UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16

or 15d-16

Under the Securities Exchange Act of 1934

For the month of: August 2024 (Report No. 6)

Commission file number: 001- 38041

SCISPARC LTD.

(Translation of registrant’s name into English)

20 Raul Wallenberg Street,

Tower A

Tel Aviv 6971916,

Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

Attached hereto and incorporated

by reference herein is the Notice of Annual General Meeting of Shareholders, Proxy Statement and Proxy Card for the Annual General Meeting

of Shareholders of SciSparc Ltd. (the “Company”) to be held on Tuesday, October 1, 2024 (the “Meeting”).

Only shareholders of record

who hold ordinary shares, no par value, of the Company at the close of business on Tuesday, August 27, 2024, will be entitled to notice

of and to vote at the Meeting and any postponements or adjournments thereof.

This Report of Foreign Private Issuer on Form

6-K and its exhibits, are incorporated by reference into the Company’s registration statements on Form F-3 (File Nos. 333-275305,

333-269839, 333-266047, 333-233417, 333-248670 and 333-255408) and on Form S-8 (File Nos. 333-278437 and 333-225773) filed with the Securities

and Exchange Commission to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents

or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SciSparc Ltd. |

| |

|

| Date: August 22, 2024 |

By |

/s/ Oz Adler |

| |

Name: |

Oz Adler |

| |

Title: |

Chief Executive Officer and Chief Financial Officer |

2

Exhibit 99.1

August 22, 2024

Dear SciSparc Ltd. Shareholders:

We cordially invite you to attend

the Annual General Meeting of Shareholders of SciSparc Ltd. (the “Meeting”), to be held on Tuesday, October

1, 2024 at 3:00 p.m. (Israel time), at the Company’s offices, at 20 Raul Wallenberg Street, Tower A Tel Aviv 6971916 Israel.

At

the Meeting, shareholders will be asked to consider and vote on the matters listed in the enclosed Notice of Annual General Meeting of

Shareholders (the “Notice”). Our board of directors recommends that you vote FOR each of the proposals

listed in the Notice.

Only shareholders of record at

the close of business on Tuesday, August 27, 2024 are entitled to notice of and to vote at the Meeting.

Whether or not you

plan to attend the Meeting, it is important that your ordinary shares be represented and voted at the Meeting. Accordingly, after reading

the enclosed Notice and the accompanying proxy statement, please sign, date and mail the enclosed proxy card in the envelope provided

or vote by telephone or over the Internet in accordance with the instructions on your proxy card.

We look forward to

greeting as many of you as can attend the Meeting.

| |

Sincerely, |

| |

|

| |

Mr. Amitay Weiss |

| |

Chairman of the Board of Directors |

Notice of Annual General Meeting of

Shareholders

To be Held on October 1, 2024

Dear SciSparc Ltd. Shareholders:

We cordially invite you to attend

the Annual General Meeting of Shareholders (the “Meeting”) of SciSparc Ltd. (the “Company”),

to be held on Tuesday, October 1, 2024 at 3:00 p.m. (Israel time), at the Company’s offices, at 20 Raul Wallenberg Street, Tower

A Tel Aviv 6971916 Israel.

The

following matters (the “Proposals”) are on the agenda for the Meeting:

| (i) | to re-elect each of Ms. Liat Sidi and Mr. Amnon Ben Shay to serve as Class I directors of the Company,

until the Company’s third annual general meeting of shareholders following this Meeting, and until their respective successor is

duly elected and qualified; |

| (ii) | to approve the grant of equity awards to the Company’s Chief Executive Officer; |

| (iii) | to approve the grant of equity awards to the Company’s President; |

| (iv) | to approve the grant of equity awards to the Company’s Chairman of the Board; |

| (v) | to approve the grant of equity awards to the Company’s directors; and |

| (vi) | to re-appoint Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as our independent

registered public accounting firm for the year ending December 31, 2024 and until the next annual general meeting of shareholders, and

to authorize the Company’s board of directors (with power of delegation to its audit committee) to set the fees to be paid to such

auditors. |

In addition to considering

the foregoing Proposals, the Company’s shareholders will have the opportunity to hear from representatives of the Company’s

management, who will be available at the Meeting to review and discuss with shareholders the consolidated financial statements of the

Company for the year ended December 31, 2023.

You are entitled to receive notice

of, and vote at, the Meeting if you are a shareholder of record at the close of business on Tuesday, August 27, 2024, in person or through

a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing

of a securities depository on that date.

You can vote your ordinary shares

by attending the Meeting or by completing and signing the proxy card to be distributed with the proxy statement. If you hold ordinary

shares through a bank, broker or other nominee (i.e., in “street name”) which is one of our shareholders of record at the

close of business on Tuesday, August 27, 2024, or which appears in the participant listing of a securities depository on that date, you

must follow the instructions included in the voting instruction form you receive from your bank, broker or nominee, and may also be able

to submit voting instructions to your bank, broker or nominee by phone or via the Internet. Please be certain to have your control number

from your voting instruction form ready for use in providing your voting instructions. If you hold your ordinary shares in “street

name,” you must obtain a legal proxy from the record holder to enable you to participate in and to vote your ordinary shares at

the Meeting (or to appoint a proxy to do so).

Our board of

directors recommends that you vote FOR each of the above Proposals, which are described in the proxy statement.

The presence (in person or by

proxy) of any two or more shareholders holding, in the aggregate, at least 15% of the voting power of the Company’s ordinary shares

constitutes a quorum for purposes of the Meeting. If such quorum is not present within half an hour from the time scheduled for the Meeting,

the Meeting will be adjourned to Wednesday, October 2, 2024, at 3:00 p.m. (Israel time). At such adjourned meeting the presence of at

least one or more shareholders in person or by proxy (regardless of the voting power represented by their ordinary shares) will constitute

a quorum.

The last date for submitting a

request to include a Proposal in accordance with Section 66(b) of the Israeli Companies Law, 5759-1999, is Thursday, August

29, 2024. A copy of the proxy statement (which includes the full version of the proposed resolutions) and a proxy card is being made available

to shareholders and also furnished to the U.S. Securities and Exchange Commission, pursuant to a Report of Foreign Private Issuer

on Form 6-K. Shareholders are also able to review the proxy statement at the “Investors” portion of our website,

https://investor.scisparc.com/ or at our offices at 20 Raul Wallenberg Street, Tower A Tel Aviv 6971916 Israel , upon prior notice

and during regular working hours (telephone number: +972-3-7175777) until the date of the Meeting.

Whether or not you plan to attend

the Meeting, it is important that your ordinary shares be represented and voted at the Meeting. Accordingly, after reading the Notice

of Annual General Meeting of Shareholders and the proxy statement, please sign, date and mail the proxy card in the envelope provided

or vote by telephone or over the Internet in accordance with the instructions on your proxy card. If voting by mail, the proxy card must

be received by no later than 11:59 p.m. EDT, Monday, September 30, 2024 to be validly included in the tally of ordinary shares voted

at the Meeting. Detailed proxy voting instructions will be provided both in the proxy statement and in the proxy card.

| |

By Order of the Board of Directors, |

| |

|

| |

Mr. Amitay Weiss |

| |

Chairman of the Board of Directors |

Proxy Statement

Annual General Meeting of Shareholders

To Be Held on October 1, 2024

This proxy statement is being

furnished in connection with the solicitation of proxies on behalf of the board of directors (the “Board”) of

SciSparc Ltd. (the “Company” or “SciSparc”) to be voted at an Annual General Meeting

of Shareholders (the “Meeting”), and at any adjournment or postponement thereof, pursuant to the accompanying

Notice of Annual General Meeting of Shareholders (the “Notice”). The Meeting will be held on Tuesday, October

1, 2024, at 3:00 p.m. (Israel time), at the Company’s offices, at 20 Raul Wallenberg Street, Tower A Tel Aviv 6971916 Israel.

This proxy statement, the attached

Notice and the enclosed proxy card or voting instruction form are being made available to holders of SciSparc’s ordinary shares,

beginning August 22, 2024.

You are entitled to receive notice

of, and vote at, the Meeting if you are a shareholder of record at the close of business on Tuesday, August 27, 2024, in person or through

a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing

of a securities depository on that date. You can vote your ordinary shares by attending the Meeting or by following the instructions under

“How You Can Vote” below. Our Board urges you to vote your ordinary shares so that they will be counted at the Meeting

or at any postponements or adjournments of the Meeting.

Agenda Items

The

following matters (the “Proposals”) are on the agenda for the Meeting:

| (1) | to re-elect each Ms. Liat Sidi and Mr. Amnon Ben Shay to serve as Class I directors of the Company, to

serve until the Company’s third annual general meeting of shareholders following this Meeting, and until their respective successor

is duly elected and qualified; |

| (2) | to approve the grant of equity awards to the Company’s Chief Executive Officer; |

| (3) | to approve the grant of equity awards to the Company’s President; |

| (4) | to approve the grant of equity awards to the Company’s Chairman of the Board; |

| (5) | to approve the grant of equity awards to the Company’s directors; and |

| (6) | to re-appoint Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as our independent

registered public accounting firm for the year ending December 31, 2024 and until the next annual general meeting of shareholders, and

to authorize the Company’s board of directors (with power of delegation to its audit committee) to set the fees to be paid to such

auditors. |

In addition to considering

the foregoing Proposals, the Company’s shareholders will have the opportunity to hear from representatives of the Company’s

management, who will be available at the Meeting to review and discuss with shareholders the consolidated financial statements of the

Company for the year ended December 31, 2023.

We are not aware of

any other matters that will come before the Meeting. If any other matters are presented properly at the Meeting, the persons designated

as proxies intend to vote upon such matters in accordance with their best judgment and the recommendation of the Board.

Board Recommendation

Our Board unanimously

recommends that you vote “FOR” each of the above Proposals.

Quorum and Adjournment

As of August 22, 2024, we had

a total of 10,357,108 ordinary shares issued and outstanding. Each ordinary share outstanding as of the close of business on Tuesday,

August 27, 2024, is entitled to one vote on each of the Proposals to be presented at the Meeting. Under our amended and restated articles

of association, currently in effect (the “Articles”), the Meeting will be properly convened if at least two

shareholders attend the Meeting in person or sign and return proxies, provided that they hold ordinary shares representing at least 15%

of our voting power. If such quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will be adjourned

to Wednesday, October 2, 2024 at 3:00 p.m. (Israel time). At such adjourned meeting the presence of at least one or more shareholders

in person or by proxy (regardless of the voting power represented by their ordinary shares) will constitute a quorum.

Abstentions and “broker

non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs

when a bank, broker or other holder of record holding ordinary shares for a beneficial owner attends the Meeting but does not vote on

a particular Proposal because that holder does not have discretionary voting power for that particular item and has not received instructions

from the beneficial owner. Brokers that hold ordinary shares in “street name” for clients (as described below) typically have

authority to vote on “routine” Proposals even when they have not received instructions from beneficial owners. The only item

on the Meeting agenda that may be considered routine is Proposal No. 6 relating to the reappointment of the Company’s independent

registered public accounting firm until the next annual general meeting of shareholders; however, we cannot be certain whether this will

be treated as a routine matter since our proxy statement is prepared in compliance with the Israeli Companies Law 5759-1999 (the

“Companies Law”), rather than the rules applicable to domestic U.S. reporting companies. Therefore, it

is important for a shareholder that holds ordinary shares through a bank or broker to instruct its bank or broker how to vote its ordinary

shares, if the shareholder wants its ordinary shares to count for the Proposals.

Vote Required for Approval of Each

of the Proposals

The affirmative vote

of the holders of a majority of the voting power represented and voting in person or by proxy is required to approve each of the Proposals.

In addition, approval

of Proposal No. 2 is subject to the fulfillment of one of the following additional voting requirements: (i) the majority of the ordinary

shares that are voted at the Meeting in favor of the Proposal, excluding abstentions, includes a majority of the votes of shareholders

who are neither controlling shareholders nor have a personal interest in the approval of the Proposal (each, an “Interested Shareholder”);

or (ii) the total percentage of ordinary shares of the shareholders mentioned in clause (i) above that are voted against the Proposal

does not exceed two percent (2%) of the total voting rights in the Company.

For this purpose,

a “controlling shareholder” is any shareholder that has the ability to direct the Company’s activities (other than by

means of being a director or office holder of the Company). A person is presumed to be a controlling shareholder if it holds or controls,

by itself or together with others, one half or more of any one of the “means of control” of a company. “Means of control”

is defined as any one of the following: (i) the right to vote at a general meeting of a company, or (ii) the right to appoint directors

of a company or its chief executive officer. A “personal interest” of a shareholder in an action or transaction of a company

includes a personal interest of any of the shareholder’s relatives (i.e. spouse, brother or sister, parent, grandparent, child as

well as child, brother, sister or parent of such shareholder’s spouse or the spouse of any of the above) or an interest of a company

with respect to which the shareholder or the shareholder’s relative (as defined above) holds 5% or more of such company’s

issued shares or voting rights, in which any such person has the right to appoint a director or the chief executive officer or in which

any such person serves as director or the chief executive officer, including the personal interest of a person voting pursuant to a proxy

which the proxy grantor has a personal interest, whether or not the person voting pursuant to such proxy has discretion with regards to

the vote; and excludes an interest arising solely from the ownership of ordinary shares of a company. For purposes of Proposal No. 2,

the term controlling shareholder shall also include a person who holds 25% or more of the voting rights in the general meeting of the

company if there is no other person who holds more than 50% of the voting rights in the company; for the purpose of a holding, two or

more persons holding voting rights in the company each of which has a personal interest in the approval of the transaction being brought

for approval of the company will be considered to be joint holders.

Under Israeli law,

every voting shareholder is required to notify the Company whether such shareholder is an Interested Shareholder. To avoid confusion,

every shareholder voting by means of the enclosed proxy card or voting instruction form, or via telephone or internet voting, will be

deemed to confirm that such shareholder is NOT an Interested Shareholder. If you are an Interested Shareholder (in which case your vote

will only count for or against the ordinary majority, and not for or against the special tally under Proposal No. 2), please notify Mr.

Oz Adler, the Company’s Chief Executive Officer, at 20 Raul Wallenberg Street, Tower A Tel Aviv 6971916 Israel, telephone: +972-3-7175777,

or by email (oz@scisparc.com). If your shares are held in “street name” by your broker, bank or other nominee and you are

an Interested Shareholder, you should notify your broker, bank or other nominee of that status, and they in turn should notify the Company

as described in the preceding sentence.

We do not believe

we have a controlling shareholder as of the record date of the Meeting, and therefore, we believe that (other than our Chief Executive

Officer and his relatives) none of our shareholders should have a personal interest in Proposal No. 2 and be deemed an Interested Shareholder.

In connection with

Proposal No. 2, the Companies Law allows the Board to approve such proposal even if the general meeting of shareholders has voted against

its approval, provided that the Company’s compensation committee, and thereafter the Board, each determines to approve it, based

on detailed arguments, and after having reconsidered the matter.

How You Can Vote

You can vote either

in person at the Meeting or by authorizing another person as your proxy, whether or not you attend the Meeting. You may vote in any of

the manners below:

| ● | By Internet — If you are a shareholder

of record, you can submit a proxy over the Internet by logging on to the website listed on the enclosed proxy card, entering your control

number located on the enclosed proxy card and submitting a proxy by following the on-screen prompts. If you hold shares in “street

name,” and if the brokerage firm, bank or other similar nominee that holds your shares offers Internet voting, you may follow the

instructions shown on the enclosed voting instruction form in order to submit your proxy over the Internet; |

| ● | By telephone — If you are a shareholder

of record, you can submit a proxy by telephone by calling the toll-free number listed on the enclosed proxy card, entering your control

number located on the enclosed proxy card and following the prompts. If you hold shares in “street name,” and if the brokerage

firm, bank or other similar organization that holds your shares offers telephone voting, you may follow the instructions shown on the

enclosed voting instruction form in order to submit a proxy by telephone; or |

| ● | By mail — If you are a shareholder

of record and received a printed proxy card, you can submit a proxy by completing, dating, signing and returning your proxy card in the

postage-paid envelope provided. You should sign your name exactly as it appears on the enclosed proxy card. If you are signing in a representative

capacity (for example, as a guardian, executor, trustee, custodian, attorney or officer of a corporation), please indicate your name

and title or capacity. If you hold shares in “street name,” you have the right to direct your brokerage firm, bank or other

similar organization on how to vote your shares, and the brokerage firm, bank or other similar organization is required to vote your

shares in accordance with your instructions. To provide instructions to your brokerage firm, bank or other similar organization by mail,

please complete, date, sign and return your voting instruction form in the postage-paid envelope provided by your brokerage firm, bank

or other similar organization. |

Registered Holders

If you are a shareholder of record

whose ordinary shares are registered directly in your name with our transfer agent, Vstock Transfer LLC., you can vote your ordinary shares

by attending the Meeting or by completing and signing a proxy card. In such case, these proxy materials are being sent directly to you.

As the shareholder of record, you have the right to grant your voting proxy directly to the individuals listed as proxies on the proxy

card or to vote in person at the Meeting. Please follow the instructions on the proxy card. You may change your mind and cancel your proxy

card by sending us a written notice, by signing and returning a proxy card with a later date, or by voting in person or by proxy at the

Meeting. We will not be able to count a proxy card from a registered holder unless we receive it at our offices at 20 Raul Wallenberg

Street, Tower A Tel Aviv 6971916 Israel, or Broadridge Financial Solutions, Inc. receives it in the enclosed envelope no later than 11:59 p.m.

EDT on Monday, September 30, 2024.

If you provide specific

instructions (by marking a box) with regard to the Proposals, your ordinary shares will be voted as you instruct. If you sign and return

your proxy card or voting instruction form without giving specific instructions your ordinary shares will be voted in favor of each Proposal

in accordance with the recommendation of the Board. The persons named as proxies in the enclosed proxy card will vote in their discretion

on any other matters that properly come before the Meeting, including the authority to adjourn the Meeting pursuant to Article 30

of the Company’s Articles.

Beneficial Owners

If you are a beneficial

owner of the ordinary shares held in a brokerage account or by a trustee or nominee, these proxy materials are being forwarded to you

together with a voting instruction form by the broker, trustee or nominee or an agent hired by the broker, trustee or nominee. As a beneficial

owner, you have the right to direct your broker, trustee or nominee how to vote, and you are also invited to attend the Meeting.

Because a beneficial

owner is not a shareholder of record, you may not vote those ordinary shares directly at the Meeting unless you obtain a “legal

proxy” from the broker, trustee or nominee that holds your ordinary shares, giving you the right to vote the ordinary shares at

the Meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee

or nominee how to vote your ordinary shares.

Who Can Vote

You are entitled to receive notice

of, and vote at, the Meeting if you are a shareholder of record at the close of business on Tuesday, August 27, 2024, in person or through

a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing

of a securities depository on that date.

Revocation of Proxies

Shareholders of record

may revoke the authority granted by their execution of proxies at any time before the effective exercise thereof by filing with us a written

notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. A shareholder who holds shares

in “street name” should follow the directions of, or contact, the bank, broker or nominee if he, she or it desires to revoke

or modify previously submitted voting instructions.

Solicitation of Proxies

Proxies are being made available

to shareholders beginning August 22, 2024. Certain officers, directors, employees and agents of SciSparc, may solicit proxies by telephone,

emails, or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing, and handling,

and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of ordinary shares.

Voting Results

The final voting results

will be tallied by the Company based on the information provided by Broadridge Financial Solutions, Inc. or otherwise, and the overall

results of the Meeting will be published following the Meeting on a Report of Foreign Private Issuer on Form 6-K that will be furnished

to the U.S. Securities and Exchange Commission (the “SEC”).

Availability of Proxy Materials

Copies of the proxy

card, the Notice and this proxy statement are available at the SEC’s website at www.sec.gov and at the Investors section

of our website, https://investor.scisparc.com/. The contents of that website are not a part of this proxy statement. In addition,

shareholders of record who wish to receive by post-mail copies of the proxy materials, may contact the Company directly at 20 Raul Wallenberg

Street, Tower A Tel Aviv 6971916 Israel, Attn: Oz Adler, Chief Executive Officer, telephone number: +972-3-7175777.

COMPENSATION

OF EXECUTIVE OFFICERS

For information concerning

the annual compensation earned during 2023 by our five most highly compensated executive officers see Item 6.B. of our Annual Report

on Form 20-F for the year ended December 31, 2023, as filed with the SEC on April 1, 2024 (the “Annual Report”),

a copy of which is available on our website at https://investor.scisparc.com/.

DIRECTOR

INDEPENDENCE

Our Board has determined

that each of Mr. Vider, Ms. Sidi, Mr. Ben Shay, Mr. Revach and Mr. Dayan satisfy the independent director requirements

under the Nasdaq Stock Market (“Nasdaq”) corporate governance requirements. As such, the Board is comprised of a majority

of independent directors as such term is defined in Nasdaq rules.

Our Board has further

determined that each member of our audit committee is independent as such term is defined in Rule 10A-3 under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and that each member of our audit committee and compensation committee

satisfies the additional requirements applicable under Nasdaq rules to members of audit committees and compensation committees, respectively.

BOARD DIVERSITY (as of August 22, 2024)

|

Country of Principal Executive Offices |

Israel |

| Foreign Private Issuer |

Yes |

| Disclosure Prohibited Under Home Country Law |

No |

| Total Number of Directors |

7 |

| Part I: Gender Identity |

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

| Directors |

1 |

6 |

|

|

| Part II: Demographic Background |

|

| Underrepresented Individual in Home Country Jurisdiction |

|

| LGBTQ+ |

|

| Did Not Disclose Demographic Background |

4 |

PROPOSAL 1

APPROVAL OF THE RE-ELECTION OF EACH OF MS. LIAT SIDI AND MR. AMNON BEN SHAY AS A CLASS I DIRECTOR OF THE COMPANY

Background

Our Board currently

has seven directors, who are divided into three classes with staggered three-year terms as follows:

| ● | the Class I directors consist of Ms. Liat Sidi and Mr. Amnon

Ben Shay and their terms will expire at the Meeting; |

| ● | the Class II directors consist of Mr. Lior Vider,

Mr. Alon Dayan and Mr. Moshe Revach and their terms expire at our annual general meeting of shareholders to be held in 2025; and |

| ● | the Class III directors consist of Mr. Amitay Weiss

and Mr. Itschak Shrem and their terms will expire at our annual general meeting of shareholders to be held in 2026. |

At each annual general

meeting of our shareholders, the election or re-election of directors following the expiration of the term of office of the directors

of that class, will be for a term of office that expires on the date of the third annual general meeting following such election or re-election.

At the Meeting, shareholders

will be asked to re-elect each of Ms. Liat Sidi and Mr. Amnon Ben Shay as a director of the Company.

If re-elected at the

Meeting, each of Ms. Liat Sidi and Mr. Amnon Ben Shay will serve until the third annual general meeting of our shareholders following

this Meeting, and until their respective successors have been duly elected and qualified, or until their office is vacated in accordance

with our Articles. If re-elected at the Meeting, Ms. Liat Sidi will continue to serve as the Company’s Chairman.

In accordance with

the Companies Law, each of Ms. Liat Sidi and Mr. Amnon Ben Shay has certified to us that they meet all the requirements of the Companies

Law for election as a director of a public company and possess the necessary qualifications and has sufficient time to fulfill their duties

as a director of SciSparc, taking into account the special needs of SciSparc.

For information on

the compensation payable to our directors, please see our Annual Report.

Biographical information

concerning Ms. Liat Sidi and Mr. Amnon Ben Shay is set forth below:

Ms. Liat Sidi has

served as a member of our Board of Director since August 2020. Ms. Sidi serves as the manager of the accounting department for Foresight

Autonomous Holdings Ltd. (Nasdaq and TASE: FRSX) and has served as director for Save Foods Inc. (Nasdaq: SVFD) since November 2023. Ms.

Sidi previously served as director for Plantify Foods Inc. (CVW: PTFY) from September 2023 to January 2024. Ms. Sidi previously served

as an accountant for Panaxia Labs Israel Ltd. (TASE: PNAK) from 2015 to 2020 and as an accountant for Soho Real Estate Ltd. from 2015

to 2016. Ms. Sidi also served as an accountant for Feldman-Felco Ltd. from 2006 to 2010 and as an accountant for Eli Abraham accounting

firm from 2000 to 2006. Ms. Sidi completed tax, finance and accounting studies in Ramat Gan College of Accounting.

Mr. Amnon Ben Shay

has served as a member of our Board of Directors since January 2021 and served as our external director under the Companies Law between

January 2021 and January 2022. Mr. Ben Shay has been chief financial officer of Aerodrome Group Ltd since October 2022. Mr. Ben Shay previously

served on the board of directors of Azorim Investments and Building Development Company Ltd. (TASE: AZRM), Value Capital One Ltd. (TASE:

VALU) and B.G.I. Investments (1961) Ltd. (TASE: BGI). Mr. Ben Shay was chief financial officer of Hadar Hasharon Marketing and Distributions

Ltd. from February 2019 to October 2022. From February 2017 to January 2019, Mr. Ben Shay served as the chief financial officer of Fridenson

Air & Ocean Ltd. From January 2014 to January 2017, Mr. Ben Shay served as the chief financial officer of Abetrans Logistics Ltd.

Prior to that, Mr. Ben Shay served as the chief financial officer of Isline Export and Import Services Ltd. from 2010 to 2013. Prior to

the year 2009, Mr. Ben Shay served as the chief financial officer of several Israeli real estate investment groups. Mr. Ben Shay holds

a B.A. in economics and business and an M.B.A in business, both from The Hebrew University of Jerusalem, Israel, and an accounting certificate

from The College of Management Academic Studies, Israel.

Proposal

It is proposed that

the following resolutions be adopted at the Meeting:

“RESOLVED,

that Ms. Liat Sidi be re-elected as a Class I director, to serve until the third annual general meeting of shareholders following

this Meeting and until her successor has been duly elected and qualified, or until her office is vacated in accordance with the Company’s

amended and restated articles of association or the Companies Law; and

RESOLVED, that

Mr. Amnon Ben Shay be re-elected as a Class I director, to serve until the third annual general meeting of shareholders following

this Meeting and until his successor has been duly elected and qualified, or until his office is vacated in accordance with the Company’s

amended and restated articles of association or the Companies Law.”

Vote Required

See “Vote Required for Approval

of Each of the Proposals” above.

Board Recommendation

The Board recommends

a vote “FOR” the re-election of each of Ms. Liat Sidi and Mr. Amnon Ben Shay as a Class I director for a term to expire

at the third annual general meeting of shareholders following this Meeting.

PROPOSAL 2

APPROVAL OF GRANT OF EQUITY AWARD TO THE COMPANY’S

CHIEF EXECUTIVE OFFICER

Background

Under the Companies Law,

as a public Israeli company, we are generally required to obtain the approval of our compensation committee, our Board and our shareholders,

in that order, for any arrangements regarding the compensation of our Chief Executive Officer, Mr. Oz Adler whom we refer as our CEO.

Mr. Adler has been the

Company’s CEO since January 2022. The last grant to Mr. Adler occurred on February 27, 2022, when he was granted options to purchase

31,100 of our ordinary shares subject to a twelve quarter vesting schedule.

The

compensation committee firmly believes that our CEO’s compensation program should reward actions and behaviors that drive shareholder

value creation. The compensation committee aims to foster those objectives through compensatory measures that emphasize variable, performance-based

incentives that create a balanced focus on both our short-term and long-term financial, operational and strategic goals. Accordingly,

on June 19 and June 20, 2024, and on August 12, 2024 the compensation committee and the Board, respectively, approved a proposed equity

award to our CEO, comprised of 200,000 restricted share units (“RSUs”).

The compensation committee

believes that the proposed grant fulfills the following performance-based compensation principles in order to:

| ● | Closely align the interests of the CEO with those of SciSparc’s shareholders in order to enhance

shareholder value; |

| ● | Align a significant portion of the CEO’s compensation with SciSparc’s short and long-term

goals and performance; |

| ● | To provide the CEO with a structured compensation package, including competitive salaries, performance-motivating

cash and equity incentive programs and benefits, and to be able to present to the CEO an opportunity to advance in a growing organization; |

| ● | To strengthen the retention and the motivation of our CEO in the long-term; |

| ● | To provide appropriate awards in order to incentivize superior individual excellence and corporate performance;

and |

| ● | To maintain consistency in the way our CEO is compensated. |

At

the Meeting, shareholders will be asked to approve a grant of 200,000 RSUs to the Company’s CEO, with a fair value of approximately

$171,000 (the “CEO Award”). The CEO Award complies with our Compensation Policy for Officers and Directors

(the “Compensation Policy”). Subject to the CEO’s continued employment by the Company, 12.5% of the RSUs

will vest each quarter after the vesting commencement date. Unless otherwise stated, the terms of the CEO Award are subject to the SciSparc

Share Incentive Plan (2023) (the “Plan”). The CEO Award shall be granted in accordance with Section 102 of the Israeli Income

Tax Ordinance (New Version), 1961, as amended, and the regulations promulgated thereunder, under the capital gains track though a trustee

(“Section 102 of the Tax Ordinance”).

Proposal

We are proposing the adoption by our shareholders

of the following resolution at the Meeting:

“RESOLVED, to approve

the grant of equity award to the Company’s Chief Executive Officer, in such amounts and with such terms and conditions (including

vesting terms), as set forth in Proposal 2 of the Proxy Statement for the Meeting, dated August 22, 2024.”

Required Vote

See “Vote Required for Approval of the Proposals”

above.

Board Recommendation

The Board unanimously

recommends a vote “FOR” the foregoing resolution approving the grant of equity awards to our Chief Executive Officer.

PROPOSAL 3

APPROVAL OF GRANT OF EQUITY AWARD TO THE COMPANY’S

PRESIDENT

Background

Under the Companies Law,

as a public Israeli company, we are generally required to obtain the approval of our compensation committee, our Board and our shareholders,

in that order, for any arrangements regarding the compensation of our directors. The Company’s President, Mr. Itschak Shrem, also

serves as a member of the Board of the Company, and as such, the approval of the Company’s shareholders is required in matters relating

to his compensation.

Mr. Shrem has been the

Company’s President since January 2022, prior to which he served as our Chairman from August 2020 to January 2022. The last grant

to Mr. Shrem occurred on February 27, 2022, when he was granted options to purchase 31,100 of our ordinary shares subject to a twelve

quarter vesting schedule.

The compensation committee

firmly believes that our President’s compensation program should reward actions and behaviors that drive shareholder value creation.

The compensation committee aims to foster those objectives through compensatory measures that emphasize variable, performance-based incentives

that create a balanced focus on both our short-term and long-term financial, operational and strategic goals. Accordingly, on June 19

and June 20, 2024, and on August 12, 2024 the compensation committee and the Board, respectively, approved a proposed equity award to

our President, comprised of 200,000 RSUs.

At

the Meeting, shareholders will be asked to approve a grant of 200,000 RSUs to the Company’s President, with a fair value of approximately

$171,000 (the “President Award”). The President Award complies with our Compensation Policy. Subject to the

President’s continued engagement by the Company, 12.5% of the RSUs will vest each quarter after the vesting commencement date.

Unless otherwise stated, the terms of the President Award are subject to the Plan. The President Award shall be granted in accordance

with Section 102 of the Tax Ordinance.

In approving the President

Award, our compensation committee and our Board considered the President’s equity interest in the Company, the alignment of his

interests with those of the Company, and the desire to encourage him to continue contributing his talent and time as President and director.

Proposal

We are proposing the adoption

by our shareholders of the following resolution at the Meeting:

“RESOLVED, to approve

the grant of equity award to the Company’s President, in such amounts and with such terms and conditions (including vesting terms),

as set forth in Proposal 3 of the Proxy Statement for the Meeting, dated August 22, 2024.

Required Vote

See “Vote Required

for Approval of the Proposals” above.

Board Recommendation

The Board unanimously

recommends a vote “FOR” the foregoing resolution approving the grant of equity awards to our President.

PROPOSAL 4

APPROVAL OF GRANT OF EQUITY AWARD TO THE COMPANY’S

CHAIRMAN

Background

Under the Companies Law,

as a public Israeli company, we are generally required to obtain the approval of our compensation committee, our Board and our shareholders,

in that order, for any arrangements regarding the compensation of our directors, including the Company’s Chairman, Mr. Amitay Weiss.

Mr. Weiss has served

on the Company’s Board since August 2020 and as Chairman since January 2022. Mr. Weiss served as the Company’s chief executive

officer from August 2020 to January 2022. The last grant to Mr. Weiss occurred on February 27, 2022, when he was granted options to purchase

31,100 of our ordinary shares subject to a twelve quarter vesting schedule.

The compensation committee

firmly believes that our Chairman’s compensation program should reward actions and behaviors that drive shareholder value creation.

The compensation committee aims to foster those objectives through compensatory measures that emphasize variable, performance-based incentives

that create a balanced focus on both our short-term and long-term financial, operational and strategic goals. Accordingly, on June 19

and June 20, 2024, and on August 12, 2024 the compensation committee and the Board, respectively, approved a proposed equity award to

our Chairman, comprised of 200,000 RSUs.

At

the Meeting, shareholders will be asked to approve a grant of 200,000 RSUs to the Company’s Chairman, with a fair value of approximately

$171,000 (the “Chairman Award”). The Chairman Award complies with our Compensation Policy. Subject to the Chairman’s

continued engagement by the Company, 12.5% of the RSUs will vest each quarter after the vesting commencement date. Unless otherwise stated,

the terms of the Chairman Award are subject to the Plan. The Chairman Award shall be granted in accordance with Section 102 of the Tax

Ordinance.

In approving the Chairman

Award, our compensation committee and our Board considered the Chairman’s equity interest in the Company, the alignment of his interests

with those of the Company, and the desire to encourage him to continue contributing his talent and time as Chairman and director.

Proposal

We are proposing the adoption

by our shareholders of the following resolution at the Meeting:

“RESOLVED, to approve

the grant of equity award to the Company’s Chairman, in such amounts and with such terms and conditions (including vesting terms),

as set forth in Proposal 4 of the Proxy Statement for the Meeting, dated August 22, 2024.”

Required Vote

See “Vote Required

for Approval of the Proposals” above.

Board Recommendation

The Board unanimously

recommends a vote “FOR” the foregoing resolution approving the grant of equity awards to our Chairman.

PROPOSAL 5

APPROVAL OF GRANTS OF EQUITY AWARDS TO THE COMPANY’S

DIRECTORS

Background

Under the Companies Law, the

terms of compensation of directors, including equity-based compensation, generally require the approval of the compensation committee,

board of directors and shareholders, in that order.

Our

compensation committee and Board determined to approve, subject to shareholder approval, the grant of 60,000 RSUs to each of the following

directors: Ms. Liat Sidi, Mr. Amnon Ben Shay, Mr. Lior Vider, Mr. Alon Dayan and Mr. Moshe Revach (the “Directors”).

Each of the Directors’

last grants occurred on February 27, 2022, when each Director was granted options to purchase 5,500 of our ordinary shares subject to

a twelve quarter vesting schedule.

At

the Meeting, shareholders will be asked to approve a grant of 60,000 RSUs to each of the Directors, with a fair value of approximately

$51,500 each and an approximate total fair value of $257,500 (the “Directors’ Award”). The Directors’

Award complies with our Compensation Policy. Subject to each Director’s continued engagement by the Company, 12.5% of the RSUs

will vest each quarter after the vesting commencement date. Unless otherwise stated, the terms of the Directors’ Award are subject

to the Plan. The Directors’ Award shall be granted in accordance with Section 102 of the Tax Ordinance.

In approving the Directors’

Award, our compensation committee and our Board considered the Directors’ equity interests in the Company, the alignment of their

interests with those of the Company, and the desire to encourage them to continue contributing their talent and time as directors.

Proposal

It is proposed that the following resolution be

adopted at the Meeting:

“RESOLVED, to approve

the grant of equity award to the Directors who shall serve in such capacity immediately following the Meeting, in such amounts and with

such terms and conditions (including vesting terms), as set forth in Proposal 5 of the Proxy Statement for the Meeting dated August 22,

2024.”

Vote

Required

See “Vote Required for

Approval of the Proposals” above.

Board

Recommendation

Our Board of Directors

recommends a vote “FOR” the foregoing resolution approving grant of equity awards to our directors.

PROPOSAL 4

RE-APPOINTMENT OF INDEPENDENT AUDITORS

AND AUTHORIZATION OF THE BOARD TO FIX THEIR REMUNERATION

Background

Our audit committee

and Board have approved the re-appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent

registered public accounting firm for the year ending December 31, 2024 and until the next annual general meeting of shareholders, subject

to the approval of our shareholders.

For information regarding

the total compensation that was paid by the Company and its subsidiaries to its independent auditors, please see Item 16C of our

Annual Report.

Proposal

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

to re-appoint Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as the Company’s independent registered

public accounting firm for the year ending December 31, 2024 and until the next annual general meeting of shareholders, and to authorize

the Company’s board of directors (with power of delegation to its audit committee) to set the fees to be paid to such auditors in

accordance with the volume and nature of their services.”

Vote Required

See “Vote

Required for Approval of Each of the Proposals” above.

Board Recommendation

The Board recommends

a vote “FOR” the approval of the re-appointment of Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global,

as our independent registered public accounting firm for the year ending December 31, 2024 and until the next annual general meeting of

shareholders.

PRESENTATION AND DISCUSSION OF AUDITED

CONSOLIDATED FINANCIAL STATEMENTS

In addition to considering

the foregoing agenda items at the Meeting, we will also present our audited consolidated financial statements for the fiscal year ended

December 31, 2023. A copy of the Annual Report, including the audited consolidated financial statements for the year ended December 31,

2023, is available for viewing and downloading on the SEC’s website at www.sec.gov as well as on the Investors section

of our Company’s website at https://investor.scisparc.com/.

OTHER BUSINESS

The Board is not aware

of any other matters that may be presented at the Meeting other than those described in this proxy statement. If any other matters do

properly come before the Meeting, including the authority to adjourn the Meeting pursuant to Article 16 of the Company’s Articles,

it is intended that the persons named as proxies will vote, pursuant to their discretionary authority, according to their best judgment

in the interest of the Company.

ADDITIONAL INFORMATION

The Annual Report

filed with the SEC on April 1, 2024 is available for viewing and downloading on the SEC’s website at www.sec.gov as well

as under the Investors section of the Company’s website at https://investor.scisparc.com/.

The Company is subject

to the information reporting requirements of the Exchange Act applicable to foreign private issuers. The Company fulfills these requirements

by filing reports with the SEC. The Company’s filings with the SEC are available to the public on the SEC’s website at

www.sec.gov. As a foreign private issuer, the Company is exempt from the rules under the Exchange Act related to the furnishing

and content of proxy statements. The circulation of this proxy statement should not be taken as an admission that the Company is subject

to those proxy rules.

| |

By Order of the Board of Directors, |

| |

|

| |

Mr. Amitay Weiss |

| |

Chairman of the Board of Directors |

Dated: August 22, 2024

16

Exhibit 99.2

|

SCISPARC LTD.

20 Raul Wallenberg Street, Tower A

Tel Aviv 6971916 Israel. |

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions

and for electronic delivery of information up until 11:59 p.m. Eastern Time, Monday, September 30, 2024. Have your proxy card in hand

when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred

by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically

via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when

prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your

voting instructions up until 11:59 p.m. Eastern Time, Monday, September 30, 2024. Have your proxy card in hand when you call and then

follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return

it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: |

KEEP THIS PORTION FOR YOUR RECORDS |

| |

DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND

DATED.

| SCISPARC LTD. |

|

|

|

The

Board of Directors recommends you vote FOR the following proposals: |

|

|

|

| |

|

|

|

| 1. |

To re-elect each of Ms.

Liat Sidi and Mr. Amnon Ben Shay to serve as Class I directors of the Company, until the Company’s third annual general meeting

of shareholders following this Meeting, and until their respective successor is duly elected and qualified. |

|

|

|

| |

|

|

|

| Nominees: |

For |

Against |

Abstain |

| |

|

|

|

| 1a. |

Liat Sidi. |

☐ |

☐ |

☐ |

| |

|

|

|

| 1b. |

Amnon Ben Shay. |

☐ |

☐ |

☐ |

| |

|

|

|

|

| 2. |

To approve the grant of equity awards to the Company’s

Chief Executive Officer. |

☐ |

☐ |

☐ |

|

|

|

|

|

| 3. |

To approve the grant of

equity awards to the Company’s President. |

☐ |

☐ |

☐ |

|

|

|

|

|

| 4. |

To approve the grant of

equity awards to the Company’s Chairman of the Board. |

☐ |

☐ |

☐ |

| |

|

|

|

|

| 5. |

To approve the grant of

equity awards to the Company’s directors. |

☐ |

☐ |

☐ |

| |

|

|

|

|

| 6. |

To re-appoint Kost, Forer,

Gabbay & Kasierer, a member of Ernst & Young Global, as our independent registered public accounting firm for the year ending

December 31, 2024 and until the next annual general meeting of shareholders, and to authorize the Company’s board of directors

(with power of delegation to its audit committee) to set the fees to be paid to such auditors. |

☐ |

☐ |

☐ |

Please sign exactly as

your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such.

Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership

name by authorized officer.

| |

|

|

|

|

|

|

| |

Signature [PLEASE SIGN WITHIN BOX] |

Date |

|

Signature (Joint Owners) |

Date |

|

Important Notice Regarding the Availability

of Proxy Materials for the Annual General Meeting:

The Proxy Statement is available

at www.proxyvote.com.

SCISPARC LTD.

Annual General Meeting of Shareholders

To be held October 1, 2024

This proxy is solicited by the Board of Directors

The undersigned shareholder(s) hereby appoint(s)

Oz Adler and Amitay Weiss, and each of them, as proxies and attorneys-in-fact, each with the power to appoint (his/her) substitute or

successive substitutes, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of

the ordinary shares of SciSparc Ltd. that the shareholder(s) is/are entitled to vote at the Annual General Meeting of Shareholders to

be held at 3:00 PM (Israel time) on October 1, 2024 , at 20 Raul Wallenberg Street, Tower A Tel Aviv 6971916 Israel, and in their discretion,

according to their best judgment and the recommendation of the board of directors, to vote upon such other business as may properly come

before the meeting, any adjournment(s) or postponement(s) thereof. The undersigned shareholder(s) also acknowledge(s) receipt of the Notice

of Annual General Meeting of Shareholders and the Company’s Proxy Statement, dated August 22, 2024, for such meeting (including

either a physical copy or by way of electronic access).

IMPORTANT NOTE: BY EXECUTING THIS PROXY

CARD, THE UNDERSIGNED SHAREHOLDER IS CONFIRMING THAT HE, SHE OR IT DOES NOT HAVE A CONFLICT OF INTEREST (I.E., THE UNDERSIGNED IS NOT

AN “INTERESTED SHAREHOLDER”) IN THE APPROVAL OF PROPOSAL NO. 2 AND CAN THEREFORE BE COUNTED TOWARDS OR AGAINST THE MAJORITY

REQUIRED FOR APPROVAL OF THAT PROPOSAL. IF YOU HAVE SUCH A CONFLICT OF INTEREST IN THE APPROVAL OF PROPOSAL NO. 2, PLEASE NOTIFY MR. OZ

ADLER, THE COMPANY’S CHIEF EXECUTIVE OFFICER, AT 20 RAUL WALLENBERG STREET, TOWER A TEL AVIV 6971916, ISRAEL, TELEPHONE: +972-3-7175777

OR EMAIL OZ@SCISPARC.COM.

This proxy also delegates, to

the extent permitted by applicable law, discretionary authority to vote with respect to any other business which may properly come before

the annual general meeting or any adjournment(s) or postponement(s) thereof.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING,

PLEASE COMPLETE, DATE AND SIGN THIS FORM OF PROXY AND MAIL THE ENTIRE PROXY PROMPTLY, ALONG WITH PROOF OF IDENTITY IN ACCORDANCE WITH

THE COMPANY’S PROXY STATEMENT, IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF THESE SHARES. NO POSTAGE NEED BE AFFIXED

IF THE PROXY IS MAILED IN THE UNITED STATES.

This proxy, when properly executed, will be

voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors'

recommendations.

Continued and to be signed on reverse side

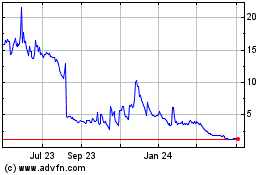

SciSparc (NASDAQ:SPRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

SciSparc (NASDAQ:SPRC)

Historical Stock Chart

From Dec 2023 to Dec 2024