Roma Financial Corporation (Nasdaq:ROMA) (the "Company"), the

holding company of Roma Bank and RomAsia Bank, announced it is

issuing a correction to its press release issued earlier today,

reporting its financial condition and results of operation for the

three months and year ended December 31, 2009.

In the sixth paragraph, line 5 of the original release, the

percentage of non-performing loan to capital should be 6.85% not

0.07%.

The corrected release, in its entirety, is as follows:

ROMA FINANCIAL CORPORATION ANNOUNCES FOURTH QUARTER 2009

EARNINGS

Robbinsville, New Jersey, March 3, 2010-- Roma Financial

Corporation (Nasdaq:ROMA) (the "Company"), the holding company of

Roma Bank and RomAsia Bank, announced today its financial condition

and results of operation for the three months and year ended

December 31, 2009.

The Company's consolidated net income, for the three months and

year ended December 31, 2009, was $87 thousand and $2.6 million

respectively. These represented decreases of $1.2 million and

$2.0 million compared to the three months and year ended December

31, 2008, respectively. On a fully diluted basis, net income for

the year ended December 31, 2010, represented $0.09 per share

compared to $0.15 per share last year.

For the three months and year ended December 31, 2009, net

interest income was $9.4 million and $33.1 million, compared to

$7.6 million and $28.4 million for the same periods in 2008. For

the year ended December 31, 2009 this represented an increase of

16.5% from the prior year.

Net income in 2009 was negatively impacted primarily by

substantially higher loan loss provisions and Federal Deposit

Insurance Premiums, and a fourth quarter impairment charge on an

available for sale security, which combined to negate the benefit

of strong growth in net interest income.

At December 31, 2009, the Company had consolidated assets,

deposits, borrowings and equity of $1.3 billion, $1.0 billion,

$64.8 million and $216.2 million, respectively.

"As was feared, the recession deepened during 2009 and inflicted

severe strain on the credit quality of our loan portfolios,

particularly the commercial loan portfolio which experienced an

increase of $4.5 million in non-performing loans to $14.8 million,

representing 2.48% of total loans, 1.13% of total assets and 6.85%

of the Company's capital. While the level of

non-performing loans is disconcerting, it is within levels found in

the industry and those banks we monitor as peer institutions,"

commented Peter A. Inverso, President and CEO. "Further, the

protracted economic recession has hampered our efforts to speedily

resolve and dispose of non-performing commercial loans and is

causing concomitant pressure on the underlying value of collateral

securing these loans. As a result, we prudently increased our

provision for loan losses $2.5 million this year over the provision

in 2008," added Inverso.

"The second element contributing to the decline in net income

this year was a $1.6 million increase in our deposit insurance

premiums arising from the convergence of a special assessment

levied against all deposit taking financial institutions; the

expiration of credits available to offset premiums in the

comparable prior year periods; and an increase in the basic

assessment rates imposed on a much higher deposit base," stated

Inverso.

"Lastly, an impairment charge of $2.2 million was taken in the

fourth quarter this year. The decline in the value of this

investment was exacerbated by the termination of an announced

merger just prior to year end which would have benefitted its

carrying value by the substitution of the acquirer's stock, which

is more widely traded and pays dividends," said

Inverso.

"Stripped of these elements, our core earnings before taxes

would have improved over last year, reflecting the Company's

capacity in contending with the great recession of our day, intense

local competition and growth. Fueled by record deposit

growth, assets grew 21.8% to a record of $1.3 billion,

encapsulating a record level of loans," Inverso added.

In closing, Inverso stated, "The Company remains strong, highly

capitalized, and well fortified to deal with the economic

challenges of the year ahead."

Shares of the Company began trading on July 12, 2006, on the

NASDAQ Global Select Market under the symbol "ROMA."

Roma Financial Corporation (Nasdaq:ROMA) is the holding company

of Roma Bank, a community bank headquartered in Robbinsville, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 86 years with a

complete line of financial products and services, and today Roma

Bank operates branch locations in Mercer, Burlington and Ocean

counties in New Jersey. Visit Roma online at

www.romabank.com.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning the financial condition, results of operations and

business of the Company. We caution that such statements are

subject to a number of uncertainties and actual results could

differ materially, and, therefore, readers should not place undue

reliance on any forward-looking statements. The Company does

not undertake, and specifically disclaims, any obligation to

publicly release the results of any revisions that may be made to

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

CONTACT: Roma Financial Corporation

Peter A. Inverso, President & CEO

609 223-8310

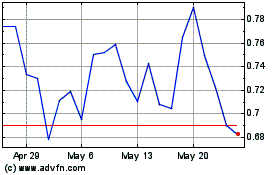

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

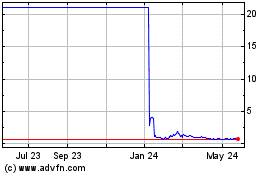

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2023 to Dec 2024