Market Talk Roundup: Sanofi Shares Rise as New Strategy Sets Ambitious Targets

December 10 2019 - 8:03AM

Dow Jones News

The French pharmaceutical company has shared a new strategy

which outlines fresh targets and forcasts under its recently

appointed CEO Paul Hudson. Below is a selection of comments.

0634 GMT - Sanofi's new strategy should draw positive market

reactions, Citi analysts say. The French pharmaceutical company's

new mid-term margin target of 32% suggests at least 15% upside to

consensus expectations, Citi says. Commentary around the potential

monetization of the consumer unit, which could potentially be worth

EUR26 billion to EUR32 billion according to Citi, will also be

taken well and highlights the company's significant balance sheet

flexibility, the bank says. (cristina.roca@dowjones.com)

0954 GMT - Sanofi shares are buoyant on Tuesday morning after

the company shared new chief executive Paul Hudson's fresh

strategy. It set ambitious margin targets, gave a bullish forecast

for its star drug Dupixent and said it would give up on hunting for

new drugs in the challenging areas of diabetes and cardiovascular

medicine. It also hinted at a possible separation of its consumer

healthcare business with plans to make it a standalone unit within

Sanofi. Shares in the company are up 4.6% at EUR 85.60.

(denise.roland@wsj.com ; @deniseroland)

1049 GMT - French pharmaceutical company Sanofi is looking to

exceed consensus expectations under the new targets unveiled by its

recently-arrived chief executive Paul Hudson, say analysts at Bank

of America Merrill Lynch. They say that the targets on sales,

margins and savings imply a 2025 earnings per share more than 10%

higher than the bank's estimates. De-emphasis on the diabetes and

cardiovascular portfolio, a possible divestment of the Regeneron

stake, as well as greater independence for the consumer unit all

provide further positive momentum, BAML adds.

(carlo.martuscelli@wsj.com; @carlomartu)

1059 GMT - The decision to make Sanofi's Consumer Healthcare

unit a standalone business within the organization implies the

division is being prepared for an exit from the company, Bryan

Garnier's Jean-Jacques Le Fur says. The bank values the business at

close to EUR25 billion, five times estimated 2020 sales. Le Fur

says that the targets set out by new CEO Paul Hudson are ambitious,

aiming for a 2022 operating margin of 30%, which is above the

bank's 28.5% forecast. Shares rise 13% to EUR85.72.

(carlo.martu@wsj.com; @carlomartu)

1134 GMT - French pharmaceutical company Sanofi has set itself

an aggressive, EUR10 billion peak sales target for Dupixent, an

injected treatment for eczema and asthma, says UBS, noting that the

figure is well above consensus forecasts of EUR7.1 billion in 2026.

"This is exciting but sets the bar high and we expect investors

will want to understand how this breaks down and when it might be

reached," says the bank. "Other assets are identified as

priorities, although some (fitusiran, BIVV001, venglustat) have

already been scrutinised and we expect the focus to be on what

might emerge from the proposed acquisition of Synthorx (focussed on

immuno-oncology) for $2.5 [billion], announced earlier yesterday."

Shares trade 13% higher. (carlo.martuscelli@wsj.com;

@carlomartu)

(END) Dow Jones Newswires

December 10, 2019 07:48 ET (12:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

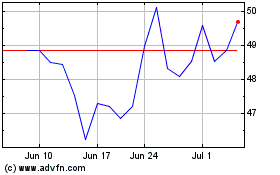

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

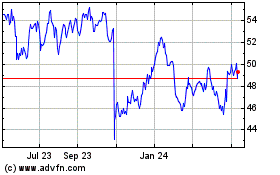

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024