Ryanair: Boeing 737 MAX Grounding Will Hurt Profit -- Update

May 20 2019 - 6:20AM

Dow Jones News

By Robert Wall

LONDON -- Ryanair Holdings PLC, Europe's biggest budget airline

and the region's largest customer for Boeing Co.'s 737 MAX jets,

warned profit would be dented this year by the plane's global

grounding.

The Irish carrier said Monday it faces higher-than-expected

costs because of the suspension of MAX deliveries after the jet

suffered two fatal crashes in Indonesia and Ethiopia in less than

five months. Ryanair was due to receive its first MAX planes this

spring, which would have provided more seats and greater fuel

efficiency. The airline, which mostly operates older-model 737s,

has labeled the new plane a "gamechanger."

Ryanair said the delay in getting the new planes, together with

generally lower airfares and higher fuel costs, would limit profit

this year to between EUR750 million ($837 million) to EUR950

million, or roughly flat on last year. Analysts expected about EUR1

billion in profit, according to FactSet.

Shares opened 5% lower on the muted outlook.

Ryanair now plans to receive its first MAX planes in October and

start flying them in November if the jet has been approved by

regulators. It still wants to take about 47 of the planes this

financial year.

The carrier expects the U.S. Federal Aviation Administration to

clear the MAX to resume flying around July or August, with Europe's

regulator to follow about a month or two later, Chief Executive

Michael O'Leary said. Ryanair has suspended all MAX-related

pre-delivery payments to Boeing.

"We are working on a daily and weekly basis with Boeing and with

EASA, the European safety agency, on a return to service," Mr.

O'Leary said.

He added that he still had "utmost confidence" in the MAX,

though added the planes wouldn't generate meaningful cost savings

until the financial year ending in March 2021. Ryanair has ordered

135 of the planes with options for 75 more.

Ryanair said it would carry about a million fewer passengers

this year because of the MAX delay, which likely equates to about

EUR37 million in lost sales based on its average airfares.

"We will be looking for compensation from Boeing," Chief

Financial Officer Neil Sorahan said, without giving a figure.

Ryanair's downbeat outlook and plan to seek compensation follows

similar comments from other airlines that have warned on the

financial impact of the MAX grounding.

Ryanair also said it had taken delivery of its first 737 MAX

simulator and would get two more before year-end. The FAA has

indicated it won't require MAX pilots to undergo extra simulator

time, though some regulators are still considering mandating such

sessions. The FAA this week expects to meet with foreign regulators

to discuss how to manage the MAX's potential return to service.

Mr. Sorahan said the airline was sure Boeing would fix the MAX

and Ryanair would consider, at the right price, also buying larger

737 MAX 10 models. Purchasing rival Airbus A321s would also be an

option, he added, depending on costs.

The comments came as Ryanair reported a roughly 40% fall in net

profit for financial year ended March 31 to EUR885 million, despite

a 7% increase in sales to EUR7.7 billion. Profitability was hit by

a 6% slump in average fares and EUR139.5 million in costs

associated with getting Austrian carrier Lauda running after

Ryanair bought the airline in 2018.

Nevertheless, the airline's board has approved a EUR700 million

share repurchase.

Airlines in Europe have faced multiple headwinds, including

rising fuel costs and overcapacity in some markets. Several smaller

carriers have gone bust and others -- including Ryanair -- have

issued profit warnings in recent months. Carriers, including

British Airways parent International Consolidated Airlines Group SA

and British budget carrier EasyJet PLC, this month said they would

slow expansion.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

May 20, 2019 06:05 ET (10:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

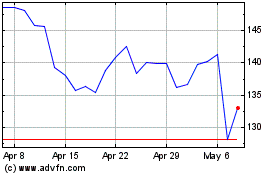

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

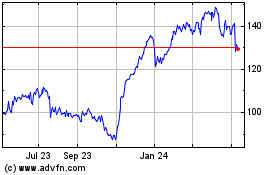

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024