Roma Financial Corporation (Nasdaq:ROMA) (the "Company"), the

holding company of Roma Bank and RomAsia Bank, announced today its

financial condition and results of operations for the three months

and year ended December 31, 2011.

"During 2011, mildly improved economic conditions spawned modest

improvement in new loan demand, but governmental intervention to

constrain long term interest rates placed continued stress on our

interest margin. Additionally, the level of non-performing loans

remains stubbornly high as additions during the year outpaced the

speed with which judicial resolutions occurred. Nevertheless,

we are pleased to report that consolidated financial results were

much improved over 2010. Our balance sheet continued to grow,

reflecting record levels in virtually every category, while

maintaining regulatory capital at well-capitalized

levels," commented Peter A. Inverso, President and

CEO.

The Company's consolidated net income for the year ended

December 31, 2011, was up $1.9 million, or 36.7%, to $7.0 million,

while net income for the fourth quarter 2011 was up 31.1% to $1.6

million, compared to the fourth quarter of 2010. Net income on

a per share basis was $0.23 per diluted share, compared to $0.17

per diluted share last year.

Despite a modest reduction in the annual average net interest

margin, net interest income improved in 2011 but declined slightly

in the fourth quarter. For the three months and year ended

December 31, 2011, net interest income was $13.1 million and $52.8

million, compared to $13.2 million and $46.1 million for the same

periods in 2010. For the year ended December 31, 2011, this

represented an increase of 14.3%, over the prior year.

Net income in 2011 principally benefitted from the $6.6 million

improvement in net interest income and a $2.4 million reduction in

loan loss provisions. Earnings in the prior year had

benefitted from a $2.2 million recovery of virtually all of an

impairment charge taken in 2009 on an available for sale equity

security.

At December 31, 2011, the Company had consolidated assets,

deposits, gross loans and equity of $1.9 billion, $1.6 billion,

$0.98 billion and $218.0 million, respectively.

Non-performing loans inched up to 4.59% of total loans and

represented 2.38% of total assets at December 31, 2011, from 4.44%

and 2.22%, respectively, in 2010. "Management is intently

focused on converting these loans into earning assets," said

Inverso.

"It is noteworthy, that the Office of the Comptroller of the

Currency (OCC) became the federal regulator of the Company's banks

during 2011, replacing the Office of Thrift Supervision

(OTS). Unlike the OTS, the OCC strongly prefers that specific

reserves not be carried as a component of the allowance for loan

loss, but rather that the loan impairment be recognized by reducing

the carrying value of the corresponding loan. Accordingly, in

the fourth quarter, $5.2 million of specific reserves carried by

Roma Bank were written off. As a result, the consolidated

allowance for loan losses, together with the unused credit marks

against loans acquired in the Sterling Bank acquisition, fell to

36.6% of non-performing loans and 1.8% of total loans at the end of

the year, compared to 60.5% and 2.6%, respectively, at the end of

2010," Inverso stated.

In closing, Inverso commented, "Throughout the economic tempest

of the last three plus years, our Company has continued to reinvest

our shareholders' and our depositors' funds into our communities,

and grown while remaining well capitalized. As a premier

community bank, we take pride in these accomplishments."

Shares of the Company began trading on July 12, 2006, on the

NASDAQ Global Select Market under the symbol "ROMA."

Roma Financial Corporation (Nasdaq:ROMA) is the holding company

of Roma Bank, a community bank headquartered in Robbinsville, New

Jersey, and RomAsia Bank headquartered in South Brunswick, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 91 years with a

complete line of financial products and services, and today Roma

Bank operates branch locations in Mercer, Burlington, Camden and

Ocean counties in New Jersey. Visit Roma online at

www.romabank.com, or RomAsia Bank at

www.romasiabank.com. RomAsia Bank has two branch locations in

Middlesex County, New Jersey.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning the financial condition, results of operations and

business of the Company. We caution that such statements are

subject to a number of uncertainties and actual results could

differ materially, and, therefore, readers should not place undue

reliance on any forward-looking statements. The Company does

not undertake, and specifically disclaims, any obligation to

publicly release the results of any revisions that may be made to

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

CONTACT: Peter A. Inverso

President & CEO

609 223 8310

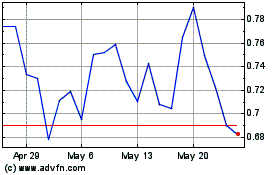

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

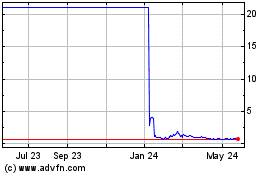

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2023 to Dec 2024