RYVYL Inc. (NASDAQ: RVYL) ("RYVYL" or the "Company"), a leading

innovator of payment transaction solutions leveraging electronic

payment technology for diverse international markets, announced it

expects to report 2024 total revenue of $56.0 million, within the

range of 2024 full year revenue guidance of $56 million to $60

million. Management intends to report financial results in

mid-March 2025.

“Robust business development and sales

initiatives in 2024 have positioned us to resume strong growth in

2025,” said Fredi Nisan, CEO of RYVYL. “In addition, our efforts to

grow our high-margin, banking-related revenue at RYVYL EU are

coming to fruition. Our product mix has been shifting. As this

continues, we expect to drive significantly higher overall gross

margin in 2025.”

RYVYL 2025 Guidance

Based on the strength of its RYVYL EU as well as

newly signed business and a solid pipeline for both RYVYL EU and

NEMS, the Company expects 2025 revenue to be in the range of $80

million to $90 million. This represents over 50% growth at the

mid-point of the range in comparison to 2024 preliminary revenue

results. The Company also expects to increase gross margins to the

mid-40s percent, which would yield a positive annual adjusted

EBITDA and positive operating cash flow in the second half of the

year.

The foregoing guidance is based on the Company’s

continuation of the business, as currently conducted. On January

24, 2025, the Company entered into an agreement with a financing

source that was structured as a pre-funded asset sale with a 90-day

closing period, which ends on April 23, 2025 and may be extended an

additional 30 days to May 23, 2025, if the Company pays $500,000

for such extension. Shares in the Company’s RYVYL EU subsidiary

were placed in escrow during the closing period. Although there are

no guarantees, the Company intends to terminate the asset sale

within the closing period by paying $16.5 million in consideration

of such termination. The Company’s financial guidance for 2025 is

based on fully retaining its RYVYL EU subsidiary.

Strengthened Balance Sheet

With the recent January 27, 2025 payment of

$13.0 million to the Securityholder, the outstanding balance of the

Series B Convertible Preferred Stock (“Preferred Stock”) was fully

retired and the 8% Senior Secured Note (the “Note”) balance was

reduced to $4.0 million. The Company previously had converted $55.0

million of the Note principal into the Preferred Stock.

George Oliva, CFO of RYVYL, stated, “I am very

pleased that the net effect of these two transactions was to

increase shareholder equity by over $50 million without any

associated dilution to the common shareholders. We expect the

impact of this balance sheet restructuring will lower the cost of

capital as we invest in our growth in 2025.”

The Company has recently filed an S-1

registration statement to raise up to $24 million, including the

overallotment, and intends to explore all fund-raising options,

including term debt, equity or some combination to fund the

termination payment of $16.5 million. There is an option to extend

the closing period 30 days to May 23, 2025, in exchange for a

payment of an additional $500,000.

Transaction Processing Volumes as a Percentage of

Revenue

Transaction processing volumes in the Company’s

merchant acquiring business is one measure of the Company’s

business, and this has been correlated with overall revenue growth.

The Company is providing the following additional information

regarding processing volumes in relation to revenue for the period

from January 1, 2021 through December 31, 2024 (estimated). During

this period, the blended percentage has been trending lower due to

the rapid growth in the Company’s International business, which, as

compared to North America, has a higher mix of banking revenues

that carry a lower residual rate versus acquiring. The Company

expects this trend to continue in 2025 as its International revenue

is expected to increase as a percentage of total revenue compared

to 2024.

$ in Millions

|

Processing |

|

2021 |

|

|

2022 |

|

|

2023 |

|

2024E |

|

Q1 24 |

Q2 24 |

Q3 24 |

Q4 24E |

|

North America |

$ |

1,514.5 |

|

$ |

1,000.5 |

|

$ |

1,360.0 |

|

$ |

738.5 |

|

|

$ |

239.0 |

|

$ |

152.6 |

|

$ |

170.6 |

|

$ |

176.3 |

|

|

International |

|

- |

|

$ |

683.0 |

|

$ |

1,690.0 |

|

$ |

3,746.4 |

|

|

$ |

755.0 |

|

$ |

902.1 |

|

$ |

952.3 |

|

$ |

1,137.1 |

|

|

Total |

$ |

1,514.5 |

|

$ |

1,683.5 |

|

$ |

3,050.0 |

|

$ |

4,485.0 |

|

|

$ |

994.0 |

|

$ |

1,054.6 |

|

$ |

1,122.9 |

|

$ |

1,313.5 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

North America |

$ |

26.4 |

|

$ |

28.6 |

|

$ |

48.9 |

|

$ |

18.2 |

|

|

$ |

9.7 |

|

$ |

3.0 |

|

$ |

2.8 |

|

$ |

2.7 |

|

|

International |

|

- |

|

$ |

4.3 |

|

$ |

16.9 |

|

$ |

37.8 |

|

|

$ |

7.1 |

|

$ |

8.9 |

|

$ |

10.4 |

|

$ |

11.4 |

|

|

Total |

$ |

26.4 |

|

$ |

32.9 |

|

$ |

65.9 |

|

$ |

56.0 |

|

|

$ |

16.8 |

|

$ |

11.9 |

|

$ |

13.2 |

|

$ |

14.1 |

|

| Revenue as %

Processing |

|

|

|

|

|

|

|

|

|

North America |

|

1.7 |

% |

|

2.9 |

% |

|

3.6 |

% |

|

2.5 |

% |

|

|

4.1 |

% |

|

2.0 |

% |

|

1.6 |

% |

|

1.5 |

% |

|

International |

|

- |

|

|

0.6 |

% |

|

1.0 |

% |

|

1.0 |

% |

|

|

0.9 |

% |

|

1.0 |

% |

|

1.1 |

% |

|

1.0 |

% |

|

Total |

|

1.7 |

% |

|

2.0 |

% |

|

2.2 |

% |

|

1.2 |

% |

|

|

1.7 |

% |

|

1.1 |

% |

|

1.2 |

% |

|

1.1 |

% |

About RYVYL

RYVYL Inc. (NASDAQ: RVYL) was born from a

passion for empowering a new way to conduct business-to-business,

consumer-to-business, and peer-to-peer payment transactions around

the globe. By leveraging electronic payment technology for diverse

international markets, RYVYL is a leading innovator of payment

transaction solutions reinventing the future of financial

transactions. Since its founding as GreenBox POS in 2017 in San

Diego, RYVYL has developed applications enabling an end-to-end

suite of turnkey financial products with enhanced security and data

privacy, world-class identity theft protection, and rapid speed to

settlement. As a result, the platform can log immense volumes of

immutable transactional records at the speed of the internet for

first-tier partners, merchants, and consumers around the globe.

www.ryvyl.com

Cautionary Note Regarding Forward-Looking

Statements

This press release includes information that

constitutes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements are based on the Company's current

beliefs, assumptions, and expectations regarding future events,

which in turn are based on information currently available to the

Company. Such forward-looking statements include statements

regarding timely payment of the second tranche, the benefit to

stockholders from the repayment of the Note and repurchase of the

Preferred Stock, and the timing and expectation of revenues from

the license described herein and are charactered by future or

conditional words such as "may," "will," "expect," "intend,"

"anticipate," "believe," "estimate" and "continue" or similar

words. You should read statements that contain these words

carefully because they discuss future expectations and plans, which

contain projections of future results of operations or financial

condition or state other forward-looking information. By their

nature, forward-looking statements address matters that are subject

to risks and uncertainties. A variety of factors could cause actual

events and results to differ materially from those expressed in or

contemplated by the forward-looking statements, including the risk

that the licensee understands and complies with various banking

laws and regulations that may impact the licensee's ability to

process transactions. For example, federal money laundering

statutes and Bank Secrecy Act regulations discourage financial

institutions from working with operators of certain industries -

particularly industries with heightened cash reporting obligations

and restrictions - as a result of which, banks may refuse to

process certain payments and/or require onerous reporting

obligations by payment processors to avoid compliance risk. These

statements are also subject to any damages the Company could suffer

as the result of previously announced litigation or actions of any

governmental agencies. These and other risk factors affecting the

Company are discussed in detail in the Company's periodic filings

with the SEC. The Company undertakes no obligation to publicly

update or revise any forward-looking statement, whether because of

the latest information, future events or otherwise, except to the

extent required by applicable laws.

Disclaimer Regarding Financial

Information

The financial information presented in this

press release, for the year ended December 31, 2024, is based on

preliminary financial statements prepared by management, for the

year ended December 31, 2024. Accordingly, such financial

information may be subject to change. All such information

contained in this press release will be qualified with reference to

the audited financial results for the year ended December 31, 2024,

which the Company intends to release or before March 13, 2025, and

in any event by March 31, 2025, and will be posted

on www.sec.gov. While the Company does not expect there to be

any material changes to the financial information provided in this

press release, any variation between the Company’s actual results

and the preliminary financial information set forth herein may be

material.

IR Contact: David Barnard,

Alliance Advisors Investor Relations, 415-433-3777,

ryvylinvestor@allianceadvisors.com

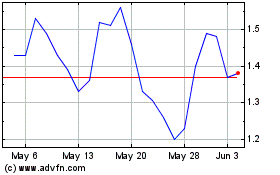

RYVYL (NASDAQ:RVYL)

Historical Stock Chart

From Jan 2025 to Feb 2025

RYVYL (NASDAQ:RVYL)

Historical Stock Chart

From Feb 2024 to Feb 2025