“Closing Financing”). As a result of AutoMax receiving the Loan Amount, no Closing Financing will take place.

Additional

Information and Where You Can Find It

In

connection with the proposed transactions between the Company and AutoMax, the Company will file a registration statement and a proxy

statement with the United States Securities and Exchange Commission (“SEC”). This communication is not a substitute for the

registration statement, the proxy statement or any other documents that the Company may file with the SEC or send to its shareholders

in connection with the proposed transactions. Before making any voting decision, investors and securityholders are urged to read the

registration statement or the proxy statement, as applicable, and all other relevant documents filed or furnished or that will be filed

with or furnished to the SEC in connection with the proposed transaction as they become available because they will contain important

information about the proposed transaction and related matters.

You

may obtain free copies of the proxy statement and all other documents filed or that will be filed with the SEC regarding the proposed

transaction at the website maintained by the SEC at www.sec.gov. Once filed, the proxy statement will be available free of charge on

the Company’s website at https://investor.scisparc.com, by contacting the Company’s Investor Relations at IR@scisparc.com

or by phone at +972-3-6167055.

Participants

in Solicitation

The

Company, AutoMax and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from the holders of the Company’s ordinary shares in connection with the proposed transaction. Information about the Company’s

directors and executive officers is set forth in the Company’s annual report on Form 20-F for the year ended December 31,

2023, filed with the SEC on April 1, 2024. Other information regarding the interests of such individuals, as well as information regarding

AutoMax’s directors and executive officers and other persons who may be deemed participants in the proposed transaction, will be

set forth in the proxy statement, which will be filed with the SEC. You may obtain free copies of these documents as described in the

preceding paragraph.

Forward-Looking Statements

This Report of Foreign Private Issuer on Form

6-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995 and other Federal securities laws. For example, SciSparc is using forward-looking statements when it discusses the

prospective closing of the transactions contemplated by the Merger Agreement. In addition, there can be no assurance that the Company

will be able to complete the transactions contemplated by the Merger or related transactions. Since such statements deal with future events

and are based on SciSparc’s current expectations, they are subject to various risks and uncertainties and actual results, performance

or achievements of SciSparc could differ materially from those described in or implied by the statements in this press release. The forward-looking

statements contained or implied in this press release are subject to other risks and uncertainties, including those discussed under the

heading “Risk Factors” in SciSparc’s Annual Report on Form 20-F filed with the SEC on April 1, 2024, and in subsequent

filings with the U.S. Securities and Exchange Commission. Except as otherwise required by law, SciSparc disclaims any intention or obligation

to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information,

future events or circumstances or otherwise.

Non-Solicitation

This

Report of Foreign Private Issuer on Form 6-K will not constitute an offer to sell or the solicitation of an offer to sell or the solicitation

of an offer to buy any securities, nor will there be any sale of securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

This

Report of Foreign Private Issuer on Form 6-K is incorporated by reference into the Company’s registration statements Form F-3 (File

Nos. 333-275305, 333-269839, 333-266047, 333-233417, 333-248670 and 333-255408)

and on Form S-8 (File Nos. 333-278437 and 333-225773)

filed with the Securities and Exchange Commission to be a part thereof from the date on which this report is submitted, to the extent

not superseded by documents or reports subsequently filed or furnished.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

SciSparc Ltd. |

| |

|

|

| Date: September 11, 2024 |

By: |

/s/ Oz Adler |

| |

Name: |

Oz Adler |

| |

Title: |

Chief Executive Officer and Chief Financial Officer |

3

Exhibit 99.1

SciSparc Advances $1.85 million Loan to AutoMax,

Following AutoMax’s Direct Import Agreement with Major Chinese Vehicle Manufacturer

To date, SciSparc has advanced $4.25 million

to Automax under the Bridge Loan agreement and amendments thereto

TEL AVIV, Israel, Sept. 11, 2024 (GLOBE

NEWSWIRE) -- SciSparc Ltd. (Nasdaq: SPRC) (“Company” or “SciSparc”), a specialty clinical-stage

pharmaceutical company focusing on the development of therapies to treat disorders and rare diseases of the central nervous system,

announced that it had entered into a second amendment (the “Second Amendment”) to that certain bridge loan agreement,

dated January 14, 2024, and as amended on June 9, 2024, (the “Bridge Loan Agreement”) with AutoMax Motors Ltd.

(“AutoMax”).

Pursuant to the Second Amendment, the Company extended an additional

loan in the amount of $1.85 million to AutoMax under terms similar to the Bridge Loan Agreement, bringing the total bridge loan amount

to $4.25 million (the “Loan Amount”). In consideration for the Loan Amount, AutoMax established a first ranking fixed charge

security interest on AutoMax’s shares of its wholly-owned subsidiary AutoMax Leasing Ltd in favor of the Company.

The Company, AutoMax and SciSparc Merger Sub Ltd., an Israeli limited

company and wholly-owned subsidiary of the Company, previously entered into an Agreement and Plan of Merger, dated April 10, 2024 (the

“Merger Agreement”), according to which, among other things, the Company agreed to deliver to AutoMax an amount of $4.25 million,

less any amount owed by AutoMax to the Company under any loan agreement between the parties (the “Closing Financing”). As

a result of AutoMax receiving the Loan Amount, no Closing Financing will take place.

AutoMax has signed, through its wholly owned subsidiary Automax Leasing

Ltd. (“Automax Leasing”), a direct import agreement with Anhui Jianghuai Automobile Group Co., Ltd. (“JAC Motors”),

a major Chinese automobile and commercial vehicle manufacturer.

JAC Motors is a comprehensive automobile enterprise that integrates

research and development, production and sales of a full range of commercial, passenger and powertrain vehicles, and spans various sectors

such as ride hailing/sharing and financial services.

About SciSparc Ltd. (Nasdaq: SPRC):

SciSparc Ltd. is a specialty clinical-stage pharmaceutical

company led by an experienced team of senior executives and scientists. SciSparc’s focus is on creating and enhancing a portfolio

of technologies and assets based on cannabinoid pharmaceuticals. With this focus, the Company is currently engaged in the following drug

development programs based on THC and/or non-psychoactive cannabidiol: SCI-110 for the treatment of Tourette Syndrome, for the treatment

of Alzheimer’s disease and agitation; and SCI-210 for the treatment of autism and status epilepticus. The Company also owns a controlling

interest in a subsidiary whose business focuses on the sale of hemp seed oil-based products on the Amazon Marketplace.

Important Information About the Acquisition

for Investors and Shareholders

This communication may be deemed to be solicitation

material in respect of the proposed transaction between SciSparc and AutoMax. In connection with the proposed transaction between SciSparc

and AutoMax, SciSparc will file a registration statement on Form F-4 and a proxy statement with the United States Securities Exchange

Commission (“SEC”). This communication is not a substitute for the registration statement or proxy statement or any other

documents that SciSparc may file with the SEC or send to SciSparc shareholders in connection with the proposed transaction. Before making

any voting decision, investors and securityholders are urged to read the registration statement and proxy statement and all other relevant

documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will

contain important information about the proposed transaction and related matters.

Investors and securityholders may obtain free

copies of the registration statement, proxy statement and all other documents filed or that will be filed with the SEC regarding the proposed

transaction at the website maintained by the SEC at www.sec.gov. Once filed, the registration statement and the proxy statement will

be available free of charge on SciSparc’s website at scisparc.com or by contacting SciSparc’s Investor Relations by e-mail

at IR@scisparc.com or by phone at +972-3-6167055.

Participants in the Solicitation.

SciSparc, AutoMax and their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies from the holders of SciSparc’s ordinary shares

in connection with the proposed transaction. Information about SciSparc’s directors and executive officers is set forth in SciSparc’s

Annual Report on Form 20-F for the fiscal year ended December 31, 2023, which was filed with the SEC on April 1, 2024, and in subsequent

filings made by SciSparc with the SEC. Other information regarding the interests of such individuals, as well as information regarding

AutoMax’s directors and executive officers and other persons who may be deemed participants in the proposed transaction, will be

set forth in the proxy statement, which will be filed with the SEC. You may obtain free copies of these documents as described in the

preceding paragraph.

This communication shall not constitute an

offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements:

This press release contains forward-looking statements

within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and other Federal

securities laws. For example, SciSparc is using forward-looking statements when it discusses the prospective closing of the transactions

contemplated by the Merger Agreement. In addition, there can be no assurance that the Company will be able to complete the transactions

contemplated by the Merger or related transactions. Since such statements deal with future events and are based on SciSparc’s current

expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of SciSparc could differ

materially from those described in or implied by the statements in this press release. The forward-looking statements contained or implied

in this press release are subject to other risks and uncertainties, including those discussed under the heading “Risk Factors”

in SciSparc’s Annual Report on Form 20-F filed with the SEC on April 1, 2024, and in subsequent filings with the U.S. Securities

and Exchange Commission. Except as otherwise required by law, SciSparc disclaims any intention or obligation to update or revise any forward-looking

statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or

otherwise.

Investor Contact:

IR@scisparc.com

Tel: +972-3-6167055

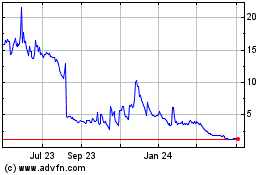

SciSparc (NASDAQ:SPRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

SciSparc (NASDAQ:SPRC)

Historical Stock Chart

From Nov 2023 to Nov 2024