Roma Financial Corporation (Nasdaq:ROMA), the holding company of

Roma Bank, and Sterling Banks, Inc. (Nasdaq:STBK), the holding

company for Sterling Bank, jointly announced today that their

Boards of Directors have approved an Agreement and Plan of Merger

providing for Sterling to merge with and into a subsidiary of Roma

Financial in exchange for a cash payment to Sterling shareholders.

Under the terms of the merger agreement, which has been approved by

the boards of directors of both companies, Roma Financial will

acquire all of the outstanding shares of Sterling for a total

purchase price of approximately $14.7 million in cash, or $2.52 per

share for each share of Sterling common stock outstanding. The

transaction is subject to receipt of all required banking

regulatory approvals, Sterling stockholder approval and certain

financial and other contingencies.

Peter A. Inverso, President and Chief Executive Officer of Roma

Financial Corporation, commented, "We believe that our shareholders

recognize the commitment of Roma Bank to our community banking

philosophy. This is an opportunity to expand our geographic reach

into attractive markets and acquire a community bank franchise with

minimum impact on our capital and early earnings

accretion. This acquisition allows us to expand our market

presence in Burlington County and enter Camden County. We look

forward to servicing Sterling's loyal customers with the same

customer centric focus that distinguishes Roma in our dealings with

our customers, and are excited to add Sterling's 10 branch network

and its employees to our existing franchise."

"We are pleased to be able to partner with Roma Financial and

Roma Bank. Both companies have earned a great reputation in the

market in Central and Southern New Jersey. The combination of

talent, locations and increased presence in the market will enable

us to better serve our customers," noted Robert H. King, President

and CEO of Sterling.

Financial highlights include:

The pro forma institution is projected to have $1.7 billion in

assets and $1.3 billion in deposits.

The transaction is expected to be accretive to Roma's earnings

in the first full year of operations.

The projected dilution to tangible book value is less than 2%

and the projected tangible book value work back is less than 3

years.

Roma expects to be able to utilize a large portion of Sterling's

deferred tax asset.

Sterling Bank will merge with and into Roma Bank, with Roma Bank

as the surviving bank. Roma will appoint one of Sterling's

directors to its Board of Directors, and Robert H. King, President

and CEO of Sterling, will join Roma Bank as a senior

officer. It is expected that the merger will be consummated in

the third quarter of 2010.

The transaction is subject to certain conditions, including

requisite regulatory approval, the approval of Sterling's

stockholders, and Sterling maintaining its financial condition

through the closing such that Sterling's nonperforming assets,

inclusive of troubled debt restructurings, do not exceed $30.0

million for the period from January 1, 2010 through the

Closing Date, and Sterling's tangible common equity capital being

not less than $9.9 million on the Closing Date. At December 31,

2009, Sterling's tangible common equity was $15.0 million, and its

non-performing assets, inclusive of troubled debt restructurings,

were $23.9 million.

Sterling Banks, Inc. is the holding company of Sterling Bank, a

community bank headquartered in Mount Laurel, New

Jersey. Sterling Bank's 10 offices are located in Burlington

and Camden Counties in New Jersey. The common stock of Sterling

Banks, Inc. is traded on NASDAQ under the symbol "STBK". For

additional information about Sterling Bank, visit our website at

http://www.sterlingnj.com.

Roma Financial Corporation is the holding company of Roma Bank,

a community bank headquartered in Robbinsville, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 89 years with a

complete line of financial products and services. Roma Bank

has 14 branch locations in Mercer, Burlington and Ocean counties in

New Jersey. Visit Roma online at http://www.romabank.com

FinPro served as financial advisor to Roma and Malizia Spidi

& Fisch, PC was Roma's legal counsel in the

transaction. Sterling's financial advisor was Griffin

Financial, and its legal counsel was Stevens & Lee.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning Sterling and Roma. We caution that such statements

are subject to a number of uncertainties and readers should not

place undue reliance on any forward-looking statements. Sterling

and Roma do not undertake, and specifically disclaim, any

obligation to publicly release the results of any revisions that

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements.

In connection with the merger, Sterling will file a proxy

statement with the Securities and Exchange Commission to be

distributed to the stockholders of Sterling. Stockholders are

urged to read the proxy statement regarding the proposed

transaction when it becomes available and any other relevant

documents filed with the SEC, as well as any amendments or

supplements to those documents, because they will contain important

information. Stockholders will be able to obtain a free copy

of the proxy statement, as well as other filings containing

information about Sterling and Roma, free of charge from the SEC's

website (http://www.sec.gov), by contacting Sterling Banks,

Attention: Robert H. King, telephone 856-273-5900. Sterling

and its directors, executive officers, and certain other members of

management and employees may be soliciting proxies from Sterling's

stockholders in favor of the transaction. Information regarding the

persons who may, under the rules of the SEC, be considered

participants in the solicitation of Sterling stockholders in

connection with the proposed transaction will be set forth in the

proxy statement when it is filed with the SEC. You can find

information about Sterling's executive officers and directors in

its most recent proxy statement filed with the SEC, which is

available at the SEC's website (http://www.sec.gov). You can also

obtain free copies of these documents from Sterling using the

contact information above.

CONTACT: Roma Financial Corporation

Peter A. Inverso, President and Chief Executive Officer

Sharon Lamont, Chief Financial Officer

609 223 8300

Sterling Banks, Inc.

Robert H. King, President

rking@sterlingnj.com

R. Scott Horner, Executive Vice President

shorner@sterlingnj.com

856 273 5900

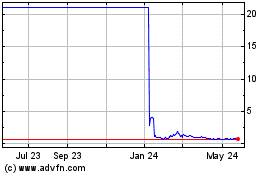

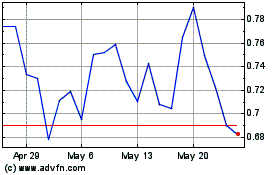

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2023 to Dec 2024